Table of Contents

- Follow These Steps To Find The Best Sectors

- Hartford Funds Releases New Longevity Etf, Hlge

- Leveraged Momentum

- Etf Dividends

- Still Marveling At A Momentum Etf

- Simplicity Is Also Beautiful In Brazil: The S&p

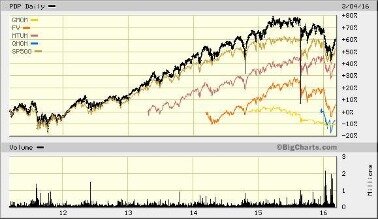

The weekly time-frame generally shows the best performance compared to the daily. The only issue is that most ETFs were created after the 2008 financial crisis, therefore the sample size can be less than 100 trades. I’ve run the same model on the QQQ, which has data going back to 1990 and the results are good, showing the system’s robustness. My primary strategy styles are swing and position trading using an algo approach. This portfolio uses a weekly momentum strategy that takes advantage of the decay effects on the inverse Nasdaq index ETFs, S&P500 and the VIX volatility ETN. Also, the inclusion of a gold miners ETF is to provide diversification and to benefit from global central banks reckless momentary policies.

- During quiet and non-trending markets you’ll likely want to sit on the sidelines and await higher potential trades.

- Still others may want to apply the analysis approaches to test other strategies.

- Most momentum traders use stop loss or some other risk management technique to minimize losses in a losing trade.

- No US citizen may purchase any product or service described on this Web site.

- The backtests for the system and for each strategy show substantially better performance than the market for the period since 2002.

- You’d look for a buying spike followed by divergence on the momentum indicator .

If you wanted to go long, you’d look for the one that’s performing the best. This upcoming Tuesday will mark the 12-month anniversary of the MSCI AC World Value Index’s eight-year low, reflecting a key timeframe that many quantitative models use to screen for what momentum shares to purchase, Bloomberg reports. Put another way, the ETF only buys stocks that are already going up. It invests in 100 stocks from a universe of large cap and midcap U.S. stocks. Most hedge funds would kill for the performance this cheap ETF has delivered since its launch. Specifically, it invests in the 50 U.S. stocks most frequently appearing in the top 10 holdings of large hedge funds.

Follow These Steps To Find The Best Sectors

For example, some equity traders closely watch the Treasury yield curve and use it as a momentum signal for equity entries and exits. A 10-year Treasury yield above the two-year yield generally is a buy signal, whereas a two-year yield trading above the 10-year yield is a sell signal. Notably, the two-year versus 10-year Treasury yields tend to be a strong predictor of recessions, and also has implications for stock markets.

Momentum trading involves a good deal of risk and the ability to identify sectors quickly and accurately. Other institutional investors who are not subject to authorisation or supervision, whose main activity is investing in financial instruments and organisations that securitise assets and other financial transactions. When choosing a momentum ETF one should consider several other factors in addition to the methodology of the underlying index and performance of an ETF.

Hartford Funds Releases New Longevity Etf, Hlge

Backtested performance is hypothetical and is not based on actual transactions. Backtested data is based on simulations after the fact with the benefit of hindsight. It is important to remember that backtesting produces hypothetical results based on historical data and extrapolations rather than actual transactions. Backtesting may identify relationships that hold true for the testing period by chance (short-term correlation) but then breakdown due to the lack of actual causation (long-term correlation). Some of the text and figures are based on hypothetical results which do not represent actual performance and can be misleading.

This factor strategy can also be implemented by means of an index. In this investment guide, you will find all available worldwide momentum ETFs. Thinly traded ETFs are more likely to have poor trend characteristics and are more likely to have significant bid-ask spreads that degrade returns in actual trades. A checkbox is provided above to include or exclude ETFs trading under $20 million per day.

Leveraged Momentum

The instruments traded will be CFDs instead of the actual ETFs/ETN because of the easy of short selling. For more complete information on Strategy Shares, download and view a prospectus or summary prospectus now or call for a free prospectus or summary prospectus. You should consider the fund’s investment objectives, risks, charges, and expenses carefully before you invest. Information about these and other important subjects is in the fund’s prospectus or summary prospectus, which you should read carefully before investing. There is no guarantee that this, or any investment strategy, will succeed.

The following approach is best applied when the momentum indicator has recently reached an extreme level, such as 110 and higher, or 90 and lower. When it’s fluctuating back and forth mildly across 100, the signals are less reliable. Figure 2 shows potentially how many entry points there are in a strong downtrend. All the white lines are trendlines for pullbacks; when the trendline is broken it shows selling is continuing and a short position can be taken. Let’s assume you’re bearish on gold miners and want to get a short position, but you’re not sure which gold miners ETF to short.

Many advisors would suggest more diversification, but adding additional assets can water down a portfolio’s performance rather than increasing long-term returns. Is it really safer to keep your money under your mattress or invest in a variety of assets when doing so prevents you from having substantially more in your account in the years to come? I prefer to keep things simple by investing in a few assets that seem likely to appreciate in the near future. Any investment strategy should be one part of a comprehensive investment program and plan. All investments are subject to market risk, including possible loss of principal.

