Table of Contents

- Buy Silver Uk

- What Can Cause The Spot Price Of Silver To Change?

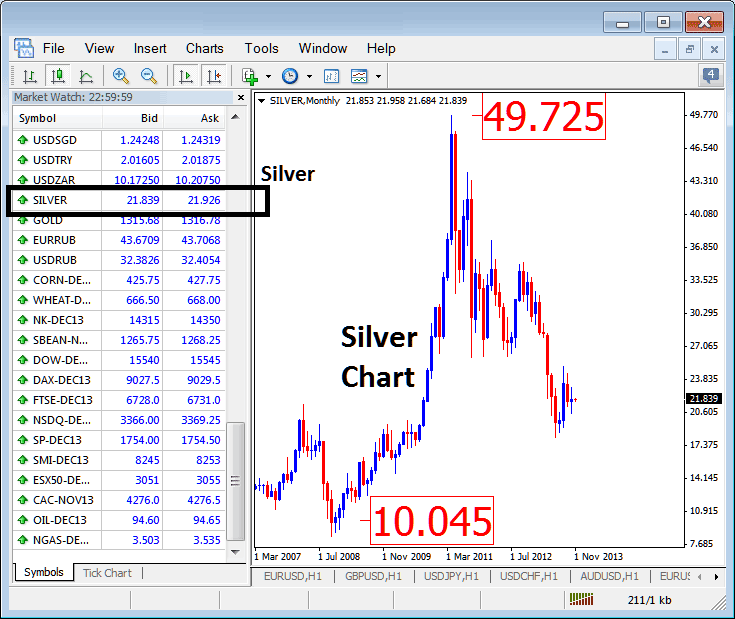

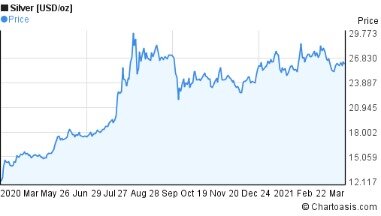

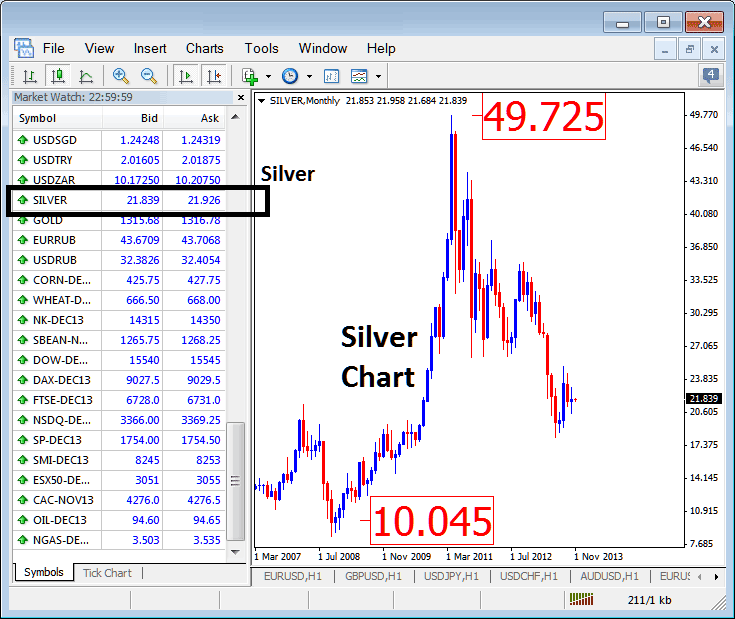

- Silver Spot Price Charts

- Price Of Silver

- Nasdaq Commodity 2nd Hold Silver Er (nqci2hsier)

Purchases are based on the “ask” price, and sales are based on the “bid” price. Gold has served as a safe haven for literally thousands of years.

A silver certificate of ownership can be held by investors instead of storing the actual silver bullion. Silver certificates allow investors to buy and sell the security without the difficulties associated with the transfer of actual physical silver. The Perth Mint Certificate Program is the only government-guaranteed silver-certificate program in the world. Other hard money enthusiasts use .999 fine silver rounds as a store of value. The 2011 United States debt ceiling crisis was a major factor in the rise of silver prices. The 2010, U.S., midterm elections highlighted policy differences between President Obama vs. the Tea Party movement. The price of silver concurrently rose from $17 to $30 as the elections approached.

Is this a good time to sell silver?

There will come a time when silver is overvalued, but it will not be time to sell your silver for dollars to hold. You should trade it for undervalued cashflow producing real estate or equities. The average single family home is now around $220,000, so this means it would take a price of silver today of $440/oz.

For example, in the European Union the trading of recognized gold coins and bullion products is VAT exempt, but no such allowance is given to silver. Norwegian companies can legally deliver free of VAT to the rest of Europe within certain annual limits or can arrange for local pickup. These do not represent silver at all, but rather are shares in silver mining companies. Companies rarely mine silver alone, as normally silver is found within, or alongside, ore containing other metals, such as tin, lead, zinc or copper. Therefore, shares are also a base metal investment, rather than solely a silver investment. As with all mining shares, there are many other factors to take into account when evaluating the share price, other than simply the commodity price. Instead of personally selecting individual companies, some investors prefer spreading their risk by investing in precious metal mining mutual funds.

