Table of Contents

- What Are Candlestick Charts?

- Winning Trade

- Forextraining Group

- How To Use Candlestick Patterns To Start Winning More Trades

- D Short Candlestick Forex Trading Strategy

If the asset is truly overbought or oversold, the next candlestick will go opposite direction of the trend. If you take a look at the screenshots, you’ll see examples of both.

The inverse hammer suggests that buyers will soon have control of the market. The only difference being that the upper wick is long, while the lower wick is short. In the following examples, the hollow white candlestick denotes a closing print higher than the opening print, while the black candlestick denotes a closing print lower than the opening print. If you ever wondered what it takes to become a more consistently profitable trader and to view my trade entry techniques in detail, then be sure to check my course offering here. I like taking these sorts of trades and in some cases, the targets are even larger, I was just lucky that the price moved strongly and rapidly in my favor. Using only the histogram of a MACD indicator it became clear as daylight that momentum started becoming less and less as price continued to move downwards. This is called momentum divergence and I rely heavily on this condition as part of my entries.

What Are Candlestick Charts?

A bullish gap on the third bar completes the pattern, which predicts that the recovery will continue to even higher highs, perhaps triggering a broader-scale uptrend. According to Bulkowski, this pattern predicts higher prices with a 49.73% accuracy rate. Each bar posts a lower low and closes near the intrabar low. The fourth bar opens even lower but reverses in a wide-range outside bar that closes above the high of the first candle in the series. According to Bulkowski, this reversal predicts higher prices with an 83% accuracy rate. This analysis relies on the work of Thomas Bulkowski, who built performance rankings for candlestick patterns in his 2008 book, “Encyclopedia of Candlestick Charts.” There are various candlestick patterns used to determine price direction and momentum, including three line strike, two black gapping, three black crows, evening star, and abandoned baby.

What does a white candlestick mean?

What Is a White Candlestick? A white candlestick depicts a period where the security’s price has closed at a higher level than where it had opened. It is a point on a security’s candlestick chart representing a bullish period.

We will also show you how to integrate other forms of technical analysis with candlesticks to develop mechanical trading signals. Profitable Trades Using Japanese Candlestick Trading StrategiesI detail five candlestick patterns that often forecast great trading opportunities without the need to do extensive research beforehand. By identifying these patterns, traders will be able to open good trading positions for awesome profits. Read traders psychology on the chart based on the candlestick patterns. The pin bar candlestick pattern is a tailed bar that shows a sharp reversal in price across the time period of the chart. So, a daily chart pin bar is showing a sharp price reversal during that day period, whereas a 1-hour pin bar shows a reversal in price across a 1-hour period. The higher the time frame, the more ‘weight’ a signal carries, or the more important it is.

Winning Trade

The bullish engulfing represents a reversal of supply and demand. Whereas supply has previously far outstripped demand, now the buyers are more eager than the sellers. Perhaps at a market bottom, this is just short covering at first, but it is the catalyst that ultimately creates a buying stampede. A gravestone doji is formed when the open, low and closing prices are all near each other, with a long upper shadow . The price action that leads to the formation of this candle creates a shape like an upside-down T. Similar to the dragonfly doji, a gravestone doji may signal a reversal in the previous trend of the market. Again, try using support and resistance levels or Fibonacci bands to confirm your ideas.

On June 24, AIG formed a hammer pattern after a prolonged downtrend. The stock opened at $43.01 and made a low of $41.53 before closing at $42.30.

Forextraining Group

This is a two-candle reversal pattern where the second candle completely ‘engulfs’ the real body of the first one. The Bullish Inverted Hammer consists of a black body followed by an Inverted Hammer. Its key characteristics are its long upper shadow and a small body. This pattern is similar in shape to the Bearish Shooting Star. However, the Inverted Hammer is usually observed in a downtrend and indicates a bullish reversal. If the candle is green or white, it means the lower extreme is defined by the opening price and that the stock’s price rose during the period being charted. If the candle is red or black, then the lower extreme identifies the closing price, and the stock fell during the period.

The second illustration is the same circumstance but in reverse. We have a slow downward trend followed by a BUOB that resulted in a sharp trend reversal upward. With Contracts for Difference trades like those on the Olymp Trade Forex platform, we would open a Buy position.

How To Use Candlestick Patterns To Start Winning More Trades

On a very short-term basis, a line chart is definitely a proper choice for deci- sion making. Furthermore, after a short corrective movement, the bullish trend gets confirmed by the Three Bullish Soldiers candle pattern, which is another confirmation that the bulls definitely dominate! We stay in the market until we get the Bearish Engulfing at the end of the trend. Then, after a new increase, we get the Hanging Man candlestick pattern, which is followed by a new price decrease of 80 pips. The total price action in this example equals about 1,000 pips for 1 month, More than enough opportunity to make high probability trade setups using candlestick patterns. The third candle pattern on the chart is the Spinning Top, which as we said has undefined character. This means that after a Spinning Top candle, the price might either increase or decrease, depending on the context of price action at the time.

