Table of Contents

- Bottom Chart Patterns

- Why Do Candlestick Patterns Work? Learn To Trade Price Action

- Final Word On Day Trading Triangle Patterns

- Start Learning Forex Today!

- Engulfing Pattern

- Forex Candlestick And Why It’s So Popular

- Trend Reversal Pattern And Transitions In Price Action

Above you can see the 5-minute chart of the EUR/USD for February 7, 2017. The chart includes the ZigZag indicator expressed by the straight red lines on the chart. the vertical distance between the Head and the Neck Line applied starting from the moment of the breakout. Your Stop Loss order should be located approximately in the middle of the pattern. The only difference is that the bottoms of the Pennant pattern are ascending, while the Flag creates descending bottoms that develop in a symmetrical way compared to the tops. As you see, Flags and Pennants’ technical analysis works exactly the same way. At the same time, your Stop Loss order should go below the lowest point of the Pennant.

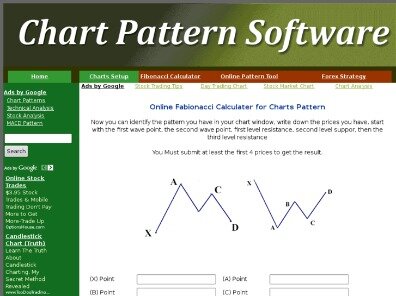

This is often true for patterns such as head and shoulders, cup and handles and double tops/bottoms. The measure comes from the extreme of the pattern to the neckline. So whatever that distance is we can anticipate price to move that distance again once the pattern confirms. While this can give us a target price, we shouldn’t rely on them to transpire. Chart patterns separate into two categories; reversal and continuation. As the names suggests a reversal pattern is at the extreme of a trend, indicating that the trend is coming to an end.

Bottom Chart Patterns

You should practice spotting, drawing and trading triangles in a demo account before attempting to trade these patterns with real money. Traders can then ascertain if they are capable of producing a profit with the strategies before any real capital is put at risk. For example, assume a triangle forms and you expect that the price will eventually breakout to the upside based on our analysis of the surrounding price action. Instead, the price drops slightly below the triangle but then starts to rally aggressively back into the triangle. If a trader thinks the price will eventually break below the triangle, then they can short sell near resistance and place a stop-loss just above the triangle. By going short near the top of the triangle the trader gets a much better price than if they waited for the downside breakout. If the price breaks above triangle resistance , then a long trade is initiated with a stop-loss order placed below a recent swing low, or just below triangle support .

Which is the best bullish candlestick pattern?

We will focus on five bullish candlestick patterns that give the strongest reversal signal. 1. The Hammer or the Inverted Hammer. Image by Julie Bang © Investopedia 2021.

2. The Bullish Engulfing. Image by Julie Bang © Investopedia 2020.

3. The Piercing Line.

4. The Morning Star.

5. The Three White Soldiers.

Continuation chart patterns usually occur during price consolidation periods and offer great opportunities for traders to open positions in the direction of the dominant trend. Forex chart patterns are on-chart price action patterns that have a higher than average probability of follow-through in a particular direction. These trading patterns offer significant clues to price action traders that use technical chart analysis in their Forex trading decision process. To sum up, the forex chart patterns technical analysis is a crucial part of the Forex price action trading.

Why Do Candlestick Patterns Work? Learn To Trade Price Action

Price action traders read and interpret raw price action and identify trading opportunities as they occur. While still a form of technical analysis, price action involves the use of clean or ‘naked’ charts; no indicators to clutter the charts. Trading chart patterns is the highest form of price action analysis, and it helps traders to track trends as well as map out definitive support and resistance zones. This means that traders are able to place buy and sell orders in the market early enough and at optimal price points. Double tops or bottoms are probably the most well recognisable chart patterns. Again you can consider them a continuation or a reversal chart pattern.

Then you take that distance from the bottom of the handle and that will give you the proper target. Similar to a flag pattern, the pennant is a continuation pattern that tends to trade back in the direction of the strong and current trend. Usually we have a consolidation that takes the form of a symmetrical triangle. If it is consolidating after a strong run higher/lower, you probably are dealing with a pennant pattern. In the coming weeks we will also be releasing an education segment on the Forex Analytix website which will be a great guide for traders.

Final Word On Day Trading Triangle Patterns

If the pattern occurs after a recent uptrend, the pattern signals for a reversal downward if it breaks through the neckline. A bullish or bearish wedge is usually defined by “consistent highs and higher lows” which would be bullish or “consistent lows with lower highs” which would be bearish. Just because they are bullish or bearish doesn’t mean that they will break in those directions. This is the maximum position you can take to keep your risk on the trade limited to 1% of your account balance. Make sure that there is an adequate volume in the stock to absorb the position size you use. If you take a position size that is too big for the market you are trading, you run the risk of causing slippage on your entry and stop-loss.

You’ll actually gain more insights into what happens in the market. In addition, because these patterns often emerge after a news release, chances are that even more traders will be active than otherwise. This structure is created when strong sellers are pushing down the price while weaker buyers are trying to reverse the trend.

