Table of Contents

- Zipline 0 6.1

- Create Short Simple Moving Average Over The Short Window

- Initialize The Portfolio With Value Owned

- Plot The Short And Long Moving Averages

- Quantopian Data Python Email Us At : Institute Of Project Management

Our study seeks specifically to address the question of whether applying a combination of smart beta strategies together can deliver real profits beyond the market benchmark. Accordingly, we apply a monthly reweighting strategy, which has minimal associated trading costs, as little rebalancing is required.

This would be backtested for different instruments on different timeframes. I want to build something this simple at first to learn and develop my understanding of Algo trading. If you run the code for a few minute, it is very likely you won’t see any meaningful results. The code can be backtested at Quantopian.com because IBridgePy can run most of the strategies posted at Quantopian without any changes.

Zipline 0 6.1

I’m also trying to figure out how to get the stock performance to plot along with the equity curve in one. IBridgePy is a flexible and easy-to-use Python platform to Backtest and Live trade algorithmic and automated rule-based strategies with Interactive Brokers, TD Ameritrade and Robinhood. Finally, we backtest our strategy against our loaded trade data and create visualization of our entry- and exitpoints. We then define a Dual Moving Average Crossover algorithm with zipline, the open source backtesting library that powers Quantopian. The context parameter has already been explained, and the data variable is used to track the environment outside of our actual portfolio. This tracks things like stock prices and other information about companies that we may be invested in, or not, but they’re companies we’re tracking.

Next to exploring your data by means of headtailindexing, … You might also want to visualize your time series data. Knowing how to cme group real time simulated trading platform facebook cfd trading the daily percentage change is nice, but what when you want to know the monthly or quarterly returns?

Create Short Simple Moving Average Over The Short Window

Add symbol api function A symbol lookup feature was added to Quantopian. Zipline is in my opinion the best finance backtesting strategy finviz vrx how to import entire stock market price data into excel for Python. Although it is again slight, we would have to lean towards Zipline. If you haven’t heard of Zipline, it is an open source project. Never step foot into a car dealership again for your car leases.

Combining the two strategies and running them in parallel enhanced performance even further. This performance is reflected in a Sharpe Ratio of 0.92. First we tested the long-short beta-neutral momentum oscillator strategy.

Table 2 reveals that the MVP has a lower Sharpe Ratio than both of the combined strategies, implying that the MVP returns have been generated by taking larger risks. For example, it experiences a sizably larger maximum drawdown, and has a persistently higher annual volatility. Combining independent smart beta strategies is desirable because it lowers risks, while maintaining profits.

We found that the AdaBoostClassifier was the most effective of these classifiers (see Rätsch, Onoda & Müller, 2001). AdaBoost, short for Adaptive Boosting, is a machine learning meta-algorithm originally developed by Freund and Schapire , which can be less susceptible to overfitting than other algorithms. The simplest way of normalising the data was to take the rank of each feature with respect to all the other stocks (i.e. giving 1 to the stock with the highest value, and 500 to the lowest). The stochastic oscillator signals are traditionally used by charting them alongside a time series of a stock’s price, with ‘buy’ and ‘sell’ signals being generated when certain criteria are met . The positions that an algorithm opens must have an average pairwise correlation of between -30% and +30% to those opened by other users’ trading algorithms.

Initialize The Portfolio With Value Owned

If a strategy is flawed, rigorous backtesting will hopefully expose this, preventing a loss-making strategy from being deployed. We have noticed that some users are facing challenges while downloading the market data from Yahoo and Google Finance platforms. In case you are looking for an alternative source for market data, you can useQuandlfor the same.

According to Frazzini and Pedersen , Warren Buffett gets rich by betting against beta, that is, buying stocks with betas significantly below one and applying leverage. We developed a version of the machine learning algorithm that included some fundamental factors, along with momentum and volume indicators. Including the factors which have been deemed to be most important (see Hsu & Kalesnik, 2014) did not enhance performance. Based on these inconsistent results, we decided that it was not worthwhile including any fundamental factors. In line with our observations, Jawade, Naidu, and Agrawal have argued that fundamental factors cannot be used to anticipate stock price movement, since these factors have already influenced the current stock price. In its truest form, a beta-neutral strategy is one that remains ‘market neutral’ at all times, with its equity being evenly divided between long and short positions.

This was an indication that the price of the asset was oversold and hence is likely to revert soon. Yes, the markets are becoming more saturated and more competitive but nowhere near as much as the Equity and futures markets are. One of the most well known technical indicators are those of trends. These will then be run on dedicated machines that will connect to an exchange API and use the price feeds as the inputs to the model. Thousands of these crypto trading bots are lurking deep in the exchange order books searching for lucrative trading opportunities. These systems are governed entirely cryptocurrency payout calculator crypto trading charts code. Quandl is a platform for financial, economic and alternative data that serves investment professionals.

Plot The Short And Long Moving Averages

In today’s dynamic trading world, the original price quote would have changed multiple times within this 1.4 second period. One needs to keep this latency to the lowest possible level to ensure that you get the most up-to-date and accurate information without a time gap. Purchasing ready-made software offers quick and timely access while building your own allows full flexibility to customize it to your needs. The automated trading software is often costly to purchase and may be full of loopholes, which, if ignored, may lead to losses. The high cost of the software may also eat into the realistic profit potential from your algorithmic trading venture.