- The period then closes very close to the high mark, leaving only a small wick on top.

- In Thomsett’s work, there are over 200 candlestick patterns.

- This may trigger buyers to come back into the stock lifting the price back up very close to or above the opening price.

- Candlesticks are the building blocks of what will later become a swing high or swing low.

- #2 represents the first candlestick to close outside of the flag and is an entry the aggressive trader would consider taking.

- You can set the time period for your candlestick chart, which will help you read it and interpret it in the most relevant way for your trades.

Other candlestick patterns need two candles to be complete, or even up to 3 candles to form a combination formation. As explained in the previous paragraphs, each candle provides a valued source of information whether the market remains/changes to bullish, bearish or indecisive. Some of the candlesticks, however, do provide more value than others. These candlesticks have various names because they are of more importance than regular and “normal” candles. Three black crows is a bearish candlestick pattern that is used to predict the reversal of a current uptrend. Candlestick patterns capture the attention of market players, but many reversal and continuation signals emitted by these patterns don’t work reliably in the modern electronic environment.

The Ultimate Guide To Candlestick Charts

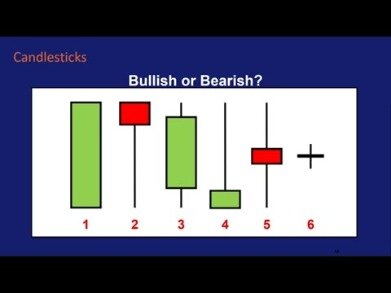

The pattern shows traders that, despite some selling pressure, buyers are retaining control of the market. When a market’s open and close are almost at the same price point, the candlestick resembles a cross or plus sign – traders should look out for a short to non-existent body, with wicks of varying length.

Wedge patterns are just awesome and are one of the best day trading patterns. Rising wedges in the stock market are a mess with the 11+ year bull market – but falling wedges? Falling Wedge patterns are fantastic in perma-bull markets. There’s a stock trading maxim that says pro’s trade the close, and amateurs trade the open. I have mixed feelings on how relevant that adage is in today’s markets, but trading the end of this daily session with a buy stop at #4 would have yielded an excellent return on the gap open the next day. Wedge patterns are associated with a fast descent in price at a fairly steep angle.

On June 25, AIG opened at $42.85 and once $43.01 was broken, longs could have been initiated with a stop loss at the June 23 low of $41.53. After a long uptrend, the appearance of a doji can be an ominous warning sign that the trend has peaked or is close to peaking. When assessing a doji, always take careful notice of where the doji occurs. If the security you’re examining is still in the early stages of an uptrend or downtrend, then it is unlikely that the doji will mark a top, but it could precede a pause in the current trend move.

D Short Candlestick Forex Trading Strategy

They hit bottom and then rebound sharply, making up all the ground — and sometimes more — that they lost when the selloff started. A bullish candlestick on the following day confirms this analysis. When traditional technical analysis talks about reversals, usually it is referring to formations that occur over long periods of time. It is arguably the most sought after bullish candlestick patterns. Out of all the single candlestick patterns that exist, none is perhaps more confirming of a bullish move than the bullish engulfing candlestick. In Thomsett’s work, there are over 200 candlestick patterns. But for day trading, we need only concern ourselves with some of the most powerful patterns.

A bearish engulfing pattern occurs at the end of an uptrend. The first candle has a small green body that is engulfed by a subsequent long red candle. It consists of consecutive long green candles with small wicks, which open and close progressively higher than the previous day. There is usually a significant gap down between the first candlestick’s closing price, and the green candlestick’s opening. It indicates a strong buying pressure, as the price is pushed up to or above the mid-price of the previous day. A hammer shows that although there were selling pressures during the day, ultimately a strong buying pressure drove the price back up.

Japanese Candlesticks: Why Day Traders Use Them

As a speaker, he attended multiple seminars for various organizations. Traders who wants to improve their skills on technical analysis to understand the traders sentiment on different conditions of the market – and consistently make winning trades. Ability to read the market sentiment with these candlestick pattern. A long-tailed pin bar pattern is exactly what its name implies; a pin with an unusually long tail on it.

The candle has the same open and closing price with long shadows. It looks like a cross, but it can also have a very tiny body. A doji is a sign of indecision but also a proverbial line in the sand. Since the doji is typically a reversal candle, the direction of the preceding candles can give an early indication of which way the reversal will go.

Any information contained in this site’s articles is based on the authors’ personal opinion. These articles shall not be treated as a trading advice or call to action.

My understanding of forex is improving with your team detailed teachings. And if you were to trade it, your stop loss is at least the range of the Hammer . It’s only AFTER the conditions of your trading setup are met, then you look for an entry trigger. AOV is an area on your chart where buying/selling pressure is lurking around (E.g. Support & Resistance, Trendline, Channel, etc.).

We have noticed that some users are facing challenges while downloading the market data from Yahoo and Google Finance platforms. In case you are looking for an alternative source for market data, you can useQuandlfor the same. In addition to this, you can check our blog for articles on different quantitative trading strategies.