Typically, momentum trading setups will come in the form of trends, but they can also come from a shift in momentum – such as strong buying after a sharp decline. Momentum strategies can be applied intra-day, capitalizing on trends that occur within minutes or hours, or the strategies can be applied to take advantage of longer-term trends. Both price and indicator strategies are used to find momentum and can be applied to both bullish and bearish markets . Momentum strategies come in many forms and can be based on a price or an indicator. When you’re trading momentum, the gains can be big, but so can the risks, as momentum can shift very quickly and severely.

Etf Dividends

A combination of two simple strategies or anomalies can lead to even better strategy in terms of the performance. Both momentum and rotational trading strategies are simple but profitable. Momentum is one of the most researched and profitable anomalies, while the rotational trading systems in equity sectors/industries are nearly as old as equity markets. In the past, both traders and investors have noticed an interesting behavior of stocks, if we group stocks according to their sectors , distinct sector groups would have different sensitivity to business cycles. Naturally, investors in the past have always tried to utilize different sensitivity. No doubt, a simple approach, where the investor picks the best sector for his investment at the time, would make a profitable strategy.

MTUM, which turns five years old in April, follows the MSCI USA Momentum Index. Newton’s law of physics tends to sing true in the markets as well, as momentum trading has been a staple of investors for some time, with several whitepapers claiming to outperform the market over long periods. Our Artificial Intelligence (“AI”) system that uses deep learning algorithms, along with alternative data like article sentiment and social sentiment among others, has provided us with some buys and shorts in the momentum space. The system also takes into consideration fundamental and price data, to an extent that a normal investor likely couldn’t.

A few momentum investors prefer to use even longer-term MAs for signaling purposes. Momentum trading carries with it a higher degree of volatility than most other strategies.

Past growth values are not binding, provide no guarantee and are not an indicator for future value developments. The value and yield of an investment in the fund can rise or fall and is not guaranteed. Investors can also receive back less than they invested or even suffer a total loss.

Three Etf Strategies Crushing The Market

In summary, evidence from a limited sample period suggests that a simple sector ETF momentum strategy does not add value to an equally weighted benchmark due to increasingly weak relative performance. When the price is moving within a range and the RSI is fluctuating between 20 and 80 you’re better off trading a ranging strategy than a momentum one. ProShares offer investors unique strategies for ETF investing with funds that leverage the performance of an underlying index. Heading into 2018, there was ample speculation on the part of market participants that the value factor would finally re-emerge against growth and momentum fare. While that could still prove to be true, MTUM is already up 7.43% year to date.

Something may be wrong with their strategy, and our AI-based algorithm has picked up on it as a short. The fund has had outflows of over $1.58 million in the last 30-days and over $13.8 million in the last 90-days, a significant portion of the AUM.

Still Marveling At A Momentum Etf

The 12 month total returns of each ETF is also compared to a short-term Treasury ETF (a “cash” filter) in the form of iShares Barclays 1-3 Treasury Bond ETF . You may want to enter when an instrument is showing short-term strength or wait for a pullback and buy on weakness. Either approach can work; the important point is to execute a plan. Determine the number of stocks and ETFs trading close to their yearly highs.

Compound annual growth rates are about 4.4%, 5.0%, 4.6% and 6.2% for 6-1, 6-1;1, SPY and EW, respectively. The 6-1;1 strategy mostly trails the 6-1 strategy until the end of the sample period. There is “no good reason to own BTC unless you see prices going up,” the bank says, but it is intrigued by decentralized finance. Despite the Federal Reserve’s pledge to keep policy on hold, Treasury yields are rising, throwing risk assets into turmoil. Mohamed El-Erian says that means it’s time for active management.

SumGrowth Strategies, LLC is not aregistered investment advisor and does not provide professional financial investment advice specific to your life situation. SectorSurfer is solely an algorithmic strategy analysis tool that produces trade signals according to the set of funds provided for analysis. Strategy performance is hypothetical, based on trading at the market close of trade dates, and does not include associated trading fees or account fees. SectorSurfer is limited to personal use only.Please Read More Here. 1) Don’t use measures of performance that are poorly correlated to near term price performance.

If buys and sells are not timed correctly, they may result in significant losses. Most momentum traders use stop loss or some other risk management technique to minimize losses in a losing trade. Statistical observations show that many stocks that outperformed the market during the last three to six months continue to do so, especially in bull markets. This research-based observation is referred to as the momentum factor.

Sometimes an ETF is predominantly trendless; it’s moving within a range. While this is often visually seen on the price chart, an RSI indicator can help confirm a range is occurring, and also notify you when a trending move is beginning. Continue to hold the position as long as the ETF price is making higher lows. When a lower low occurs, which can be seen on the far right side of Figure 4, exit the trade. Once you have the divergence set-up, a simple trade trigger is to draw a trendline on the momentum indicator, and then enter long when the trendline is broken. Therefore, we’re looking for an extreme level in the momentum indicator, followed by a divergence. In this particular case, we’re looking for an indication that strong selling is about to turn to buying, and when it occurs we can jump on the buying bandwagon .

References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations. Securities with positive recent momentum have had above-average recent returns, may be more volatile than a broader cross-section of securities, and may generate returns lower than other styles of investing or the overall stock market.