Table of Contents

- Stock Volatility

- How Loss Aversion Increases Market Volatility And Predicts Returns

- 4 3 Volatility

- How Traders Can Take Advantage Of Volatile Markets

- Not The Answer You’re Looking For? Browse Other Questions Tagged Volatility High

- 4 4.1 Risk Control

Therefore, high levels of volatility reflect extraordinary characteristics of supply and/or demand. As an indicator of uncertainty, volatility can be triggered by all manner of events. An impending court decision, a news release from a company, an election, a weather system, or even a tweet can all usher in a period of market volatility. Any abrupt change in value for any underlying asset — or even a potential change — will inject a measure of volatility into the connected markets. VIX does that by looking at put and call option prices within the S&P 500, a benchmark index often used to represent the market at large. Those numbers are then weighted, averaged, and run through a formula that expresses a prediction not only about what might lie ahead but how confident investors are feeling. Economists developed this measurement because the prices of some stocks are highly volatile.

The post ties in with SRSV’s lecture on risk premia and implicit subsides. China’s success in product assembly, marketing and design relies on huge chip imports. We surveyed nearly 7,000 people in seven countries to find out about risk literacy during the Covid-19 crisis. The recent US equity market rally highlights the rise of a new kind of “all-in” retail investor, one that is ramping up leveraged trading through the derivatives market. Bond vigilantes are testing the US Fed’s commitment to long-lasting loose monetary policy. It is quite easy to overestimate or underestimate money growth and therefore underestimate the uncertainty surrounding the outlook for inflation.

Stock Volatility

It is common that investment opportunities with a high price volatility can mean a higher return on investment , meaning you can make more money faster than investing in low price volatility opportunities. However, the higher the volatility, the riskier the investment tends to be. Price volatility simply means the degree of change in the price of a stock over time. Some investment opportunities have a high degree of change, or high price volatility, and some have a low degree of change, or low price volatility. A value style of investing is subject to the risk that the valuations never improve or that the returns will trail other styles of investing or the overall stock markets. Beta is a measure of risk representing how a security is expected to respond to general market movements. The Allocation Charts measure beta versus the S&P 500, which is given a baseline of 1.0.

The underlying may be random, but the payoff function of a well-defined contract or a position has to be known. Payoff functions of most classical volatility strategies are not invariant to underlying risks, and most volatility instruments turn out to be imperfect tools for isolating this risk. Even when traders’ anticipations come true, the trader may realize that the underlying volatility payoff functions have changed due to movements in other variables. Hence, classical volatility strategies cannot provide satisfactory hedges for volatility exposures.

- The average annual return for each portfolio from 1926 through 2015, including reinvested dividends and other earnings, is noted, as are the best and worst 20-year returns.

- Currency volatility is a statistical technique deployed within the financial industry to measure standard deviation of asset returns.

- notes that on average, during the 1970s, 1980s, and 1990s, the volatility of fixed exchange rates was approximately the same as that of floating rates.

- In retaliation, Iran threatened to close the Straits of Hormuz, potentially restricting oil supply.

- 252 are the number of days in a year that stocks can actually change in price.

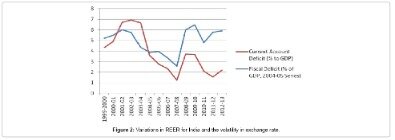

second, conventional wisdom notwithstanding, there is some evidence that implied volatility is backward-looking. Like it or not, Figure 3 shows that implied volatility and perceived volatility have been closely correlated , both in-sample (from 15/07/1993 to 30/12/2005) and out-of-sample (from 30/12/2005 onwards). In the chart below, observe the relative volatilities and the deviations thereof over the course of the recent market meltdown. So as not to get into any trouble with physicists out there, the formulas for standard deviation and movement of a pendulum are different and I am not equating the two from a statistical perspective. Stocks with a swing that is greater from point 1 to point 2 vs. that of another stock will have a higher volatility than the other stock.

