Table of Contents

- Strategy 6: Long Strangle

- Pack Your Lunch, Pack Your Wallet: How To Save Money On Lunch At Work

- Short Strangle

- Calendar Spreads

- High Implied Volatility Strategies

In summary, volatility trading gives you the option to detach yourself from the price moves. It also gives you the opportunity to create trades with more flexibility and precision. Volatility trading strategies seek trading opportunities beyond price movements. Understanding the implied volatility and how to trade volatility can help you choose the appropriate options strategy. While implied volatility tries to forecast the future stock price range, the historical volatility is the realized volatility over time.

Traders can also trade volatility-trading products such as the VIX. Directly trading the volatility found within the everyday stock price movement.Traders seek to capitalize on the fast-paced price moving and highly rewarding market moves. An increase in implied volatility also suggests an increased possibility of a price swing, whereas you want the stock price to remain stable around strike A. You want the stock exactly at strike A at expiration, so the options expire worthless.

We do this with the understanding that over time most of our options trades will end up decaying in value more than the underlying instrument. Options present traders with unique opportunities to earn a profit. When markets are volatile, options trading strategies can be even more effective. It can be a little difficult to pull the trigger if you don’t have the right education.

Strategy 6: Long Strangle

You can waste a lot of time searching for the most profitable options strategy reddit feed or watching YouTube videos that promise instant success. Some traders, especially those who are new to the game or inexperienced, see profit calculators as a shortcut. David Jaffee shares the trades that he sends to his trade alerts subscribers on YouTube.

A long straddle costs a lot more but starts to make profits much quicker whereas and long strangle costs less but needs a larger move in the underlying in order to make a decent profit. These are my personal favorites for getting long volatility as the positions have a significantly high Vega. This form collects information we will use to send you updates, reminder and special deals. Traders do not want to waste time or money on unsuccessful efforts.

Wikipedia® is a registered trademark of the Wikimedia Foundation, Inc., a non-profit organization. Information is provided ‘as-is’ and solely for informational purposes, not for trading purposes or advice, and is delayed. To see all exchange delays and terms of use, please see disclaimer. SPY shares were trading at $322.68 per share on Friday afternoon, down $1.28 (-0.40%). Year-to-date, SPY has gained 1.29%, versus a % rise in the benchmark S&P 500 index during the same period.

Pack Your Lunch, Pack Your Wallet: How To Save Money On Lunch At Work

Using an options calculator may provide some quick results, but they are not sustainable. You need knowledge and experience to really be successful trading options. You do NOTwant the most complex option strategy,instead you should strive for a simple strategy that has a high probability of profit which you can easily implement. David Jaffee of BestStockStrategy.com is frequently asked which option strategy is most profitable. When the market gaps higher, especially after it had been moving lower, all fear of a bear market disappears and option premium undergoes a significant and immediate decline. When the market declines rapidly, implied volatility tends to increase rapidly.

Note that writing or shorting a naked call is a risky strategy, because of the theoretically unlimited risk if the underlying stock or asset surges in price. What if Netflix soars to $150 before the June expiration of the $90 naked call position? In that case, the $90 call would be worth at least $60, and the trader would be looking at a whopping 385% loss. In order to mitigate this risk, traders will often combine the short call position with a long call position at a higher price in a strategy known as a bear call spread. Continuing with the Netflix example, a trader could buy a June $80 put at $7.15, which is $4.25 or 37% cheaper than the $90 put.

Short Strangle

Prior to trading securities products, please read the Characteristics and Risks of Standardized Options and the Risk Disclosure for Futures and Options found on tastyworks.com. The iron condor is our go to strategy when we see high volatility start to come in. The value in the options will come out quickly and leave you with a sizable profit in a short period of time. If, however, your prediction was wrong your losses will be capped so you don’t have to worry about blowing out your portfolio.

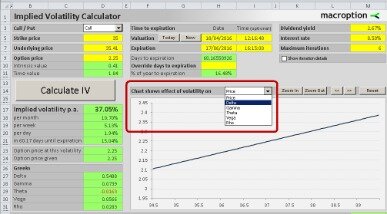

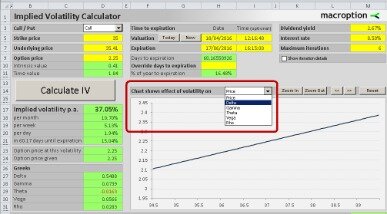

To understand how to use implied volatility to help us decide what volatile trading strategies to use, we’re going to consider a hypothetical example. Our team of professionals at Trading Strategy Guides always promotes responsible trading and proper risk management. Don’t forget that managing exposure to both beta and alpha risk is what ensures your volatility trading strategy is effective. We will also discuss how to effectively implement volatility trading strategies. Trading the expected future volatility of the underlying asset via options trading. If you’re doing this as a volatility strategy, you want to see implied volatility abnormally high compared with historic volatility.

Calendar Spreads

Naked puts and calls will be the easiest strategy to implement but the losses will be unlimited if you are wrong. This strategy should only be run by the more experienced option traders. If you are bullish on the underlying while volatility is high you need to sell an out-of-the-money put option. This is a neutral to bullish strategy and will profit if the underlying rises or stays the same.

