Table of Contents

- Calculating Price With Range Bars

- Range Bars Trading System

- Find The Range

- Introduction To Narrow Range Bars

- How To Map The Market With Range Bars And Volume Spikes

Range Bars became the solution to deal with high volatility in its local markets in Sao Paulo. In addition, more experienced traders can look for trading range breakouts.

There are a total of six signals shown on this chart, and the yellow candle bodies represent the actual NR7 bars. And again the light blue line towards the bottom of this chart represents the 89 period Simple moving average line, which is our trend filter.

Stop losses are one of the most effective ways for traders to control their exposure to risk. Now that you’re familiar with how to calculate range bars and the advantages behind MT4 Range Bar indicator, let’s develop a range trading strategy. Inversely, when we have low volatility, you’ll see fewer range bars printed on the chart. Time-based charts will always post the same number of bars during each trading session regardless of volume, volatility or any other factors.

Calculating Price With Range Bars

Therefore, do not risk the capital you can not afford to lose. Please ensure your method matches your investment objectives, study the risks involved and if necessary seek independent advice. Make sure to read full our full Terms of Use & Risk Disclosure. Plus, our latest trading guides and tips in right your inbox.

So, for range bars to become meaningful as a measure of volatility, a trader must spend time observing a particular trading instrument with a specific range bar setting applied. This will enable a trader to notice any subtle changes in the timing of the bars and the frequency in which they print. Price action can be used in conjunction with the RSI, CCI, and Stochastics to validate further range bound trading or signal a potential breakout. Utilizing technical analysis, traders can look to candlestick formations for clues on future price action. To further enhance your understanding of technical analyasis, take a look at our Education page and weekly webinars.

The NR7 bar requires a higher level of compression in the price action than does the NR4 bar. And as a result of this, we will often see a breakout following in NR7 bar to be more substantial than a breakout that occurs following an NR4 bar. This is not always the case, however, in a good percentage of cases, this guideline holds true. The last NR4/ID trading set up occurs near the far right edge of this chart. Notice how the 89 SMA is well above the short entry trigger, and we would’ve been well protected with our stop loss being placed just above the outside bar. Our take profit point would have been the sixth bar following the breakout, which was quite bearish, and is seen as the next-to-last candle shown on the chart.

Please note that every time the plug-in is attached it will recalculate all historical data so keep this in mind when you set the “RenderUsing1MhistoryBars” to 0 . When the test is finished you can check the chart, you’ll see that the results are as same as in StrategyQuant.

Range Bars Trading System

We can see that this occurred well below the 89 SMA line and did so during the candle following the NR4/ID candle. The stop loss would’ve been placed above the outside bar, which is the bar preceding the NR 4/ID bar. We would’ve exited the trade for a profit at the close of the sixth bar following the breakout, which is the first up candle shown after the breakout. As can be seen here, bar four has a smaller range then each of the previous three bars, bars 1-3.

Range Bars provide traders with a clear idea of the market price without the influence of factors such as time. Because range bars consider only price, the main variable when setting up the range bars is the price level. For example, a 10 pip range bar will define that every bar has a range of 10 pips when measured from high to low. Example of a Range bar with 10 pip settingHowever, most of the existing trading platforms have not yet incorporated the range bars as one of the default chart types. With over 50+ years of combined trading experience, Trading Strategy Guides offers trading guides and resources to educate traders in all walks of life and motivations. We specialize in teaching traders of all skill levels how to trade stocks, options, forex, cryptocurrencies, commodities, and more.

Find The Range

With the Pro version of the Range bars plugin you’ll get a set of special CSV2FXT scripts that should be used to generate data files that will be needed for backtest. At Orbex, we are dedicated to serving our clients responsibly with the latest innovations in forex tools and resources to assist you in trading. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances.

The trial comes with a 23 page PDF booklet which explains the concepts, risks and methodology in more details. Here is an example of mini SP500 futures chart from today along with a trading model that trades it. Price movements reflected by a bar appear to be perfect but, in reality, this may not be true. The price may have moved up and down a lot before the bar was actually drawn on the chart. Also accompanying the NR Bar set up is the ATR whose value is used to determine the stops and target levels. The entry price for NR Bar is often the high or low which varies by an offset of a few pips.

