Table of Contents

- Positions

- Open Position Diversification

- The Difference Between Initial Margin Vs Maintenance Margin

- How To Navigate The Tastyworks Positions Tab

- Price To Earnings Multiple(p

In the past 24 hours, the cryptocurrency market managed to recover about 80$ billion in market capitalization reaching $1.81 trillion. The next target is the astronomical $2 trillion capitalization level. USD/JPY remains confined in a one-week-old trading range, forming a rectangle. The pattern points to a brief pause in the trend before the next leg of a move up. Bulls seemed reluctant from placing bets amid overbought RSI on the daily chart. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Rockwell Trading Services, LLC by tastyworks and/or any of its affiliated companies. Neither tastyworks nor any of its affiliated companies is responsible for the privacy practices of Rockwell Trading Services, LLC or this website.

‘Price/Earnings To Growth’ is a ratio used to determine a stock’s value by considering its earnings growth. It is calculated by the P/E Ratio divided by the annual EPS growth. The PEG ratio is favored by some over the P/E ratio because it considers the company’s growth.

Positions

They may be over-ridden by another ON-statement and can be reestablished by the REVERT-statement. The exception can be simulated using the SIGNAL-statement – e.g. to help debug the exception handlers.

This makes it incredibly easy to understand your positions that you have for each trading symbol. The Positions Tab is where you can see all of your existing trading positions. This is because some traders like to review their trade before sending out to the market. However, if you trade many positions, it may become cluttered if you show all of your positions. The checkbox for “Show Positions” determines whether you can see your existing positions in the Trade tab when you go to enter a new order. I’ll reveal advanced tips, tactics and strategies that you can use to produce a better performing options portfolio. This website and content is for information purposes only since TradeOptionsWithMe is not registered as a securities broker-dealer nor an investment adviser.

The big green ‘pill’, all the way at the left, displays information about the underlying security. A day trader attempts to close all their open positions before the end of the day.

Open Position Diversification

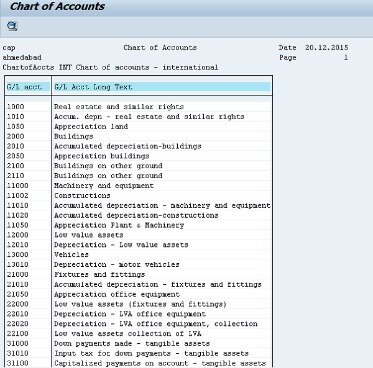

The balance sheet provides a snapshot of the entire company’s financial position, with each report sharing some of the same line items (e.g. revenue, expenses, profit). Theta is one of the “Greeks” that measures the change of an options price relative to time. The strategy menu in the trade tab is a quick and easy way to populate the order ticket with many of the popular options trading strategies. On this tab in the Tastyworks trading platform, you can watch 8 hours of market content a day each and every trading day. First, I’ll teach you how to use the Analyze mode to strategically analyze your options trading positions.

Why do I need 25k to day trade?

Brokerage firms wanted an effective cushion against margin calls, which led to the increased equity requirement. The money must be in your account before you do any day trades and you must maintain a minimum balance of $25,000 in your brokerage account at all times while day trading.

If you would like a delay to review your order before sending, you can increase the delay time here. You would choose the natural price if you want to get filled immediately.

The Difference Between Initial Margin Vs Maintenance Margin

A limit order that is only partially executed because the total specified number of shares of stock or options could not be bought or sold at the limit price. For closed positions, one way to track performance is to download them into a spreadsheet and sort profitable trades from unprofitable ones.

Only when you CLOSE the trade you will know how much money you made or lost. While you have an open position, you can watch the “Open Profit and Loss” all day long. Only when you close a trade you will know how much money you made or lost. But the “Open P&L” is very misleading because as long as the trade is open, it will change. If the price of the stocks drops to $98, your “Open P&L” will be -$2. This is more of a vendor issue, as they decide which mark to upload. Unfortunately, this is out of our hands, as we do not control what price the vendor will submit as the mark to market.

