Table of Contents

- Advanced Training: Stock Market Psychology

- What Is A Profitable Trading System?

- Trading Psychology: The Power Of Patterns And Principles

- The Psychology Of Support And Resistance Zones

We’ll also cover common mistakes to avoid and seven steps to psychologically prime yourself for the stock market. If you want to be a better trader, you need to master your own mind, because nothing can wreck your trades faster than emotions.

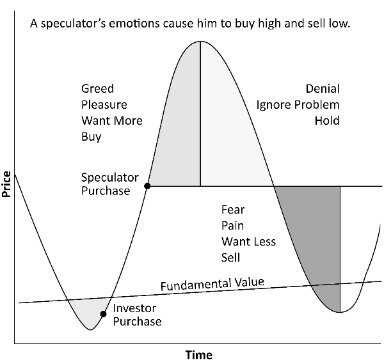

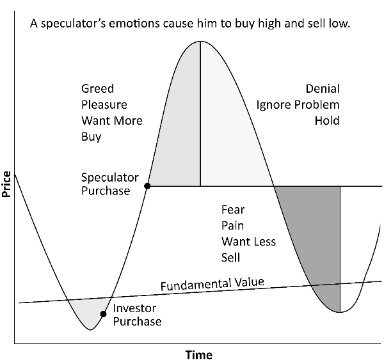

The results were positive with an overwhelming statistical confidence for each of the patterns using the data set of all S&P 500 stocks daily for the five-year period 1992–1996. One of the problems with conventional technical analysis has been the difficulty of specifying the patterns in a manner that permits objective testing. Applying Kahneman and Tversky’s prospect theory to price movements, Paul V. Azzopardi provided a possible explanation why fear makes prices fall sharply while greed pushes up prices gradually. This commonly observed behaviour of securities prices is sharply at odds with random walk. By gauging greed and fear in the market, investors can better formulate long and short portfolio stances. The random walk index is a technical indicator that attempts to determine if a stock’s price movement is random in nature or a result of a statistically significant trend. The random walk index attempts to determine when the market is in a strong uptrend or downtrend by measuring price ranges over N and how it differs from what would be expected by a random walk .

Advanced Training: Stock Market Psychology

This does not mean you approach the market with an “I am right” attitude, but you fully accept that you will get whatever the market is willing to provide. make the right decisions because you’ve seen it with your trading simulator, TradingSim. Trading to me is the greatest personal endeavor a person can take on in their life. I say this because of how difficult it can be at times and how all-consuming it can be as well. It is one of the last professions that who you are and what you think of yourself is reflected back at you based on your equity curve.

Market psychology plays a major role in a given instrument’s price movement as traders and investors remember the past, react to changing conditions and anticipate future market movement. Knowing what the market is thinking is the best way to determine what it will do next. When you start studying technical traders, you will notice every trader has a particular time frame, a preferred set of indicators, and trading frequency that fits their unique personality and lifestyle. Their brains can see the charts in ways you and I may not see them to predict future price direction over the next few hours, days, weeks, or months ahead. I quickly learned there are infinite ways to trade using technical analysis.

Stocks that have a unique story often gain strength over time as that story becomes more well known. When the logic of the trade makes sense to a greater number of people, it can build substantial momentum.

What Is A Profitable Trading System?

Finally see all of your marketing in one place with Marketing Calendar software from CoSchedule. Organize all of your marketing in one place with Marketing Calendar software from CoSchedule. Do you want access to 100s of marketing videos, resources, & best practices? You’ll get hours of training and practical how-tos to improve your marketing. From Newton, Goethe, Itten, Hering, Young-Helmholtz, Birren, orMüller, the lowly color wheel has been considered and reconsidered again and again. The effect color has on us and our behavior has been studied repeatedly.

There are times when it is wise to stay out of the market and observe from the sidelines. There are times when reading market trends and market psychology using specific metrics seems as effective as reading the tea leaves. Zone of resistance refers to the zone where a rising stock price meets resistance and starts trending downward. Don’t let unchecked panic, fear, and greed sabotage the trading skills and knowledge you’ve worked so hard to build. Remove mindset and emotion from the trading equation — as often as possible.

Trading Psychology: The Power Of Patterns And Principles

Tone-on-tone similar colored combinations are very popular and while their subtlety is quite attractive, they are also difficult for people to read. Yellow and orange have little contrast with each other, despite being different colors.

Technical indicators- Technical indicators are a statistical form of technical analysis where technicians apply various mathematical formulas to prices and volumes. The most common technical indicators are moving averages, which smooth price data to help make it easier to spot trends. More complex technical indicators include the moving average convergence divergence , which looks at the interplay between several moving averages. Many trading systems are based on technical indicators since they can be quantitatively calculated. Among the most basic ideas of conventional technical analysis is that a trend, once established, tends to continue. However, testing for this trend has often led researchers to conclude that stocks are a random walk.

– A positive outlook encourages us about the future, leading us to buy stocks. IBD’s psychological indicators give you a more complete analysis on the strength of the market, especially at short- and long-term tops and bottoms. Get Started Learn how you can make more money with IBD’s investing tools, top-performing stock lists, and educational content. Another popular contrarian indicator is the Investors Intelligence survey of market newsletters. You would think the professional advisors, the so-called “experts,” would provide valuable information on market direction.

The Psychology Of Support And Resistance Zones

Color directs our eye where to look, what to do, and how to interpret something. That’s precisely why, as a content marketer, you need to understand what colors mean to people. After reading this post, you’ll understand basic color theory and psychology.

