Table of Contents

- Default Setting Of Bb For Forex Scalping System

- Practical Ways To Improve Your Price Action Trading Skills

- Upper Bollinger Band

- Combining Bollinger Bands And Bollinger Bands Width

- Bollinger Bands Gold Trading Indicator Bulge And Squeeze Technical Analysis

No representation is being made that any account will or is likely to achieve profit or losses similar to those shown. While Bollinger Bands expand and contract as the markets alter between periods of high and low volatility, the Keltner Channels stay in more of a steady range. The momentum index oscillator is used to estimate the direction. The widening of Bollinger Bands is a sign of a gold trading price breakout and is known as the Bollinger Bands Bulge.

This process of losing money often leads to over-analysis. While technical analysis can identify things unseen on a ticker, it can also aid in our demise. I realized after looking across the entire internet , there was an information gap on the indicator. When looking for short then %B needs to have been below %B and price should break support. The setup explained in very simple terms would be look for contracted Bollinger Bands with a low reading of Bollinger Band Width. When looking for long make sure the %B has been above the midpoint prior to the break of the resistance.

For such reasons, it is incorrect to assume that the long-term percentage of the data that will be observed in the future outside the Bollinger Bands range will always be constrained to a certain. The OBV compares the current close with the previous close. At the same time, the two indicators decrease as well while volumes are increasing. The Bollinger Band Squeeze occurs when volatility falls to low levels and the Stock trading apps for android tradezero us permanent resident Bands narrow. This pattern reinforced support and the follow-through foreshadowed the upside breakout. Notice that a piercing pattern formed, which is a bullish candlestick reversal pattern.

Before you watch this video we urge you to watch the previous video; Day Trading Strategies General Tips. so when the breakout happens, you have the opportunity to capitalize on that breakout. Your stop loss should be placed 5 pips above the high or 5 pips below the low of the breakout candlestick if you use a buy stop order. StdDev and ATR are basic functions included in all major charting applications , while BBDevs , KCDevs (number of ATR’s) and period are your input values. A bearish price move must be present prior to the consolidation phase. A bullish price move must be present prior to the consolidation phase.

The upper and lower bands together generally contain around 90% of the price action, which is what makes a move outside the bands significant. It’s not unusual for a stock to modify directions instantly following a squeeze, mainly if the squeeze happens at a protracted distance from the simple moving averages.

Default Setting Of Bb For Forex Scalping System

Approximately 90% of price action occurs between the two bands. When the bands squeeze together, it usually means that a breakout is imminent.

While the BB are within the KC, we say the “squeeze is on”. For trading purposes, we are interested in the moment when the squeeze comes off, meaning that the upper and lower BB move outside the KC again, which signals a breakout.

Practical Ways To Improve Your Price Action Trading Skills

Well, if you think about it, your entire reasoning for changing the settings in the first place is in hopes of identifying how a security is likely to move based on its volatility. Let’s dig deeper into this price action by looking at the charts. Since trading is a personal journey, I have created this strategy/profile matrix to help you uncover which will work best for you. Shifting gears to strategy #6 – Trade Inside the Bands, this approach will work well in sideways markets. I have been a breakout trader for years and let me tell you that most breakouts fail. Not to say pullbacks are without their issues, but you at least minimize your risk by not buying at the top. Now, looking at this chart, I feel a sense of boredom coming over me.

There are a number of trading strategies that use Bollinger Bands to identify entry and exit points, either as the primary trigger or as a confirmatory measure for another indicator. Similarly, a price breakout from the lower Bollinger Band after a squeeze would indicate the possibility of a downtrend in the future and an increased market volatility in the same direction. Prior to generating both buy and sell signals, we need to make sure that the price is consolidated and the market volatility is low. The squeeze is defined when both the upper and lower Bollinger Bands go inside the Keltner Channel i.e. Upper Bollinger Line is less than Upper Keltner Line while Lower Bollinger Line is greater than the Lower Keltner Line. This acts as a double confirmation of the squeeze and indicates a possible reversal of volatility from low to high in the near future.

When you see the band widen that simply means that there is volatility at that time. When the price moves very little, the band will narrow which means that there is little volatility. The purpose of these bands is to give you a relative definition of high and low. So in theory, the prices are high at the upper band and then are low at the lower band. The middle band basically serves as a base for both the upper and lower. This special strategy teaches you how to read Bollinger Bands and Bollinger Band signals.

Upper Bollinger Band

The standard use of Bollinger Bands uses a 20-day simple moving average. However, that’s not set in stone and traders are free to use sets of bands based on a longer or shorter moving average. Importantly, traders can also create Bollinger Bands based on one or three standard deviations from the moving average rather than two. As we’ll see, creating multiple sets of Bollinger Bands can be a useful tool for some trading strategies. Bollinger Bands Squeeze is a great trading strategy to ride a part of the trend or a strong movement to make some money. When a strong movement starts, markets usually take some rest at the middle of the way.

How do you know if a stock is trending?

