Table of Contents

- Pivot Points For 60

- Support, Risk & Stop

- Limitations Of Pivot Points

- Ford Marketing Campaign Boosts Stock Prices

- Long Trade

And finally, do you use pivot points in your day trading strategy? Following the same exit strategy, I should have exited at 132.80 as the latest pullback had failed. Due to being away from the computer though, I missed moving the stop loss at that level. Another exit would have been the likely profit target at the S1 pivot point which also hit.

Crude oil prices drifted lower in January, but bottomed in early February at $95.44. On February 23, the monthly R1 at $109.81 was tested, and four days later, was exceeded as the high was $110.55, point 3. On October 15, crude oil closed above the quarterly pivot . As I had discussed on October 11 Has Crude Oil Finally Bottomed? , the OBV had broken its downtrend, line a, and the same week crude oil closed above it’s quarterly pivot .

This technique is commonly used by day traders, though the concepts are valid on various timeframes. Common types of pivot points are Traditional, Fibonacci, Woodie, Classic, Camarilla and DM and each type has its own calculation method. A pivot point uses a previous period’s high, low, and close price for a specific period to define future support.

The double top which was drawn right on the mid pivot point was enough to convince me to short 200 shares of VFC at 192.72. The profit for this trade was about 130 dollars, the smallest of them all. It’s essential to have a good strategy for your stop loss as much as to have an entry strategy.

Pivot Points For 60

Therefore, if you place your stop slightly beyond this point, you will likely avoid being stopped out of the trade. You will need to look at level 2 or time and sales to see which level you need to focus on.

Have been watching FB for some time, it’s now hitting resistance again and I expect a rather significant drop within the next few weeks. We caught a nice reversal yesterday within our community, lets see can we get continuation today. As the airlines continue to climb higher AAL hit the .786 Fib level and got rejected, a break above $26.00 is the next opportunity for longs.

Traders have worked on improving the original pivot point and now there are other ways to calculate for pivot points. The standard method of calculating pivot points is NOT the only way to calculate pivot points. To better gauge this proposition, let’s first get a quick background on what Cytonics stock is all about. The SPY spent most of the 2nd quarter of 2006 below the quarterly pivot and began the 3rd quarter also below the pivot line. For that quarter, the software predicted that the S1 at $122.12 was the most likely area of support . By the start of the 3rd quarter, AAPL was already declining as it opened at $671.16 and shortly thereafter dropped below the quarterly pivot at $647.00. Right before the election, the S1 quarterly support at $590.07 was also broken as APPL made a low in mid-November at $505.75.

Support, Risk & Stop

MarketSmith is a registered trademark of MarketSmith, Incorporated. Database and all data contained herein are provided by William O’Neil + Co. Daily Graphs and Daily Graphs Online are trademarks of William O’Neil + Co. The SPY continued to make higher highs throughout the first two quarters and peaked at $156 in July, which was just below the R1 at $156.25. Those of you who remember this period will recall that the selling was quite heavy as the quarterly pivot was violated before the end of the month. Of course, the same methodology works on any market, and next, I would like to take a brief look at crude oil from the last quarter of 2011 through the 2nd quarter of 2012. The SPY opened the 2nd quarter of 2010 at $117.80, which was above the new quarter’s pivot at $113.41.

The best advice is to use your Pivot Point of choice with other technical analysis tools, including MACD, candlesticks and RSI. A move above the Pivot Point indicates strength and signals the trader to look at the first resistance as a target. Just like Standard Pivot Points, Fibonacci Pivot Points also start with a Base Pivot Point. The main difference is that they also incorporate Fibonacci levels in their calculations. Traders should remember this to avoid buying high or selling low even as the price moves away from the pivot. Keeping this in mind, as it allows you to avoid much of the market noise that may show up later in the day. Oh boy, my short trade would bring more money if WHR shares plummet to the weekly S1 pivot point at 129.60!

Limitations Of Pivot Points

Those with the strongest trend, either up or down, are then further analyzed to determine entry, exit and risk levels. I use Fibonacci retracement, projection and extension analysis to determine both profit objectives as well as stops. Support and resistance levels based on Pivot Points can be used just like traditional support and resistance levels. The key is to watch price action closely when these levels come into play. Should prices decline to support and then firm, traders can look for a successful test and bounce off support. It often helps to look for a bullish chart pattern or indicator signal to confirm an upturn from support.

