Table of Contents

- Moving Average Crossovers And Day Trading

- How To Backtest A Trading Strategy Even If You Cant Code

- Choosing The Crossover Technique (single, Dual, And Triple) As Ways To Deal With Lag And Noise

- Volume Breakout Indicator

- Tema And Trend Direction

To overcome lag, we decrease length, which creates more noise and to overcome noise, we increase the length, which creates more lag. We appreciate your interest in our interactive educational course. Has plenty of features such as Lot/Risk Management, Filtering trades and Reverse Trading, Lifetime Support. We’ll help you become intelligent Money Managers and gain you entry into the elite group that actually makes money trading Forex.

- While we have been looking at the simple moving average, the use of alternate averages can provide another approach to this technique.

- This is because I have progressed as a trader from not only a breakout trader but also a pullback trader.

- Their variability is insignificant, and trying to fine-tune the periodicity is nothing more than retrofitting of data.

- The image illustrates a long trade with the GE stock, taken by signals from the TEMA and the VWMA.

- The purpose of the average lines is to smooth out the random movements and discover the underlying price trends.

- Trading is risky and a large proportion of people who try trading lose money.

- The first trade was a short at 10,765, which we later covered for a loss at 11,270.

Multiple moving averages combines a number moving averages to highlight short-term and long-term trends. As with the Golden Cross or Death Cross, when the short-term moving averages moves above or below the long-term moving averages it indicates a new trend is forming. A variant of moving average strategy was introduced by Philip Swift as a way of calling tops in the price of bitcoin. However, in July the price of bitcoin broke below the SMA and the break of the moving average foreshadowed a fall in the value. In the downtrend, the MA acted as a dynamic resistance level, as BTC-USD touched the moving average twice in August and September but was rejected and sent lower. The crossover of a shorter MA above or below a longer MA is used to provide an entry signal.

Moving Average Crossovers And Day Trading

TEMA is a custom setup, which is missing in many trading platforms. Above is the 2-minute chart of General Electric from Apr 27, 2016. GM then makes one final push higher and ultimately closes beneath the TEMA. The second correction actually breaches the TEMA, but the price was unable to close beneath the TEMA. Suddenly, volumes in GM begin to increase and the price forms a bigger bullish candle.

Nonetheless, the lack of frequency ensures that there are less false signals. Conversely, the shorter-term moving averages can provide a trader with a more active indicator, with recent price action providing a significantly greater. Signals are much more frequent, with the reactive nature of these averages meaning that signals can be timelier than the long-term moving averages.

How To Backtest A Trading Strategy Even If You Cant Code

If the price is below the average, and then moves above it, that signals the price is rallying. Such crossover signals may be used to aid in deciding whether to enter or exit positions. we’re looking at a daily chart , but the same trigger will apply if we have a trading horizon of only a few hours (i.e.a day trader).

Alternatively, you could identify the trend on the 1-hour chart and then wait for the EMA to cross above or below the EMA in the same direction on the 15-minute chart, for example. In addition, the material offers no opinion with respect to the suitability of any security or specific investment.

Choosing The Crossover Technique (single, Dual, And Triple) As Ways To Deal With Lag And Noise

Trading stocks, options, futures and forex involves speculation, and the risk of loss can be substantial. Clients must consider all relevant risk factors, including their own personal financial situation, before trading. Trading foreign exchange on margin carries a high level of risk, as well as its own unique risk factors.

Expect a lot of whipsaw if you decide to take a trade based on only a crossover. This site discusses and illustrates “setups” and stop losses . The first is very important to timing entry points with big potential in a short time with minimal risk.

However, by making the calculation more complex, many developers have attempted to come up with faster and smoother versions, designed to better track trends. TD Ameritrade is a trademark jointly owned by TD Ameritrade IP Company, Inc., and the Toronto-Dominion Bank © 2021 TD Ameritrade IP Company, Inc. Access to real-time market data is conditioned on acceptance of the exchange agreements. Futures, futures options, and forex trading services provided by TD Ameritrade Futures & Forex LLC. Trading privileges subject to review and approval. Forex accounts are not available to residents of Ohio or Arizona. Forex trading involves leverage, carries a high level of risk and is not suitable for all investors. Please read theForex Risk Disclosureprior to trading forex products.

