Table of Contents

- Stops Around Support And Resistance

- Ohlc, Pivot Points, And Support

- Understanding Technical Analysis Price Patterns

- Support & Resistance Using Pivots

- Important Support And Resistance Levels

- How To Find Support And Resistance Levels

The price starts increasing and the MACD starts trending in a bullish direction. In the middle of the next trading day the MACD lines interact in the bearish direction. In this pivot trading strategy I will include the Moving Average Convergence Divergence indicator.

In the chart example above we see how Support rejected the price and pushed back up. We also see the candle that formed afterward to signal the end of the down movement and the beginning of and upward movement.

Stops Around Support And Resistance

This first step is really simple and should be complicated. The only thing you need to do is to open any chart an pick the type you prefer.

Based in Pittsburgh, Analyzing Alpha is a blog by Leo Smigel exploring what works in the markets. Think about the low of the Covid-19 crash, that level is much more significant than the low of last week. Notice how the Shopify hourly chart seems to respect the 12-period EMA on multiple instances. Institutions must buy or sell large volumes of shares without moving the market too much, causing slippage or tipping the market off and being front-run.

Ohlc, Pivot Points, And Support

The above shows support and resistance as a straight line in blue. You’ll see that the asset price on this chart often falls to the support level but then bounces back up. But eventually, the price does break through the support line. Dedicated to providing traders with the help and tools necessary to make a living day trading. You have to remember that prices are driven by the actions of large numbers of people. Both the support and resistance lines are not absolute points on a chart. When a stock approaches either line, maybe a bounce happens a few cents from the support or resistance.

How many tops or bottoms does it take to confirm a trend line?

It takes at least two tops or bottoms to draw a valid trend line but it takes THREE to confirm a trend line. The STEEPER the trend line you draw, the less reliable it is going to be and the more likely it will break.

This time you will add all four indicators, PrevDay High, PrevDay Low, PrevWeek High and PrevDay Low to the data series. Now you can add the PrevDay Low indicator as the support line by repeating the “add indicator” procedure as you just did for the PrevDay High indicator. The script presented here obtains the highs and lows of the previous week and plots them on the daily chart. It also plots the difference between the MACD and its signal line . As Hartle states in the article, the first step is to plot two trendlines going forward, one off the previous week’s high and one off the previous week’s low. In the article, a how-to on plotting the trendlines manually is given. In TradeStation, however, it is quite straightforward to implement this as an indicator, just like MACD, and we present the EasyLanguage code for such an indicator here.

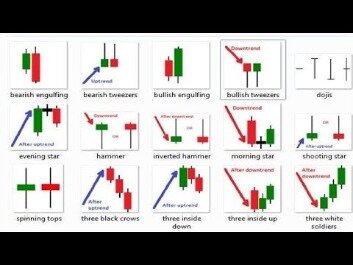

Understanding Technical Analysis Price Patterns

One example of this is recurring patterns in historical stock prices. These price patterns are essentially shapes that sometimes appear on stock charts.

Whenever you feel you can connect 2 highs/lows, add an horizontal line. The lines do not necessarily have to be at the complete low. The important thing here is to draw a simple line at all lows and highs. Then, you want to identify all the highs and lows you see on your chart.

Support & Resistance Using Pivots

With the help of some simple calculations and the high, low and close prices of previous days, several points can be derived. These points may appear to be crucial support and resistance levels. These several points calculated from that are the so called pivot levels. Pivot points are predictive indicators that were first used by floor traders. The three key levels are R1, S1 and PP, although most traders also calculate the R2, R3, S2 and S3 levels.

They are more like zones that can be breached and pushed into. The trend may pull the price action back out of it, or maybe price action will succeed in breaking it for good. With so many traders using both tools in their analysis, they can easily become self-fulfilling.

Important Support And Resistance Levels

In a downtrend, you would connect the highest high to the lowest low. Those new to this indicator think of it as the amount the price pulls back before likely continuing the move. Imagine there’s a ton of short-sellers shorting Apple at $100. The price moves down to $95 and then starts to move back on the shorts. They’ll likely cover around the $100 area as not to take a loss. More short positions equals more short covering, and more covering leads to higher price rejection at the level. If an institution was accumulating shares at a certain price area finds a better place to put their money to work, that price area will no longer act as support.

The high degree of leverage that is often obtainable in commodity interest trading can work against you as well as for you. The use of leverage can lead to large losses as well as gains. Optimus Futures, LLC is not affiliated with nor does it endorse any trading system, methodologies, newsletter or other similar service. The use of descriptions such as “best” are only for search purposes. Optimus Futures, LLC does not imply that you cannot find better tools or opposing valid views to our opinion.

A trader monitoring this stock may have bought the stock on the day of the breakout and potentially profited in the following days. Like horizontal support, diagonal support is formed by connecting lows. The difference with diagonal support is that the lows are sequentially higher because a stock is in an uptrend. Notice how the stock stopped going down, and continued trending up, on several occasions after its price dropped near the diagonal support line. A trader identifying this support might try to buy the stock near support. Among all the aspects of technical analysis, perhaps the most important and actionable concepts are support and resistance.

- A resistance line is one of the tools used in technical analysis to predict future prices and guide investment decisions.

- This way, you will not dilute your attention by trying to watch out for too many features.

- One way to determine your support and resistance levels is to use basic market trend structure.

- We can see in the chart that after a strong move down, prices retraced to reach various Fibonacci retracement levels.

The sellers have been unable to beat the buyers when the stock price approaches the support level. Hands on is the best teacher so crack open your charts and staring perfecting your use of support and resistance trading. The assumptions that either levels ‘work’ all the time or they are,as the trader at the beginning had decided, non-existent, are both flawed. Protective stops are accumulating just beyond resistance and the traders on the sidelines are waiting for price to break resistance so they can go long. Many breakout traders get nailed when price tests a level, appears to want to break and then simply snaps back up.

Maxima and Minima is calculated and then those values are flattened . I consider a price only if it is the highest or the lowest among N candles on both side of it. Sort the prices by score and remove the ones close to each other(at a distance of x% from each other). Create a list of important price – The high and low of each candle in your range is important. Each of this prices is basically a probable SR(Support / Resistance).

As the name suggests, resistance is something which stops the price from rising further. The resistance level is a price point on the chart where traders expect maximum supply for the stock/index. The resistance level is always above the current market price. Support and resistance are key elements of technical analysis. Support and resistance levels are caused by fundamental and technical reasons, usually due to institutional activity. There are multiple ways to draw support and resistance areas and to trade using them. Institutional investors and traders determine support and resistance levels for most securities.

The larger the psychological price level, the more significant the reaction should be. There are also price levels that are not specifically anchored by chart indicators but are more based on simplistic psychological areas or based on underlying derivative based mechanics. The strength of a support or resistance is increased when there are multiple indicators that overlap near the same levels. Swing high is a technical analysis term that refers to price or indicator peak. Swing highs are analyzed to show trend direction and strength.