Table of Contents

- Do You Buy Bearish Or Bullish?

- Warrior Trading Blog

- Penny Stock Promoter Busted!

- How Can You Trade Bullish Vs Bearish Markets?

If asset prices go down, they can buy back the shares for less then they paid and keep the price difference. You’ve probably heard the terms before on CNBC but, if you’re a new investor, you might not know what they mean. However, Wall Street didn’t pull these terms out of thin air. In fact, they make perfect sense when you put them in context with their history. Bulls and bears have been battling it out on Wall Street for over a hundred years. To understand the stock market, you have to understand that it all comes down to bulls vs bears. This would provide you with investments in a broad range of stocks, which offers the safety of diversification while allowing you to capture market-wide gains.

In this scenario, the country’s economy is typically strong and employment levels are high. A bear marketis one in which the prices of securities in a key market index (like the S&P 500) have been falling for a period of time by at least 20%. This isn’t a short-term dip like the one you’ll see during a correction, a time period when there are declines in prices of 10% to 20%. A bear market is a trend that leaves investors feeling pessimistic about the future outlook of financial markets or some part of a financial market. The longest U.S. bear market was 61 months, from March 10, 1937, to April 28, 1942. The most severe bear market chopped 86% from the market’s value; it extended from Sept. 3, 1929 to July 8, 1932. A bearish investor, also known as a bear, is one who believes prices will go down.

Do You Buy Bearish Or Bullish?

All options become worthless after their expiration date, so traders need to sell them or convert them beforehand or they’re beat for their profits. Bear has been used to describe a negative outlook on asset prices since the 18th century. The usage originated in the early 1700s around the bearskin trade. In those days, trappers gathered bearskins and sold them to a middleman. The middleman usually had them sold before he even received them, so it was in his best interest if bearskin prices went down. Then, he could afford to buy more bearskins with his cash on hand and generate more profits.

Start The Gauntlet Mini™ to get your funded trading account and trade like a professional. Bear markets are the worst fear of the majority of investors. However, this doesn’t mean that they don’t create opportunities, and you can’t make profits when the market is nose-diving. During the Financial Crisis of 2008, for example, John Paulson, a hedge fund manager, who will remain in history for his opportunistic views, made $15 billion in just a single year.

Warrior Trading Blog

But you can out pick most ‘experts’ by flipping a coin. Never trade on a single piece of information on its own. Check out Steve Nison’s “The Candlestick Course” to better understand how the patterns work. I also suggest you read “The Complete Penny Stock Course” written by my student Jamil . That book answers so many of the most frequently asked trading questions. Businesses don’t typically make as much money, and it’s uncertain as to when or if they’ll hit their highs again. BTW, all this talk of awful treatment of animals sickens me.

A bear market is in place once the market has sold off at least 20% of a couple month time period. Many times people don’t know a bear market happened until it’s over. Either because they are not following the charts, or because economic data tends to “lag”. If you want to find out if hedge funds are bullish or bearish on stock, then check out our FlowAlgo review. Knowing which one is the best to do, depends on your skill set.

Penny Stock Promoter Busted!

The bull market run marks an extended period of time during which the economy is sound, and the market is on the rise. During the run, investors are showing optimism and increased positivity towards the future of the market. The bullish market run can last anywhere from a few months to a couple of years. Buying on margin basically means a multiplication of the purchasing power. One investor borrowing money to buy 4x the amount he initially intended to is equal to four investors buying the particular stock.

- In sum, the decline in stock market prices shakes investor confidence.

- As an example, assume Suzy goes long 100 shares of ZYZY stock at $10.00, costing her $1,000.

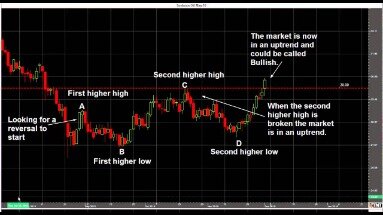

- Now we were looking for point we would look for points to buy in this type of market and not necessarily sell we always want to go with the trend.

- In this case we’re looking at a bearish pair we’re looking at the U.S. dollar Canadian dollar pair.

- When the bulls reign in the market, people are looking to invest money; confidence is high and the acceptance of risk generally goes up.

