Table of Contents

- Asian Session Scalping Strategy

- Before You Trade, Asktraders

- Forex Day Momentum Strategy Anatomy:

- Strategy 2 Momentum With Stochastic And Macd Trading System

- Elements Of Momentum Investing

- Moving Average Strategies For Forex Trading

Open a 5-minutes time frame chart of the desired currency pair and plot the 20-period EMA on the chart. After plotting both the indicators, look for the currency pair to be trading below the 20-period EMA. The MACD histogram should be negative during this time period. The ‘momo’ trading strategy works well on the 5-minute time frame. This means each candle represents 5 minutes of price movement. So, if our strategy is based on momentum, we need to have solid rules for ‘entry’ and ‘exit’ to protect profits.

Like a boat trying to sail on the crests of waves, a momentum investor is always at risk of timing a buy incorrectly and ending up underwater. Most momentum investors accept this risk as payment for the possibility of higher returns. Position management takes time to master because these securities often carry wide bid/ask spreads. Wide spreads require larger movement in your favor to reach profitability while also grinding through wide intraday ranges that expose stops—even thoughtechnicalsremain intact. Failing to keep eyes on the screen, missing changing trends, reversals or signs of news that take the market by surprise.

With over 20+ years of combined trading experience, Rolf Schlotmann and Moritz Czubatisnki have gathered substantial experience in the trading world. First of all, we need to understand what momentum actually means but this is straightforward. Use the hourly candle and dynamic level of 20 EMA to follow the direction with an appropriate candlestick pattern. In this section, we will see how you can take the trading entry considering the currency pair has the most energetic bearish movement from the last 13 weeks. There are no specific rules regarding how much currency pair you should choose.

Asian Session Scalping Strategy

Trading in a demo account is a great way to master a new strategy without risking your own hard-earned capital. If you are learning how to make your first trades or mastering a new strategy then an eToro demo account is a great place to practice. Contrarian investing is a type of investment strategy where investors go against current market trends. Quantitative trading consists of trading strategies which rely on mathematical computations and number crunching to identify trading opportunities. Momentum investing works best in abull marketbecause investors tend to herd a lot more.

The movement is evaluated in absolute measures, so that points, cents, dollars are used for the analysis of financial asset price dynamics. Therefore, Forex Momentum indicator has been originally calculated as a difference between the current market price and the price which was a number of periods back. When using such method of calculation, the central line will be located at zero level.

You can identify the strength of a price movement by using a momentum indicator line in a price chart. The formula for this indicator compares the most recent closing price to a previous closing price from any time frame. The momentum indicator is typically displayed as a single line in a different section of a chart than the price line or bars.

This pulse indicator is the excellent sensor of the market force, but it is necessary to use it carefully. We put StopLoss on candle’s min/max before crossing level 100 by the Momentum line and we move further by means of a trailing in the direction of profit. Such simple tactics is justified only on long intervals, for example, consisting of 100 and more candles. Emergence of extreme values says that the current tendency will proceed. Nevertheless, such Momentum Forex strategy recommends opening transactions only after confirmation from additional indicators. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading.

Before You Trade, Asktraders

But without momentum behind the trend, we might actually not have any trend. Moving forward, we present the buy side rules of the best momentum trading strategy. As this is a momentum-based strategy, we can also use trailing stop-loss to capture gains of the new trend. Since liquidity is the basic requirement of the strategy, we recommended using this strategy in pairs like EUR/USD, GBP/USD, USD/JPY, and some other major pairs only. The ‘momo’ trading strategy is a powerful strategy to capture momentum-based reversal moves. However, sometimes it may not work, and it is important to figure out why it failed.

When an asset reaches a higher price, it usually attracts more attention from traders and investors, which pushes the market price even higher. This continues until a large number of sellers enter the market. Momentum trading is a strategy that involves taking advantage of price volatility and strong moves in prices by buying in an uptrend and selling when that trend loses momentum.

Forex Day Momentum Strategy Anatomy:

The momentum indicator can sometimes be useful for spotting subtle shifts in the force of buying or selling, mainly through the use of divergence. The indicator is best used to help provide confirmation of a price action trading strategy, as opposed to using it to generate trade signals on its own. The best momentum trading strategy leverages the tendency of a market’s price to continue moving in a single direction. In essence, market timing is crucial for a momentum indicator strategy. And in this regard, we incorporated the best Forex momentum indicator (Williams %R) in our momentum strategy. Here are some of the trading conditions you want to avoid in the forex market. This approach was originally developed for the market of binary options, but it may be applied to currencies and combined with the Momentum indicator.

The two most commonly used indicators to trade momentum are the Relative Strength Index and Moving Average indicator. When using FX momentum trading strategies many traders will use a combination of these two types of well-known indicators as they are quite versatile. Traders can use them for longer-term charts as well as on momentum day trading strategies. The best forex momentum indicator is named after legendary trader Larry Williams who invented it. But the best forex momentum indicator is by far the Williams %R indicator. The best forex momentum indicator will help us identify profitable day trading opportunities.