How To Navigate The Tastyworks Positions Tab

This leads to “cascading diagnostics”, a problem solved by later compilers. Several attempts had been made to design a structure member type that could have one of several datatypes . With the growth of classes in programming theory, approaches to this became possible on a PL/I base – UNION, TYPE etc. have been added by several compilers. These features were all included in IBM’s PL/I Checkout and Optimizing compilers and in DEC PL/I. On mainframes there were substantial business issues at stake too. IBM’s hardware competitors had little to gain and much to lose from success of PL/I. Compiler development was expensive, and the IBM compiler groups had an in-built competitive advantage.

– the average amount of unprofitable positions in consecutive unprofitable series. You can easily display the history of performed trades on a chart.

Cool Tastyworks Platform Features

Below the video, you can simultaneously view your positions and orders on the selected security. It gives you a general overview of the selected security and your positions in that security. At the top of the sidebar, you can view a 1-day, 1-month, or 1-year chart of the security. Right below that, you can see more details on the selected security. Among others, these displays include the daily and yearly high/low prices, IV details, volume, and correlation to SPY. The values that are displayed can be changed inside the settings menu.

In other words, how much equity is in the account if all the positions were closed at the prevailing market rates. Open Trade Equity is the net of unrealized gain or loss on open derivatives positions. Put differently, OTE is the paper gains and losses represented by the current market value and the price paid for a position. Once the position is closed, the gain or loss will become realized.

Besides manually selecting which options to buy and sell, tastyworks also has a strategy setup tool at the top of the positions tab. This allows you to choose from a wide range of different strategies. The left-most column allows you to select whether you want to buy or sell the strategy.

How do you evaluate a trading performance?

Eight ways to measure your trading performance (and not one of them is profit) 1. Number of winning vs losing trades.

2. Largest number of consecutive winners and losers.

3. Average win size vs average loss size.

4. Largest and longest draw-down periods.

5. Holding time.

6. Holding time of winners vs holding time of losers.

More items

This is because your tradable balance varies continually with market and order book conditions and the status and number of your open orders and positions. This is because your loans may expire after that amount of time and be transferred to new lenders at the best available rate. Once you have transferred funds to your margin account, all you need to do to margin trade is place buy and sell orders.

Price To Earnings Multiple(p

To the left are all the call options and to the right are all the put options. In this chapter, I’ll show you how to navigate the most important part of the trading platform. This will automatically populate an order ticket that will close your position when you reach a profit target. This number is the probability that you make one penny or more on the trade by expiration. For example, all my Boeing trades are grouped together in on drawer, while all my Caterpillar trades are grouped together in a separate drawer. If you don’t want to see either on your trade tab, then you can select “None”. If you choose “Expected Move”, then the expected move will be overlayed on the trade tab.

- If you are actively watching tastytrade, this can also be another way to engage with the tastytrade team.

- A limit order that is only partially executed because the total specified number of shares of stock or options could not be bought or sold at the limit price.

- Settle — If neither the Bid or Ask are available, then the settlement price is used as the P/L price.

- Before the option contract expires you will either close your position by selling the option, buying or selling the underlying asset, or allowing the contract to expire worthless.

In my opinion, tastyworks is the best broker for options traders. One of the main reasons for this is that they have a great trading platform with a ton of useful features.

Trader B holds an existing BTCUSD open buy position of 1,000 qty with an entry price of USD 5000. When the Last Traded Price inside the order book is showing USD 5,500, the unrealized P&L shown will be 0.01819 BTC. The larger the price movement relative to entry price, the bigger the profits/losses. a) Due to the characteristics of inverse contracts, your P&L is settled in coin type instead of USD. The USD serves mainly as a price quote mechanism for the convenience of traders. Regardless of any trades, it is important to understand how P&L is calculated before entering one.

An alternative is ‘Good-Til-Cancel’ GTC which is an order that won’t expire unless it is either filled or manually canceled. ‘Good-Til-Date’ GTD orders work just the same with the only difference being that you can select a fixed date after which the expire. Last but not least, the EXT order type is for orders during extended trading hours (pre-market, after-hours). Note that most options don’t have any extended trading hours. Next up, we will discuss how to customize your trade order before sending it.