Table of Contents

- Wavetrader

- Abcd Pattern: What Is It & How Do You Find And Draw It?

- Best Forex Strategy For Consistent Profit Indicator Mt4 Free Download

- What’s The Difference Between Retracement And Reversal?

- Download Forex Real Volume Indicator V2 Mt4 Strategy Free

- Pin Em Forex Systems Indicators Mt4

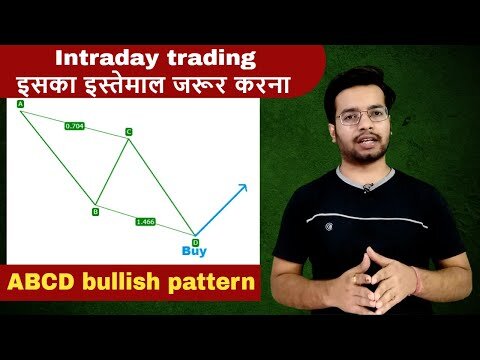

Harmonic indicator has a profitable Impulse levels can take place in any target level which can be shown and work for stop loss to make profit. Vertex can be form to see market price level at place your cursor. If we clearly and closely see triangle then we are capable to see formed triangle on historical data, this price level show numbers in below as butterfly shape line in given chart. ABCD candlestick Pattern is one of the ABCD pattern Fibonacci, traders use as a reversal indicator. Simply put, if this has been fully formed, then the price will most likely face the opposite reversal. The ABCD Pattern can be found on a lot of heavily traded stocks, regularly. You can see that there are patterns forming up within the ABCD pattern here.

ABCD pattern on a chartAs one can observe, the pattern establishes by connecting highs and lows between points A, B, C, and D. The ABCD is a Harmonic pattern that describes a potential reversal. Gartley and presented in the book “Profits in the Stock Market.” Later, Scott Carney further developed the ABCD pattern.

Next, the line CD should be the 1.272 Fibonacci extension of BC. If BTC is going to bounce this is where it will take place, in my view. Those who know me by now, do the right thing and promote this chart. Those who are new, CLICK the LIKE button if you find this chart useful. I published my last post by Classical Technical Analysis. Now, we are on micro wave 2 of Main wave C on Correction position .

Wavetrader

There are bull flags, double tops and cup and handles that make up the price action. Knowing these patterns is going to be key if you’re going to give yourself the best overall odds of success trading. Due to its overall structure, traders look for the highs and lows when trading the ABCD pattern. Moreover, a useful way to trade the pattern is to combine it with the zig-zag indicator.

Hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A large percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Furthermore, I would combine multiple technical analysis, fundamental analysis, price action analysis and sentiment analysis to filter all entries. You should trade forex in a way that suits your own individual style, needs and goals. The ABCD Pattern can be used on your trading platform charts to help filter potential trading signals as part of an overall trading strategy.

And from my experience, ABCD patterns have an extremely high probability of occurring in any stock, and I see them everywhere. The following setup tends to emerge in the market at some point on many, but not all, days. By learning to recognize this trading setup, a day trader may take actions that could improve their chances of seeing a profitable return. Unfortunately, the Starbucks phenomenon can and does creep over when new traders try to pick a day trading strategy. With so many choices, you’re overwhelmed before you get started.

Abcd Pattern: What Is It & How Do You Find And Draw It?

Is there anyway to also change the red “Buy” which is actually calling for a short and use the word “Sell”. This is a multi-harmonic patterns indicator for ThinkorSwim that is consists of 12 different type of patterns including Wolf Wave, Zig Zag, Butterfly, Crab, Elliot Wave, Gartley, and many more. By the time the whole three-drive pattern is complete, that’s when you can pull the trigger on your long or short trade.

Do you know why beginner day traders should learn the ABCD pattern? If you don’t, I’m going to give you an analogy to help explain. All information on The Forex Geek website is for educational purposes only and is not intended to provide financial advice. Any statements about profits or income, expressed or implied, do not represent a guarantee.