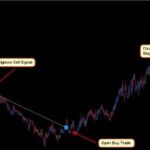

The image shows a couple of pivot point bounce trades taken according to our strategy. We hold the trade until the price action reaches the next pivot point on the chart. When this happens, the price creates a couple of swing bounces from R2 and R1. You should always use a stop loss when trading pivot point breakouts. A good place for your stop would be a top/bottom which is located somewhere before the breakout. This way your trade will always be secured against unexpected price moves. To enter a pivot point breakout trade, you should open a position using a stop limit order when the price breaks through a pivot point level.

There was no need to check out other time frames, since the gap up and the pivot point’s breakout were more than enough to point out the up trend. I went long on this stock during the first hour of trading. Although that specific period is quite risky, the volatility creates promising candlestick patterns on the charts. At the second pivot point, the support level is where we want to liquidate our entire position and be square for the day. The first pivot point support level is the first trouble area and we want to bank some of the profits here. We also advice moving your protective stop loss to break even after you took profits.

Ford Marketing Campaign Boosts Stock Prices

Wikipedia® is a registered trademark of the Wikimedia Foundation, Inc., a non-profit organization. This concept is sometimes, albeit rarely, extended to a fourth set in which the tripled value of the trading range is used in the calculation. If share price opens below “Pivot Point” there are more chances that you will get the “Buy Point” first and vice versa. After taking a position, if corresponding Profit taking or Stoploss points are not hit on same day, carry the position to next day. In trending shares, using this indicator for entry/exit decisions in not recommended.

Pivot Points can be used to help determine where to draw trendlines in order to visualize price patterns. Pivot Point Highs are determined by the number of bars with lower highs on either side of a Pivot Point High. Pivot Point Lows are determined by the number of bars with higher lows on either side of a Pivot Point Low.

But another reason why so many have decided to invest in Cytonics stock is the issuing company’s innovative approach to the novel coronavirus pandemic. Recently, I shared with InvestorPlace readers interested in equity crowdfunding opportunities a privately held biotechnology firm called Cytonics. Just enter the previous period’s data below and press the “Calculate” button. Charts provided by MarketSmith are used by IBD under license agreement.

Back to the trade example above, I bought AAP on the break of both the pre-market and intra-day high. After purchasing the stock, it’s now about holding on and riding the trend up to the next Fibonacci level up at 261.8% retracement. If there is no one looking to sell at a pivot point resistance level and there are no swing highs – that equals odds in your favor. The stop loss order for this trade should be located above the pivot level if you are short and below if you are long. Now that we understand the basic structure of pivot points, let’s now review two basic trading strategies – pivot point bounces and pivot level breakouts.

Similarly, should prices advance to resistance and stall, traders can look for a failure at resistance and decline. Again, chartists should look for a bearish chart pattern or indicator signal to confirm a downturn from resistance. Pivot Points were originally used by floor traders to set key levels. Like modern-era day traders, floor traders dealt in a very fast moving environment with a short-term focus. At the beginning of the trading day, floor traders would look at the previous day’s high, low and close to calculate a Pivot Point for the current trading day. With this Pivot Point as the base, further calculations were used to set support 1, support 2, resistance 1, and resistance 2. These levels would then be used to assist their trading throughout the day.

These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. As you can see, there are many different pivot-point systems available. Yet another pivot-point system was developed by Tom DeMark, founder and CEO of DeMARK Analytics.

Pivot Strategies: A Handy Tool For Forex Traders

Therefore over time, you will inevitably win more than you lose and the winners will be larger. If you are the type of person that has trouble establishing these trading boundaries, pivot points can be a game-changer for you. Nowadays so many gurus are talking about low float, momo stocks that can return big gain. Here is an example I literally just traded today for the stock Advanced Auto Parts .

In the calculator here, enter the values for high , low and closing trade values and click calculate to get the values for Pivot points, Resistance Level and Support Level . The pivot point itself represents a level of highest resistance or support, depending on the overall market condition. If the market is directionless , prices may fluctuate greatly around this level until a price breakout develops. Trading above or below the pivot point indicates the overall market sentiment.

Pivot Points (high

For the last week, the stock has had a daily average volatility of 11.52%. Repeat the trade from step 4, as many times as necessary, until either your daily profit target is reached, or your market is no longer active. Wait for the price to trade at your target or at your stop loss, and for either your target or stop loss order to get filled.