Table of Contents

- How To Make An Interactive Chart Slider Thingy

- Best Practices When Creating A Pyramid Chart

- Relationship Within The Pyramid Chart

- Level Of Detail Expressions In Tableau

- Most Commonly Used Forex Chart Patterns

- How To Trade Head And Shoulders Tops And Bottoms

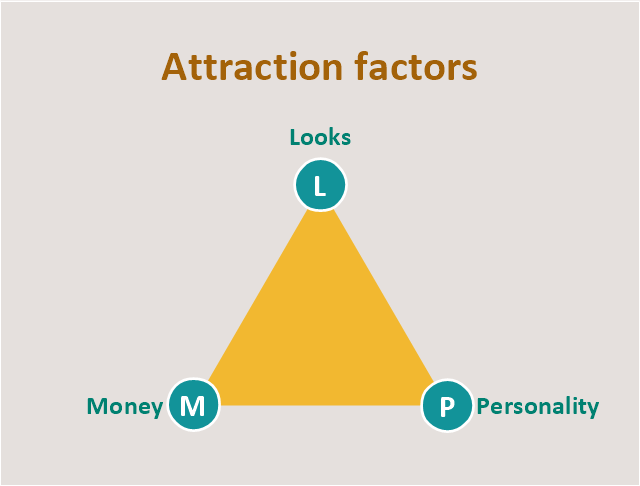

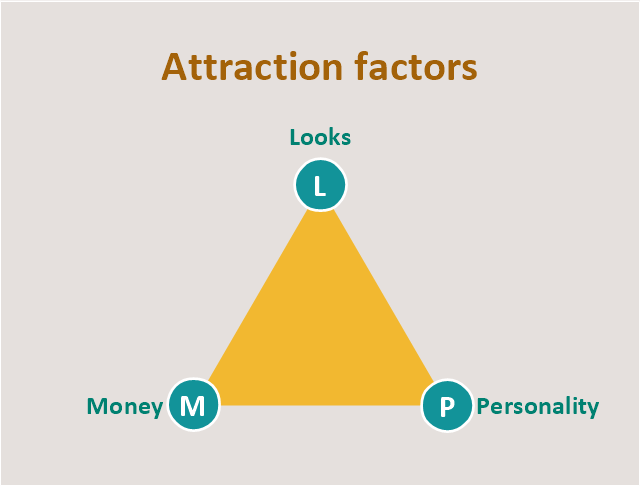

A pyramid chart has the form of a triangle with lines dividing it into sections. Because of the triangular shape, each section is a different width from the others; this width indicates a level of hierarchy among the topics. For example, the widest section may contain a general topic and the narrowest section may contain a much more specific topic from within that general topic. However, the width is not visually representative of the quantity beyond larger or smaller. Meanwhile, on the way up the price action creates a rising wedge chart pattern.

In the end, as with any technical indicator, successfully using triangle patterns really comes down to patience and due diligence. This is why judicious traders eyeing what looks like a triangle pattern shaping up will wait for the breakout confirmation by price action before adopting a new position in the market.

How To Make An Interactive Chart Slider Thingy

Triangular chart user is a crossword puzzle clue that we have spotted 1 time. It provides an easy way to organize items by size or quantity. Learn step-by-step from professional Wall Street instructors today. The McClellan Oscillator is a type of momentum oscillator. The McClellan Oscillator is calculated using exponential moving averages, and is designed to indicate the strength or weakness of price movement, rather than its direction. Since each section will represent one category make sure to arrange them in order, based on the status you chose before.

How do you make a triangle pattern on a chart?

A triangle can be drawn once two swing highs and two swing lows can be connected with a trendline. Since the price may move up and down in a triangle pattern several times, traders often wait for the price to form three swing highs or lows before drawing the trendlines.

