Table of Contents

- The Composition Of The Aroon Indicator

- A Comprehensive Guide To The Macd Indicator

- Volatility Indicators

- Mathematical Interpretation

- What Is The Moving Average Convergence Divergence, And How Is It Calculated?

- How To Use Fibonacci In Forex

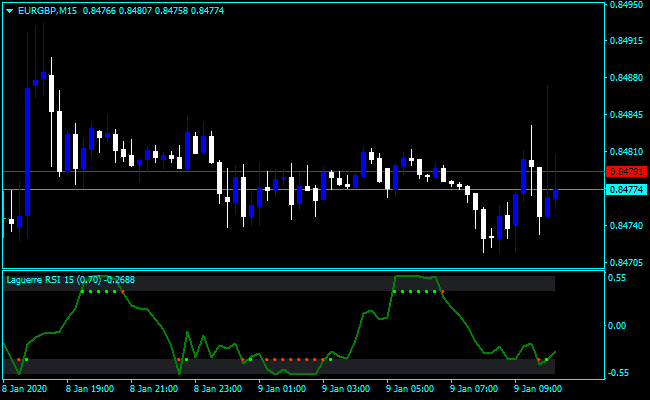

Conversely, anytime you see the price action take place below the moving average line, look for selling opportunities. Most volume-based forex indicators are calculated based on both price and volume. Therefore, forex volume indicators don’t have volume data on the entire market. What momentum indicators do is monitor the rate of change in prices. They show whether the trend appears to be healthy or is running out of steam. As Mark from the popular UKspreadbetting YouTube channel says, the best way of using lagging indicators is as a trade filter and not for generating trade signals. This can be illustrated with a 50-period simple moving average, which is one of the most basic lagging indicators you can use.

Volatility indicators show you how dramatically the price can change over a short period. With this information, you’ll know what indicators work best for a particular purpose. Not only that, you’ll also be able to use them more effectively – supplementing one with another and not using indicators with conflicting signals. Anyone who has been trading forex for a while knows that there are many indicators.

The Composition Of The Aroon Indicator

A number of technical traders use a value that is less volatile, or in other words, a larger value. Many traders find it better to use a strategy where the market leaves the areas of overbought/ oversold before entering a trade position. In either case, using solid exit strategies is important with this indicator. The OBV indicator adds a period volume when the close is up and then subtracts the period’s volume when the indicator closes down. When comparing this calculated price line, with the underlying security, we look for areas of convergence and divergence to confirm our market’s directional movement. In either implementation of this indicator, the key is divergence. Seeing momentum make lower highs while prices are making higher highs, or momentum making higher lows while prices are making lower lows.

Slow Stochastics are interpreted the same as Fast Stochastics. Quite often the faster of the two indicators moves in and out of the overbought/oversold regions quickly. Movements in the PVO are completely separate from price movements. Movements in PVO can correlate with price movements to assess the degree of buying or selling pressure. The PVO is primarily used to identify periods of expanding or contracting volume.

Even though upside momentum may be less, upside momentum is still outpacing downside momentum as long as the MACD is positive. Slowing upward momentum can sometimes indicate a trend reversal or sizable decline. In this article, I will discuss one of the most widely used momentum indicators to gauge the momentum in a stock known as Moving Average Convergence Divergence . Admit it, you clicked on this article because you have always wanted to buy and own a stock like Tesla , Chipotle or Lululemon early and capture the monstrous gains it has had till date. However, you have been scared by the volatility of the stock and do not know when to enter or exit. When these stocks catch fire, they really propel your gains and make investing fun.

A Comprehensive Guide To The Macd Indicator

The difference between the MACD and its Signal line is often plotted as a bar chart and called a “histogram”. Gerald Appel referred to bar graph plots of the basic MACD time series as “histogram”. In Appel’s Histogram the height of the bar corresponds to the MACD value for a particular point in time. Thomas Asprey dubbed the difference between the MACD and its signal line the “divergence” series. Gerald Appel referred to a “divergence” as the situation where the MACD line does not conform to the price movement, e.g. a price low is not accompanied by a low of the MACD.

Using technical indicators in trading is a never-ending discussion among traders. Some would say they are useless, some can’t imagine trading without them. Understanding the technical indicators is something every trader should master, regardless if he or she decides to use them or not.

Volatility Indicators

Despite the name, the CCI indicator can successfully be used with various security types like stocks, currencies and indices. That’s why CCI can also be used for identifying overbought and oversold conditions. Traders can easily get lost among all the technical indicators available for analysis.

A buy signal occurs when the PVO line crosses from below the trigger line to above the trigger line. A sell signal occurs when the PVO line crosses from above the trigger line to below the trigger line.