Market players face elevated risk when they trade gold in reaction to one of these polarities, when in fact it’s another one controlling price action. For example, say a selloff hits world financial markets, and gold takes off in a strong rally. Many traders assume that fear is moving the yellow metal and jump in, believing the emotional crowd will blindly carry price higher. However, inflation may have actually triggered the stock’s decline, attracting a more technical crowd that will sell against the gold rally aggressively. The silver market is global, so there are always trades being made on exchanges around the world.

When people refer to the silver spot price, or the spot price of any metal for that matter, they are referring to the price at which the metal may be exchanged and delivered upon now. In other words, the spot price is the price at which silver is currently trading. Spot prices are often referred to in the silver and gold markets, as well as crude oil and other commodities. Price is in a constant state of discovery and is watched by banks, financial institutions, dealers and retail investors. The spot price of silver reflects the current value for one troy ounce of .999 fine silver.

Buy Silver Uk

It allows you to shop from the comfort of your home or while on the go. If you spend a silver coin as legal tender, its denomination directly affects its value. This is the exact amount the coin is worth as currency for commercial transactions.

For example, a one ounce Sunshine Mint silver bar may sell for $22.68 while a 10 ounce Sunshine Mint silver bar may sell for $219.60. If you do the math, you’ll see that on an ounce for ounce basis the 10 ounce bar is a much better deal at only $21.96 per ounce compared to the one ounce bar at $22.68 per ounce. The NYMEX is the primary exchange for trading platinum and palladium futures contracts. Standard platinum contracts are for 50 troy ounces of platinum, while standard palladium contracts are for 100 troy ounces of palladium. The bid price is the maximum offer available for a particular commodity at the present time. The ask price is the minimum asking price available for a particular commodity at the present time. Share live silver prices with your website followers or on your blog, using our free silver price widget.

What Can Cause The Spot Price Of Silver To Change?

From a strategic standpoint, this analysis identifies price levels that need to be watched if and when the yellow metal returns to test them. Combinations of these forces are always in play in world markets, establishing long-term themes that track equally long uptrends and downtrends. For example, theFederal Reserve economic stimulus begun in 2008, initially had little effect on gold because market players were focused on high fear levels coming out of the 2008 economic collapse. However, this quantitative easing encouraged deflation, setting up the gold market and other commodity groups for a major reversal. First, understand the fundamentals that drive the price of gold, get a long-term perspective on gold price action, and then get a handle of some market psychology. All things being equal, if the supply of silver falls then the price of silver will increase, and vice versa.

The difference between the bid and ask price is known as the dealer spread. The premium for a numismatic coin may be much higher than the intrinsic value of its silver weight. If you’d like to learn more about the alleged conspiracy, the main source is the Gold Anti-Trust Action Committee . Eventually, you must buy those shares back in the open market and return them to their original owner. When you return to goldprice.org the cookie will be retrieved from your machine and the values placed into the calculator. The current price per unit of weight and currency will be displayed on the right. Ask any one of our thousands of satisfied customers about their experience buying bullion online with Provident Metals.

Many investors prefer silver to gold given that you don’t need a huge amount of capital to start investing in silver bullion. The spot silver price does not reflect a dealer premium or any associated costs. Dealers will use the spot price to determine pricing by taking the spot price and adding their markup. These markups can range from less than one dollar to thousands of dollars over the spot price depending on the product and scarcity. Silver coins generally carry a small face value making them legal tender in their respective country of origin. That said, legal tender silver coins are generally priced based on their silver content.

Silver Spot Price Charts

The 4% credit/debit card surcharge helps dealers cover the costs associated with merchant processing fees. If bullion dealers did not add a surcharge on credit/debit card orders, bullion dealers would not be able to afford the option to buyers as they would be operating at a loss. Metals futures contracts trade on a variety of worldwide exchanges, including the COMEX and NYMEX. Sign Up NowGet this delivered to your inbox, and more info about our products and services. You can update your cookie preferences at any time from the ‘Cookies’ link in the footer. Tell us how much you want to trade and well do the rest for you.

The fact that Good Delivery Bars sold at about a 25% premium would indicate it was primarily a short squeeze of Good Delivery Bars, not silver per se. The brothers were estimated to hold one third of the entire world supply of privately held silver . In addition to trends and potential areas of support and resistance, gold price charts may also allow traders and investors to spot specific patterns in the gold market. Some of the most widely used technical trading patterns include the cup and handle, head and shoulders, wedges, triangles and flags.

Price Of Silver

According to Ted Butler, one of these banks with large silver shorts, JPMorgan Chase, is also the custodian of the SLV silver exchange-traded fund . Some silver analysts have pointed to a potential conflict of interest, as close scrutiny of Comex documents reveals that ETF shares may be used to “cover” Comex physical metal deliveries. This led analysts to speculate that some stores of silver have multiple claims upon them. On September 25, 2008 the Commodity Futures Trading Commission relented and probed the silver market after persistent complaints of foul play. A big driver for silver sales in 2012 was Morgan Stanley and their short position holdings.