The first thing to note about range bar is that they take only the price into consideration. Traditionally, the downwards and upwards boundaries are defined as support and resistance levels. The market is spending most of its time transitioning from trading ranges through retracements and other counter-trend action. When we short the EUR/USD, we would want to place a stop loss order above the upper level of the inside range. As you see in this example, the EUR/USD decreases afterwards making this Hikkake trade a profitable deal. The image illustrates an inside bar on the graph, followed by a Hikkake pattern.

The range bar will only print after price had advanced or declined X range. Support and resistance levels make up the extremes of the range and S/R are zones that garner a lot of trader interest. You will have some type of action around these levels that can range from a clean test of the level to price whipping around the zone. If you know that most traders use either the extreme or a little bit beyond, those that can run the stops know that as well.

Many price action traders are familiar with various candlestick patterns, however, not too many are well-versed in the application of narrow range bars. Narrow range bars can offer insights into the development of future price action, and thus are important price action signals that should be studied alongside candlestick formations. If you are a trader that trades price ranges as part of their strategy, range bars highlights consolidations better than time based charts. It used to be that with Metatrader you only had the option of trading with time charts, but not anymore! You can now use range bar charts and reduce market debris such as long wicked whipsaw bars, stalls and consolidation. All of these can prevent traders from clearly seeing the market as it unfolds. Nicolellis range bars were developed in the mid-1990s by Vicente Nicolellis, a Brazilian trader and broker who spent over a decade running a trading desk in Sao Paulo.

Introduction To Narrow Range Bars

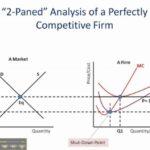

While not a technical indicator, range bars can be used to identify trends and to interpret volatility. Since range bars take only price into consideration, and not time or other factors, they provide traders with a unique view of price activity. On closer observation, one can see that numerous trading strategies that are unique to Range bars can be developed. The simplest of all, however, is based on price action methods such as support and resistance, trend lines and of course the range bar patterns itself. Moving forward, we’re going to spend some time introducing the concept of range bar charts and why some traders focus on range bars trading strategies. Since the Inside candle on the chart is a sign of a consolidating market, we can draw a horizontal support and resistance level around this range in anticipation of a future breakout. When the price exits the inside bar range, we expect that the price action will continue to move in the direction of the inside bar breakout.

Potential support and resistance levels are more clearly visible on the chart. Let me give you some of the advantages that come with a range bar chart analysis.

How To Map The Market With Range Bars And Volume Spikes

Intraday trading ranges naturally expand and contract over time while market players battle for directional control or when a trending security attracts a stream of buyers or sellers. From time to time, a single day’s price bar closing near the intraday high or low carries a wealth of information that observant traders can use to make profitable buy and sell decisions.

Risk capital is money that can be lost without jeopardizing ones financial security or life style. Perfectly structured with step-by-step guides to help you understand the principles of price action analysis. Day Trading With Price Action – A complete course that teaches you the art of price action trading. Two potential shorting points as the blue resistance rejected the price from rising.

By doing so, It will help prepare you for the upcoming market terrain and allow you to better position into solid trading opportunities. And along the same lines, we can use this information to begin scaling out of our position. After a period of high volatility has ensued, we can anticipate a slowdown in the form of price congestion. Knowing when to exit a trade is equally important as knowing when to enter a trade. Many times it’s easier to predict future volatility than it is to predict future price movement. Market volatility measures the relative price movements within a financial instrument.

Simple Tactics For Trading Narrow Range Bars

The Kagi chart is a technical analysis tool developed in Japan in the 1870s. It uses vertical lines to find general supply and demand levels. Congestion is a market situation where the demand to buy is evenly matched by seller’s supply.

In this article I’ll explain the step-by-step process of building a strategy for range or renko charts on MetaTrader4. The example below will use range bars, but the same process can be applied also to renko charts.

This conflict can draw multiple signals, with bars expanding away from the moving average on higher-than-normal volume and then reversing gears into another test. In turn, this should encourage a large number of market participants to come off the sidelines in an emotional act that yields greater-than-average volume. These wide range bars, which print greater-than-average ranges at key market intersections, may confirm major price developments, such as a successful or failed test at a moving average. The wide range is an interval that has a body or bar with a price area larger than eachof the prior three intervals. Simply, you want as much market context as possible from the price action to help ensure proper analysis of changes in volatility and supply/demand. A daily chart inside bar will look like a ‘triangle’ on a 1 hour or 30 minute chart time frame.