Table of Contents

- Why Bitcoin’s Price Will Grow Again

- Forex Bollinger Bands Super Reversal Trading System With Supporting Adx Indicator

- Scenario #1: Price Bars Tagging The Bollinger Bands And Reversing

- How To Read Price Action With Bollinger Bands

- Advantages Of The Bollinger Band Forex Trading Strategy

- Learn To Day Trade 7x Faster Than Everyone Else

So the Bollinger Band settings is usually expressed as Bollinger . As a trader or investor it is important to understand technical indicators and how they work. Bollinger Bands are a widely used indicator that can help you find excellent entry and exit points by using the techniques above. Make sure to practice using Bollinger Bands in a simulator until you have a solid understanding of how they work. Traders should remember that Bollinger Bands are based on historical information. Therefore, the bands react to price movements but don’t anticipate future price movements.

As the price retraces back up and reaches the 20-period moving average, we trail our stop to the 20-period SMA after a bar closes on the opposite side of it. Our trade will then be exited as soon as the price reverses and crosses the SMA from above. As such, we will incorporate a filter which shows market exhaustion and generates a counter-trend move. We will enter the market after the price has touched one of the BB boundaries, only if the following bar does not hit a new high or low, thus is an inside bar. It signifies a period of contracted volatility, which means that the previous market moves strength is declining and the chance for a reversal is much higher. Thus, the combination between Bollinger Bands and inside bars helps you enter on reversals by selling exceedingly high or buying exceedingly low prices.

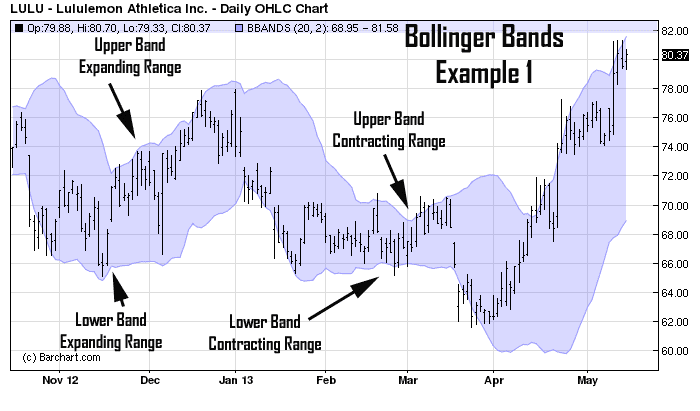

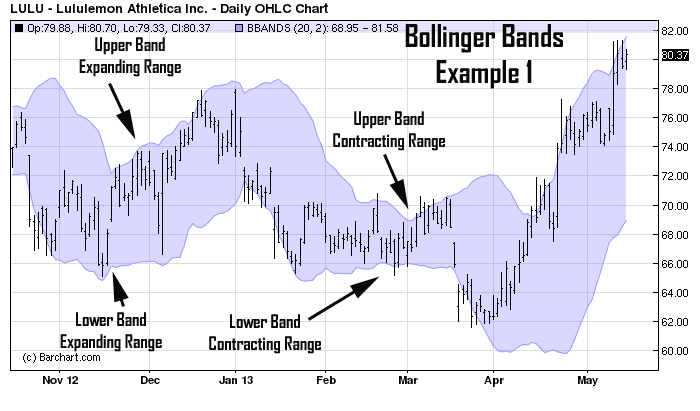

In a similar manner, instead of a 5-day moving average, for Bollinger bands, we use the 20-day moving average. You must be wondering why it is stipulated at 20-day moving average. Well, for one thing, it was specified by the creator of the Bollinger bands, Mr John Bollinger himself. Adding in the MACD, price action, and support and resistance as described is a positive addition to a powerful trading indicator. To do so, we can use the double top or bottom formations and are called M or W patterns. You could trade these blindly and get many false signals or we can add a simple failure test to aid us in a better entry. The upper and lower bands will also contract and expand depending on the volatility of prices.

Why Bitcoin’s Price Will Grow Again

This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. These lines, also known as envelopes or bands, widen or contract according to how volatile or or non-volatile a market is. This indicator is used to help traders time the market and find optimal entry and exit prices on their trades. However, there are only a handful that can help you predict future stock prices.

So, if you want to take less action and can seriously handle being wrong eight out of ten times, this system will be perfect for you. Since trading is a personal journey, I have created this strategy/profile matrix to help you uncover which will work best for you. Shifting gears to strategy #6 – Trade Inside the Bands, this approach will work well in sideways markets. Like any other trade signal, you will need to exit your position without reservation.

Forex Bollinger Bands Super Reversal Trading System With Supporting Adx Indicator

They do this by moving toward each other and ‘squeezing’ together. The sell zone is the area between the first lower SD and the second lower SD – it is located below the middle band. When the price is in the sell zone, it is a signal to go short. In such markets, Bollinger Bands can be used as a trend-following indicator. In strong and prolonged trending markets, Bollinger Bands usually slope in the direction of the trend. This is a theory that the price of an asset will tend to revert to its average price over time. For instance, if the asset price falls ‘too much’, it will tend to revert to a ‘normal’ price.

The bands are relatively close to each other squeezing the price action and the indicator. Suddenly, the bands start expanding rapidly during the decrease. Soon we see the price action creating a bullish Tweezers reversal candlestick pattern, which is shown in the green circle on the image. This is a strong long signal occurring at the lower band, and thus creates a nice opportunity to buy the EUR/USD. A stop loss order should be placed below the lowest point of the Tweezers chart pattern as shown on the image. When the Bollinger Bands are close to each other, then the trading indicator is conveying to us that the volatility of the Forex pair is relatively low.

