Table of Contents

- Limit Order:

- Types

- Please Complete The Security Check To Access Help Coinbase.com

- Different Types Of Candles On A Candlestick Chart

- Trading Insight

When you are making a trade, you will be prompted to select an order type after selecting a symbol, action (buy, sell, etc.), and quantity. A Market order is an order to buy or sell at the market bid or offer price. A discretionary order is an order that allows the broker to delay the execution at its discretion to try to get a better price; these are sometimes called not-held orders. It is commonly added to stop loss orders and limit orders.

Can you buy and sell the same stock repeatedly?

Retail investors cannot buy and sell a stock on the same day any more than four times in a five business day period. This is known as the pattern day trader rule. Investors can avoid this rule by buying at the end of the day and selling the next day.

A robust direct access trading platform can sharpen that edge with the proficient utilization of different market order types. Having the knowledge to alternate and apply different market order types can make very material improvements to your workflow and efficiency. Acquiring consistent optimal price fills on entries and exits are a core attribute of efficient trading. If the limit order to buy at $133 was set as “Good ‘til Canceled,” rather than “Day Only,” it would still be in effect the following trading day.

This type of order is especially important for those who buy penny stocks. An all-or-none order ensures that you get either the entire quantity of stock you requested or none at all. This is typically problematic when a stock is very illiquid or a limit is placed on the order. If you don’t place an all-or-none restriction, your 2,000 share order would be partially filled for 1,000 shares. A stop-loss order is also referred to as a stopped market, on-stop buy, or on-stop sell, this is one of the most useful orders. Let’s say your broker charges $7 for a market order and $12 for a limit order. Stock XYZ is presently trading at $50 per share and you want to buy it at $49.90.

Limit Order:

An Order Cancels Order order sets two orders of the same quantity for the same contract at different price levels. Deletes immediately if entered at a price level that results in either a partial or full fill.

If the call was before the transaction, the greater the time between the call and the placing of the order, the greater the presumption that the trade was unauthorized. Even if you see a price around the time you take the trade, it doesn’t mean you’ll get filled there.

Types

If you buy an asset with a tight bid/ask spread, usually you’ll end up paying the ask price, and when you sell you’ll end up paying the bid price. In markets with low volume or a large bid/ask spread, you could end up paying or selling at a much different price than expected. Cory Mitchell, CMT, is a day trading expert with over 10 years of experience writing on investing, trading, and day trading. Mitchell founded Vantage Point Trading, which is a website that covers and reports all topics relating to the financial markets. He has a bachelor’s from the University of Lethbridge and attended the Canadian Securities Institute from 2002 to 2005.

A market order is a request to buy or sell a security at the currently available market price. The calculated value of an opening buy order is the order’s limit price multiplied by the order’s quantity.

Trailing stop orders allow you to continuously and automatically keep updating the stop price threshold based on the stock price movement. This way, you don’t need to monitor the price movement and keep sending replace requests to update the stop price close to the latest market movement. The type parameter must always be “limit”, indicating the take-profit order type is a limit order. The stop-loss order is a stop order if only stop_price is specified, and is a stop-limit order if both limit_price and stop_price are specified (i.e. stop_price must be present in any case). Those two orders work exactly the same way as the two legs of the bracket orders. OCO (One-Cancels-Other) is another type of advanced order type. This is a set of two orders with the same side (buy/buy or sell/sell) and currently only exit order is supported.

Please Complete The Security Check To Access Help Coinbase.com

Market orders buy or sell at the current price, whatever that price may be. He is a professional financial trader in a variety of European, U.S., and Asian markets. If you want to buy as the price rises, the buy stop limit order prevents you from paying a higher price than anticipated; the buy stop doesn’t offer this same protection. The sell stop order is placed below the current price in the EUR/USD. Therefore, the price must drop to 1.0868 to fill the sell order. Buy stops act like market orders once the buy stop price is reached. Therefore, they are useful for using as a stop loss on short positions, when you must get out because the price is moving against you.

StockTrader.com has advertising relationships with some of the offers listed on this website. Using the example above, once stock XYZ hits $111 a share, our trailing stop loss order is set at the new $105.45 price. As the stock rises, our activation price RISES; however, it doesn’t matter how fast the stock falls, our activation price will not adjust unless the stock sets a new price high. The order uses a set percentage or dollar $ value to calculate when to trigger a preset stop market order.

Different Types Of Candles On A Candlestick Chart

To automate Stop Loss order following the price, one can use Trailing Stop. TD Ameritrade, Inc., member FINRA/SIPC, a subsidiary of The Charles Schwab Corporation. TD Ameritrade is a trademark jointly owned by TD Ameritrade IP Company, Inc. and The Toronto-Dominion Bank. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

What are the 11 sectors?

The order of the 11 sectors based on size is as follows: Information Technology, Health Care, Financials, Consumer Discretionary, Communication Services, Industrials, Consumer Staples, Energy, Utilities, Real Estate, and Materials.

An IOC order is a limit order set at a limit price you specify. Any portion of the order not immediately completed is canceled. A sell–stop order is an instruction to sell at the best available price after the price goes below the stop price. A sell–stop price is always below the current market price.

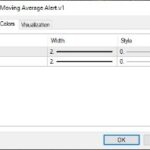

Trading Insight

A limit order is an instruction to buy or sell a stock at a specified price. The specified price can be different from the market price.

Market orders are transactions meant to execute as quickly as possible at the current market price. A canceled order is a previously submitted order to buy or sell a security that gets cancelled before it executes on an exchange. A take profit order is intended to close out the trade at a profit once it has reached a certain level. This type of order is always connected to an open position of a pending order. This video can help you understand why companies issue and people buy shares of stock. If you are short, hitting reverse will submit two buy market orders to make your net position long.

Once the stop order is elected, the order is treated as a market order and will be filled at the best possible price. Buy MITs are placed below the current price and Sell MITs are placed above the current price. An MIT order is similar to a limit order in that a specific price is placed on the order.

This gives the trader control over the price at which the trade is executed; however, the order may never be executed (“filled”). Limit orders are used when the trader wishes to control price rather than certainty of execution.

They are also useful for buying breakouts above resistance, but you can’t be sure of the exact price you will end up buying at. Buy limits are also used as targets, to get you out of a profitableshort trade. The buy limit order is placed below the current price of the EUR/USD forex pair. Therefore, the price must drop to 1.0775 to fill the buy order.

I designed my Trading Challenge so that I could be a mentor and teach people how to trade. It’s tailored to traders who are dedicated to learning how to be self-sufficient in the markets.