Table of Contents

- Fundamental Causes Of Support & Resistance

- Single Support Lines

- Professional Trader, Author & Coach

- How To Draw Support And Resistance Lines

- How To Draw Support And Resistance Zones

As with any indicator, support and resistance is not 100% reliable–but when they are not, the breaches provide critical market information that is equally actionable. Let’s dig a little deeper into some tactics concerning this matter. Imagine an auction where buyers are bidding for a limited number of products. Prices are moving higher as the limited supply tightens.

What is support level?

In general finance terms, support level is the level at which buyers tend to purchase or enter into a stock. It refers to the stock share price that a company rarely goes below. Traders use support and resistance levels to plan entry and exit points for trades.

That is it, by doing that technique you will have more accurate support and resistance levels available to you. Hence if the stock is trading at an all time high, plotting the resistance is not possible. The support and resistance lines are only indicative of a possible reversal of prices.

Fundamental Causes Of Support & Resistance

While discussing candlestick patterns, we had learnt about the entry and the stoploss points. Step 4 -For taking entries and if the zone is too big then try to connect more than two points with the horizontal line. And remember, always look for 2 or more swings in a zone for the zone to be valid — the more swing points it has, the better. Now when you are done with the higher timeframe, you can move to the lower timeframe and repeat the same steps.

Instead, wait for the dust to settle and only trade when the price has established a clear sense of direction. The price goes from respecting a level, to neglecting it, back to respecting it.

However, the price will keep looking for the next obstacle to rebound. A support level is a level where the price tends to find support as it falls. This means that the price is more likely to “bounce” off this level rather than break through it.

Single Support Lines

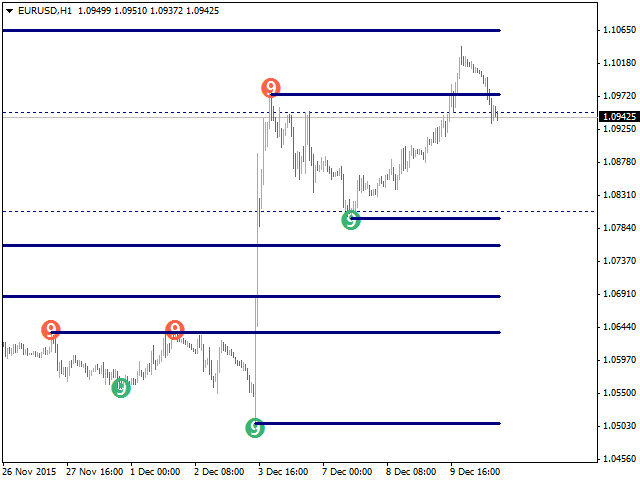

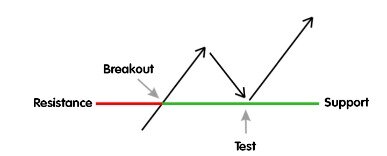

If the support or resistance line holds, and is not violated or broken, the test is said to have failed. The more failed tests a support or resistance line has, the more significant that line becomes. When a support or resistance line is significant, they provide entry signals when a test of the line fails, as well as when a test succeeds in violating or breaking the support or resistance. Selling stocks that breakdown below support, or buying stocks that breakout above resistance, are a few ways to apply support and resistance. Some traders monitor stocks near resistance and buy once the stock experiences a breakout above resistance. You can see an example of a breakout above resistance in Figure 6.

A trading range is simply an area of price contained between parallel support and resistance levels like we see below . The most reliable source for identifying support and resistance levels is historical prices, making them invaluable to traders. The key is to familiarise yourself with past patterns – sometimes from very recent activity – so you can recognise them if they appear again.

Professional Trader, Author & Coach

But if a price breaks through any given level for a longer period of time, it is likely to keep rising or falling until a new support or resistance level is established. Finally, the support and resistance lines on charts with a larger time-frame are more significant than support and resistance lines on charts with a short time-frame. However, old support and resistance lines tend to lose some but not all of their significance with the passage of time. Most technical analysis is performed by observing and interpreting charts. A chart is a historical record of stock price movements plotted over a time period, like one day, one year, one decade, or even longer. One of the assumptions of technical analysis is that history repeats in the stock market. One example of this is recurring patterns in historical stock prices.

Support and resistance lines can also be identified in areas of congestion where prices battled to close higher or lower. These areas can be identified by the length of time the price struggled at a level and/or the amount of volume that was traded at that level. Among all the aspects of technical analysis, perhaps the most important and actionable concepts are support and resistance.

Simply connect two swing highs or two swing lows in a price-chart with a trendline, and project the trendline into the future. However, bear in mind that in both cases (horizontal and trendline S&R lines), the lines become more important if the price touches them at least three times.

How do you find support and resistance in day trading?

In a downtrend, each lower low will be a support level and each lower high will be a resistance level. Just have a look at the the chart below. In an uptrend, we have the opposite. Each consecutive higher peak will be a resistance level, and each higher trough will be a support level.

This used to be very frustrating for us, and we are sure this has happened to many of you too. Below is a perfect example of support which acted as resistance after the breakout.