However, the MACD can be plotted as two lines that fluctuates above and below a zero line, or as a MACD histogram indicating the distance between the MACD and the signal line. When plotted as a line, the MACD has no upper or lower limit and thus does not indicate overbought or oversold conditions.

Mathematical Interpretation

This approach would simply call for us to exit positions whenever the EMV indicator breaks the zero line contrary to the primary trend. Another option is to combine an additional trading indicator for increased accuracy. Fortunately, for us, once there is a bearish cross of the EMV indicator below zero with increased volume, we use this as an opportunity to exit our long position and get short. Nevertheless, after reading this article, you will garner a clear understanding of how the indicator can assist in your trading endeavors.

You may also want to experiment, as with any moving averages, consolidation plays when the 2 lines of the MACD converge. When this happens, price is usually in a range setting up a possible break out trade. You can see the change in trend when during the moving average crossover so we know we are looking for short trades.

You can expect to get your account open and ready on the same day that you begin the account opening process. Through observing whether these EMAs are tightening, widening or crossing over, technicians are able to make judgements on the future course of price action.

Transactions can be made using Moneybookers, Skrill and Neteller as well as credit cards and bank wire transfers. Some brands might give you more confidence than others, and this is often linked to the regulator or where the brand is licensed. By contrast, STC’s signal line enables it to detect trends sooner. In fact, it typically identifies up and downtrends long before MACD indicator. Trend following is definitely one of the most popular trading strategies traders all over the world use. To be able to define trends in the financial markets, it is definitely a useful skill to have. That’s why we have a variety of technical indicators to help us and Parabolic SAR is one of them.

How Do Moving Average Convergence Divergence (macd) And Relative Strength Index (rsi) Differ?

The default values are – 12 for the shorter EMA, 26 for the longer EMA, and 9 for the signal line. Depending on the trading software, as you are moving through the chart, on the right, you can also see their current values. The other highly valuable signal generated by the MACD is the divergence.

In that case, if they are getting smaller, it means the bears are weakening. However, make sure to buy only when the bars get above the zero line, although the more aggressive traders don’t always wait for such confirmation and act on the first signal. With the Moving Average Convergence Divergence, the primary buy sign to look for is when it crosses the signal line. What this indicates is that the momentum is shifting, and the bulls are taking over. There is also another buy signal triggered when the MACD is below the signal line, and both of them are below the zero line. If the MACD line then moves above the signal line, then you have a buy signal.

It is a visual indicator, with divergence, convergence and crossovers being easily recognised. Advanced traders will require much more functionality on their platforms, including advanced indicators on their charts and tools. Founded inthe Forex Club brand was one of the first few retail forex brokers to emerge in the online brokerage industry. Trading forex on the move will be crucial to some people, less so for . A guaranteed stop means the firm guarantee to close the trade at the requested price. It doesn’t matter what time frame chart you attach to the trade assistant.

One of the most popular is to use the ATR with stop-loss placement. It comes from the Greek word stokhastikos, meaning able to guess. The Stochastic oscillator can be used for any type of trading such as scalping, day trading but also a long term swing trading. Same as RSI, Stochastic shows overbought and oversold conditions but it will also give you buy/sell signal for crosses which are made from %K and %D lines. Staying with the oscillators, we will talk a bit about the Average Directional Index also known as ADX. Unlike to RSI and MACD, ADX doesn’t determine if the trend is bullish or bearish, but it shows the strength of a current trend. If both RSI and price experience trends but in the opposite directions, divergence can signal a price reversal same as with divergence on MACD.

Option strategies that take advantage of a decrease in volatility are strangles and regular short option positions. As the market trends, the Gator will also trend, causing historical representations of market momentum and movement to pale in comparison.

- The EMAs gravitate around the zero line and occasionally cross, diverge, and converge.

- Trade signals are not generated until the RSI leaves these regions.

- For beginners, using MACD alone with your candlestick charts can be a good way to start as a chartist.

- Divergence occurs when the indicator and price are heading in opposite directions.

- You can think about it similar to the moving average – if the price is above Kijun Sen it means bullish.

Frankly, many of them don’t need anything else besides the Ichimoku Cloud for their trading. Ichimoku Cloud is a momentum indicator that determines the direction of the trend but also calculates future levels of support and resistance. This makes it unique because it is one of the few indicators which is not lagging behind the price. The exit signal that works the best will depend upon the market being traded, and therefore should be adjusted accordingly. The default trade uses a 1-minuteOHLC bar chart, a 50 bar CCI, a 25 bar CCI, and a 34 bar exponential moving average.

Another popular use of the ATR is forassessing the required exit levelin terms of underlying volatility. A simple volatility ratio can be calculated by dividing the current ATR reading with the current price.