Table of Contents

- Fpmarkets

- Forex Bar Chart: A Different Perspective

- Choosing Currency Pairs According To Their Components Strength Differential

- Understanding Currency Pairs Correlation For Forex Trading

- Measuring Changes In Currency Value

Some examples of crosses include the EUR/GBP, GBP/JPY, and EUR/CHF. This list of currency pairs is only scratching the surface of the forex currency pairs that are available for a trader to use. This list is by no means all currency pairs that are available to traders, however it must be noted that these are the ones that most brokers offer to their clients. There is another group of currency pairs, that are as heavily traded as the other pairs. Now, although to be considered the best currency pairs, the majors aren’t the only pairs that Forex traders feel comfortable doing their business in. The crosses that consist of the the three major pairs , excluding the US dollar, are the most popular type of cross currency pairs. Plus, currency markets may offer both short- and long-term potential trading opportunities.

You are unlikely to face any problems since the U.S. dollar is very popular and traded currency all over the world. Whereas if you wish to buy a South African Rand, you may face some challenges. Imagine, there is the only currency exchange ready to sell you the Rand in the amount that you need.

The price at which the market is willing to sell you a currency. The price at which the market will purchase your currency from you.

Fpmarkets

Participants in the forex market sometimes differ as to exactly which currency pairs they consider to be major, minor or exotic. Nevertheless, in most cases, these general categories describe currency pairs that respectively tend to be very liquid, quite liquid or relatively illiquid. Furthermore, most minor currencies are quoted as the counter currency in currency pairs with U.S. According to this traditional pecking order, the foreign exchange market usually quotes the EUR/GBP and USD/CHF currency pairs in that order, rather than as GBP/EUR or CHF/USD.

What moves a currency pair?

A pair will move if the base currency weakens or strengthens and/or if the quote currency strengthens or weakens. For instance, if the euro strengthens and the US dollar remains the same, it means that one euro is worth more in US dollars. The price of the EUR/USD would, therefore, rise.

Knowing which pairs move opposite and which move together is a useful tool for a trader, but can be hard to work out, particularly due to the fact that correlation in Forex can change. Therefore, neglecting the economic conditions or other factors that can play a role in a traded currencys valuation can greatly reduce the probability of a trade and even render it a loser. Thus, your currency of choice would either gain less-than-projected or not gain at all, incurring losses. Therefore, going long on a strong economy/weak economy cross (or short on weak economy/strong economy pair) presents you the best chance of maximizing profits while minimizing risk. Currency trading is the most liquid and robust market in the world.

Forex Bar Chart: A Different Perspective

If you find these terms initially confusing, it helps to remember that the terms bid and ask are from the broker’s perspective, not yours. When you’re buying, you’ll pay what the broker’s asking for the currency; when you’re selling, you’ll need to accept what the broker’s bidding. Understanding these terms in a little more depth can help you as you get ready to set up your initial trades.

What are the 28 currency pairs?

These names are easy to use for research and are convenient when communicating with other Forex traders.USD (US Dollar) – Greenback or Buck.

GBP (Pound Sterling) – Sterling.

EUR (Euro) – Single currency or Fiber.

CHF (Swiss Franc) – Swissy.

CAD (Canadian Dollar) – Loonie.

AUD (Australian Dollar) – Aussie or Ozzie.

More items•

The two currencies involved in this exchange are grouped into a currency pair. If you are trading EUR/USD, for example, you are exchanging euros for US dollars. A currency pair involves two currencies and represents the value of one currency against another. In forex trading, the changing value of a currency pair provides traders with the opportunity to make a profit. In a trading market however, currencies are offered for sale at an offering price , and traders looking to buy a position seek to do so at their bid price, which is always lower than the asking price.

Choosing Currency Pairs According To Their Components Strength Differential

Capital movements across borders are powerful forces that drive currencies higher and lower. Economic data and interest rates are the key fundamental drivers for this capital movement. As a result, trends can last months or even years and can potentially provide both short- and long-term profit opportunities in the currency markets. ForexSignals.com offers a highly rated platform with mentors who have 80 years of combined experience in the trading pits. They’ll help you decode real-time daily live streams using market analysis, trade signals and more. You can access hundreds of educational videos and workshops and even individualized private sessions with mentors. Before you begin forex trading, you’ll need to choose a broker to execute your trades for you.

For example, a trader using a scalping strategy that has a short average trade duration will usually be looking for the best dealing spreads and the ability to trade significant amounts very quickly. Such traders will probably want to confine their trading activities to highly liquid top traded currency pairs like EUR/USD and USD/JPY. These popular forex pairs feature the tightest dealing spreads and their markets can handle very large amounts due to the significant number of well capitalized market makers and other participants. The next lower tier of liquidity is shared by the minor currency pairs, which include the so-called cross currency exchange rates that do not involve the U.S. Some traders include the NZD/USD in this classification, while others place it among the major FX pairs since it remains popular among traders and tends to enjoy quite liquid markets as a result.