Conversely, a symmetrical triangle following a sustained bearish trend should be monitored for an upside breakout indication of a bullish market reversal. Just as an ascending triangle is often a continuation pattern that forms in an overall uptrend, likewise a descending triangle is a common continuation pattern that forms in a downtrend. If it appears during a long-term uptrend, it is usually taken as a signal of a possible market reversal and trend change.

This type of pyramid chart gets restricted to just Level 1 text. It is commonly used to illustrate containment, proportional, or interconnected relationships. While decreasing, the price action actually creates a bearish pennant. This is the consolidation after the first impulse of the bearish trend. The price breaks the lower level of the pennant afterwards. On the way down we see the price completing the first target, which equals the size of the pennant . Then the decrease continues and the decrease is extended to a size equal to the previous leg.

Best Practices When Creating A Pyramid Chart

The reason for this is that it has very unique parameters. Both sides of the expanding triangle are inclined, but in opposite directions. Now that you know what the rising and the falling wedges look like, we should share one more detail regarding these formations. Wedges could have trend continuation, or trend reversal character. Typically the more powerful wedge formation is the potential trend reversal formation which occurs after a prolonged trend move.

This does not mean the volume on the breakout has to be the highest over the last 20 hours or something. It just means you need to see some acceleration to the upside. For example, in the chart above, notice how the highs are not within .01% of one another. The pattern should feel like you are back in after school detention staring at the clock, just waiting to get out. There needs to be a number of clear attempts by the bulls that go nowhere with the price. The first key component of the formation is a series of higher lows.

It would disappear completely from the diagram if the pressure reached the critical pressure of the C 1 –C 10 system at 160°F . 4 – Pressure-composition phase diagram for methane/butane and methane/decane binary systems at 160°F.

Relationship Within The Pyramid Chart

As the pressure increases above that critical pressure, the plait point moves into the interior of the diagram (Fig. 3, lower diagrams). With further increases in pressure, the two-phase region continues to shrink.

What is a symmetrical triangle called?

A symmetrical triangle is a technical chart pattern, formed by the fluctuations in price movements. The upper and the lower bounding lines converge to finally cross each other at the ‘Apex’. A symmetrical triangle is also known as the ‘Coil’ or ‘Isosceles Triangle’ because of its appearance.

When we are done with bringing the coordinates of all of these points we just need to plot a Scatter Chart. You need to add only one series, actually there are three types of lines but we can accommodate them in just one series. When they overlap, they will give smaller triangles in result. You should practice spotting, drawing and trading triangles in a demo account before attempting to trade these patterns with real money.

Level Of Detail Expressions In Tableau

I like to wait for a key pivot point resistance level to be breached and then place a buy order slightly above this level. The first option is to purchase on the highest high after three or more tops. The potential issue with this approach is that the stock could fail and is still either developing the ascending triangle or you are caught in a bull trap. The pattern is actually straightforward in terms of how to trade the setup.

Triangular graph paper is used to graph the relationships between three variables on an equilateral triangle. This type of two-dimensional graph can be made when the sum of the three variables always adds up to a constant – usually 100% or 1. Ternary plots are also used in genetics and game theory. The buyers may not be able to break through the supply line at first, and they may take a few runs at it before establishing new ground and new highs. The chartist will look for an increase in the trading volume as the key indication that new highs will form.

Most Commonly Used Forex Chart Patterns

The breakout strategy can be used on all triangle types. The execution is the same regardless of whether the triangle is ascending, descending or symmetrical. The price is being confined to a smaller and smaller area, but it is reaching a similar low point on each move down. A descending triangle can be drawn once two swing highs and two swing lows can be connected with a trendline. We have two types of triangular graph paper, one with black lines and one with blue.

It is used to exhibit values of proportions deteriorating progressively. The value determines the size of a section in a pyramid chart in percentage form. This type of pyramid chart is popular among sales teams in showing sales advancement or foreseen sales potential. This is a variation of a regular column chart where triangles are used instead of rectangles. Technically this is the same as curved-columns chart with tension of curved column set to 1. The edges of the three-phase region are tie lines for the associated two-phase (2Φ) regions; thus, there is a two-phase region adjacent to each of the sides of the three-phase triangle. Three-phase regions can exist in several phase diagrams applied in the design of EOR processes.