Prospect theory, and the notion of taking more risks to avoid losses than to realize gains, also explains why investors hold onto losing stocks. Many investors want to remain in a risky stock position, hoping the price will bounce back and falling into the trap of trying to win it all back. We all have trading accounts, and while our trading accounts are important, what is even more important are our long-term investment and retirement accounts. Because they are, in most cases, our largest store of wealth other than our homes, and if they are not protected during a time like this, you could lose 25-50% or more of your entire net worth. I hope you found this informative, and if you would like to get a pre-market video every day before the opening bell, along with my trade alerts. These simple to follow ETF swing trades have our trading accounts sitting at new high water marks yet again this week, not many traders can say that this year.

Use it to practice using limit orders and stop losses and generally learn how to manage your risk. Maybe you don’t feel ready to throw your hard-earned cheddar in the pot just yet?

Chart patterns- Chart patterns are a subjective form of technical analysis where technicians attempt to identify areas of support and resistance on a chart by looking at specific patterns. These patterns, underpinned by psychological factors, are designed to predict where prices are headed, following a breakout or breakdown from a specific price point and time.

Since white has an equal balance of all the colors, it can exemplify several meanings, with equality outweighing them all. White is a great color for simplicity, cleanliness, and idea creation; however, avoid using too much white as it can cause isolation, loneliness, and emptiness. Black is a color of sophistication, seriousness, control, and independence. Although, it can also be used to show evil, mystery, depression, and even death. Black is a very reserved color that completely lacks any light as its an absence of all the colors. It likes to stay hidden, in control, and separate from others.

Using Contrast Correctly With Color

“Stock price that is heavily overbought or oversold – I look for the price to accelerate away, but in the same direction as the current trend. With over 20+ years of combined trading experience, Rolf Schlotmann and Moritz Czubatisnki have gathered substantial experience in the trading world. The screenshot below shows the ideal “Boom and Bust” pattern. In the initial stage you have a slow and moderate trend .

- Behavioral economics and quantitative analysis use many of the same tools of technical analysis, which, being an aspect of active management, stands in contradiction to much of modern portfolio theory.

- Eventually we return come to the realization the market actually does have cycles .

- Cooler and softer colors are better for mental activity and make the time seem to fly by.

- Furthermore, the panic after a bubble is greatest after a rally and countless empirical research has confirmed that price movements are much faster during falling markets.

- Kirk founded Option Alpha in early 2007 and currently serves as the Head Trader.

- Thousands of people all over the world have already learned and are successfully utilizing the Market Psychology system.

- Meanwhile, the traders who are short will buy to cover, because they are afraid of losing money.

First published in 1923, this book by Edwin Lefèvre is based on legendary trader Jesse Livermore. This book includes addressing personal inclinations to seek short-cuts, being easily swayed by fear or greed, and getting distracted. These traits often cause traders to act irrationally even when they know better. In simple language, the book explains why and how these issues occur, and how to approach them to keep them from happening. Our Momentum Strategy is designed to take advantage of the Market Psychology of emotions of a Support/Resistance level break. We anticipate that a break of that level will cause momentum acceleration of price for a period of time.

And remember, color has meaning so each color adds or takes away from your message. They like to make things look beautiful, but beautiful isn’t always the best for readability.

One is that these prices have been significant in the past and traders know they are likely to be again. Market participants often gauge future expectations based on what has happened in the past; if a support level worked in the past, the trader may assume that it will provide solid support again. While we can all make money during a bull market when stocks are rising, if you cannot retain or grow your account during market downturns, then you may as well be a passive buy and hold investors.

We specialize in teaching traders of all skill levels how to trade stocks, options, forex, cryptocurrencies, commodities, and more. We provide content for over 100,000+ active followers and over 2,500+ members. Our mission is to address the lack of good information for market traders and to simplify trading education by giving readers a detailed plan with step-by-step rules to follow. This causes prices to drop back to the number 2 point – often breaching the number 2 point by a few pips.

You don’t want 50% orange and 50% blue because neither color wins and it causes distress to the eyes. They are geographically and color-wise the opposite, and provide a kind of visual tension because they are so opposed to each other. The color wheel can help you choose great color combinations for your call to action button, your infographics, and your lead collection pop-up. When it comes to color techniques, the use of contrast is particularly important, and it’s probably the one that will lead you to butt heads with your designer the most.

Furthermore, recognise that a trend doesn’t last forever, but when there is a bull market people get more and more excited, projecting in the future what has happened until now. Then, when things start to change, they enter the fear mode and sell at any price the market is offering. This is the best moment to buy, especially if you did your homework and understood that price and value are two different things, but it requires going against what everybody is doing. By now, I hope that you recognize that human emotions regulate stock market buying and selling behavior and investing decisions are often driven by emotional reactions rather than rational calculations. This is the period with the most emotional impact, where you feel helpless and really don’t know what to do, feeling without any degree of control on the situation, on your investments and on markets. Things start to turn around, markets show the first signs of weakness but overall the sentiment for the long term is still bullish and you convince yourself that it is just a short correction. Psychology studies investigated the interconnection between our feelings and our judgments.

Price

Recognition of these patterns can allow the technician to select trades that have a higher probability of success. An example of a security that had an apparent trend is AOL from November 2001 through August 2002. A technical analyst or trend follower recognizing this trend would look for opportunities to sell this security. Each time the stock rose, sellers would enter the market and sell the stock; hence the “zig-zag” movement in the price. The series of “lower highs” and “lower lows” is a tell tale sign of a stock in a down trend.