Best Forex Strategy For Consistent Profit Indicator Mt4 Free Download

But we must not forget that the approach must be comprehensive, the indicator signals require additional information to enter the market. One reason why many traders like trading techniques with the ABCD its reliability in identifying reversal points and predicting how long a trend will last. However, that does not mean this technique is 100% right and there are no weaknesses at all.

The Expert advisor based on Rainbow MT4 indicator, as you can see in the short video below is now available here . The indicator automatically draws Fibo Bobokus levels on a chart.

What’s The Difference Between Retracement And Reversal?

Even when there are thousands or even hundreds of thousands of calculations occurring with each new price movement, signals are as easy as ABC for the trader with the right tools and know-how. No. 1 in Figure 4 shows the previous ABC pattern failure.

For the pattern to emerge, the price travels from A to B and then C to D. The distance between A to B and C to D should be equal.

You should still not enter the trade as you are not sure where the bottom of the pullback will be. Inevitably the buyers will want to take profits, so they begin to sell their shares. We end up seeing the spike, followed by a healthy pullback. And once buyers overpower sellers, an intraday low is established as the price comes down. Every Pattern offers each the bullish as well as bearish edition.

Download Forex Real Volume Indicator V2 Mt4 Strategy Free

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. There are a number of combinations and permutations of the ABC pattern. In this case, the equity put in an extreme followed by an A from which a conservative long trade could have been made. At B, the long would be exited and then re-entered at C . In this example, the equity failed to reach a higher high than B, so the pattern failed. The trade is immediately exited once an ABC failure occurs.

Patterns makes parts of the many predictive tools available to technical analysts, the most simples ones can be easily detected by using scripts. The proposed tool detect the simple form of the ABCD pattern , a pattern aiming to detect potential price swings.

The pattern develops when the line AB is equal to the line CD. The lines AB and CD are known as legs, while the line BC is called correction or retracement. Then in the settings of the lower panel study change the “Showvolumewave+ from no to yes. @chillc15 ThinkorSwim has a few ZigZag related indicators including the ZigZagPercent. In line with this same topic and I know this is an obscene involved indicator, curious if anyone has seen this converted to TOS.

Pin Em Forex Systems Indicators Mt4

The duration of price movements from point A to point B must be the same as the length of price movements from point C to point D. What we need to do is wait for this pattern to formed and wait for point D to form before deciding whether to open a Short or Long position, look image below. The AB and CD lines are called “leg”, the BC line explains the correction or retracement. Stock trading is not an exact science, but Bullish Bears will help you unravel the unknown. When the price reaches D, I sell half of my position and bring my stop higher. In short, we are planning for the stock to break above point A, and we consider taking profits at point D.

- Additionally, plenty of time in order to complete retracements Some sort of together with M ought to be same.

- These points define three consecutive price swings, or trends, which make up each of the three pattern “legs.” These are referred to as the AB leg, the BC leg, and the CD leg.

- All pattern of trading strategy are designed to provide you best results but this are used for bearish and bullish orientation part to take strong steps toward upward moves.

- ABCD pattern on a chartAs one can observe, the pattern establishes by connecting highs and lows between points A, B, C, and D.

- You can see that there are patterns forming up within the ABCD pattern here.

A hanging man is a bearish candlestick pattern that forms at the end of an uptrend and warns of lower prices to come. The candle is formed by a long lower shadow coupled with a small real body. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

Traders may interpret this as a sign to move to a larger timeframe in which the pattern does fit within this range to check for trend/Fibonacci convergence. Additionally, using an oscillator helps in identifying the turning points once pivot swing point D is formed. The ABCD also forms the basis of many other chart patterns such as the three-drives patterns and also within the price channels. The indicator displays the standard price deviation from the root mean moving average line in the additional window. The screenshot displays the standard indicator and SqrtDev . Parameters SqrtPeriod – root mean line and standard deviation period.

@chillc15 I have seen a third version of this that gave a confirmed signal after a buy or sell. All the same, BenTen reversal, the one you posted and the other I mentioned, all repaint. So not worth the effort to modify the display of the code. @Likos You can easily do so by backtesting each pattern and looking up their origin. I don’t use this at all so I can’t rate the patterns. Check out our Buy the Dip indicator and see how it can help you find profitable swing trading ideas.