The currency that is used as the reference is called the counter currency, quote currency, or currency and the currency that is quoted in relation is called the base currency or transaction currency. Exotics pair the US dollar with a country with an emerging economy, such as Thailand, Brazil and South Africa. Trading with exotic currency pairs is risky, as they are more sensitive to social, political and economic events. Examples of events that can cause immediate and drastic movements on currency prices are social unrest, political scandals and news of economic decline. The first currency that shows up on the pair quotation is thebase currency, also known as the transaction currency. The second currency, called thequote currency, determines the value of the base currency.

There are two concepts that you might have to understand before you start trading Forex. The bid represents the buying price of a certain currency pair. Basically, the bid is the amount of quote currency you will need to pay to buy the base currency. Before you start trading currency pairs, there are some basics that you should know. The Forex trading market is open 24 hours a day, 5 days a week. Because of this, there always is someone who is trading Forex. Exotic currency pairs are the ones that are made up of emerging market currencies.

Understanding Currency Pairs Correlation For Forex Trading

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you.

For example, the US dollar and euro exchange rate is identified as EUR/USD. Majors are highly liquid and generally stable, making them attractive to foreign exchange traders. The price also changes more frequently, giving traders plenty of opportunities to profit. Forex beginners looking to make their first trade can start with major currency pairs. Currency pairs that are not associated with the U.S. dollar are referred to as minor currencies or crosses. These pairs have slightly wider spreads and are not as liquid as the majors, but they are sufficiently liquid markets nonetheless. The crosses that trade the most volume are among the currency pairs in which the individual currencies are also majors.

When volatility surges to dangerous levels, investors try to mitigate risk and are expected to park their money in the least risky capital markets. The first one that you see in the pair is the base currency, and the second one is the quote currency.

Measuring Changes In Currency Value

In fact, if you decide forex is right for you, you can rely on many of the same tools available on the thinkorswim® platform from TD Ameritrade that you may already be using. And if you understand what makes a stock tick, you more than likely understand what makes forex—ahem, pip. Here’s what small investors should know before jumping into currency trading. Forex traders use to make educated guesses about how a currency value will change byobserving historical fluctuationpatterns.

A huge difference compared to equities – where companies are traded – is that trends in Forex can last very long. Due to the fact that macroeconomic events can continue to influence the market over a time frame of months and years, an economy that is weak tends to stay weak for a long time. A company that is in trouble can be turned around fairly quickly, but not an entire economy. In the above example the chart illustrates the strength of the base currency, the Euro, relative to the quote currency, the US Dollar. Remember, the quote currency is the one in which the exchange rate is quoted. Definitions of currency pairs and how synthetic pairs are made.

