Table of Contents

- Who Is A Pattern Day Trader?

- Day Trading

- Continue The Discussion AtCommunity Optimusfutures.com

- Strategy Performance

- Successfully Day Trade Emini Futures

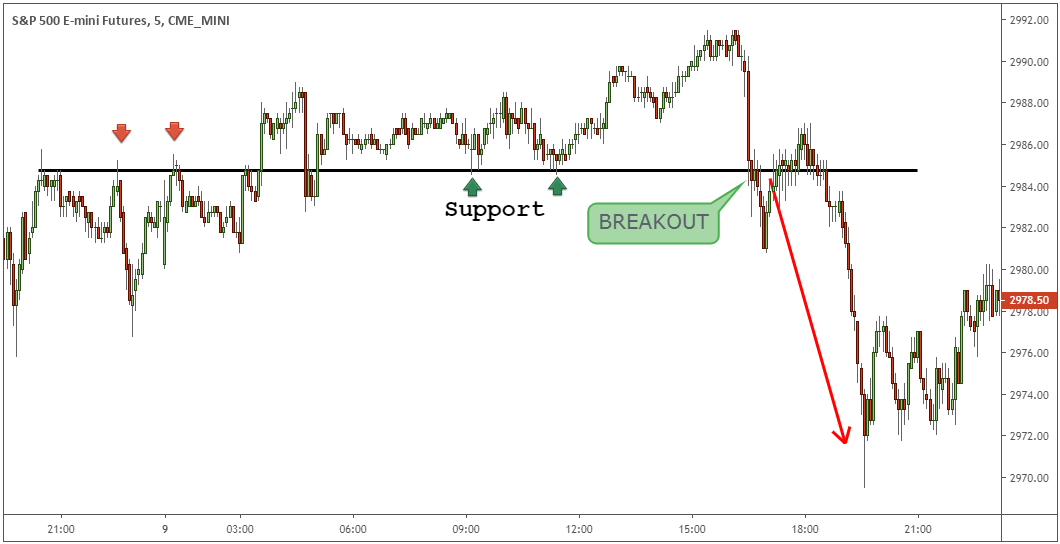

- Breakout Day Trading Strategy

Our trade signal is clear-cut and precise — everyone will see the exact same buy or sell signal. Robert Jack’s S&P 500 Emini Trading System Course will show you how to profitably day trade the emini futures.

Ultimately, picking a futures scalping strategy that works for your particular personality and availability of time during the day may be the key to your success as a futures scalp trader. Now that you know how you can sustainably scalp trade in the futures market, it’s time to develop your own futures trading scalping strategy. In the first instance, the Stochastics sell signal came when the E-Mini Futures price closed at 2950.00 and the market turned bullish after dropping only eight ticks or 2 points to 2948.00. In the second instance, the Stochastics produced a buy signal after the price closed at 2948.75, but the market turned after only reaching 2952.25 or 3.5 points. If you only applied an Oscillator based futures trading scalping strategy, your reward to risk would have been too low. Only then, can you devise the right money management strategy suitable for your technical trading strategy based on your risk tolerance and trading goals. But trading, let alone scalping which operates at a much higher speed, is never that easy.

The risk-reward ratio quantifies how much money is risked to attain a certain profit. Let’s say a trader has $7,000 in a trading account and is planning to purchase one E-mini S&P 500 future and hold on to it until the price has gone up eight ticks. Many factors go into determining how much money you could potentially make in a month by day-trading futures. Let’s create a scenario using a risk-controlled trading strategy to get a ballpark idea of its profit potential. In the day trading biz if you have trades that are winning 60% it’s considered great.

So what can I pass on, in terms of lessons learned, from trading with Larry Williams. Without breaking any confidences, revealing specific setups, etc. these are the general principles, observations and what I’ve learned from reading and watching Larry Williams trade. So that’s why I know a little bit more than most about Larry Williams. However, I have to say, since then I really haven’t kept up because I went off on my own tangent. But I’ll give you as much insight as I can – without breaking any confidences – about the way he trades and what I have learned. Unfortunately, he didn’t end up making money that session and so we never got a refund of the cost to attend.

Who Is A Pattern Day Trader?

You need only a very basic charting software to implement them for your trading such as NinjaTrader or Sierra Chart. If you use either of them, you can also obtain indicator templates for trading the systems.

By the third or fourth bar inclusive of and following the opening, you can sit back to enjoy the fantastic trading patterns made by the E-Mini as it marches towards its session close. Find these secrets in the Day Trading the E-Mini S&P 500™ eBook. The market is easy to access through the CME GLOBEX electronic platform and is open almost 24-hours a day, 5 days a week. The E-mini S&P 500 futures market has become the world’s most popular futures market for good reasons. It provides low margin entry into a highly liquid and cash-efficient global market.

Day Trading

Instinctual – assuming that his or her gut is the key to unlocking unlimited income potential, these traders do not mentally acknowledge losses. By listening to an inner voice that has the authority of Warren Buffet, trades are placed that quickly end up in negative territory. On occasion, the term “E-minis” is used to described the collective futures contracts traded on the CME’s Globex electronic trading platform. Since 1997, E-mini has grown to include 44 separate contracts. Ten of these 44 contracts have volumes in excess of 1,000 contracts. For example, if the value area is between $98 and $102, and price trades up to $106.00 on low volume, that would be a standard short for a volume profile trader. This essentially comes down to a more holistic view of support and resistance.

- Remember that the futures markets move in ticks and points .

- Breakouts or shorting moving averages, the same as everyone else gives you no advantage.

