Table of Contents

- Simple Moving Average Trading Strategy Case Study Using Cryptocurrencies

- Ultimate Moving Average

- Simple Moving Average

- The Basics Of Fundamental Analysis In Scanz

- Ninjatrader Indicators

- How To Day Trade With Bracket Orders

The second phase is the decline in the security’s price to a point where the actual death cross occurs, with the 50-day moving average falling below the 200-day moving average. This downside shift of the 50-day average signals a new, bearish long-term trend in the market. A moving average is a trend-following indicator that helps you determine whether the “average” price in a given time period is trending up or down. You can see the movement of a stock’s average price over time in relation to the actual stock price, which at times may trade above or below its moving average line. After the EMA crossover happened, and after we had two successive retests, we know the trend is up. As long as we trade above both exponential moving averages the trend remains intact. The first step is to properly set up our charts with the right moving averages.

Moving averages can be added on to all types of price charts (i.e., line, bar, and candlestick), and are also an important component of other technical indicators. In terms of when to use moving averages, they can be helpful at any time. However, they are considered to be particularly useful in upward or downward trending markets.

From there, traders can use various simple price action patterns to decide on a trading opportunity. Also known as a weighted moving average, an EMA assigns greater weight to the most recent data.

Simple Moving Average Trading Strategy Case Study Using Cryptocurrencies

With Scanz, you can use the Pro Scanner module to create highly customizable moving average crossover scans that fit any trading strategy. Conversely, a similar downside moving averagecrossoverconstitutes the death cross and is understood to signal a decisive downturn in a market. Either crossover is considered more significant when accompanied by high trading volume. Once the crossover occurs, the long-term moving average is considered a majorsupport level orresistance level for the market from that point forward. Either cross may occur as a signal of a trend change, but they more frequently occur as a strong confirmation of a change in trend that has already taken place.

When this strategy is run on a market index such as the S&P 500 Emini Futures , the following best practices apply. In addition, similar results could be expected if this strategy is applied to any other Market Index Asset such as the NASDAQ Eminis and perhaps even market index ETF’s such as the SPY and QQQ. Certainly the 200 Day Moving average is an indicator – however the 50 Day is on the edge. The 20 Day Moving Average is simply not a good length to use – based on our simulations. In fairness to the author, he doesn’t appear to be suggesting that this is always the case.

Ultimate Moving Average

From those four items, we can determine what type of trading setups we need to enter the market. When we get an mix of trend directions, we are conservative with profit targets and must exit when facing adverse price action. The value of your investment will fluctuate over time, and you may gain or lose money. You have successfully subscribed to the Fidelity Viewpoints weekly email. Any opinions, news, research, predictions, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89% of retail investor accounts lose money when trading CFDs.

The simplest way to explain this is by comparing an Index (such as the S&P 500) to an individual stock . The stock’s price can move drastically based on a negative earnings report, litigation against the company or some other black swan event. A stock market index will typically trade with lest volatility due to the diversity which makes up this asset. In what markets do the ETH20SMACO typically outperform and underperform? ETH20SMACO typically outperforms in strong shorter term directional markets , and typically underperforms in choppy markets as moving averages are lagging indicators. You must keep in mind that the lagging nature of moving averages, even EMA’s, will not enable picking tops and bottoms. That is not a bad thing as times when the trend is changing can make for some sloppy trading conditions.

Simple Moving Average

If you have been looking at cryptocurrencies over the last six months, you are more than aware of the violent price swings. Now in both examples, you will notice how the stock conveniently went in the desired direction with very little friction. The 10-period SMA is the red line, and the blue is the 20-period.

- Large numbers of traders watch these major moving averages, and it’s something that you can do.

- The next day you add the newest close price to the total and subtract the oldest close price, keeping the total number of close prices a constant of 10.

- We recommend that you seek independent advice and ensure you fully understand the risks involved before trading.

- It all comes down to my ability to size up how a stock is trading in and around the average.

- The time frame chosen for a moving average will also play a significant role in how effective it is .

- The sign I needed to pull the trigger was if the price was above or below the long-term moving average.

There are hundreds of trading indicators out in the trading wilderness that people love and hate. Hypothetical performance results have many inherent limitations, some of which are described below. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. The advantage of smoothness, achieved by choosing these two methods and/or longer periods, is that it can see the larger trend unfold and discount the short term blips that occurs. However, if this one day move in price represents the beginning of a significant change in the trend, it takes longer for the underlying trend change to be discernible.

The Basics Of Fundamental Analysis In Scanz

I would try one system one day and then abandon it for the next hot system. This process went on for years as I kept searching for what would work consistently regardless of the market. So, instead of just moving forward with the settings I had discovered based on historical data , I wanted to outsmart the market yet again.

