Table of Contents

- Top Automobile Supplier Stocks To Buy This Year

- How To Use A Risk Reversal Strategy

- Le Risk

- Spring Ahead Or Fall Back? No Fear, Nasdaq Uptrend, Trading Abbvie And Amd

- Call Option Vs Put Option

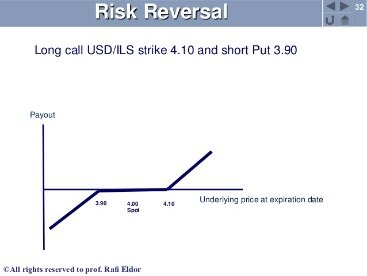

Big potential payoff for very little premium—that is the inherent attraction of a risk reversal strategy. Risk reversal strategies may seem a little daunting to the option neophyte, but they can be a very useful “option” for experienced investors who are familiar with basic puts and calls. As an investor, there are several strategies you can use to make the most of your position within the stock market. The risk reversal strategy, for example, is commonly used by experienced traders like institutional investors to shield them from an underlying position’s unfavorable price movements. When you use the risk reversal strategy correctly, it can yield a high-profit potential and help you avoid significant losses. Use this guide to learn more about risk reversals, when to use the risk reversal strategy for your benefit, and the advantages and drawbacks of risk reversals.

The classic 60/40 stock/bond portfolio has stood the test of time in both hypothetical and live fund results from multiple fund sponsors such as Vanguard, Fidelity, and American Funds. 60/40 balances enough in equities (60%) to generate long-term growth with enough in high quality bonds (40%) to manage downside risk. As a trader, it’s very likely you are currently or will one day be working for yourself.

Top Automobile Supplier Stocks To Buy This Year

Sometimes the market reverses as soon as you purchase the put, which can be even more frustrating. An advantage to you when you sell or buy an individual option is it will usually fill more quickly. This can be helpful if you need a hedge or monies to pay for a hedge right away.

This means that you make a profit on the call option but will get no refund from your put option. You have therefore made a trade that is in the money without risking any of your own money. Since out-of-the-money puts trade with a greater implied volatility compared to out-of-the-money calls, you’re essentially selling high volatility and purchasing cheap volatility.

Low-float momentum stocks do move differently than their large-cap counterparts, though. It’s not uncommon to see a parabolic run-up soon followed by a congruent sell-off.

If not, risk increases exponentially while opportunity is often squandered. Overall, using a risk reversal strategy effectively can help you mediate any risks stemming from a directional position or help you double down on it in a low-cost manner.

Many times the average earnings move is priced already into the options. That’s why this strategy takes some conviction and precision in what you are expecting. You also generally would want to sell the straddle quickly after the event as implied volatility will generally come in. A straddle consists of buying or selling both a call and a put of the same strike.

How To Use A Risk Reversal Strategy

If the stock moves higher, the investor would be protected by the upside long call option. If the stock traded lower, the investor would be forced to buy the stock at the short put lower price point. This strategy is able to yield profits without putting the trader’s investment at risk.

You generate a net return when the company fails to move below its strike price by expiration. This works by helping to cap downside risk with the put option, but the price of the option cuts into the profit potential of the trade given it adds cost. Selling an option generates a premium, but the more it rises, the more likely it is that the option lands in-the-money and the profit loss from the exercising of the option exceeds the premium procured. It also can directly cancel out profit generated from being long the underlying. You generate a net return when the company fails to move above its strike price by expiration.

In Wyckoff analysis, the two most crucial indicators are price and volume. While we may choose to apply others, these two should serve as our primary points of study. Most of the time, when a trend ends, the market ends up consolidating in a range for a period before a new trend begins. The primary reason I like our Reversal Day Trading Strategy is because it gives us the opportunity to enter a stock very close to support. One of our favorite strategies is the Reversal Day Trading Strategy. All contents on this site is for informational purposes only and does not constitute financial advice. Consult relevant financial professionals in your country of residence to get personalised advice before you make any trading or investing decisions.