- An advantage E-mini has over stock trading is accessibility and volatility.

- By being able to understand the market and keeping it simple everyone is able to trade and make money the way that they feel comfortable.

- The last–and probably most important thing– is that the E-mini S&P 500 is the most heavily traded market in the world for professional day traders.

Stock Traders deal with overnight risk, where a large portion of their hard earned profits get wiped out because the market opened with a large gap up or down. This market once thoroughly investigated can prove out to be the only market that any serious trader will ever need. Derivative transactions, including futures, are complex and carry a high degree of risk. They are intended for sophisticated investors and are not suitable for everyone. For more information, see the Risk Disclosure Statement for Futures and Options. The number of times you enter into trades each day makes it harder to learn what you need to know about day trading.

Continue The Discussion AtCommunity Optimusfutures.com

The large stop allows you to sit through quite a lot of volatility in the market. Then if you happen to have a profitable open position, close the position out, take your money. So the market reverting to mean is a very strong force in the market, and he was using that to look for trading opportunities.

Based on this, many practitioners see significant deviations from the point of control as an ‘unfair’ price, so they’ll fade those moves. A market profile displays how much volume has been executed at each price, as opposed to a traditional volume histogram. A profile provides visual context as to where most supply and demand exists. This is in contrast to short-term stock trading, where 100% of your profits are taxed as short-term capital gains.

You can buy and sell any futures contract any time you want, you are not obligated to hold onto it. The good news is, the S&P 500 is a CASH MARKET. Nothing really gets delivered. It’s traded as a futures contract to provide a hedging vehicle for those with exposure in the stock market and it’s traded as a futures contract for speculative purposes. The range of results in these three studies exemplify the challenge of determining a definitive success rate for day traders. At a minimum, these studies indicate at least 50% of aspiring day traders will not be profitable. This reiterates that consistently making money trading stocks is not easy.

Strategy Performance

The opening gaps are used to anticipate initial market direction. There are many good trading strategies that lend themselves well to the E-mini S&P. A trend gap strategy is one that is well suited to intraday trading the shorter timeframes, and to scalping trading. Also called going long on futures, holding positions overnight can possibly cause you to lose money. The futures may close at the end of the day at one price and open the next day at a much different price. If you are a new trader, you should be wise about certain things when you learn how to trade futures. Since we are now opening day trading centers around the world we have our program in Spanish, English, and Portuguese. We have live classes every week where one of our Master Traders talks about the market, live.

You are trading the YM (E-Mini Dow Futures) using a 1-minute chart before the bell. The average true range over the last six hours stood at around 6 points. Remember that past performance is not indicative of future results. Last but not least, when you make a series of decisions in a context wherein real money is at stake, you may be prone to making more errors in thinking and execution. You can also see the output indicator at the bottom, plotting the Daily P/L. it updates on a bar by bar basis and is green when the results are positive and red when the results are negative. The result for each day can also be written to a text file.

But The Goal For Day Trading Is Consistency!!!

It takes time to learn about future trading strategies in day trading. Position traders may make only one trade every week, but day traders often make many trades every day.

You will learn our trading method that has been consistently profitable throughout the years — a winning rate in the 85% area. We are now in our 17th year of teaching students how to trade profitably. So if you have any questions you can always ask me at traderchick.com. Or if you want to learn day trading basics – check out MY Courses. Trading futures and options involves substantial risk of loss and is not suitable for all investors. The risk of loss in trading commodity interests can be substantial.

He has done speaking gigs all over the world and he also used to run his ‘Million Dollar Challenge’ . These days you’ll find Larry talking about his trading on his website IReallyTrade.com. Larry Williams burst onto the trading scene in 1987 when he won, what used to be called, the Robbins Trading Competition. He turned a $10,000 account into over $1.1 million in 12 months. He actually turned the account into over $2 million but a couple of final trades didn’t work out and the account ended up being closed out at $1.1 million. To fulfill this intention our goal is to provide investors with trading systems that provide consistent outsized returns while keeping losses and drawdowns contained. To achieve this goal we offer very short term trading strategies that put a relatively small amount of capital at risk and are in the market only when perceived opportunity is the greatest.

When the $TICK hits an extreme reading, this can be interpreted as a contrarian indicator, because when there are too many buyers or sellers the market tends to correct to find balance. Or, if a trend forms within the $TICK reading, this can indicate continuation. The goal of this article below is to give a broad introduction to the world of E-mini futures. Day Trade the World™ is a registered trademark of Select Vantage Canada Inc. Your ability to open a DTTW trading office or join one of our trading offices is subject to the laws and regulations in force in your jurisdiction. Due to current legal and regulatory requirements, United States citizens or residents are kindly asked to leave this website. features a daily live trading broadcast, professional education and an active community.

The overnight initial minimum is another thing to take into consideration when trading E-minis. This is the amount of money needed to hold your position in the market after close. Both the initial and overnight margins can fluctuate at any moment-based market volatility. As Marcello points out there is no best day trading strategy which will work for everyone, because what works for one person may not be right for another. The basic DTA strategy is a good foundation, but if you follow signals blindly you have missed the point.

Conversely, a trader who exits a trade at their own initiative, rather than using a stop loss, may not always lose the full five ticks. If a trader loses five ticks on a losing trade but makes eight ticks on a winning trade, they will be ahead of the game even if they win only 50% of their trades. That’s why many futures day traders strive to make more profit on each winner. The win rate, which is also known as the win-loss ratio, is the percentage of all trades that are profitable.