Volume Breakout Indicator

The weighted moving average is designed to find trends faster but without whipsaws. It’s calculated by multiplying each data point by a different ratio and then takes the sum of all those products. Since they make a calculation based on previous price data, they can only ever tell you what has happened in the past and not the future. The longer the look-back (or number of days/periods used in the calculation) the more lagging the indicator will be. The Momentum% study measures the velocity of price changes for a fixed time interval. Momentum is a price expressed as a percentage of an earlier price.

The slower moving average is slower in responding to changes in the price curve. Moving average is one of the most widely used technical indicators for validating the movement of markets. Few other indicators have proved to be as unbiased, definitive and practical as the moving average. Moving averages help traders identify trends and empower them to increase the number of profitable trades by making those trends work in their favour. The Moving Average Convergence/Divergence is an indicator that was developed by Gerald Appel in the 1970s. The difference between two exponential moving averages is used to calculate the MACD and then a signal line, which is an EMA of the MACD is drawn. Many trend following trading strategies will have moving averages at their heart.

The reader agrees to assume all risk resulting from the application of any of the information provided. Past performance, historical or simulated results are not a reliable indicator of future returns and may not account for real world settings.

The first and most basic problem that a crossover trader faces is which moving average pair to use. At time t+1 there are three straight lines, the price, the moving average 1 and the moving average 2 . Notice that the blue line starts to fall next after the price line.

