Table of Contents

- Strong Jobs Report Is Good For Dollar

- Understanding Nonfarm Payrolls

- Beating The Crunch: Can We Invest Wisely In An Economic Downturn?

- January Us Jobs Report Review

The BLS also provides numbers for private-sector non-farm employment and other subsets of the aggregate. Investors and traders are aware that the monetary policies of the Federal Reserve of the United States are closely linked to NFP data. Significant changes in NFP figures can lead to major fluctuations in financial markets. In addition to being a fairly accurate indicator of the economic conditions, job statistics are also important for several reasons. When the unemployment rate reduces below 5%, there is usually a shortage of good workers, and businesses may have to pay higher compensation.

A NonFarm Payrolls Forecast is some sentiment-based piece of content that tries to predict what the NFP numbers will be and what impact will they have on the markets. The headlines are impressive – a fall of the US unemployment rate to 8.4% and an increase of 1.371 million jobs, within expectations. The upbeat headlines have pushed stocks higher, allowing them to recover after Thursday’s sell-off. Positive for COVID-19 – the new about President Donald Trump’s trumps everything, even the critical jobs report. The worrying news about the leader of the world’s most powerful country has been grabbing the headlines.

Strong Jobs Report Is Good For Dollar

This is due to the fact that one employee can be mentioned in several payrolls , thus the report data can be inaccurate. The timing of the ADP Non-Farm Employment Report is typically several business days before the U.S.

This number does not include details of employees of private households, non-profits, or workers on farms. The NFP statistics are considered important since they affect the financial markets, especially the gold, stock market indices, share prices, and the US dollar. The ADP National Employment Report is a measure of the monthly change in non-farm, private employment, based on the payroll data of approximately 400,000 U.S. business clients. The release, two days ahead of government data, is a good predictor of the government’s non-farm payroll report.

Understanding Nonfarm Payrolls

That’s why the Fed pays close attention to the employment indicator when deciding rate hikes. Non-Farm Payroll , also known as the non-farm employment change, is an economic indicator which measures jobs added in the previous month. Farming related jobs are excluded because they tend to be seasonal in comparison to other general employment. The jobs numbers are reported as part of the “Monthly Employment Situation Report” from the Bureau of Labor Statistics. The widely publicized “job creation” number is a net figure, computed as jobs created less jobs lost during the survey month.

ADP, the ADP logo and ADP Research Institute are registered trademarks of ADP, Inc. Interest in the ADP Report Please select Aid investment decisions Aid government policy decisions Aid human resource decisions Aid general business decisions Aid academic research General interest Other Please select an interest.

Beating The Crunch: Can We Invest Wisely In An Economic Downturn?

Those who advocate trading NFP releases base their advice on a previous preparation and some fundamental research. The elaboration of some macroeconomical analysis is essential for successful trading.

Increasing the value of a currency is not always good for the country because it prevents their suppliers and factories to sell their products to other countries. It also prevents tourists from buying the currency, traveling to the country and spending their money there.

Historically, the best month for wage growth is usually May, with an average of 129,000 additional jobs. For nonfarm payrolls, the year 1994 was the best on record with 3.85 million jobs added. In 2009, the job force lost 5.05 million jobs, marking the worst statistical year for the nonfarm payroll count. In 2018, payroll employment growth totaled 2.6 million compared to additions of 2.2 million in 2017 and 2.2 million in 2016.

We diligently work to meet the stringent standards set by the JSC in order to put our client’s best interests at the centre of our business.

January Us Jobs Report Review

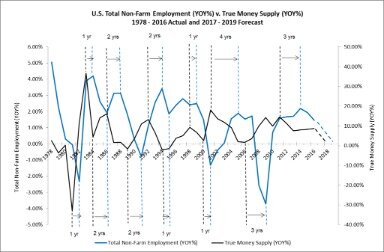

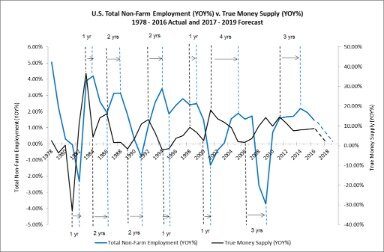

Bureau of Labor Statistics as part of the Employment Situation Report on the state of the labor market. As the chart above shows, there BLS and ADP’s data are highly correlated. But there is no clear long-term relationship between the gold price and non-farm payrolls, neither total nor private. The next couple of days could be crucial for what happens next with the S&P 500.

- The short-term market moves indicate that there is a very strong correlation between the NFP data and the strength of the US dollar.

- This is measured by the Bureau of Labor Statistics , which surveys private and government entities throughout the U.S. about their payrolls.

- However, in the post financial crisis world, this could have a different effect than what one would initially expect.

- You can do it, but you need something more to have a reasonable income through Forex trading.

- Non-farm payrolls are a monthly statistic representing how many people are employed in the US, in manufacturing, construction and goods companies.

- Telephone calls and online chat conversations may be recorded and monitored.

A job market is a market in which employers search for employees and employees search for jobs. It alludes to the competition and interplay between different labor forces. Nonfarm payroll statistics also show which sectors are expanding and contracting. Expanding sectors will contribute a higher number of new payrolls and contracting sectors may have low or negative contributions showing a reduction in job availability.

“Buy the rumor, sell the fact’ – that has been one of the consistent trading patterns through the decades and perhaps the centuries. January 2021’s NFP has proved no different. It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider.

One thing is for sure, there could be some fireworks at the end of the week. However, when looking at equities in general, there are plenty of reasons to think that they should continue to find buyers.

Estimates are generated via the “Establishment Survey”, also known as the payroll survey or Current Employment Statistics program. The nonfarm payroll statistic is released monthly, on the first Friday of the month, by the U.S.

This reading followed January’s increase of 166,000 and beat the market expectation of 182,000 by a wide margin. The numbers are released on the first Friday of the new month and capture employment trends from the month before. The job openings and labor turnover survey is a conducted by the United States Bureau of Labor Statistics to help measure job vacancies. Current Population Survey is a statistical survey of households that is performed by the U.S. U.S. Nonfarm payrolls were severely impacted by the COVID-19 global pandemic in March of 2020.

When there is no recession, the NFP numbers for the increase in jobs will usually increase by between ten thousand and two hundred and fifty thousand monthly. This value indicates the increase or decrease in the employee numbers in the last month, excluding the farming sector. When NFP numbers rise, it indicates that businesses expect growth. These new employees getting salaries are likely to purchase services and goods, leading to further growth. When businesses do not expect growth, they do not hire, and there is a decrease in NFP figures.

It causes companies not to receive enough orders from other countries. Therefore, if the value of the currency, or USD in this case, keeps on going up, it will have a negative impact on the economy. When the economy is good, people get hired and Non-Farm Payroll goes up.