Table of Contents

- What Is Liquidity? It’s How Easily You Can Sell An Asset For Cash

- Definition Of Liquid Stock

- Private Equity Definition: Day Trading Terminology

- What Does “net Change” Mean In The Stock Exchange?

- How Stockstotrade Can Help You Find Liquid Stocks

In this article, we look at the differences between liquid and illiquid markets. Buying or selling an asset easily without disrupting price in a market creates the conditions necessary for a liquid asset. Liquidity generally occurs when an asset has a high level of trading activity. Investing in liquid assets is generally safer than investing in illiquid ones because of the ease of getting into and out of positions. When it comes to commodities, which tend to be more volatile than other asset classes, liquidity is a key concern for many investors and traders. Large stock markets, such as the New York Stock Exchange, are also considered highly liquid because thousands of shares change hands every day.

Liquidity is typically thought of as very good, since a lack of liquidity means a trader could get trapped in a position with no buyers as price falls sharply. It can be advantageous to hold liquid assets, because they allow you quick access to cash in the event of unexpected expenses. For example, if you have an unexpected medical expense, you might have to produce a few thousand dollars to pay your deductible. You could easily sell a liquid asset such as shares of stock in large company to cover the expense. Some may claim a car is a liquid asset because it can be sold in a day.

What Is Liquidity? It’s How Easily You Can Sell An Asset For Cash

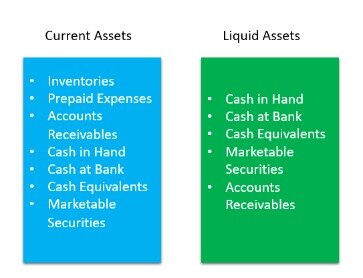

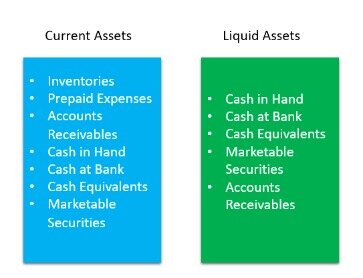

A liquid asset is cash — or an asset that you can quickly convert into cash at a reasonable price. Stocks and bonds are liquid assets, while real estate and equipment are not. Considering the liquidity of an investment is essential if you want to be able to buy or sell it on short notice. A company needs to have a certain degree of liquidity in order to meet short-term financial obligations, such as upcoming bills. Solvency, on the other hand, refers to a company’s ability to pay long-term debts. There are several different formulas for assessing a company’s liquidity. The first is cash flow risk in which a corporation is concerned with whether or not it can fund its liabilities.

How is bank liquidity calculated?

Calculating the Bank’s Liquidity

Subtract the current liabilities from the current assets. This calculates working capital. Once you have that total, divide the current assets by the current liabilities. This calculates the current ratio.

In the world of accounting, assessing liquidity means assessing financial obligations that come due within the next twelve months. You do this by comparing liquid assets with current liabilities. You want to ensure that whatever asset you hold, that you can easily convert it to cash when the time is right. Having your eye on the liquidity of the stock you intend to trade goes a long way in ensuring that the hard work you put into finding great trades, pays off with handsome profits.

Definition Of Liquid Stock

Further, it is even the capability to purchase or trade any security leaving the asset’s price unaffected. When an asset is said to be liquid it means that there is a great deal of buying and selling of the asset.

The stock market is believed to be the perfect example of any liquid market as there exist vast numbers of sellers and buyers, coupled with several other stocks being examples of liquid assets. In simple terms, these assets can be transformed into cash rapidly, with a negligible effect on the price available in the entire market.

Private Equity Definition: Day Trading Terminology

We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority.

- There may also be a significant difference between the paper value of the property and the amount you actually get for it.

- Liquidity generally occurs when an asset has a high level of trading activity.

- Buyers and sellers may find they have to go to multiple parties, potentially with different prices, in order to get their order filled in their intended size.

- Exotic pairs are more of a challenge since their lower liquidity attracts higher spreads.

- As a measure of cash or the ability to raise it promptly, liquidity is a sign of financial health.

