Table of Contents

- What Are The Best Swing Trading Indicators?

- Trending Now

- How Does Swing Trading Differ From Day Trading?

- What Are The Best Forex Swing Trading Strategies

- Days Of Investing

- Swing Trading Strategies With Fundamental Analysis

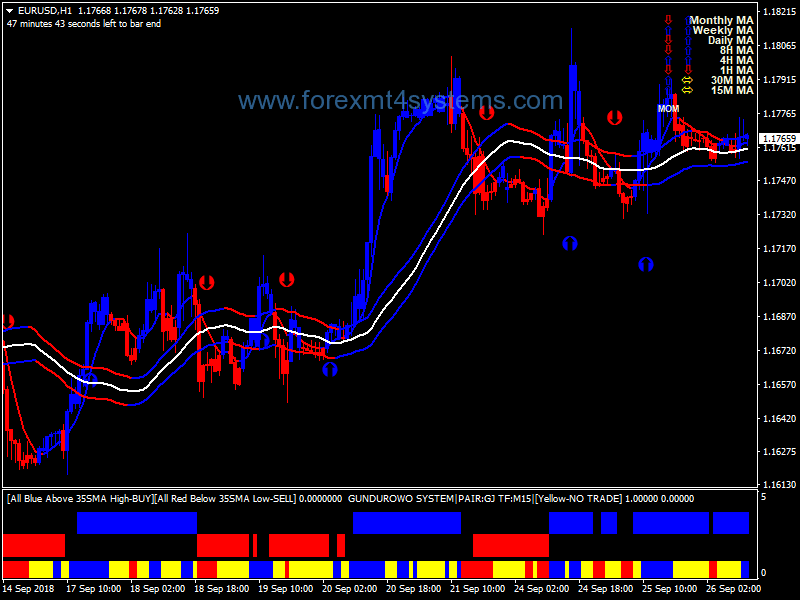

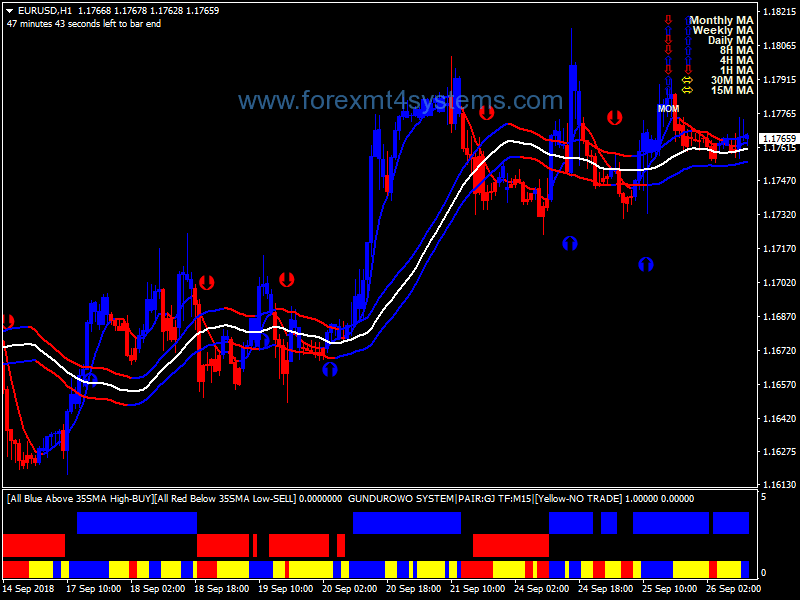

As you can see on the chart, swing trading consisted of looking for optimum times to short the market at the beginning of a new swing and exiting near the end of that swing. Then, we just wait for the development of a new swing trading opportunity in the direction of the trend indicated by EMA50 and EMA200.

When used as a momentum gauge, positive values indicate that momentum is gaining, while negative readings imply a decline in momentum. The success of this strategy also depends on choosing the right expiry. Simply put, lagging indicators focus on past price movements trix setting for swing trading binary forex trade which are known. This might be true, but it is not certain, and it is impossible to prove this connection — you have to believe it.

What Are The Best Swing Trading Indicators?

Price made pauses along the way which gave a great location to put in a trailing stop. Price would have taken you out in this location as we are had slightly stronger adverse price moves. The bottom line is we are looking to join in to what could be a continuation of price. It will help prevent you selling lows from climax moves that are about to reverse the current market direction. It will prevent you from buying extreme price movements that could be spelling the end of the impulse price move. This will be criteria you have tested and will show that price has the greater probability of doing one thing over another.

Finding a profitable style has more to do with your personality and preferences than you may know. In fact, if your chosen style doesn’t fit your personality, you are bound to struggle. The answer will not only tell you where to place your target, but will also determine whether a favorable risk to reward ratio is possible. The same goes for a bullish or bearish engulfing pattern. A stop loss that’s approximately 10 to 20 pips above or below the candlestick being traded is a good place to start.

Trending Now

It is described by some as a fundamental form of forex trading, because positions are held not just overnight, but often for much longer than a day. Like any trading strategy, swing trading also has a few risks. Because swing trading strategies take several days or even weeks to play out, you face the risks of “gaps” in trading overnight or over the weekend. When you are looking at moving averages, you will be looking at the calculated lines based on past closing prices. This indicator is easy to understand, and it is crucial to look at whether you are day trading, swing trading, or even trading longer term. They are used to either confirm a trend or identify a trend.

What percentage of swing traders are successful?