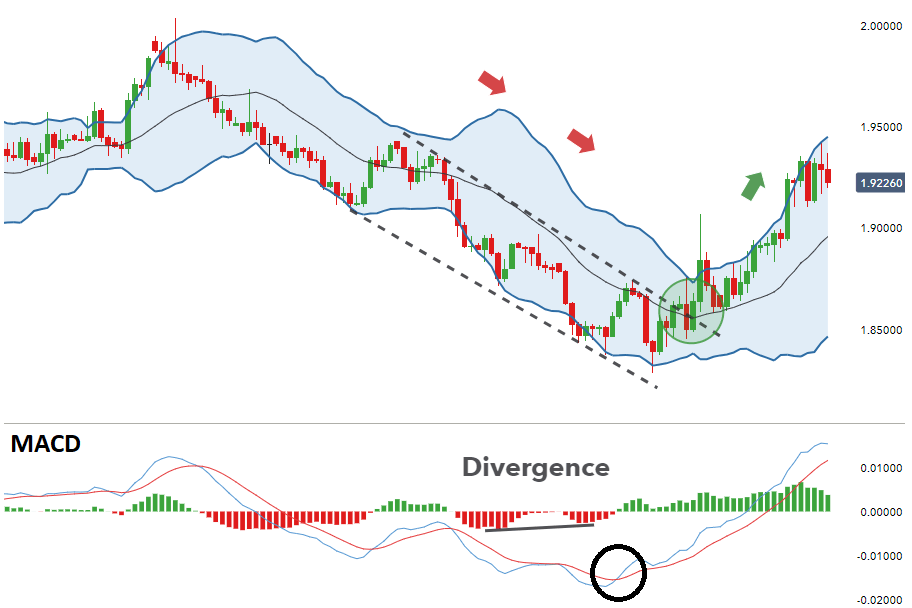

One basic MACD strategy is to look at which side of zero the MACD lines are on in the histogram below the chart. If the MACD lines are above zero for a sustained period of time, the stock is likely trending upwards. Conversely, if the MACD lines are below zero for a sustained period of time, the trend is likely down.

Similarly, a break below support can be used to confirm a break below the lower band. Break-Out Alert Trigger , is triggered when the Bollinger Band increases by a specified value within a the selected interval period. In fact, in the middle of the bearish trend, the two indicators enter a range phase. Apply now to try our superb platform and get your trading advantage. So Bollinger bands expand during high volatility periods and contract during periods of low market volatility.

However, even without Band Width confirmation, you can find excellent breakout trades if you pay attention to price action. In this case, the breakout from the Squeeze was also a continuation of the bearish trend. This Squeeze signal enjoyed confirmation from both sets of indicators.

Combining Bollinger Bands And Bollinger Bands Width

Most people are aware of Bitcoin, but a little known fact is that there are literally thousands of alternative cryptocurrencies out there. These alternative cryptocurrencies are commonly called “altcoins”, short for alternative coins.

Subsequent rising troughs on Twiggs Money Flow would give me sufficient confidence to enter the trade before the next breakout, with a stop below the recent low at $56. More cautious traders would wait for breakout above the upper Bollinger Band but this often gives a wider risk margin because the stop should still be set below $56.

Bollinger Bands Gold Trading Indicator Bulge And Squeeze Technical Analysis

Some of the most popular are Ethreum, Litecoin, and Dash. Another aspect that all these cryptocurrencies share is volatility, which to a typical investor may seem like a deterrent, However, to a day trader it’s a big plus. Trading Bitcoin and altcoins allows the trader an amazing opportunity to take advantage of outrageous price fluctuations that just aren’t seen in the traditional marketplace. For these reasons day traders are currently flocking to trade cryptocurrencies. Probably the most popular and commonly used Bollinger bands trading strategy is the double bottom. This strategy looks to identify a common pattern of lower resistance level testing that happens before a sharp price rally. So while in a squeeze we can calculate the price at which the stock must close at the next session to lift the upper BB above the upper KC.

The upper line of the Bollinger band is computed as being two standard deviations above the central SMA line. And similarly, the lower line of the Bollinger band is calculated as two standard deviations below the central SMA line. However, such breakout plays are prone to failures (called ‘head fakes by John Bollinger in his book). Hence, looking for subtle price action clues in the trading range leading up to the breakout is invaluable. Of course, trading with the last established trend also increases your winning odds. A moving average ribbon is a series of moving averages of different lengths that are plotted on the same chart to create a ribbon-like indicator. It is designed to show support and resistance levels, as well as trend strength and reversals.

This indicates that the downward pressure in the stock has subsided and there is a shift from sellers to buyers. Also, pay close attention to the volume; you need to see it drop off dramatically.

Which MACD positive crossover is a strong bullish signal?

It means the trend in the stock – its magnitude and/or momentum – is starting to shift course. When the MACD(12,26) crosses above the EMA-9, this is considered a bullish signal.

From my personal experience of placing thousands of trades, the more profit you search for in the market, the less likely you will be right. Strategy 5 – Snap back to the middle band, will work in very strong markets. #5 affords you the flexibility of jumping on a hot stock while lowering your risk as you wait for the pullback.

This is because very often after a period of low volatility price will break out with a force that gives the trader an opportunity to profit from the move. After that candlestick breaks out and closes either above or below the band, place a buy stop order 5 pips above the high of the breakout candlestick if it breaks out of the upper band. You can apply it directly to the chart that you’re trading, but I have found it to be extremely effective when applied to a higher time frame chart such as the daily chart. To help reduce the clutter you could develop a separate indicator for the squeeze and simply remove the Bollinger Bands and Keltner Channel from the chart.

Bollinger Bands Bandwidth For Tradestation And Multicharts

Standard deviation will be higher when gold trading prices are changing significantly and lower when the gold trading market gold prices are calmer. The candlestick reversal involves waiting for prices that have moved outside their Bollinger bands to close at either a daily high or low before trading on an upcoming correction. Therefore, a stock whose price has exceeded its upper band will be ready for a correction downward when it ends a trading down at the lowest price for that day. The simple and intuitive theory behind the use of Bollinger bands is the general limitations of a security’s price change based on its recent history. Bollinger bands are one of the most popular and widely used technical indicators. Many successful trading strategies are based on nothing more than Bollinger bands and a few complementary indicators.