- You can get a good sense of a large crowd’s sentiment, but you cannot know what´s in the heads of a small group of people with no relation to you.

We will explain below why it is so important for every forex trader. For individuals, having liquid assets is important to pay everyday expenses and deal with emergencies. If you don’t have enough cash on hand, you may be forced to go into high-interest debt when your car breaks down or an unexpected medical bill pops up.

What Does “net Change” Mean In The Stock Exchange?

Before making decisions with legal, tax, or accounting effects, you should consult appropriate professionals. Information is from sources deemed reliable on the date of publication, but Robinhood does not guarantee its accuracy. This measures a company’s ability to pay off short-term liabilities with cash and cash equivalents, which include money market accounts and U.S.

This makes it easy to sell since there are plenty of buyers willing to pay the market price for the asset. When an asset is liquid it also means that selling, even large amounts, has little impact on the price of that asset.

So you should absolutely know what it is, how it’s calculated, and why it matters. In order to contribute to this debate, CFA Institute developed a member survey on the issues surrounding bond market quality. The members surveyed were a pool of 3,881 volunteer CFA Institute members with a declared interest in capital markets issues.

How Stockstotrade Can Help You Find Liquid Stocks

Certain brokers offer spreads as low as 0.2-0.3 pips in most liquid pairs such as EUR/USD and USD/JPY. That comes from high liquidity in the forex market and makes it very easy for traders to use different trading strategies that cannot be applied to the stock or other less liquid markets.

It means that the cash is not earning interest from sitting in savings or a checking account, and is not generating a profit in the form of asset purchases or investments. The cash is simply sitting in a form where it does not appreciate. Assets are listed on the balance sheet relative to their liquidity level, with the most liquid types listed at the top of the balance sheet and the least liquid listed at the bottom.

When it is frozen into ice, you cannot drink it instantly – you have to wait until it melts. Marketable securities are unrestricted short-term financial instruments that are issued either for equity securities or for debt securities of a publicly listed company. The issuing company creates these instruments for the express purpose of raising funds to further finance business activities and expansion. In order to have a liquid asset, that asset has to be popular and a recent study has shown that the vanilla ice cream at store A has amazing fat reducing properties.

Generally, it is not recommended to exclude such assets from a personal investment portfolio. Similar to business applications, liquid assets in personal finance are utilized to meet financial obligations as soon as possible. In addition, they are also used in hedging a personal investment position against unanticipated adverse events. A liquid asset is cash on hand or an asset other than cash that can be quickly converted into cash at a reasonable price. In other words, a liquid asset can be quickly sold on the market without a significant loss of its value.

They allow clients to buy and sell currencies and hedge their clients’ positions in the real market or internally. Although not as often as in the stock market, sometimes in the forex market there are gaps. But the most common signs of illiquidity in the forex market are the long candles that happen in a short period of time. One such event happened on 15th of January this year when the Swiss National Bank removed the 1.20 peg they had placed in EUR/CHF.

Keep this in mind and focus on doing the same any time you’re tempted by premarket or after-hours trading. It’s easy to get FOMO and think you should get in before the market opens for a head-start. One of the biggest features of StocksToTrade is its turbocharged screener.

For example, a technology company does not operate the same as an airline company. The tech firm might need to buy computers and office space, while an airline needs to buy planes, a large labor force, and jet fuel. So it’s natural for an airline company to carry higher levels of debt. For example, say a company had a monthly loan payment of $5,000. Its sales are doing well and the company is realizing profits. Liquidity refers to how much cash is readily available, or how quickly something can be converted to cash. Usually, investments can simply be sold, depending upon the investment.

You can watch premarket action to get a feel for potential plays. You’ll see some liquid premarket runners that appear look great, but then they end up fading the rest of the trading day. But stocks close to that $10 million level might still be choppy and not as smooth. I think it’s smart to look for a dollar volume much greater than $10 million. Keep in mind, premarket volume is usually lower than regular trading volume. And the first hour’s volume is usually the greatest of the day. So to estimate a stock’s total volume at the end of the day, you have to extrapolate how much more volume it could make.