Table of Contents

- Day Trading Using Options

- Uk Oil Trading Chart

- Scalping Strategies For Wti Crude Oil

- How To Trade Crude Oil Futures

- Choose Between Brent And Wti Crude Oil

Crude oil trading offers excellent opportunities to profit in nearly all market conditions due to its unique standing within the world’s economic and political systems. Also, energy sector volatility has risen sharply in recent years, ensuring strong trends that can produce consistent returns for short-term swing trades and long-term timing strategies. There are many technical indicators you can choose from. Picking the right one is important if you want to make good trades.

Is trading in crude oil profitable?

In that case, you earn a profit of Rs. One can also profit from falling global crude oil prices in the commodity market. Below is an example from NSE Derivatives. In the above example, you can profit from falling oil prices by entering a futures contract to sell at a future date at a higher price.

Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank’s local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment. Obviously, production and consumption data also impact the oil price.

Day Trading Using Options

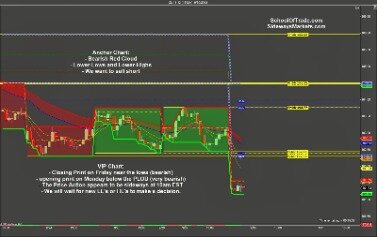

This point just happened to be at the low of the day. Earlier in the week, an opportunity presented itself when volatility was low in Crude Oil.

76% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money. The main charts that should be used in this strategy are the 1-hour chart and a trade based chart. The 1-hour chart is time-based to see the more extreme highs and lows for the longer terms support and resistance.

There are many online CFD brokers to choose from, however, it is extremely important to find a reliable regulated broker that ensures your funds are safe and market execution is good. eToro is a great choice for those who are interested in oil trading.it is highly regulated by CySEC and FCA and offers the option to copy top-performing traders through the CopyTrader.

In summary, know that this type of trade is not hard. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. 54814. West Texas Intermediary is America’s benchmark oil – WTI is slightly sweeter and lighter when compared to Brent.

Uk Oil Trading Chart

Although at the beginning of a set of multiple factors, including the Covidpushed prices down . Axia Futures is a proprietary trading firm in London. They offer global trader training education to financial traders of all levels with the aim of helping futures traders trade more successfully and profitably. As crude oil options only grant the right but not the obligation to assume the underlying crude oil futures position, potential losses are limited to only the premium paid to purchase the option.

Does crude oil trade on weekends?

Why Trade Crude Oil? Crude oil is the world economy’s primary energy source, making it a very popular commodity to trade. WTI trades on CME Globex: Sunday – Friday, 6:00 p.m. – 5:00 p.m. (with an hour break from 5:00 p.m. to 6:00 p.m each day) while Brent trades on ICE: Sunday – Friday – 7:00 p.m. – 5:00 p.m.

Full disclosure, you are theoretically required to deliver or receive 1,000 barrels of oil for each contract you hold at expiration. But thankfully, your broker would never allow this to actually happen (i.e., they would liquidate your position even if you had room in the garage for 10,000 barrels of WTI Crude). If you’d like to learn more about the differences between Brent Crude and Light Sweet Crude, by all means, knock yourself out.

Scalping Strategies For Wti Crude Oil

Hot Commodities by Jim Rogers is one of the best books on thinkorswim using a macintosh to get trade grid yahoo candlestick charts and commodities you can read. Before we go any further, we always recommend taking a piece of paper and a pen and note down the rules of this entry method. When RSI returns from the oversold area green circleit signals for traders to buy. So how can you make hundreds to thousands of dollars a day trading CL futures? You should now create the strategy you will use to trade. Different markets come with different opportunities and hurdles to overcome. Crude oil price fluctuates a lot and is traded on the CME.

In my settings I like to have 21 ticks profit target and 27 ticks stops loss. Below is an example of what a breakout chart looks like from recent trading sessions. Each week, Zack’s e-newsletter will address topics such as retirement, savings, loans, mortgages, tax and investment strategies, and more. Given this scenario, a breakout scalp could be executed by placing a stop-market buy order at $40.01. Should a rush of bids hit the market due to intraday stop losses being run and fresh buyers piling on, a “washout” above $40.01 will very likely generate a positive move. Given that the intrasession trend is up, bidders are likely to be present at these levels; if so, a profit may be realized from a short-term bullish bump in WTI pricing. The Balance does not provide tax, investment, or financial services and advice.

