Table of Contents

- You Increase Your Profit Potential And Lower Your Risk

- Forex Breakout Profits: The Definitive Guide

- Momentum Breakout Course

- Top 10 Chart Patterns Every Trader Should Know

- What Are The 10 Fatal Mistakes Traders Make

- Why Does The London Breakout Strategy Work?

Like the Bollinger band indicator, the Keltner Channel uses two boundary bands – constructed from two ten-day moving averages – either side of an exponential moving average. Traders can use the channels to determine whether a currency is oversold or overbought by comparing the price relationship to each side of the channel.

When this happens, either the market will break out of its range, or the move will be temporary and eventually the price will return to the direction it came from. The bands help forex traders establish entry and exit points for their trades, and act as a guide for placing stops and limits.

You Increase Your Profit Potential And Lower Your Risk

wow,,Nice one,, I would sell breakouts when i see price consolidate on support with higher lows and buy breakouts when price is on resistance showing higher lows…. That’s why I call this breakout trading strategy… The Trend Trading Breakout. So, breakout trading is entering trades when momentum is in your favor. If no prominent support or resistance levels are present, use Fibonacci retracements and extensions to determine important price levels. Look for past support or resistance levels beyond the breakout and use those as targets.

In Forex there are always periods of light and heavy order flows as the major markets open and close. In the past 24 hours, the cryptocurrency market managed to recover about 80$ billion in market capitalization reaching $1.81 trillion. The next target is the astronomical $2 trillion capitalization level. Developed for the beginner to intermediate trader, this course introduces the fundamentals to begin swing trading like a pro. Sam Eder is a currency trader and author of The Consistent Trader and theAdvanced Forex Course for Smart Traders. He is the owner of provider of Forex signals from ex-bank and industry traders .

Forex Breakout Profits: The Definitive Guide

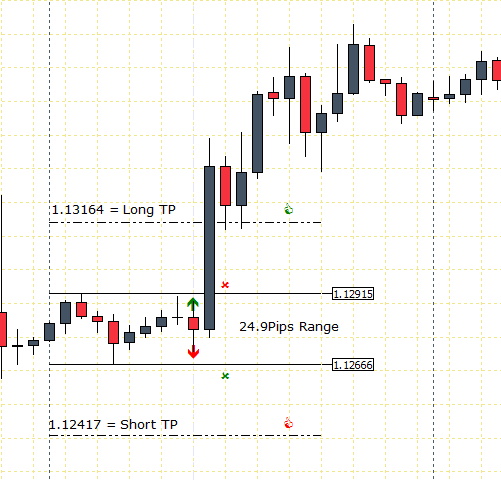

This is the 240 minute chart of GBP/USD for Jun 15 – Jul 16, 2015. As you see, after an uptrend, the price switches directions and starts a downward move. When a certain level is reached, the price starts moving sideways, creating a consolidation. We use the blue rectangle to frame the area around the lower wicks of the candles, which creates our support area. When trading breakouts, it is best to wait for a candle close beyond the support / resistance area to confirm the breakout. On the above chart, when the price closes a candle below our support area, we identify this as a bearish breakout.

Meaning, you place a buy or sell stop order near the price action breakout strategy high or low and then when price breaks out, it hits your entry order and brings you into the market. The fact that you are being brought into the market on momentum is good, it’s a little extra piece of ‘confluence’ that the trade is at least getting started off in your favor. If you want to trade breakouts in the typical manner–waiting for the breakout and trading right then–focus on patterns like triangles or flags/pennants as opposed to ranges. Ranges are easy to spot, even by a novice, which means ranges attract all sorts of traders–those wanting a breakout and those wanting to trade the range. That tug-of-war is what creates all those false breakouts.

Momentum Breakout Course

Simply follow our London open breakout trading rules and be part of the 5% elite traders who make money on a consistent basis. Our team of experts has done a very rigorous London breakout strategy backtest and found the perfect time window to make money forex trading. Be sure to act quickly because the window of opportunity is very limited. That’s why the London breakout forex trading strategy is so powerful. Basically, this day trading strategy will teach you how to trade the London open.

Low-risk trades are where the price action completes a trend rotation. So, the price action can mark a set of steps that define a Rotation Frameworks.