How Loss Aversion Increases Market Volatility And Predicts Returns

Now that she knows the standard deviation, she finishes the calculation to find price volatility by multiplying the standard deviation times the square root of 252. 252 are the number of days in a year that stocks can actually change in price. 2 A common assumption in finance is that increasing a portfolio’s risk exposure should generate a higher return. In contrast, the low volatility anomaly refers to the observation that historically, portfolios of lower-volatility stocks produced higher risk-adjusted returns than portfolios with high-volatility stocks. – The standard deviation of a stock’s return over a period of time. High volatility means that the price of a security can change dramatically over a short time period in either direction. A lower volatility means that a security’s value does not fluctuate dramatically, but changes in value at a steady pace over a period of time.

How do you explain volatility?

Volatility is a statistical measure of the dispersion of returns for a given security or market index. In most cases, the higher the volatility, the riskier the security. For example, when the stock market rises and falls more than one percent over a sustained period of time, it is called a “volatile” market.

Volatility affects pricing of options, being a parameter of the Black–Scholes model. Glosten and Milgrom shows that at least one source of volatility can be explained by the liquidity provision process. When market makers infer the possibility of adverse selection, they adjust their trading ranges, which in turn increases the band of price oscillation. It is effectively a gauge of future bets investors and traders are making on the direction of the markets or individual securities. For simplicity, let’s assume we have monthly stock closing prices of $1 through $10. As the option moves further out of the money, the delta value will head towards 0. I use Yhang Zhang measure for intraday volatility for timeseries with a rolling 5 or 10 day window.

4 3 Volatility

Floating rates float up and down and down and up from year to year, week to week, and minute by minute. What a floating exchange rate will be a year from now, or even a week from now, is often very difficult to predict. Floating exchange rates have not resulted in currency volatility, as feared. If we have 30-day volatility of 5% , then on 20 of those days (i.e. 68%) the next day’s price should differ by less than 5% . On about 28 of the days (i.e. 95%), the daily price difference should be less than 10% .

What is a volatility crush?

Volatility crush is a term used in options trading to describe the swift reduction in implied volatility of an option after the underlying stock’s earnings are announced or some other major news event.

The VIX was created by the Chicago Board Options Exchange as a measure to gauge the 30-day expected volatility of the U.S. stock market derived from real-time quote prices of S&P 500 call and put options. There are several ways to measure volatility, including beta coefficients, option pricing models, and standard deviations of returns. In measuring central tendencies of returns in the financial context, variance doesn’t really make sense because variance is not in standardized units like standard deviation.

How Traders Can Take Advantage Of Volatile Markets

Of increase, decrease, or no change, the effect on an importer’s profits if he waits to exchange currency and the foreign currency rises in value vis-à-vis the domestic currency in the meantime. Volatile exchange rates can quickly and significantly change the profitability of importing and exporting. The rate of return works out to be negative, which means that instead of making money on the foreign deposit, this investor actually loses $317. Had he deposited the $10,000 in a U.S. account, he would have had a guaranteed return of 1.90 percent, earning him $190 instead. In any case, it should be clear that exchange rate fluctuations either increase the risk of losses relative to plans or increase the costs to protect against those risks.

This is because there is an increasing probability that the instrument’s price will be farther away from the initial price as time increases. The volatility of a stock relative to the overall market is known as its beta, and the volatility triggered by internal factors, regardless of the market, is known as a stock’s alpha. The term volatility indicates how much and how quickly the value of an investment, market, or market sector changes. Dispersion is a statistical measure of the expected volatility of a security based on historical returns. A variable in option pricing formulas showing the extent to which the return of the underlying asset will fluctuate between now and the option’s expiration. Volatility, as expressed as a percentage coefficient within option-pricing formulas, arises from daily trading activities. How volatility is measured will affect the value of the coefficient used.