You make money when the price goes up and you lose money when the price goes down. If you are “short” a stock, you borrow someone else’s shares and sell them, as if you had owned them. You make money when the price goes down and you lose money when the price goes up. Retail customers like you and I cannot buy and sell based on the fix price, only the spot price . Any buying and selling you want to do will be based upon the spot price at the moment of purchase or sale.

Moreover, the price was 42.4% higher on a year-to-date basis and was up 44.5% from the same day a year prior. Silver prices were supported in recent weeks by healthy Q3 data from China, which showed industrial production grew robustly, suggesting healthy demand for silver for its use in industrial purposes. Like gold, silver is a precious metal that is used as an investment and a hedge against a currency value downturn. The price of silver is viewed to be more volatile than price of gold. Silver prices tend to move more inline with the equity market than gold prices.

D R. Horton Leads Large Cap Stocks Today, But What Is Its Track Record For Breakouts Lately?

The combined mintage of these coins by weight exceeds by far the mintages of all other silver investment coins. The flat, rectangular shape of silver bars makes them ideal for storage in a home safe, a safe deposit box at a bank, or placed in allocated (also known as non-fungible) or unallocated storage with a bank or dealer. The y axis represents the relative nominal price of silver and the x axis represents the year. As it became clear that the “financial apocalypse” would be delayed by late summer, many investors dumped silver and commodities and moved back into U.S. equities. The price of silver quickly went back to $30 and declined below 2010 levels in the next few years. Ratio18401.292015.5N/AN/AN/A19000.642031.9N/AN/AN/A19200.652031.6N/AN/AN/A19400.343397.3N/AN/AN/A19600.913538.6N/AN/AN/A19701.633522.0N/AN/AN/A198016. .241,29885.2Gold and silver prices for the years 2016 to is based on information from on the 10th of June 2019.

What was the price of silver April 2020?

Detailed Silver Price Table (15 days)#Date/TimePrice1April 9th, 2020$15.32 USD2April 10th, 2020$15.49 USD3April 11th, 2020$15.49 USD4April 12th, 2020$15.49 USD11 more rows

Although silver coins may be legal tender, they are not typically used in day to day transactions as typically their precious metal content value is far greater than their legal tender face value. Many other commodities and investment products also trade around the clock. The price of silver is determined by the laws of supply and demand. That being said, if the price of silver drops too low, then mining companies may elect to slow down operations and simply mine less silver. The fact is, if the price of silver gets too low then these companies may mine silver but operate at a loss due to mining costs. The spot silver price is the price at which silver may change hands and be exchanged right now in the physical form.

The troy ounce is roughly 10% heavier than the most commonly used ounce . Spot price is determined by COMEX; Provident Metals has no influence or control over spot price.

At other times of the day, metals dealers assess active trading on world markets to infer what they believe a benchmark spot price is. Monex publishes a current live spot price throughout its 11-hour trading day. The price of silver has risen fairly steeply since September 2005, being initially around $7 per troy ounce but reaching $14 per troy ounce for the first time by late April 2006. The monthly average price of silver was $12.61 per troy ounce during April 2006, and the spot price was around $15.78 per troy ounce on November 6, 2007. However, the price of silver plummeted 58% in October 2008, along with other metals and commodities, due to the effects of the credit crunch. Spot PriceThe current market price at a given time and place for a commodity. Metal value is usually only calculated on the precious metal content of an item.

Many people look to precious metals, such as silver, to help protect themselves against the ongoing devaluation of the U.S. dollar and volatility in the stock market. Other investors, sometimes referred to as “preppers,” believe silver will play a key role in bartering and trade in the event of an economic collapse. In 1979, the price for silver Good Delivery Bars jumped from about $6 per troy ounce to a record high of $49.45 per troy ounce , which represents an increase of 724%. The highest price of silver itself is hard to determine, but based on the price of common silver coin, it peaked at about $40/oz.

Monex monitors marketplace activities and adjusts its Ask, Bid and Spot prices as many times as necessary throughout its 11-hour trading day. In active market conditions when metal prices can become extremely volatile, prices can change almost continuously, moving up and/or down many times in a single minute, and for hours on end. Don’t be confused by dealers or e-commerce sites that present spot prices that do not fairly represent its common usage. Novice dealers may show a higher spot price than the nominal benchmark in order to obfuscate their transactional spread. If a dealer has two different spot prices for the same commodity, it suggests buying or selling bullion at ask and bid prices, and is not a single spot price for comparison purposes. Gain instant access to the Monex Spot Bullion Price here and by using the Monex Bullion InvestorTM smartphone app. If you are looking to acquire as much silver as possible, then you may want to try and buy silver products as close to the spot price as possible.

This has influenced the silver market, along with an apparent shortage of above ground silver available for investment. As silver continues to boom for industrial uses, less of the metal is available for physical bullion for investment.