How To Draw Support And Resistance Lines

You can see that each of the reversals above originated from prices which are quite close to one another. The My Trading Skills Community is a social network, charting package and information hub for traders. Access to the Community is free for active students taking a paid for course or via a monthly subscription for those that are not. To draw the Fibonacci retracements on your chart, click the Fibonacci tool on your Toolbar and select the swing lows and highs on your chart, which represent the initial move of the trend. Each time the price approaches towards a trendline, there is a high chance that the price will bounce off the trendline.

Some say that it takes more than 10,000 hours to master. What is important to know that no matter how experienced you are, mistakes will be part of the trading process. You want to really keep your trading simple as much as possible.

How To Draw Support And Resistance Zones

To draw horizontal support and resistance lines, we need to have at least one price-point at which to place our horizontal line. That price-point is usually identified as an obvious swing high or swing low where the price previously retraced. Market participants believe that the Golden Ratio can be used to measure the extend of price corrections in the market.

Again, this means that the price is more likely to “bounce” off this level rather than break through it. However, once the price has breached this level, by an amount exceeding some noise, it is likely to continue rising until meeting another resistance level.

In other words, buyers jump into the market when the price approaches important support prices. I have actually just started to take more notice of the Weekly charts and drawing key levels through them. If I draw these levels on the daily chart, should I comfortably trade off them on the H4 chart or do I have to draw a fresh set of levels for the H4 chart. We have a daily market commentary which talks about potential price action setups, key levels, market bias and other relevant information. Thank you Nial, now I already have an idea on how to identify the key resistance and support levels in a candlestick chart.

How To Combine Fibonacci Retracement With Support And Resistance

In the past 24 hours, the cryptocurrency market managed to recover about 80$ billion in market capitalization reaching $1.81 trillion. The next target is the astronomical $2 trillion capitalization level. The USD/CAD pair edged lower during the European trading hours but didn’t have a tough time reversing its direction in the second half of the day. After rising to a session high of 109.05, however, the pair went into a consolidation phase and was last seen trading at 108.86, where it was virtually unchanged on the day and the week. to avoid mistakes such as, buying close to the major resistance, or selling close to the major support.

As previously mentioned, when the price reaches a line of support or resistance, the price can either bounce off the line or break through it. When the price breaks through, the role of the two lines reverse. If a line supported price, it’s now resistance, and if it was resistance, it’s now support. I’m afraid I disagree with most reasons touted for the psychology behind support and resistance for larger stocks; however, these emotions are very real from the lens of an individual trader. These three examples are not the only ways you’ll see support and resistance manifest in a chart. Still, they are some of the most common and should give you an intuition on what to look for when analyzing charts for support and resistance. Part of what makes support and resistance such a complex concept is that it doesn’t always look the same.

Each time price revisits a level, stop loss orders accumulate underneath the zone as you can see by the increasing line thickness. Trading based on support or resistance levels alone is like trading with blinders on.

In the GBPUSD chart above – you can see how this support level was acting as strong weekly support, and had been a key turning point in this market. Or if I put it another way – swing levels are when a swing high acts as a new swing low, or an old swing low is used as a new swing high. Study the chart above and you will see each swing level lines up swing highs and lows on the horizontal plane. Intra-day levels are generally not worth worrying about, price cuts through these like a hot knife through butter on a day-to-day basis and don’t offer much technical value. When we draw our S/R levels – we work on the daily time framethe majority of the time. Mapping out your levels is going to be the most important core skill for any serious trader. If you have trouble marking your S/R levels accurately, then your trading as a whole may implode… violently.

000 Forex Price Action Traders And Growing!

If you’re reading this, then you probably don’t want ‘a free lunch’ and have the thirst for knowledge with a goal to improve your own chart reading skills. Build good habits early and they will stick with you forever. Areas explain more price movements and filter out whipsawing price. When supply increases, the bears take center stage, their selling activity pushing prices down, as there are now fewer buyers willing to purchase a given futures contract at a higher price.

- It is hard to distinguish the strong from the weak support and resistance zones.

- In Figure 1 below, I have pointed out many of the multiple support areas and resistance areas .

- The idea is to identify quality trading signals as opposed to identifying plenty but worthless trades.

- Perhaps, we are now at the most important juncture in this module.

- In the example above, if the price does drop below the minor support level, then we know the downtrend is still intact.

- Again, support and resistance levels just show potential, and it’s usually impossible to make predictions about whether a level will hold or break.

- As you can see price reacted at these levels then either continued back upwards or penetrated lower.

Support and resistance levels can help traders gain extra insight into the strength of a price trend. Here we define support and resistance levels, explain how to identify and draw both lines, and more. One of the first skills you have to learn as a price action trader is how to draw support and resistance lines (or levels as they’re sometimes called). Drawing correct support and resistance lines is no easy task for a beginner trader. Many fail to learn the skill correctly, and out of frustration scour the internet in search of an indicator which will draw the lines for them automatically. Candlestick charts do a great job not only in creating graphically appealing price-charts, but also in identifying support and resistance levels.

On a larger scale, strong weekly and monthly support and resistance levels should be marked on your chart when the current price is the vicinity, or approaching those levels. More often than not, you’ll find support and resistance to occupy wider “zones” rather than single lines.