The shipment cost in rupees remains the same at Rs 300,000, but the dollar value of the shipment rises to $5,454 or $5.45 per soccer ball. Assuming the same $5 of extra costs and a $12 final sale price, the importer will now make only $1.45 profit per soccer ball, if all balls are sold. While this is still a profit, it is about 25 percent less than expected when the decision to purchase was made three months before. Volatility represents the degree to which a variable changes over time. The larger the magnitude of a variable change, or the more quickly it changes over time, the more volatile it is. In such a situation, a full plot of the returns by quarter would generally take the shape of the famous bell curve, or normal distribution. To fix ideas, imagine that over the relevant period, a given asset has never returned more than 20% in a financial quarter on any dollar invested.

Of course, in doing this, consumers switch their currency volatility to that of a cryptocurrency, which arguably can be as hard to predict as their own fiat currency. Currency volatility will naturally subside under dollarization scenarios. However it’s not a natural prelude towards easy payments and movement of capital. A dollarized country also forgoes its monetary policy tools, leaving tax as the only major lever that a government can pull to direct the economy. The extraction process of commodities can tend to follow a smash and grab mentality, where rents are secured, but panic ensues when prices drop or reserves are exhausted.

And, as the chart below shows, it has a particularly low historical correlation with the Value factor, and negative correlation with the Quality and Momentum factors. Therefore, it may potentially help to diversify portfolios that are concentrated in these areas. This should not be construed as investment advice nor as a recommendation of a particular strategy or product. Although factor performance isn’t guaranteed, different factors tend to outperform during different phases of the market cycle. The graph below shows which factors have the potential to perform better than the overall market as it rises and falls.

4 4.1 Risk Control

For this reason, countries may choose fixed exchange rates to reduce volatility and thus to encourage international trade and investment. For example, with short-term deposits, an investor can purchase a forward contract or enter a futures market.

During the Great Moderation, the Federal Reserve responded more systematically than it had before to deviations of inflation and output from their desired levels. The setting of policy turned out to be broadly consistent with what is known as a Taylor-type rule, named after the economist John B. Taylor, who first proposed his rule in 1993. But importantly, the “Taylor Principle” dictates that the federal funds rate should be increased by more than an increase in inflation. In this way, monetary policy, as measured by the “real” federal funds rate, increases in response to an increase in inflation.

The pendulum is constructed from a steel ball, attached to a rope and then suspended from a ceiling. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and more.

Nobel Laureate Christopher Sims has offered an analogy in which fire extinguishers limit the impact of a kitchen fire, even a large one, on a kitchen’s room temperature. Effective monetary policy or structural changes in the economy—like a pair of good fire extinguishers—may limit the adverse impact of even a major shock. If the extinguishers were used quickly and effectively, Sims pointed out, the kitchen’s room temperature might rise only slightly and briefly. But “had the fire extinguishers not been used, the temperature in the kitchen would have developed very differently that evening.” But in either case, the “shock” that caused the fire was the same . However, as Bank of England Deputy Governor Charles Bean pointed out in 2009, “shocks are not measured directly, only their consequences” .

Empirically, we document that average option returns are significantly and negatively related to our proxies for volatility and volatility-of-volatility risks. Hence, using the cross-section of equity index options and VIX options, we find strong evidence for a negative market price of volatility and volatility-of-volatility risks. This increased supply of implied volatility tends to compress implied as well as realized volatility most of the time, but it also fosters by the same token the brutal volatility spikes seen in early and late 2018. This initially directly supports the prices of the underlying assets. All the resulting positions are easy to price and to manage as long as the prices of the underlying assets move, if not continuously (as assumed in the Black & Scholes model), at least gradually. A case in point are those strategies that systematically sell options (i.e. implied volatility) to enhance returns in a low interest rate environment (so-called “inverse volatility” strategies). The hunt for yield fostered by unconventional monetary policy is indeed incentivizing investors, even retail ones, to sell options.

The first is intraday volatility which reflects the difference between the high and low on the day divided by the closing price of the day for the SPX. The second, LakeView Asset Management VDEV, is a proprietary measure of volatility that I created using historical trends in the SPX to predict future volatility.