Table of Contents

- Candlestick Cheat Sheet For Forex Traders

- The 8 Candlestick Trading Strategies

- Candlestick Pattern Reliability

- The Most Important Candlestick Patterns

- Pattern 1: Pin Bar

While the arithmetic shows price changes in time, the logarithmic displays the proportional change in price – very useful to observe market sentiment. You can know the percentage change of price over a period of time and compare it to past changes in price, in order to assess how bullish or bearish market participants feel. The three black crows candlestick pattern comprises of three consecutive long red candles with short or non-existent wicks.

There are two things that the Hammer pattern shows; there was selling pressure during the day, and that the prices were driven back up because of a strong buying pressure. You can have both red and green hammers – green hammers depict a stronger bull. These candlestick patterns have three candles and look like the Abandoned Baby pattern. There are two-star candlestick patterns, Evening Star and Morning Star. Hanging Man candlestick pattern can be regarded as the Hammer pattern’s bearish equivalent .

Sideways results as expected, as the performance charts implied this would happen. The best of the worst seems to be the 4-6 hour range when the candle body is above 115% of the ATR. The candle body really needs to be 135% of the ATR to be able to flirt with the break even mark. One correlation visible here is that the success chance increases as the body size of the candle gets higher. None of the candle body sizes are able to make it over the profitability line. This example chart doesn’t look healthy, with most bars falling below the profit line (you can also think about this line as a ‘break even marker’). The average trading range between markets changes dramatically.

Candlestick Cheat Sheet For Forex Traders

The pattern then continues with a third candle, which is bearish and goes below the beginning of the first candle. The Tweezer Tops is a double candlestick pattern Forex indicator with reversal functions.

At the same time, the lower shadows of the two candles should be approximately the same size. The confirmation of all of the Doji patterns comes when with the finish of a candle that closes in the direction that is opposite to the trend. This candle is the first indication that the reversal is beginning.

The 8 Candlestick Trading Strategies

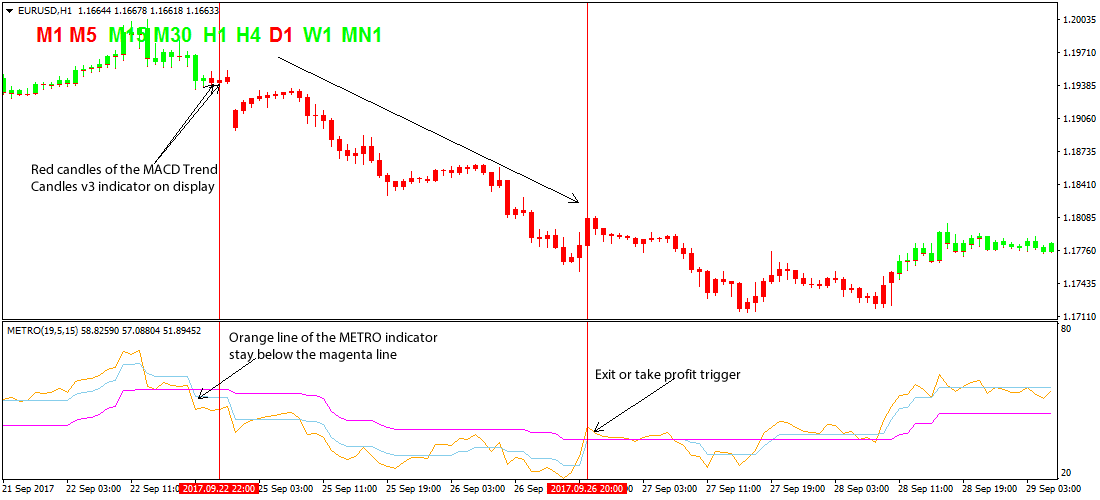

Instead, a more complete trading strategy is to use the Inside Bar with other technical indicators and good money management. In the example below, the engulfing pattern happened as a reversal pattern. The bullish trend had been going on for a while and the engulfing pattern indicated a shift in momentum. Continuation patterns are best trades early on during a trend because the likelihood of a successful continuation is higher.

Traders could then place a stop loss above the shooting star candle and target a previous support level or a price that ensures a positive risk-reward ratio. A positive risk-reward ratio has been shown to be a trait of successful traders. The hanging man candle, is a candlestick formation that reveals a sharp increase in selling pressure at the height of an uptrend. It is characterized by a long lower wick, a short upper wick, a small body and a close below the open. If you have the chart on a daily setting each candle represents one day, with the open price being the first price traded for the day and the close price being the last price traded for the day. Either you can leave all this money on the table by ignoring the candlesticks and pending it for some other day.