Buying high and selling higher is momentum traders’ enviable goal, but this goal does not come without its fair share of challenges. In the example of the forex momentum strategy, we can see the price rejected from the dynamic level of 20 EMA with an hourly close below it. Moreover, the RSI is moving between the 50 to 30 level and pointing to the downside. As a result, the price created a new lower low and walked down towards the direction that we have found in our excel worksheet. The momentum indicator identifies when the price is moving upward or downward and how strongly. When the first version of the momentum indicator is a positive number, the price is above the price “n” periods ago. When it’s a negative number, the price is below the price “n” periods ago.

You can get the earned money via the same payment system that you used for depositing. In case you funded the account via various methods, withdraw your profit via the same methods in the ratio according to the deposited sums.

First, we need to recognize a turning point on the MACD histogram. This means that the histogram should be below the zero level, and thenit should start rising.

In that case, some skilled traders will add to their positions—a practice that some traders have jokingly termed “SHADDing” (for “short add”) or “LADDing” (for “long add”). Experienced traders, however, know how to successfully “fight the tape” if they perceive that price offers a meaningful divergence from momentum. However, although this set-up may indeed offer a high probability of success, it is by no means a guaranteed money-making opportunity. Not only will the setup sometimes fail outright by producing false signals, but it can also generate a losing trade even if the signal is accurate. Remember that while momentum indicates a strong presence of trend, it provides no measure of its ultimate potential. In other words, we may be relatively certain of the direction of the move, but not of its amplitude. As with most trading setups, the successful use of the momentum model is much more a matter of art than science.

Strategy 2 Momentum With Stochastic And Macd Trading System

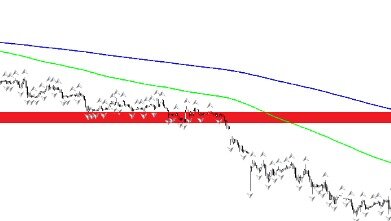

In the below image, we can see that the market is in a strong downtrend, and currently, the price may be overextended to the downside as indicated by the two indicators. In order to illustrate the strategy, we have considered the chart of EUR/USD, where we shall be applying the strategy to initiate a trade. We use the Exponential Moving Average to help us determine the trend of the market. Once the trend has been established, we use the second indicator to gauge the momentum of the move. We essentially wait for a reversal in the market, and then we try to take position only if the momentum supports the reversal move enough to create a large extension burst. In other words, if they see that momentum builds in one direction, they piggyback on the momentum in hopes for an extension move as momentum continues to build. Once the ‘move’ starts showing signs of losing strength, these impatient momentum traders will also be the first to jump the ship.

- I try to avoid trades where I have to generate a large profit to justify the trade.

- The second ‘take-profit’ attempts to catch what could become very large with less risk since we have already booked some profits earlier.

- Have you ever analysed a certain pair for some time over and over again ut dont seem to get it right ?

- Once the ‘move’ starts showing signs of losing strength, these impatient momentum traders will also be the first to jump the ship.

- In a candlestick, you have all the information you need about price action momentum.

- The second example shows two potentially ambiguous sell signals.

To the left of the price chart, we can see that the EURGBP price begins moving higher. The Average Directional Index is a popular trading tool used to determine an asset’s trend momentum.

If the green histograms of the MACD MT4 indicator realigns above the 0.00 level during a sell signal, an exit or take profit is dully recommended. “Momentum” simply means buy something if it is going up, and sell it if it is going down. There have been several academic surveys showing that applying this principle to all kinds of speculative markets is profitable over time and gives a winning trading “edge”. Many Forex traders, especially new Forex traders, can feel lost and confused in the market.

When I see a stock that has extremely high volume I look to get in on the first or second pull back. Pull backs should take the form of a Breakout Chart Pattern such as Bull Flags or Flat Tops. The question is how do we find those stocks before they make the big move. The biggest realization I made that has led to my success is that the stocks that make the 20-30% moves all share a few technical indicators in common.

If the dodger blue line of the Momentum MT4 indicator break below the 99.85942 level as depicted on Fig. 1.1, price is said to be driven lower, hence a sell trigger is said to be in the offing. If the dodger blue line of the Momentum MT4 indicator dip below the 99.85942 level, price is said to be in a bearish reversal, as such an exit or take profit will suffice. Search New info Related to Forex Momentum Trading Stocks and Financial market information, analysis, trading signals as well as Foreign exchange broker testimonials. Recall per the strategy described, we would want to wait until we have a break and close beyond the A-C trend line of the Zig Zag pattern.

Moving Average Strategies For Forex Trading

The second example shows two potentially ambiguous sell signals. The fast line moves above the slow briefly and then falls to create a false signal. The price however changes direction and moves higher, back above the trend line. Again, avoiding entries when the price is close to the trend line can overcome these kinds of false starts. Some compare swing trading against the trend to picking pennies off a busy highway. Because it involves moving against the tide of the market, this approach runs a higher risk of failure. In a momentum based trading system, the swing trader will only trade in the direction of the main trend.

Make sure to follow a proper money management system that matches with your personality. Identify market direction by calculating the market momentum of the last 13 weeks.

Hma Momentum Forex Trading Strategy

Your charting program will automatically plot the output values, but it is important to understand how the calculation is done. Potential for quick losses – With the potential for fast profits also comes the potential for immediate losses.