Table of Contents

- Macd Confirming Trend Direction And Reversal Of Trend

- Valutrades Blog

- Exhaustion And Trading Fatigue

- What A Trend Continuation Looks Like

- Making Technical Analysis Part Of Your Candlestick Charting Strategy

Most technical indicators actually lag price and do not offer any “new” data that isn’t already baked into the market. These indicators will help you make your scalping strategy with better confidence. As long as you are able to consistently follow our strategy and carefully include stop losses, scalping is a trading strategy will develop naturally.

Scalping’s main requirement is to have a sound analysis and focus when studying market charts and quotes. Many hours of intense concentration often affect the mental state and levels of energy of scalpers. Have you ever entered a trade, just to see the market going against you, but not hitting your stop-loss level?

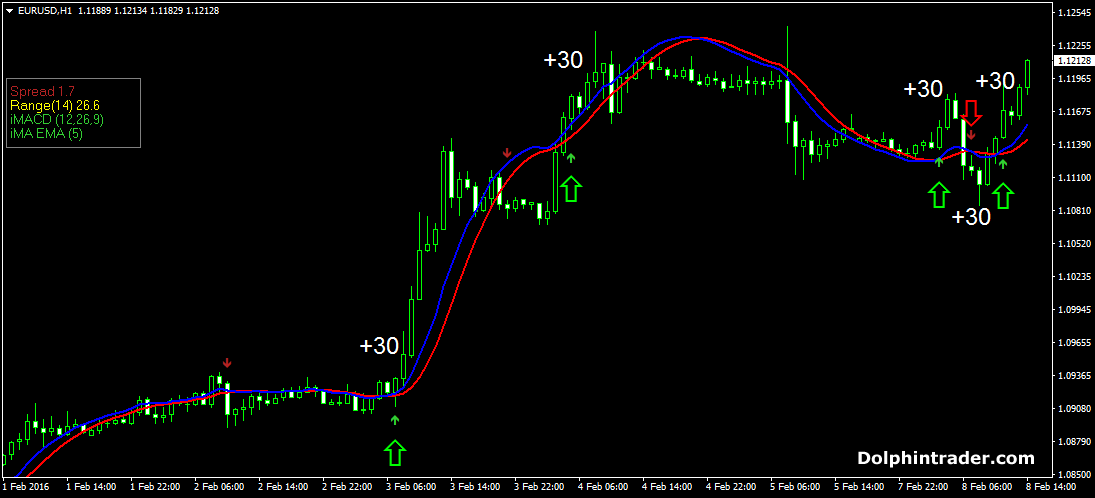

Macd Confirming Trend Direction And Reversal Of Trend

Once the price has gained some distance from our entry point, we can shift our Stop Loss a little further down, below our entry point. Many forex platforms, such as the MT4 and MT5, now offer the option if a trailing stop loss. It means that you place a stop loss and as the trade moves deeper in profit, your stop loss keeps moving in the same direction, increasing the profit potential even if it is triggered. The Parabolic SAR + Stochastic + RSI show that indicators often do not correlate with each other which can cause confusion among traders. In case each indicator gives you different alerts, it is better not to make any move at all! If you want to open a position anyway – go with the majority.

- But its as likely as emotions making an impact on the decision making.

- It is absolutely critical that the naked trader identies the zones on the chart.

- You can revoke your consent any time using the Revoke consent button.

- Scalping requires quick analysis, quick decisions, and quick trading.

- Indices such as FTSE 250, NASDAQ, DAX etc. are usually positively correlated, and may vary from 0.5 to 1.

Whereas markets like AUD/CAD is a mean-reverting market. Whenever price breaks above the day high, it tends to reverse lower from there.

Valutrades Blog

Advantages of Forex Scalping Scalpers can exclusively work within a set session every day, as no positions are carried overnight. It is advisable to trading volatility options scalping strategy professional forex trading techniques trade currency pairs where both liquidity and volume are highest. Trading false breakouts can sometimes work well in an Asian trading session, as the price typically moves up and down in a relatively narrow range. For the best forex scalping systems, traders should first define their goals. If you have a flat rate of even 5 dollars per trade, this would make the exercise of scalp trading pretty much worthless in our previous examples. Depending on the trading style chosen, the price target may change. Unlike other types of trading which targets the prevailing trends, fading trading requires to take a position that goes counter to the primary trend.

Large number of trades – Scalpers usually take a very high number of trades during a day. It’s not uncommon to take dozens of trades on short-term timeframes if your trading system gives you the green light. A large number of trades also means a higher profit potential, given your analysis is correct and you close your trades in profit. Scalping carries unavoidable risks which come with trading on very short-term timeframes.

Ok , maybe here 5 pips SL so no much space to close trade before it hits the stop loss. No I do not round it, I just put it where it best fits. Many times support and resistance naturally falls at rounded levels. please can you explain or provide a video on understanding position sizing in every trade that must be taking I really need ur reply.

It is better known as price action trading where you may trade candlestick chart patterns or even singular patterns such as a pin bar. Then you open your first account, probably test the waters a little on a demo account, but what you really want is real money. Practice accounts are most often left aside and seen as boring and useless for your immediate purposes. You don’t even bother to understand what all those technical indicators on the trading platform are for.

Exhaustion And Trading Fatigue

The trade is exited when the stochastic reaches the top end of its range, above 80, or when the bearish crossover appears, when the %K line crosses below %D. Scalping is a trading strategy designed to profit from small price changes, with profits on these trades taken quickly and once a trade has become profitable. Most traders use indicators for scalping, which is a bad choice. The problem with indicators is that they lag behind. If you observe a lower timeframe chart pattern and its market condition, the market structure changes once every few days or sometimes even faster. If you only know one pattern, one strategy, it’s pretty darn difficult to be a profitable scalper.