Low job unemployment rates and a robust economy are other conditions usually present in a bullish market. For example, if investors expect a major change in politics or in interest rates, this may increase the confidence of the market. Or, confidence may decrease due to fear of future conditions. However, I’ve learned a lot so far from my own mistakes. But as you’ve mentioned in some of your previous blogs and videos, I’ve learned not to beat myself up over them.

How Can You Trade Bullish Vs Bearish Markets?

You’ll also be able to understand what the media is saying and what economists believe the overall market and economy are doing. Both bear and bull markets will have a large influence on your investments, so it’s a good idea to take some time to determine what the market is doing when making an investment decision. Remember that over the long term, the stock market has always posted a positive return.

And if the price spikes up through the VWAP that’s bullish. But these are the general characteristics of bull and bear markets. Personally, I think the market was long overdue for a correction after over 10 years of a bull market. But I’m still prepared to trade through it — and to teach you how too. Access my no-cost, two-hour “Volatility Survival Guide” to learn how to ride the wild momentum. To say “he’s bearish on stocks” means he believes the price of stocks will decline in value. Being bearish is the exact opposite of being bullish—it’s the belief that the price of an asset will fall.

Again, this can always be a term used to describe the conditions of a market segment when those shares have decreased in price. Remember, the key to trading in any market — bear or bull — is to react. Trying to pick the top and the bottom is a great way to go broke. These lines can indicate a change from bullish to bearish and bearish to bullish. But my top students and I trade through any market conditions. It’s also important to know the limits of a pattern too. A bearish engulfing pattern is not a signal to short a low float on its first green day.

A general rise in the quantity of IPO activity throughout bull markets can be witnessed. It might be said that the prevailing sentiment of participants in a bull market is greed or fear of missing out.

If you buy $10 puts for $1 apiece, you have the option to sell 100 shares for $10 each. If share prices go down to $8, you can convert your option into shares for $800 and sell them for the agreed-upon strike price of $10 each.

During this era fur traders would, on occasion, sell the skin of a bear which they had not caught yet. They did this as an early form of short selling, trading in a commodity they did not own in the hopes that the market price for that commodity would dip. When the time came to deliver on the bearskin the trader would, theoretically, go out and buy one for less than the original sale price and make a profit off the transaction.

It can be profitable to be bullish in uptrends and bearish in downtrends everything else is just an opinion or a prediction. You’re not on the hook for $100,000 dollars, the amount you initially used to buy stocks. You’re on the hook for 1,000 shares of Apple stock which now cost $150,000 dollars. In fact, short-selling is one of the few ways you can lose more than you invest. If you believe that a company, say Apple Inc, is going to sink, you can borrow Apple stocks from a brokerage firm and sell them.

If the value is greater than one, then the investment professionals show a bullish sentiment, and vice-versa. A booming economy means more consumption and spending power. As a result, commodities like corn, oil, gas, and others usually tend to perform well during bull markets. The best way to take advantage of such investments is through futures contracts. Take a look at our in-depth Trader Survival Guides to learn everything essential about the most popular and widely-traded commodities.

Bullish markets come to an end when the asset experiences a price drop of 20% or more. During such times, the economy is usually sound, the global political stage is calm, companies innovate, sectors flourish, and people have more disposable income. Bullish markets are investors’ dreams as they are easier to navigate and provide favorable profit opportunities.

Do you buy or sell in a bullish market?

In a bull market, the ideal thing for an investor to do is to take advantage of rising prices by buying stocks early in the trend (if possible) and then selling them when they have reached their peak. In addition, investors may benefit from taking a short position in a bear market and profiting from falling prices.

Up, down or sideways, there’s a strategy you can use to turn a profit. We teach you peeps in our next level training library all the specific strategies using options to profit in any market. When the bulls reign in the market, people are looking to invest money; confidence is high and the acceptance of risk generally goes up. Yes, you can make money whether the markets are up or down, and you can weather the volatile storms a bit too. They refer to two opposing outlooks on the financial markets – either positive or negative.

As a result, prices of shares go down and the market falters. They may also view assets bearishly on a longer-term basis after negative announcements, such as a specific government regulatory action. One might hold a bullish view for a period based on an upcoming event, such as the Chicago Mercantile Exchange’s Bitcoin futures trading launch in 2017.