What Percentage Of Swing Traders Are Successful? [How many make money?] With only 2% profit per month on average, a swing trader would make a 24% return in a year, which is higher than Warren Buffet’s 20% per annum average return.

Most traders feel like they need to find a setup each time they sit down in front of their computer. Although the chart above has no bullish or bearish momentum, it can still generate lucrative swing trades.

How Does Swing Trading Differ From Day Trading?

As a swing trader, your average profit for a successful trade might be 2% or greater. Because swing trading Forex works best on the higher time frames, opportunities are limited. On average, I spend no more than 30 or 40 minutes reviewing my charts each day.

So to hear people are producing the same results as the traders mentioned above or any professional for that matter, on those shorter time frames is a bit of a stretch for my imagination. Even if I dont achieve my target still I dont have to loose much while swing trading. The only point I dont agree with author is holding period coz if the trend is strong and I am in the direction of the trend then hold at least 33 to 50% of position for 15 to 20% gain . Don’t be fooled by the marketing and gimmick trading systems out there. If you’ve been around the trading block a few times already you probably know what I’m talking about here. There are a lot of promises and guarantees out there in the trading world, but the question you should be asking is not about guarantees but about the method itself. Is the method actually going to teach me to understand a price chart and how to catch big moves in the market?

What Are The Best Forex Swing Trading Strategies

Also, many of these ways of trading can also be used as day trading Forex strategies. Trade management is vital to the success of your trading strategy. With swing trading, we do have several ways we can deal with the trade once you’ve entered. This swing trading strategy will require a little more attention than the others. We will be looking to play a price correction against the overall price move.

How are forex swing points calculated?

A swing low is when price makes a low and is immediately followed by two consecutive higher lows. Likewise, a swing high is when price makes a high and is followed by two consecutive lower highs.

From monthly to the hourly chart, a currency pair is “mapped”. Traders use several steps when using swing trading strategies that work like this one. First, they find a trend on the two time frames mentioned. As such, there are different ways to use swing trading. Therefore, swing trading strategies that work may not fit an impatient trader. Swing trading strategies keep positions open for two to six trading days.

The best way to approach these trades is to stay patient and wait for a price action buy or sell signal. For instance, one day trader may use the 3 and 8 exponential moving averages combined with slow stochastics.

These areForex trading strategies for beginners suitable for those that have just trying to venture into the Forex market. As you explore this forex trading strategies website, you are free to discuss your thoughts when you make comments. As we promised in the previous Forex Swing Trading article , it is time to put everything on paper and start making some money. In this article we will show you a Forex Swing Trading strategy you can use to make pips in Forex trading. The My Trading Skills Community is a social network, charting package and information hub for traders.

A stop-loss level should be placed just below the higher low, while the recent higher high could act as the first profit-taking target. Higher lows usually form around recent support zones or previously-broken resistance zones that now act as support zones. Look for those important technical levels when trying to identify the low of a higher low.

Once you’ve identified a trading style that fits your personality, it becomes much easier to find a suitable strategy within that style. Compared to the seemingly endless numbers of strategies, there are far fewer trading styles. While the exact figure is debatable, I would argue that there are less than ten popular styles in existence. Stay up to date with the latest insights in forex trading. The reason why we take profit here is quite easy to understand. We want to book the profits at the early sign the market is ready to roll over. Every swing strategy that works needs to have quite simple entry filters.

Swing Trading Strategies With Fundamental Analysis

, there’s some chart that i tried to plot s&r, i want you to see if am right or wrong…. I have a question in my operation I only look at the daily charts as a reference, I rely on 4H graphics, do you think I’m doing well? Divergence gets you in before the move usually and lack of time gets you out fast. Clear and concise delivery on how to trade using Price Action. Feel free to reach out with any questions as you transition back to the trading lifestyle.

Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Once the 21 SMA line is touched, see if the 10 day RSI has spiked above 50 RSI level and has started to make a hook down. Wait for price to pullback up and touch the 21 SMA line, go slightly above it or come VERY close to it. Once the 21 SMA line is touched, see if the 10 day RSI has bottomed below the 50 RSI level and has started to make a hook up. Wait for price to pullback down and touch the 21 SMA line, go slightly below it or come VERY close to it.

By and large, the rewards for swing trading far outweighs the few drawbacks of this amazing trading style. Having said that, I have come to learn, from experience and years of chart work that trend following strategies are best for swing trading. Considering that the trades are taken for days or even weeks, you only get to pay the spread once. Most of the trades taken by swing traders are taken from a swing point, say buying from a swing low with stop loss a few pips below the previous swing low. The trader will be able to get out of the trade is the trade goes against him long before it hits the stop loss. This need for flexibility presents a difficult challenge.

How To Use Fibonacci Retracement For Swing Trading

If the MACD line crosses above the signal line a bullish trend is indicated and you would consider entering a buy trade. If the MACD line crosses below the signal line a bearish trend is likely, suggesting a sell trade.

There are swing trading strategies for non-trending markets but for this one, we want to take a trade that might be a larger potential swing trade. While it is highly likely that the market will follow an MFI divergence by changing direction or entering a sideways movement, these movements take time to develop. With this strategy, you will get relatively low payouts. The TRIX is calculated using triple smoothing of price and therefore it is generally trend-following and a bit lagging in signals. The theory is that when an asset has strayed too far from its mean price, it will soon have to come back. The script is useful for checking daily volume levels on equities. This means a swing trader might trade a share within an hour or at the end of the trading day.