Table of Contents

- Trading Room Subscriptions For Sell!

- Moving Average Crossover Alert: Seagen

- Highly Ranked Undervalued Stocks

- Scan Analyze Trade Altcoins

- Learn To Day Trade 7x Faster Than Everyone Else

The purple curved line on the chart is a 5-period simple moving average. This is because five periods is such a small time frame and thus will result in some trade signals; more signals then I care to track. Finally, you would not want to trade solely based on the signals generated by moving averages. Each investment opportunity should be evaluated on its own merit, including how it aligns with your investment objectives, risk preferences, financial circumstances, and investing time frame.

This strategy, like many others using indicators, has a weakness – it may lead to whipsawing. Commodity and historical index data provided by Pinnacle Data Corporation. Unless otherwise indicated, all data is delayed by 15 minutes. The information provided by StockCharts.com, Inc. is not investment advice. With only 30 data points incorporated in the EMA calculations, the 10-day EMA values in the spreadsheet are not very accurate.

Trading Room Subscriptions For Sell!

AAPL – 50 Period Moving Average Trend DirectionThe shaded area highlights where the stock price had breached the 50 day moving average, ranged, and then gaped to the downside. With the right trading approach, the 50 period moving average can also be a buy and sell signal indicator and you would need a trigger to get you into a trade . The 50 is a slightly longer-term moving average that tracks the last 10 trading weeks. Traders will often use the 50-day on the daily charts and the 10-week moving average on the weekly charts. In this formulation, a shorter exponential moving average will have a larger multiplier – and thus give more weight to recent price data – than a longer exponential moving average.

Notice how FSLR continued lower throughout the day; unable to put up a fight. This is the true challenge with trading, what works well on one chart, will not work well on another.

Moving Average Crossover Alert: Seagen

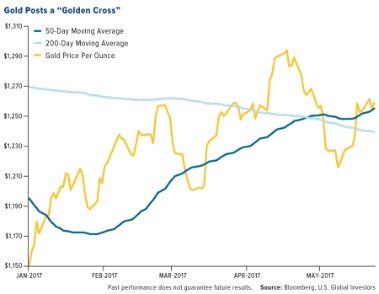

Search for or navigate to moving averages, and select the one you would like added to the chart. The S&P 500 experienced a golden cross on June 15, when the 50-day EMA crossed above the 200-day EMA—a bullish indicator for chart users. Moving averages with different time frames can provide a variety of information. A longer moving average (such as a 200-day EMA) can serve as a valuable smoothing device when you are trying to assess long-term trends.

In the above buy set up example, we can see how chart patterns or price action can also be combined into the 50/200 day moving average set up. To trade moving averages profitably you want at trend and support and resistance level in confluence. Wait for a retrace to a resistance level like support becomes resistance or resistance at the moving average 50 before you sell. Wait for a retrace to a support level like resistance becomes support or support at the moving average 50 before you buy.

Highly Ranked Undervalued Stocks

In addition to analyzing individual moving average lines on the ribbon, chartists can glean information from the ribbon itself. If the lines are running in parallel, this indicates a strong trend. If the ribbon is expanding , this indicates the trend is coming to an end.

The gain/loss ratio was excellent at 6.4x, but there were only 10 trades, 6 of which were losers. The gain to loss ratio was strong a 3.1x, but the overwhelming number of loosing trades dragged the system down with a winning % of only 39%. Surprisingly there were only 9 trades, 6 winners and 3 losers. Joe Marwood is not a registered investment advisor and nothing on this site is to be regarded as personalized investment advice. Although it gives a slightly lower CAR, the DEMA has a smaller drawdown and it therefore gives a better CAR/MDD ratio.

A 20-day moving average will provide many more “reversal” signals than a 100-day moving average. These lengths can be applied to any chart time frame (one minute, daily, weekly, etc.), depending on the trader’s time horizon. An EMA may work better in a stock or financial market for a time, and at other times, an SMA may work better. The time frame chosen for a moving average will also play a significant role in how effective it is . As a general guideline, if the price is above a moving average, the trend is up.

We will sell our position when the fast moving average crosses back under. Thus, all moving averages are a trade-off between noise and lag. Faster MA’s respond to new trends quickly but they show more noise and lead to more whipsaws. Slower MA’s are better at smoothing noise but they can be late to find new trends. Moving averages plot the average price of a security over a set number of periods or days and they’re an extremely popular tool used by traders to determine the overall trend. In this post I test nine different moving averages in order to see which is the best moving average for trading. These results are not from live accounts trading our algorithms.

Therefore, we close the trade on the assumption that the price action will reverse and this is exactly what happens. The rule to close 50-day moving average trades is very simple. Hold your trades until the price action breaks your 50-day moving average in the direction opposite to your trade. The 50-day moving average is one of the most common SMAs in stock trading. The reason for this is that the moving average needs a given number of data points based on the periods to print a value. The 50-day moving average indicator is one of the most important and commonly used tools in stock trading. A shorter moving average, such as a 50-day moving average, will more closely follow the recent price action, and therefore is frequently used to assess short-term patterns.