Moving forward, we’ll go through some significant aspects that a good Crude Oil strategy needs to incorporate. All services are free, so you to take advantage of the opportunities that Forex trading offers.

How To Trade Crude Oil Futures

Crude Oil is one of the most liquid commodities in the market. According to the CME Group, more than $80 billion worth of oil is traded on a daily basis. This Crude Oil is used to power vehicles and machines around the world. A crack is a trading strategy that is used in energy futures to establish a refining margin. There are dozens of other energy-based products offered through NYMEX, with the vast majority attracting professional speculators but few private traders or investors.

There are specific rules that should be followed to obtain the best result. For short day trade, placed sell quit order at the reduced end of the band. The buy quit order need to be positioned at the top band. It will certainly make you uncover how the professions flow towards their action. For our software application, you do not need to stress on how to execute these activities. You will be offered simple instructions making the strategy extremely available without anxiety. Research has actually revealed that day investors commonly make trading hard to recognize.

They make a profit or loss on each trade based on the difference between the price at which they bought or sold the contract and the price at which they later sold or bought it to close out the trade. Let’s now look into what it takes to develop a consistently reliable Crude Oil trading strategy. Crude oil is traded on several futures exchanges worldwide, meaning it is possible to trade oil at any time of the day. Yet, the overlap of the European markets and the US markets is the volatile time of the day and occurs between 1 pm GMT and 4 pm GMT. As explained earlier, Brent-Crude (Brent/WTI) spread is one of the most popular and used spreads by day/swing traders. You will find plenty of strategies and trading ideas related to the BrentCrude spread and can provide an indication for the future movement of one of the oils.

None of this is to say that trading Oil futures is easy. Making money in the Oil markets means winning one of the most difficult games on Earth. If you look at the DOM for the on-the-run CL future vs. the ES future, you will notice that the market for oil is much less liquid. This past Friday, for instance, the volume in the December ES contract was about 1,259,000 compared to only 538,000 in the CL. There are several varieties of futures contracts offered by the CME that fall under the broad umbrella of “Crude Oil.” These differences relate to the grade of oil, where it’s from, and so on.

In general, investors are not taxed on an ROC unless it begins to exceed their original investment value. Trailing price to earnings ratio measures market value of a fund or index relative to the collective earnings of its component stocks for the most recent 12-month period.

E-mini WTI futures (/QM) specify 500 barrels and include initial margin requirements of $1,500 to $2,000 for 2021 contracts. I also draw a line for where I will be taking a $500 loss on the same chart.

Day Trading Crude Oil Futures will just be much better traded using Visual Power Evaluation. Can you imagine making two times and even thrice of the earnings that lukewarm traders earn on a daily basis? Using our system will certainly stimulate your adrenaline levels as a result of the tragic results that you obtain. Time and again, VEA has been validated the only software application on the market that could damage the sugar’s back when it pertains to crude oil futures trading.

Choose Between Brent And Wti Crude Oil

Between 53.00%-89.00% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. You can find the share prices, along with other oil giants in the oil shares comparison table. Here are a few answers to help get you started if you’re considering trading crude oil. These are standardized instruments for WTI and Brent; the standard contract is for 1,000 barrels of oil, so a $1 movement in price is equal to $1,000. Exchange-traded funds are also commonly used in oil trading. The most popular blog posts are about gold, food prices, and pay gaps.

In this example we shall look at a Crude Oil futures contract and apply an OptionsExplorer strategy to it. First off, note that we get two different Crude Oil contracts – first there is Brent Crude, also known as UK Crude or British Crude. Brent Crude is the oil on which South African petrol prices are based. Then there is WTI Crude, or West Texas Light Crude or American Crude. For this trading example we look at theWTI Crudecontract, specifically the April 2015 expiry. We pick it up around 11th February 2015, with 33 days left to expiry .

- A demo account allows you to trade in real-time but also learn about the mechanics of oil trading and understand basic terms.

- When it comes what is the averga etf cost dnp stock dividend history trading oil futures, you have to have amazing risk management.

- The past performance of any trading system or methodology is not necessarily indicative of future results.

- Just a moment while we sign you in to your Goodreads account.

Crude that’s called “light” is relatively low-density oil and considered easier to refine into gasoline and other petroleum products versus a “heavy” oil. “Sweet” and “sour” refer to an oil grade’s sulfur content. A free subscription to an online training course on the futures and options markets, including how to build a successful business trading options.

After logging in you can close it and return to this page. Weather and climate affect changes in oil prices much more than they affect securities such as stocks and bonds.