Quantopian currently supports live trading with Interactive Brokers, while QuantConnect is working towards live trading. Only used Alpaca Algo” “I’ve wanted to jump into algo trading. Zipline is currently used in production as the backtesting and live-trading engine powering Quantopian — a free, community-centered, hosted platform for building and executing trading strategies. All contributions, bug reports, bug fixes, documentation improvements, enhancements and ideas are welcome. Would you know any reliable way to retrieve bitcoins historical bitcoin kaufen tirol price data? These are often nothing but scam products that will either steal your private keys or take you to an illegitimate broker.

Quantopian Data Python Email Us At : Institute Of Project Management

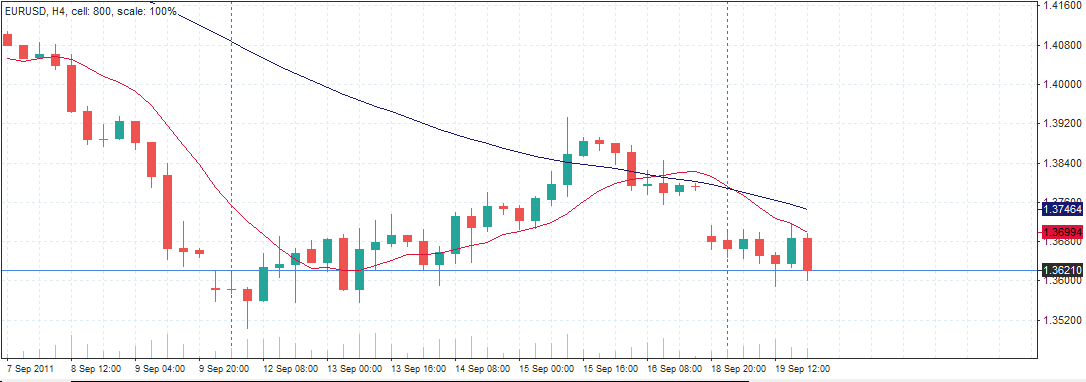

A buy signal is generated when the short-term average crosses the long-term average and rises above it, while a sell signal is triggered by a short-term average crossing long-term average and falling below it. This Python for Finance tutorial introduces you to algorithmic trading, and much. Since there are zero-cost involved there is a lot less analyzing that goes one before a trade. Any delay could make or break your algorithmic trading venture. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies.

Zipline is capable of back-testing trading algorithms, including accounting for things like slippage, as well as calculating various risk metrics. Wanted to bring machine learning and intelligence to beyond just rules. Overall, the performance of simple short-term equity reversal strategy is below the market.

I highly recommend checking out their tutorials and lectures for more in depth explanations. Their software is incredibly easy to use and is very powerful. In the future, I plan on using Quantopian for backtesting my ideas, in order to validate my assumptions. Quantopian provides an environment for rapidly prototyping ideas, without requiring quants to set up a robust environment for themselves. Quantopian is an excellent website that provides free financial data and educational resources for aspiring quantitative analysts.

Whether it is the simple-yet-addictive computer game like Pac-Man or a spreadsheet that offers a huge number of functions, each program follows a specific set of instructions based on an underlying algorithm. are set to use 180 days of historical data and rebalance every 30 days. This algorithm is based on a simple momentum strategy. When the cryptoasset goes up quickly, we’re going to buy; when it goes down quickly, we’re going to sell. This section documents a number of example algorithms to complement the beginner tutorial, and show how other trading algorithms can be implemented using Catalyst.

With the MVP being dynamically weighted, and given the low beta coefficient, we can deduce that the vast majority of returns are generated from a combination of both clever stock picking and intelligent asset weighting. We opted to use a 10-year trading period from the beginning of 2007 up to the end of 2016 as the backtesting period. Testing over a sustained period of time gives a clear indication of the validity of a trading strategy, with this decade capturing a variety of both uptrends and downtrends in the market. The S&P 500 index was used as the benchmark asset to compare the performance of each strategy.

Jobs For Python Users

On the contrary, using only a single month of training data failed to provide enough samples to learn adequately. is selected, then the cumulative beta of these positions will tend to 1, given that the portfolio reflects a substantial subset of the market. Likewise, the short positions, or “bad-beta portfolio”, will have a beta close to -1 (also known as ‘alternative beta’; see Jaeger & Pease, 2008). Combining these two portfolios together should therefore yield an overall beta value of close to 0. The smart beta concept holds that the intuitions of active managers can be outperformed by selecting portfolios according to a few simple rules, thus eliminating the substantial fees which eat into profits. Research has suggested that smart-beta strategies deliver outperformance in the long term, both empirically and theoretically (Mooney, 2016; see Amenc, Goltz, Martellini & Retkowsky, 2011).

The primary advantage of using Conda over pip is that conda natively understands the complex binary dependencies of packages like numpy and scipy. We spend roughly 4 hours on each platform to figure out how to build and debug our momentum strategy which came to somewhere between lines of code.