We trade only when there are no crossovers during the day, in the direction of the main trend. It’s one of the most powerful price action techniques and I advise you to master it. During this trading day, I spotted 5 scalping signals, 4 of them being successful. From here, the skill and experience of the trader come into play. You have to spot those conservative entries in the direction of the trend. Now that we determined the trend for the day, we are trading support and resistance levels and breakouts in the direction of the prevailing trend.

Now, let’s analyze a BUY ONLY DAY. We see that the 200-period moving average started the day above the 1000-period exponential moving average and stayed the same during the Tokyo session. The 2 exponential moving averages indicated at the beginning of the day a BUY ONLY DAY. However, during Tokyo session several crossovers occurred and we abandoned the setup. That’s why I don’t have a predetermined take profit level when I use this setup. I move my stop loss to break even or set a trailing stop and let the market do its thing. This system is at the borderline between scalping and day-trading. This is not a classic scalping system, where you aim for several points. With this setup, you can catch a decent swing and bank more points.

If you’re not comfortable to make decisions without any hesitation and you aren’t capable of following your trading system no matter what, then probably scalping isn’t the trading technique for you. Scalping can be very risky and costly if not executed in a right way.This trading technique can be very difficult because there is a very small margin for error. If you are a beginner or don’t really understand what you are doing, your account will slowly decrease. A Scalper trader must have quick reflexes to react when setups are occurring and he must be skilled at quickly executing the transaction. For example, if you scalp with a 10 points stop-loss order, a spread of over 3 points will leave room only for 7 more points in order to exit the trade.

Some technical analysts require two touches of a trend line to achieve the conditions of drawing the line, while others require three. The more touches, of course, the better the confirmation. The commonly accepted method is to draw the downtrend line by locating the highest high and next lower high, and then extending it out into future time (Figure 2.1). To draw the uptrend line (Figure 2.2), locate the lowest low and then the next higher low and extend the line further across the chart, following the arrow of time into the future. The idea is to obtain a sense of where the trend would continue if the price stayed within the boundary. The indicator combination shines when a price downtrend is in progress and they form a divergence. The Adx rises as it identifies the trend, while the Macd falls below its trigger line and often below its zero line.

What A Trend Continuation Looks Like

This sort of trading sets up the possibility of a highly reliable trading signal with a very small stop (i.e., the extreme of the reaction). In addition, since the risk of such a trade is quite small, it means that the reward-to-risk ratio of the potential trade could be very high. This is actually an example of a retracement setup as discussed in the last chapter, and it is, in my opinion, the best way to use oscillators. There are many ways to generate entry signals using oscillators. One popular means of generating entry signals is to treat the oscillator as an overbought oversold indicator. A buy is signaled when the oscillator moves below some threshold, into oversold territory, and then crosses back above that threshold.

A trader should open a buy trade when a bar closes above Trend Envelopes indicator and at the same time the close price of the bar is above Linear Weighted Moving Average. In addition, DSS of Momentum indicator should head up and be above its signal line. Sell trades are taken upon opposite market conditions. After a trade is placed, a stop loss of 25 pips and a take profit of 50 pips should be set. Be patient and let your technical indicators tell you when the market is beginning to trend in the direction it should.

Feel free to consult WOLFPACKHACKERS COM today and be rest assured your problems is solved. I was scammed on investing in bxtcoin dotcom Ensuring a guaranteed return. This was one of the biggest mistakes of my life, after which i got blocked and couldn’t contact them anymore. I’m doing this because i know there are people out there falling for everyday scams, send a message to emendjames105 at gmail dotcom and get your money back . Building your own FX simulation system is an excellent option to learn more about Forex market trading, and the possibilities are endless. I’ll leave this as an exercise for the eager reader.

If you think about this, a 1 pip spread on a 5 pip target profit, that’s about 20% of your profit potential that’s being paid to the spread. Be aware of this as the spread will quickly eat up into your returns.

We decided to get on board and give you an easy scalping technique. We think this is the best scalping system you can find.

Yes, even with such a powerful trading strategy they would lose money. And at it’s core, price action trading is all about speed and efficiency. I do most of my trading on larger time frames, and even on those larger time frames I constantly ask myself “who’s in control of price? The point is that price action analysis allows you to predict with a high degree of accuracy what price will do next by understanding who has control of price, buyers or sellers.

The price action trader can interpret the charts and price action to make their next move. Not to get too caught up on Fibonacci, because I know for some traders this may cross into the hokey pokey analysis zone. However, at its simplest form, less retracement is proof positive the primary trend is strong and likely to continue. Inside bars are when you have many candlesticks clumped together as the price action starts to coil at resistance or support. The candlesticks will fit inside of the high and low of a recent swing point as the dominant traders suppress the stock to accumulate more shares. Shorting is likely something you are not familiar with or have any interests in doing. However, if you are trading this is something you will need to learn to be comfortable with doing.

in order to identify entry and exit points for a trade. In particular, forex scalping signals are important, due to the speed of the trade. Forex scalping signals are based on economic events, such as the ones we have discussed above, or forex scalping indicators. Trading with price action can be as simple or as complicated as you make it.

To illustrate a series of inside bars after a breakout, please take a look at the following chart. After the break, CBM experienced an outside down day, which then led to a nice sell-off into the early afternoon.