Scan Analyze Trade Altcoins

They do not predict price direction, but rather define the current direction, though they lag due to being based on past prices. Despite this, moving averages help smooth price action and filter out the noise. They also form the building blocks for many other technical indicators and overlays, such as Bollinger Bands, MACD and the McClellan Oscillator. The two most popular types of moving averages are the Simple Moving Average and the Exponential Moving Average . These moving averages can be used to identify the direction of the trend or define potential support and resistance levels. Moving Average crossovers are often viewed tools by traders.

Next, we will explore these strategies and areas where the indicator can fail you if not used properly. If the price breaks the 50-day SMA upward, you should switch your opinion to bullish. If the price breaks the 50-day SMA downwards, you should switch your opinion to bearish.

Consider that by design, Moving Averages “report” on what has already happened and that they also take into consideration a whole range of past events when calculating their formula. This is what makes a Moving Average such a good technical analysis tool for trend confirmations. Also, the long term positioning of EMAs helps avoiding whipsaw trades (whether 14/50 EMA are above or below the 200 EMA on the daily chart). That is, it may signal Buy only to signal Sell soon afterwards. In the next few weeks, we’ll demonstrate several simple but powerful trading strategies that utilize moving averages and can be implemented on altFINS platform. Multiple moving averages can be overlaid the price plot by simply adding another overlay line to the workbench.

Learn To Day Trade 7x Faster Than Everyone Else

Two moving averages can be used together to generate crossover signals. In Technical Analysis of the Financial Markets, John Murphy calls this the “double crossover method”. Double crossovers involve one relatively short moving average and one relatively long moving average. As with all moving averages, the general length of the moving average defines the timeframe for the system.

Price eventually broke to the upside from the triangle chart pattern which is, on average, a continuation pattern. Scanz can help you find top-performing stocks in any sector.

- AlgorithmicTrading.net, nor any of its principles, is NOT registered as an investment advisor.

- He has over 18 years of day trading experience in both the U.S. and Nikkei markets.

- The first parameter is used to set the number of time periods.

- The most popular blog posts are about gold, food prices, and pay gaps.

- Most books that mention the Moving Average Price Crossing strategy reference it in the context of daily charts.

- By using this site, you agree to the Terms of Use and Privacy Policy.

Chartists can use moving averages to define the overall trend and then use RSI to define overbought or oversold levels. The chart above shows Home Depot with a 10-day EMA and 50-day EMA . Using a moving average crossover would have resulted in three whipsaws before catching a good trade. The 10-day EMA broke below the 50-day EMA in late October , but this did not last long as the 10-day moved back above in mid-November . This cross lasted longer, but the next bearish crossover in January occurred near late November price levels, resulting in another whipsaw. This bearish cross did not last long as the 10-day EMA moved back above the 50-day a few days later .

A system using a 5-day EMA and 35-day EMA would be deemed short-term. A system using a 50-day SMA and 200-day SMA would be deemed medium-term, perhaps even long-term. However, traders often use two or even three simple moving averages. The chart below of the Dow Jones Industrial Average exchange-traded fund shows a 20-day simple moving average acting as support for prices. The particular case where simple equally weighted moving-averages are used is sometimes called a simple moving-average crossover. Such a crossover can be used to signal a change in trend and can be used to trigger a trade in a black box trading system. Basically, the short-term average trends up faster than the long-term average, until they cross.

Conversely, a similar downside moving average crossover constitutes the death cross and is understood to signal a decisive downturn in a market. The death cross occurs when the short term average trends down and crosses the long-term average, basically going in the opposite direction of the golden cross.

The 150-day moving average is rising as long as it is trading above its level five days ago. A bullish cross occurs when the 5-day EMA moves above the 35-day EMA on above-average volume. A simple moving average is formed by computing the average price of a security over a specific number of periods. Most moving averages are based on closing prices; for example, a 5-day simple moving average is the five-day sum of closing prices divided by five. As its name implies, a moving average is an average that moves. Old data is dropped as new data becomes available, causing the average to move along the time scale.

Moving Average Crossovers

While the price has breached to the upside of the average, we need to see the sustained upside and a turn of the 50 moving average to consider the downtrend is over. The trend direction shown by the slope of the average and price below the average, indicates a down trend in the Apple stock. Given that it is often mentioned, many traders do find value in it for their own analysis based on the premise that if many are watching it, something must happen in relation to it. With a quick glance, you can get a quick overview of how the market has performed, the long term trend direction and if the price is range-bound. While it is good to know how an indicator gets its information from the various data points, your charting package will do all the calculations for you. Here’s how you can find high volume penny stocks using Scanz. Bullish Price Crossover – Price crosses above the 50 SMA while the 50 SMA is above the 200 SMA.

MACD is shown in the indicator window to confirm price crosses above or below the 50-day EMA. MACD is positive when the close is above the 50-day EMA and negative when the close is below the 50-day EMA. There are three steps to calculating an exponential moving average . First, calculate the simple moving average for the initial EMA value. An exponential moving average has to start somewhere, so a simple moving average is used as the previous period’s EMA in the first calculation. Third, calculate the exponential moving average for each day between the initial EMA value and today, using the price, the multiplier, and the previous period’s EMA value. Moving averages smooth the price data to form a trend following indicator.