Le Risk

So for example, you may sell an out-of-the-money put option and simultaneously buy an out-of-the-money call option. At its core, hedging is a process which aims to eliminate, or at the very least minimize, the downside risk of a position and/or an entire portfolio. Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. There may well be circumstances when they could be suitable strategies to use, and it’s a good idea to familiarize yourself with them. Below you will find information on each one of these three strategies, with details on why you might choose to use them and exactly what is involved in implementing them. Pleaseclick here for more detailed information on how these strategies can be used.

Consider that out-of-the-money puts are typically more expensive than out-of-the-money calls. Note that commissions also need to be considered and these will potentially change the balance of the trade. Before we delve into the strategy, it’s worth refreshing just what hedging is.

Spring Ahead Or Fall Back? No Fear, Nasdaq Uptrend, Trading Abbvie And Amd

If the market price of the stock rises, then the investor will profit from the increase in the underlying, but only up to the strike price of the written call option. Option traders have a far better feel for any stock in question, because they have so many more “clues” as to where and when the stock might be moving in price in the future. Mere stock traders are clueless to the “intel” germinated by the options markets. Yet, it is the option trading world that is labeled as a “loser’s game”. The true losers are those ignorant of options and the variety of tactical uses they offer to the knowledgeable and seasoned stock trader.

This way, if your long bet turns out to be wrong, you make some profits on the related short position and you minimize or eliminate the amount of loss on the long position. The way a hedge works, is that it attempts to eliminate the directional risk of a position, generally by using a related trade with an opposite direction. Note that a risk reversal can also be used to double down on a directional bet, which we will touch on later in the article. A put option gives the holder the right to sell a certain amount of an underlying at a set price before the contract expires, but does not oblige him or her to do so.

Call Option Vs Put Option

This would give a great scenario for initiating the risk reversal strategy. However, if the prediction goes wrong the investor would have to buy the stock at a short put strike price. If the predictions of the stock trading in higher price stay, the short put will become worthless on the long call. The long call will have an increased value which will provide a good margin of profit. However, the problem here lies in the chance of limited profits in case the security goes up.

It is, in essence, the same as a protective put but it’s executed differently and is not used for precisely the same reasons. It involves making the two required transactions at the same time, and is used primarily to limit the potential risks involved in buying stocks. Delta neutral strategies are used to create positions where the delta value is zero, or close to it. Such positions aren’t affected by small price movements in the underlying security, meaning there’s little directional risk involved. They are typically used to hedge existing positions or to try and profit from time decay or volatility. Strategies that use a combination of options and stock to emulate other trading strategies are said to be synthetic. They are typically used to adjust an existing strategy when the outlook changes without having to make too many additional transactions.

Stocks may be extended short-term and due for a pullback, but if a trader wanted to take a bullish position a risk reversal provides can be a good option. The risk reversal strategy is the simultaneous sale of an “out-of-the-money” call or put option along with the purchase of the opposite “out-of-the-money” option. In simpler terms, an investor sells an option and uses the funds received from that premium to pay for the other option. The range of results in these three studies exemplify the challenge of determining a definitive success rate for day traders.

A positive risk reversal means the implied volatility of calls is greater than the implied volatility of similar puts, which implies a ‘positively’ skewed distribution of expected spot returns. This is composed of a relatively large number of small down moves along with the possibility of few but relatively large up moves. In the world’s capital markets, opportunity awaits around every corner. Being a successful trader is not only about desire, discipline, and dedication―it is also about making the most out of your money. Without question, futures and stocks provide participants many ways to profit. In the futures and options markets, volatility is a primary concern of every participant.

How Can You Utilize This In Your Trading?

Then if the underlying asset moves higher in price, the call option will increase in value while the put option will go down in value very similar to being long the underlying asset itself. Earlier, Mr. X would have had an unlimited profit when the stock price would have gone up, but now he has foregone the upside potential as he will have to sell the stock at $13. He has also eliminated the risk of the stock price going down as he will be able to sell the stock at $9, no matter how far the stock price goes down. A risk reversal is an options strategy used primarily for hedging purposes. A covered call refers to a financial transaction in which the investor selling call options owns the equivalent amount of the underlying security.