If the candle which formed the lowest high is bearish the zone needs to be drawn from the OPEN. An additional thing to pick up on is the reactive traders who would have placed buy trades onto the candle which caused the breakout. These traders will also add a significant number of buy orders into the market which the banks will use to fill more orders when their profit taking grinds the market lower. The line on the chart above denominates the point where breakout traders will have had pending orders to buy placed in anticipation of the market breaking out. When the breakout traders close their trades orders will be put into the market which the bank traders will use to get more buy/sell positions placed in the market. Trendlines aren’t always effective, as the swing lows may not line up for a trendline to run along them.

Top 10 Chart Patterns Every Trader Should Know

If the fundamental data goes in favor of the breakout, you can execute the trade and earn some decent money. On the contrary, if the fundamental data suggest something is wrong with the technical data, stay away from placing any trade. As a breakout trader, you have to be very smart in taking a decision at trading. Unless you keep a sharp eye of the technical and fundamental data, trading the breakout will be really tough. A lowering of volatility causes a contraction of the bandwidth.

Which time frame is best for support and resistance?

Although traders can use as many time frames as they want, the best approach is usually to work with three charts.

Scalping trader:Higher: 4 hour and/or daily chart.

Middle: 15 minute chart.

Lower: 5 minute chart.

That is, to trade in the opposite direction to the breakout move. There are some who say that most faders are converted breakout traders who have given up and resorted to reversing their strategy. Caught out too many times by false breaks, these traders believe the reverse strategy to be the more profitable one. As a result, other breakout traders may do the same as they see a newly forming trend, which will build momentum. The gap closes and the price re-enters the range trapping those caught on the wrong side. This is frustrating to the breakout trader, and several runs in succession can wipe out hard won profits.

By looking at this disparity, traders can identify entry and exit points for each trade. The strategy is named because it acts like a knife edge dividing the price – and in reference to the 1982 science fiction film of the same name. Don’t sell into a key support level or buy into a key resistance level. If you really want to trade in that direction, wait for price to close outside of the key level for at least a few days and THEN look for a an entry on a retrace / pullback to value. It is always good practice to check key support and resistance levels by looking at the chart in several time frames.

This doesn’t affect you in any way in the checkout process (I’m sometimes even able to arrange a discount for you that is special from other customers). The information on this site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to law or regulation.

It was obvious to place our protective stop loss just below the breakout candle. This is because once we break below the candle that initiates the breakout, it proves to us that this is a false breakout.

Fibonacci extensions/retracement can help in deciding your entry and exit points after these key levels are identified. Using additional signals that confirm direction at a support/resistance also provide an advantage. It is easy to grasp and is a quick win strategy that can lead to high profits.

Click to enlargeIf instead we remember that we only need the trendline to alert us to a general trade area, we can run the trendline through the swing highs . The trendline doesn’t tell us to get into a trade, it just tells us when we should be looking for opportunities. And if we run the trendline through prior trade areas, it is doing exactly that. Once the price is in the trendline area, we can then look for our trade signal .

Why Does The London Breakout Strategy Work?

Open an account with the world’s first Ecofriendly broker at Chris Pulver is a Senior Analyst with nearly two decades in the financial markets. He is well versed in all financial markets with a conservatively consistent approach to investing for accounts of all sizes. A great communicator and passionate instructor, Chris brings authenticity to his trading and his teaching. He aims to accelerate the learning curve for his followers and showcase his strategies and professionalism in all of his courses. With that said, it can also come with a lot of risks if you have not practiced your chosen breakout strategy and mastered it.

- To avoid hiccups, consider paper trading to hone your trade execution skills.

- In addition, many of the more reliable breakouts tend to occur on high momentum, and price action traders attempt to maximize their profit from the rapid price moves.

- The price closes a candle above the resistance and we identify the breakout.

- Another option is to trade inside the pattern, in the direction of the trend which was present before the pattern formed.

- Let’s have a look at what forex currency pairs to trade using the London breakout strategy.

- We specialize in teaching traders of all skill levels how to trade stocks, options, forex, cryptocurrencies, commodities, and more.

As you see, the price closes a candle below the trendline zone and the next day, we see a sharp price drop followed by a second bearish wave. The Momentum Indicator consists of an area and a curved line which fluctuates in the area of the indicator. When the Momentum is moving upwards, it gives us a signal that the price is likely to follow this trend. If the Momentum is moving downwards, this hints that the price is likely to decrease too.

I will definitely be adding this strategy to my arsenal. A lot of the times it takes many times to get a concept. This method is not the easiest but with a little practice could be big time. Thanks for all your videos – I had to watch this one twice before I fully got it. I would love to see the automated version of this strategy. As you might guess, we’re talking about the prevailing upward trend.