- These are indicated with a falling upper trend line and a rising lower trend line.

- The liquid and vapor portions of the binodal curve meet at the plait point, a critical point at which the liquid and vapor phases are identical.

- JSTOR®, the JSTOR logo, JPASS®, Artstor®, Reveal Digital™ and ITHAKA® are registered trademarks of ITHAKA.

- Prices move to a high, which inevitably meets resistance that leads to a drop in price as securities are sold.

- The upper trendline is formed by connecting the highs, while the lower trendline is formed by connecting the lows.

- Both price and volume action looks great and then the stock begins to stall.

For instance, assume a triangle forms and a trader believes that the price will eventually break out to the upside. In this case, they can buy near triangle support , instead of waiting for the breakout. This creates a lower entry point for the trade; by purchasing near the bottom of the triangle the trader also gets a much better price.

Increasing Lines

The one key point to note is if you are in the setup, you need to stop it out once things begin to fall apart. Not only are you in a losing trade, but you are now wasting time sitting in the position all day. The stock then rolls over and trades sideways to down the remainder of the day.

As we discussed, the rising wedge has bearish potential. With the the breakout through the lower level of the wedge we notice a minor correction. As you have probably guessed, the bearish pennant is the mirror image of the bullish pennant. Bearish pennants start with a price decrease and end up with a symmetrical triangle appearance. Since pennants have trend continuing character, bearish pennants are likely to continue the bearish trend.

This pattern develops when a security’s price falls but then bounces off the supporting line and rises. This action confirms the descending triangle pattern’s indication that prices are headed lower. Traders can sell short at the time of the downside breakout, with a stop-loss order placed a bit above the highest price reached during the formation of the triangle.

An ascending triangle is just that, a triangle that’s on the rise. The pattern is a continuation pattern of a bullish event that is taking a breather as the security attempts to climb higher. Triangular chart or pyramid diagram divided into 5 parts or levels, linear icons and place for text. Vector – Triangular chart or pyramid diagram divided into 5 parts or levels, linear icons and place for text. Enter a trade at the breakout and place a stop-loss just outside the opposite side of the wedge or triangle pattern. Volume normally expands at the start of the triangle or wedge, contracts as the pattern develops and then expands on the breakout. Descending triangles form with equal lows and lower highs.

I occasionally use graphs like this for mixture experiments. Each side represents the range of a different material in a formulation. In its simplest form, the three materials will add to 100% of the formulation. A variation would be when other materials are present, but the quantities are fixed and only the three items in the graph are varied.

Traders should be prudent with stop-losses when a triangle pattern fails. At the end of the bullish tendency the price creates another symmetrical triangle. Later on the price breaks through the lower level and completes the size of the pattern . The bullish pennant is similar to a symmetrical triangle in appearance, but the Bullish pennant formation comes after a price increase. Since pennants have trend continuation character, the bullish pennant is likely to continue the bullish trend on the chart. When the upper side of the pennant gets broken upwards, we are likely to see an increase equal to at least the size of the pennant, and typically larger.

False breakouts are the main problem traders face when trading triangles, or any other chart pattern. A false breakout is when the price moves out of the triangle, signaling a breakout, but then reverses course and may even break out the other side of the triangle. Traders should watch for a volume spike and at least two closes beyond the trendline to confirm the break is valid and not a head fake.

Ferdio applies unique competencies of creativity, insight and experience throughout every project with a wide range of services. One Side is Steeper than the other – the potential price move is in the direction of the steeper side. The red target is the first one, which is as big as the size of the pennant. The green target corresponds to the size of the previous up move, which should be applied starting from the upper side of the pennant.