Develop Your Trading Skills

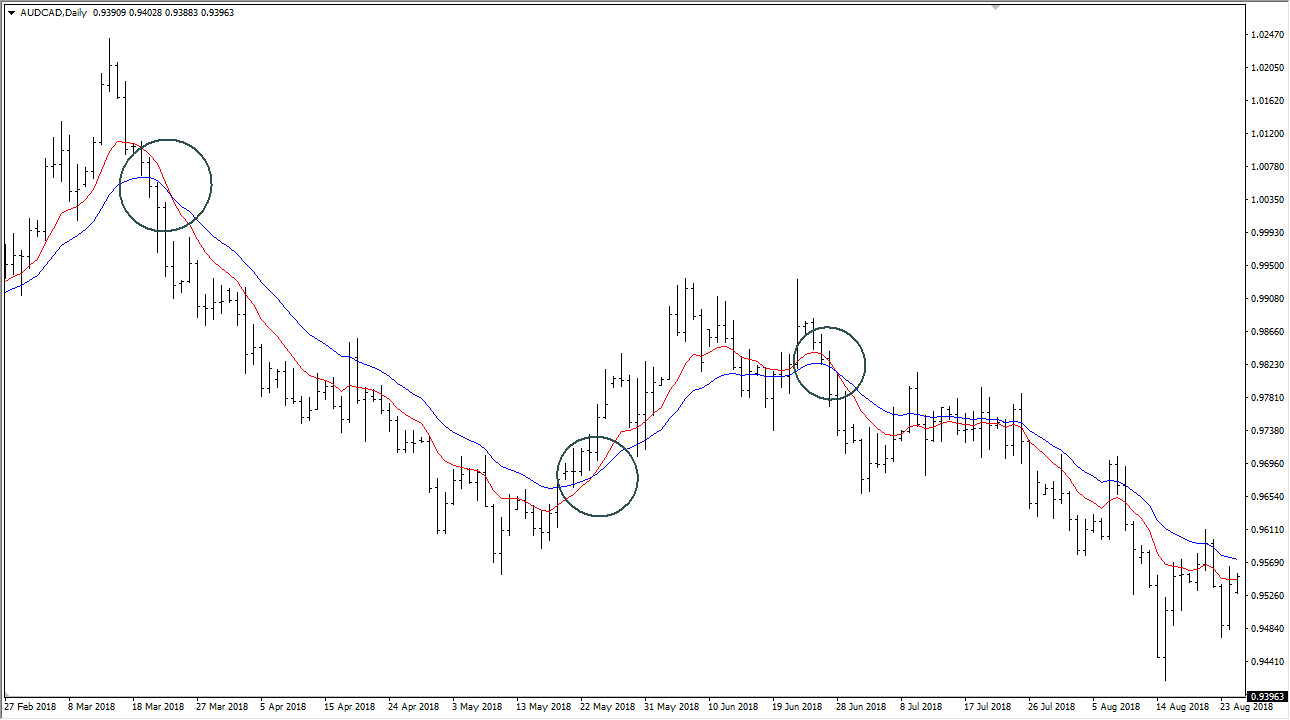

This sometimes confuses and fails the traders who attempt to enter a position. We will then hold our trades until the price action breaks the triple exponential moving average in the opposite direction. At the end of the bearish trend, the price begins to hesitate and then closes above the triple exponential moving average. The first signal comes with the first green circle when the price closes a candle above the triple exponential moving average. He has over 18 years of day trading experience in both the U.S. and Nikkei markets. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. When Al is not working on Tradingsim, he can be found spending time with family and friends.

What is moving average method in time series?

A moving average is defined as an average of fixed number of items in the time series which move through the series by dropping the top items of the previous averaged group and adding the next in each successive average.

Finally at time t+4, the price starts to rise again and the same process happens again but in reverse. The blue line is the first to react to the price turning followed by the red line. Chuck has won 10 Trading Championships- that’s more than anybody else in champion trading history.

So, going back to the chart the first buy signal came when the blue line crossed above the red and the price was above the purple line. The need to put more indicators on a chart is always the wrong answer for traders, but we must go through this process to come out of the other side. So, after reviewing my trades, I, of course, came to the realization that one moving average is not enough on the chart. From what I could see, price respected the 10-period moving average “all” the time. In my mind volume and moving averages were all I needed to keep me safe when trading. I read all the books and browsed tons of articles on the web from top “gurus” about technical analysis. As you can imagine, there are a ton of buy and sell points on the chart.

To address this issue, traders use the triple moving average crossover strategy aiming to ride the trend for just the right time and avoiding false signals while doing so. Investors and traders might be wise to incorporate another indicator into their decision-making. To increase the reliability of the signals given by the system outlined above, it might be wise to use the 50-day moving average as a context and reference. The best and most profitable time to buy a stock is early in a new trend. Later buy signals carry greater risk that the stock will soon decline (because stocks don’t go up forever). In other words, the intermediate-term 50-day average can be used to confirm and “support” the signals given by the shorter-term moving averages.

This mt4 indicator has been developed exclusively for the MetaTrader 4 forex trading platform but can also be used with any other asset class. They used a total of 300 years worth of daily and weekly data from 16 different global indices to determine which two moving averages would have produced the largest gains for crossover traders. The 50-day and 200-day SMAs are conventionally used in determining crossovers, but are they the best averages to trade? ETF HQ tested a massive number of combinations of moving averages to determine which two averages generated the highest crossover trading returns. Using moving averages, instead of buying and selling at any location on the chart, can have traders zoning in on a particular chart location.

The reverse, with the medium below the slow average and the fast below the medium average, indicates that the market is in a downtrend. Their variability is insignificant, and trying to fine-tune the periodicity is nothing more than retrofitting of data. Following a strong breakout to the upside or a severe move to the downside, the market would pause and often retrace as scalpers cover their positions while others fish for tops or bottoms. When it falls through the slower average from the top, this would indicate further price weakness. The Triple Moving Average Crossover System with AutoTrading is a highly developed version of the original Triple MA Crossover Alert System. The AutoTrading system allows the trader to automate order control based on the trader’s specific entry and exit requirements.