However, the power of candlesticks is the fact that they’re great at identifying market turning points. For example, reversals from an uptrend to a downtrend or a downtrend to an uptrend. Likewise, a bar that’s green signals that the price has gone up in that period. The Falling Three Method is used to confirm if the bearish trend will continue or not. There are three long red candles, three small green candles, and another single red candle. This pattern shows that the bull is still not powerful enough to change the market direction. The body of the candle and the wick are generally of equal length, both being short.

Candlestick Pattern Reliability

The small body of the second candle provides a warning of a possible top. The next candle finally demonstrates that the control has now indeed shifted to the bulls.

You accept that the agreement can be changed at any time and that you must comply with any changes made to the agreement. To exit the Master Candle, a trader needs to target its size. For example, if the MC has a size of 50 pips, a trader could leave at the 50 pip mark. Trading positions shouldn’t be closer to the Master’s height. When I started to learn trading more than 10 years ago, I was confused.

The Most Important Candlestick Patterns

Doji candlesticks have the same open and close price or at least their bodies are extremely short. A Doji should have a very small body that appears as a thin line. Three black crows is a bearish candlestick pattern that is used to predict the reversal of a current uptrend. This analysis relies on the work of Thomas Bulkowski, who built performance rankings for candlestick patterns in his 2008 book, “Encyclopedia of Candlestick Charts.” However, it’s worth noting that many signals emitted by these candlestick patterns might not work reliably in the modern electronic environment. Steve Nison brought candlestick patterns to the Western world in his popular 1991 book, “Japanese Candlestick Charting Techniques.”

In the second trade, the Three White Soldiers Candlestick pattern emerged near the bottom of this downtrend. At this point, professional traders for preparing for the market to reverse the prevailing downtrend.

Pattern 1: Pin Bar

For example, if the high and low are situated at equal distance from the open and closing prices, it is called a Star Doji. If the price goes up and down but returns to close at the opening price, it will be considered as Gravestone and Dragonfly Doji, respectively. These two patterns look like the letter T and an inverse letter T and considered bullish and bearish signals. In figure 2, we can see a large bearish candlestick has engulfed the previous, smaller, bullish candlestick.

In the western trading industry, these patterns are better known as Bullish Outside Bars and Bearish Outside Bars . If you see a bar has higher highs and higher lows compared to the previous bar, it is an outside bar. If the closing price is lower than the opening price, then it is a BEOB and if the closing price is higher than the opening price, you guessed it right, it is a BUOB. I would prefer to use the majority of candlestick patterns such as the Inside Bar Candlestick Pattern on the 1-hour charts and above.

The time period is expressed in intervals along the Y-axis and the exchange rate is charted along the X-axis. For example, you could set your overall chart to show a 24-hour period, with each candlestick representing one hour. Each candlestick shows the opening price at the beginning of the hour and the closing price at the end of the hour, as well as the high and low price during that period. Since you chose a 24-hour period, you would have 24 candlesticks total.

Common Candlestick Terminology

Candlestick charts are arguably the most popular types of price charts in financial markets, as they offer a clean and appealing way of representing price movements. There are many advantages of candlestick charts compared to other chart types which will be covered in the following lines. In addition, we’ll explain what candlesticks are and how they’re formed, the best way to read candlesticks, and how they can be used to identify trend continuation patterns and reversals. Undoubtedly, you will find that candlesticks can give you a more tactical view into the market than any type of chart. The Doji pattern highlights the market struggle between buyers and sellers as the closing and the opening price points are almost the same. The wicks vary in length, and the candles are almost non-existent.

There are two candles in this pattern – one is a small candle resembling a fetus, and another longer one represents the womb. The smaller candle can fit entirely inside the last session’s long body. You can use the Magic Doji to check if the market is indecisive.

It has a small body, a long upper shadow and a tiny or no lower shadow. However, the Shooting Star Forex candle comes after bullish trends and signalizes that the bulls are exhausted.

The bullish engulfing pattern is formed with a combination of blue and red candles. This pattern shows the end of the weakness of the currency pairs. You can use this information to enter a long position once the blue candle has closed. The trader below the bullish pattern will place a stop loss to ensure a tight stop loss in the hammer position. Long solid bullish body with very short or no wicks – this candlestick suggests that the closing price is relatively far away from the opening price and that buyers are heavily under control.