Lack of experience in the high-vol environment.High volatility doesn’t really happen all that often, so new traders have limited exposure to the environment. It’s like my first winter driving in snow after being a life-long Floridian. Even experienced traders need a while to “get in sync” with the market. An option strategy profit / loss graph shows the dependence of the profit / loss on an option strategy at different base asset price levels and at different moments in time. With implied volatility at a heightened level, I can sell the September $60/55 put spread for an $0.80 credit. The reality is that you don’t know if a stock is going to make a move in any direction and most often your assumptions will play out 50/50 at best long-term.

There are many other strategies where you can benefit from moves in implied volatility and receive time decay, such as diagonal spreads, ratio spreads, butterflies, iron condors, etc. A calendar spread can in effect be a “Vega” trade, but it can also be done as a Theta collection trade. Normally on a credit spread we would be selling an at-the-money or OTM strike and buying a further-out strike. So, for example, a bearish December credit spread on XYZ stock (with XYZ shares at $52) might be to sell the December 55 call while simultaneously buying the December 60 call. Remember that for every option purchase, there is a corresponding option sale; so with implied volatilities high , let’s take a look at the basics of some option trading strategies that incorporate option selling.

High Implied Volatility Strategies

Because of this gap between the strike prices on long strangles, the maximum loss occurs over a range of prices, rather than just at a single price. A long strangle also requires greater movement in either direction to be profitable. While the larger loss range and greater price movement needed are both disadvantages relative to long straddles, long strangles are actually more common because the initial cost is often much lower. The seller of a put must be willing to buy the stock at that put price at the time of expiration, even if the shares have fallen well below it. If you purchase a call option and the market continues to trend down, you can have a lot of risk and lose most if not all the high premium you paid for the option. But, if the market recovers and has a large up day, you can capture a large profit by exercising your option.

CME Group is the world’s leading and most diverse derivatives marketplace. Trader Joe wants to take advantage of the bearish trend in ABC stock. Trade a volatility product such as the CBOE Volatility Index, or VIX index. If this is your first time on our website, our team at Trading Strategy Guides welcomes you.

How Can You Make Money Trading Options?

SPY – Today’s featured article reveals the strategies you need for a high volatility market. You can read about your gains, and smile, when we send out the Saturday Report each week, or whenever you check up on your trading account. The break-even range is about $3 in either direction from the current SPY price of $121.52, assuming no adjustments are made.

Are puts riskier than calls?

Selling a put is riskier as a comparison to buying a call option, In both options are looking for long side betting, buying a call option in which profit is unlimited where risk is limited but in case of selling a put option your profit is limited and risk is unlimited.

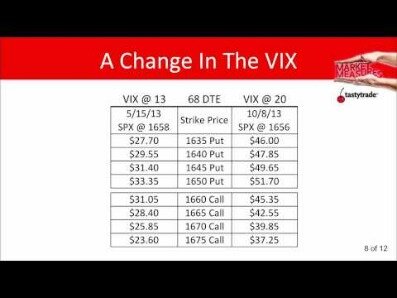

So a VIX of 36 means that SPX option traders/market makers are pricing that the SPX could move up or down 36% over the next 12 months—quite a high volatility level on both an historical and a real basis, in my view. With the headline risk from Europe affecting global stock markets, the VIX closed at 36.16, back above the key 30 level.

Consider long strangles if you expect a big move in either direction or an increase in implied volatility. Long strangles allow you to take both a bullish and a bearish position at the same time. There’s a lot more to it as you dig deeper, but I think this is a good simple example that should help you understand how experienced traders view something like this.

Well there are a few choices for a trader to make when seeking an alternative for a long stock. So, as you can see above, there are significant risks associated with trading long stocks directly. Two examples would be limiting losses to the downside, and being able to capitalize in a sideways market.

- If you want to make money trading options and earn a profit, you should focus on selling option premium.

- By falling under the spell of fake gurus and scams, you will only end up losing money.

- Since implied volatility is statistically overpriced, the underlying security is likely to stay within the range defined by the options prices.

- In this case, the $90 long call would be worth $5 and the two $100 short calls would expire worthlessly.

- Click here to get a full list of the top option strategies, and when each one should be applied to limit risk and maximize profit.

- This particular diagonal can often trigger a trader to either open or close a new position.

Some varieties of call and put spreads are also called seagull spreads. This 3-contract strategy includes two calls and a put, or two pouts and a call. You might be a stock trader, or just interested in learning more about how to trade and make the most out of your stock investment. You must first have the financial capital to start and a very great endurance for risks. Times of high-volatility should be times you relish, lick your chops, and get well-paid. Here are a few strategies that have worked for me and other traders I’ve either worked with or observed through the years. In a high-vol environment, traders need to “flip the script” in order to be successful.

It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, transaction or investment strategy is suitable for any person. Trading securities can involve high risk and the loss of any funds invested. tastytrade, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Supporting documentation for any claims , comparison, statistics, or other technical data, if applicable, will be supplied upon request. tastytrade is not a licensed financial advisor, registered investment advisor, or a registered broker-dealer. Options, futures and futures options are not suitable for all investors.

It gives traders a means to measure option pricing from one stock to another without having to analyze each one individually so they have a better understanding if they should buy or sell. It also gives investors a basis to create their entry and exit strategy. However, implied volatility is not based on fundamentals, and it can also be affected by unexpected news and events.