Scenario #1: Price Bars Tagging The Bollinger Bands And Reversing

make the right decisions because you’ve seen it with your trading simulator, TradingSim. We need to have an edge when trading a Bollinger Band squeeze because these setups can head-fake the best of us.

Standard deviation refers to the volatility of the instrument’s price movements. In an uptrend only trade the lower bands and in a downtrend only trade the upper band. This is because price action doesn’t necessarily need to reverse at the band as the band could keep climbing with the price action.

How To Read Price Action With Bollinger Bands

It is worth keeping in mind that bottoms are generally easier to spot and clearer than tops, since the underlying psychology of a market is very different in bottoms as compared to tops. Bottoms are associated with fear, while tops are associated with euphoria. We can also use the %B indicator to identify three pushes to high, where the oscillator should display lower highs. We should look for volume to fall steadily as three pushes to a high unravels. To enter a short trade after a Head and Shoulders pattern, we should look for a re-test of the neckline after we have observed signs of weakness .

- This trading system is good for trading also for binary options high/Low and One touch.

- The orange arrow in June 2016 highlights a potential exit when MSFT traded intra-day below the lower Bollinger Band.

- However, that’s not set in stone and traders are free to use sets of bands based on a longer or shorter moving average.

- That’s the primary reason why I only take setups that happen at zones on the chart that are easy to spot.

- When a stock breaks higher, the upper band may increase too since price and volatility are both increasing.

- As a result, a bullish bounce could occur, creating a long trading opportunity.

In summary, Bollinger Bands are a good way to understand the price action of an asset and helps us in forming better decisions on when to enter a trade. You can use a combination of different indicators to create your own strategy. The starter pack of Algorithmic Trading Strategies will help you create quantitative trading strategies using technical indicators which can adapt to live market conditions. Statistically, two standard deviation includes 95% of price movement.

As we previously mentioned, Bollinger Bands indicator measures the volatility on the market. A narrow band means indecision on price movement and when this happens, it is almost always guaranteed that markets are about to move either up or down. Also, if the market has recently experienced a lot of volatility and the bands are far apart, this is a sign that the market will settle down and trade into a range in the near future. Bollinger Bands are a trend indicator that detects the volatility and dynamics of the price on the market. The bands contract when the market volatility is low and expand when volatility increases. During periods of low volatility, the bands are narrow, while during periods of high volatility Bollinger Bands expand drastically.

As traders we rely on tools to help us make better, faster, and more informed decisions. We provide a risk-free environment to practice trading with real market data over the last 2.5 years. To practice the Bollinger Bands trading strategies detailed in this article, please visit our homepage at Tradingsim.com.

What are the best stock indicators?

Popular technical indicators include simple moving averages (SMAs), exponential moving averages (EMAs), bollinger bands, stochastics, and on-balance volume (OBV).

This is based on daily charts so intraday traders should not necessarily follow this. So play around with different lengths and gain an understanding of what works for you personally in trading. By finding the right length you have great potential reversal points at the bands. Most stock charting applications use a 20-period moving average for the default settings. The upper and lower bands are then a measure of volatility to the upside and downside. They are calculated as two standard deviations from the middle band. Bollinger Bands® are a type of chart indicator for technical analysis and have become widely used by traders in many markets, including stocks, futures, and currencies.

Likewise, having the standard deviation value too close to the average can lead to a lot of false signals as the market hits the bands repeatedly due to a smaller width. It’s usually drawn as a 20 day simple moving average of the closing price, with a line on each side. The distance the side lines are from the moving average is a function of the volatility, or how much the price is varying. It is two standard deviations, where standard deviation is a statistical term that gauges the price fluctuations. The statisticians tell us that two standard deviations will capture 95% of the price movement. In a strong trending market, prices will be hugging the upper/lower bollinger band lines and you may find out you will get stopped out frequently if you are looking for reversals of that trend.

You should always look for evidence of price weakening or strengthening before anticipating a market reversal. In this approach, a chart top occurring above the upper band followed by a top below the upper band generates a sell signal. Likewise, a chart bottom occurring below the lower band followed by a bottom above the lower band generates a buy signal. Traders generally use Bollinger Bands to determine overbought and oversold zones, to confirm divergences between prices and studies, and to project price targets. this is one forex trading strategy that can sometimes pick top and bottoms…which means you sell at the very top of a price swing and you buy at the very bottom of a price swing. The middle bollinger band line can be used as a reference line to move a profitable trade to breakeven or also can be used as a profit target. for example, if the price has been going up and touches the upper bollinger band line, you go short.

Price penetrated the upper band but our momentum indicator has put in lower highs. We are not allowed to trade any pullback to the moving average zone due to the MACD. An example of strength or weakness that traders should take note of is when price hugs the upper or lower band in an existing trend. Markets trend and markets will form a trading range and from these price ranges, we can get big moves as price begins to breakout from the compression and volatility increases. When the bands lie close together, a period of low volatility is indicated. Conversely, as the bands expand, an increase in price action/market volatility is indicated. When the bands have only a slight slope and track approximately parallel for an extended time, the price will generally be found to oscillate between the bands as though in a channel.

One of the first indicators I put to the test was Bollinger Bands. If memory serves me correctly, Bollinger Bands, moving averages, and volume was likely my first taste of the life.

Below is an example of the double bottom outside of the lower band which generates an automatic rally. The stock hit a new low with a 40% drop in traffic from the last swing low. Also, the candlestick struggled to close outside of the bands. Investopedia mentioned that price is contained 90% of the time , but I have no idea how they came up with that figure.