After an uptrend, the price creates a top, then it corrects. It creates a second, higher top afterwards and then it drops creating a third, lower top – head and shoulder. This time, the signal line goes through the lowest bottom for a triple top formation and through the highest top in case of a triple bottom formation.

After a downtrend which followed a descending trendline between A and B, the pair temporarily consolidated between B and C, unable to make a new low. The pair reverted to test resistance on two distinct occurrences, but it was incapable of breaking out to the upside at D. The pattern formed a horizontal support while descending resistance lines acted as buffers for the price action. Finally, the NZD/USD breached the resistance at E, signaling a potential bearish breakdown. An ascending triangle is a chart pattern used in technical analysis created by a horizontal and rising trendline.

Start Learning Forex Today!

Wedges are much similar to triangles.The difference is that wedges have a significant slope against the previous trend. The similar patterns with 3 peaks/3 troughs are called Triple top/bottom. Read in detail how to trade with the Head and Shoulders pattern.

- Timing is an important aspect when it comes to trading chart patterns.

- Typically, a trader will enter a short position during a descending triangle in an attempt to profit from a falling market.

- The chart below shows the current emerging V bottom patterns as of May 2 in the S&P 500, Nasdaq Composite , Dow Jones Index, Mastercard Inc. , Visa , American Express and JPMorgan .

- Bull flag chart pattern example is below within the context of an uptrend.

- The Stop Loss order of this trade stays below the lowest point of the Flag as shown on the image.

- Yes please, send me offers about trading related products and services.

The most successful traders are those who have trained their eyes, through long hours of study and practice, to recognize the best set-ups. They understand the price action that is producing them and are able to use other indicators – especially volume – to confirm their trades. Price then falls back, often to support at an EMA level, before rising to test the resistance again.

My goal is to get as many pips as possible and help you understand how to use indicators and price action together successfully in your own trading. The most commonly used pattern that is used by everyone from the big banks right down to the smallest retail trader is support and resistance. Charting patterns are not just for the higher time frames and you can use them for both day trading and intraday trading. You can use this knowledge to your advantage by finding and then trading these patterns to make profitable trades. This is the same reason why the same patterns continue to form over and over again.

In this respect, pennants can be a form of bilateral pattern because they show either continuations or reversals. Head and shoulders is a chart pattern in which a large peak has a slightly smaller peak on either side of it. Traders look at head and shoulders patterns to predict a bullish-to-bearish reversal. A chart pattern is a shape within a price chart that helps to suggest what prices might do next, based on what they have done in the past. Chart patterns are the basis of technical analysis and require a trader to know exactly what they are looking at, as well as what they are looking for. Chart patterns are an integral aspect of technical analysis, but they require some getting used to before they can be used effectively. To help you get to grips with them, here are 10 chart patterns every trader needs to know.

On the other hand, reversal patterns are opposite to continuation patterns. They usually reverse the current price trend, causing a fresh move in the opposite direction. When you have a trend on the chart, it is very likely to be paused for a while before the price action undertakes a new move. In most cases, this pause is conducted by a chart pattern, where the price action is either moving sideways, or not very strong with its move.

Forex Candlestick And Why It’s So Popular

To sum up, these 5 chart patterns are the most profitable and accurate when trend trading. Although some can be used as reversal patterns, they are better used as continuation patterns to support your analysis. The patterns, alongside their potential for measured moves can add confidence and odds of success to your trades. Just remember to anticipate rather than and let your edge play out over time. I use chart patterns to support my analysis, usually in the form of continuation patterns. In a strong uptrend for example, a reversal pattern is irrelevant to me because it isn’t going to give me a set up.

Which candlestick pattern is most reliable?

The 5 Most Powerful Candlestick PatternsCandlestick Pattern Reliability.

Candlestick Performance.

Three Line Strike.

Two Black Gapping.

Three Black Crows.

Evening Star.

Abandoned Baby.

The Bottom Line.

Similarly, the Head and Shoulders is another famous reversal pattern in Forex trading. It comes as a consolidation after a bullish trend creating three tops. The first and third tops are approximately at the same level. However, the second top is higher and stays as a Head between two Shoulders. Then we will give you a detailed explanation of the structure and the respective rules for each one. For example, let’s suppose the Forex pair is trending in the bullish direction.

Identifying these trading patterns can be quite frustrating for the novice trader, but once they internalize the patterns and get experience in identifying them it becomes far easier. Once it becomes second nature identifying trading patterns becomes a powerful tool. It’s important to realize too that not every pattern plays out as expected. Having an exit plan when a pattern goes wrong is just as important as identifying the trading pattern in the first place. Double tops and double bottoms form after the price makes two peaks or valleys after a strong trending move.

Please note that the Rising and the Falling Wedge could act as reversal and continuation patterns in different situations. Just remember that the Rising Wedge has bearish potential and the Falling Wedge has bullish potential, no matter what the previous trend is.

In the example below, the overall trend is bearish, but the symmetrical triangle shows us that there has been a brief period of upward reversals. Ascending triangles often have two or more identical peak highs which allow for the horizontal line to be drawn. The trend line signifies the overall uptrend of the pattern, while the horizontal line indicates the historic level of resistance for that particular asset. Both rising and falling wedges are reversal patterns, with rising wedges representing a bearish market and falling wedges being more typical of a bullish market.