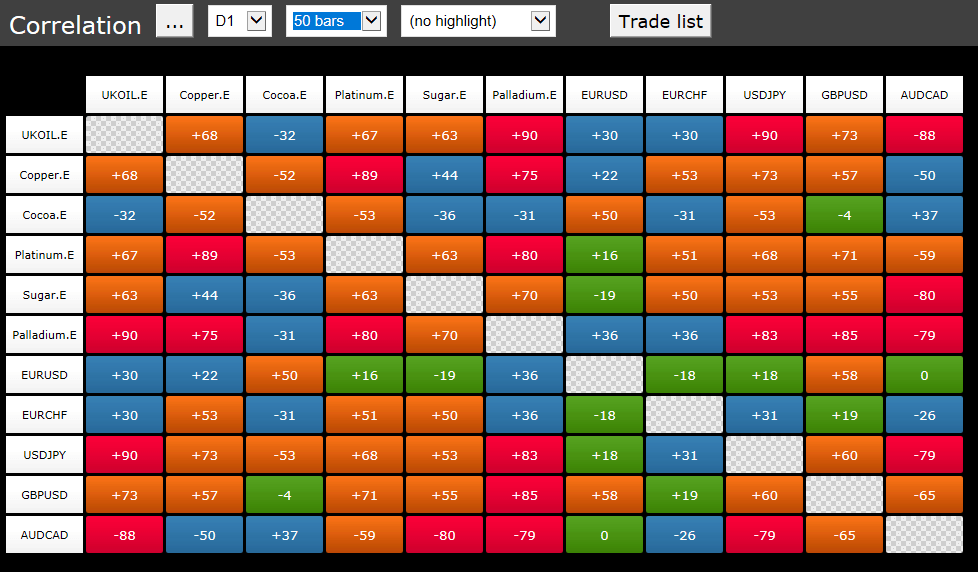

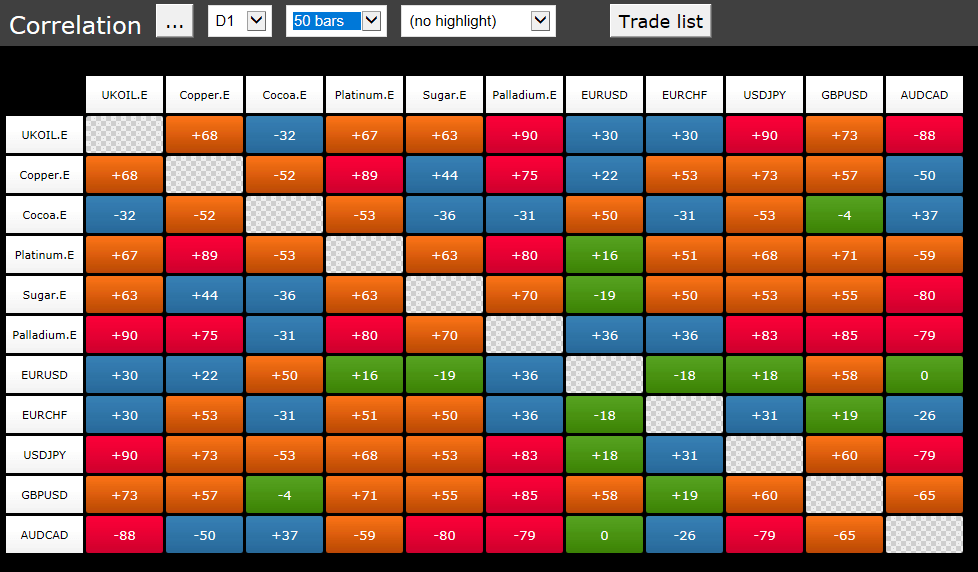

This particular example shows a positive correlation in red, which means that the prices go in the same direction. The ones in blue indicated the presence of negative correlation, meaning that the exchange rates of the two currency pairs move in opposite directions.

- Because one currency is being bought and one sold exchange rates are always quoted in pairs.

- Before we go any further, let’s discuss the Forex pairs meaning.

- Investors who trade the forex markets use multiple strategies to predict the future direction of currency pairs.

- In other words, if a currency quote goes higher, the base currency is getting stronger.

- Carefully review the Margin Handbook and Margin Disclosure Document for more details.

The meter takes readings over the last 24 hours from each forex pair and applies estimates to each. A currency strength meter is essentially a visual guide indicating which currencies are currently solid, and which currencies are poor. Exchange Rate – The value of a base currency against a quoted currency.

Currencies are always quoted in pairs, one currency value against another. This means that no single currency pair ever trades independently from others, they are all interlinked. This is called positive or negative correlation – positive when the pairs react in line and negative when they react opposite. Understanding how currency correlation works and what market factors affect different currency pairs is crucial in forex trading. Major currency pairs include one major currency against the US dollar. Simply put, these are the most actively traded currency pairs in the world, and they offer the greatest liquidity. Their volatility is consequently lower, since – given the large number of traders involved – the consensus on a given price is much stronger and harder to disrupt.

The lesson here is that if you want to fight trends in the Forex world, be sure to have a sound and tested method able to capitalize on such circumstances. The second are graphical representations of the exchange rates like you see above.

For those looking to dive deeper into currency exchange rate charts, a multitude of pay-to-use online charting platforms are available. When trading Forex, you’re trading currency pairs – what this means is you are buying one currency and selling the other so the price you see is the price of one currency relative to the other. Governments, banks, companies and individuals need foreign currency every day. This might be businesses buying stock from an overseas supplier, a bank hedging its exchange rate risk or an individual going on holiday and needing some spending money. Whether directly or through intermediaries like brokers these parties all come together to buy and sell currencies – this creates the market and the price you see on your trading screen. Now that you understand what exactly currency pairs are and how they work, you’re all set to dive deeper and look at how to set up a currency pair trade on a popular trading platform like MetaTrader 4. Although trading major currency pairs is generally less risky than trading other types of pairs, you can still lose money just as easily if you don’t know what you’re doing.

Traders refer to this extra place as a fractional pip, otherwise known as a pipette. If the GBP/USD currency pair increased from $1.23057 to $1.23058, the value moved a tenth of a tip or one pipette. When the value of one currency changes, it adjusts relative to another currency. If the quotation goes from $1.2305 today to $1.2309 the following day, it means that the pound sterling has appreciated relative to the U.S. dollar. This also implies that the U.S. dollar has depreciated relative to the pound sterling, as it will cost the trader more U.S. dollars to buy a single pound sterling. The crosses are any currency pair that doesn’t feature the USD and they do not hold any less profit potential than the majors.