There we have it, the HMA indicator could be the missing piece to your trading jigsaw. Remember that all indicators are lagging due to the nature of the computations. As you can see from the image above, it just looks like a normal moving average, but later on we’ll show you the key differences and why it is vastly superior. Futures and forex trading contains substantial risk and is not for every investor.

When a stock begins an uptrend, short-term moving averages will begin rising far earlier than longer-term moving averages. The longer a trend has persisted, the more likely it is to continue persisting, up to a point. Waiting too long to enter a trend can result in missing most of the gain. Entering the trend too early can mean entering on a false start and having to sell at a loss. Traders have addressed this problem by waiting for three moving averages to verify a trend by aligning in a certain way. To illustrate, we’ll use the 5-day, 10-day, and 20-day moving averages. When an uptrend begins, the 5-day moving average will start rising first.

A moving average is one of the simplest indicators in technical analysis. A moving average is basically an average value of the price over the last specified number of candles. So, for example, a moving average of period 10 is the average price over the last 10 candles. Typically traders will use a short term moving average and a longer term moving average. When the short term moving average crosses up over the long term moving average this is considered as a bullish signal to puy the asset under consideration. When the short term moving average crosses down below the long term moving average, this is considered as a bearish signal to sell the underlying asset.

For example, it is possible to compare a plot of the 10-day moving average for a stock to the 50-day moving average for the same stock. Short-term moving averages, such as a 20-day one, are often surrounded by a 3% or even smaller envelope. Long-term traders commonly use a 5% or a larger envelope around mid- and long-term moving averages. Envelopes are basically two boundaries placed at certain percentages above and below the moving averages. The price deviating too far from the moving average and hitting one of the two boundaries indicates that the market has become overextended. Such a sudden spike often leads to a price correction, since the overextended movement is usually not sustainable. This signal indicates to traders that a strong move is likely to come as momentum shifts in one direction.

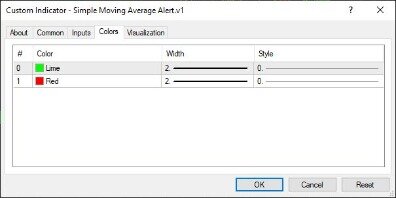

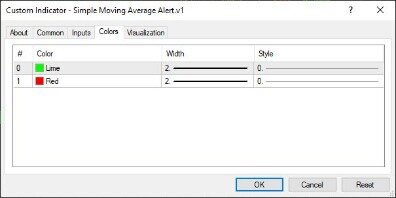

If you are interested in alert indicators, you can use the source code of the present Moving Average Crossover Indicator for your further development. Additionally, you can inspect the code of our Alert Indicator Template, which was used as the foundation for Moving Average Crossover Alert Indicator. You can benefit from this alert in both trend following and trend reversal strategies. Traders can receive email alert data at the configured email address in the MT4 options section. Trading forex on margin carries a high level of risk and may not be suitable for all investors. Now you have read this article you are in a much better position to grab the indicator and give it a go.

What is the best EMA for day trading?

The 8- and 20-day EMA tend to be the most popular time frames for day traders while the 50 and 200-day EMA are better suited for long term investors. Sometimes markets will flat-line, making moving averages hard to use, which is why trending markets will bring out their true benefits.

As a result, we would not need to adopt analways in strategy. Although our approach was purely technical in nature, this single data set does not justify generalization across other currencies or asset classes (e.g. futures, equities). From the out-of-sample analysis, we discovered that by utilizing a well-conceived parameter selection process, it appears that we did indeed succeed in selecting profitable DMAC combinations. At this point in the process we developed a selection methodology for determining what range of STMA and LTMA parameters we would recommend for out of sample analysis. This suggests that the technical approach might be able to be taken out of sample more easily. Both strategies try to achieve the same goal, but do it in opposing ways to one another.

In this Forbes article, ‘If You Want to Time the Market, Ignore Moving Averages‘, Michael Cannivet highlights the issue with using moving averages . The need to put more indicators on a chart is always the wrong answer for traders, but we must go through this process to come out of the other side. After this sell signal, bitcoin had several trade signals leading into March 29th, which are illustrated in the below chart. I only mention this, so you are aware of the setup, which may be applicable for long-term investing. Since TradingSim focuses on day trading, let me at least run through some basic crossover strategies. Simply buy on the breakout and sell when the stock crosses down beneath the price action. Below is a play-by-play for using a moving average on an intraday chart.

You can see that it did successfully pick up the three large downtrends (+410, +600, +460) on the EURUSD over the last year. You could have picked up these profits with the dual crossover alone without having to pay attention to the news of the debt contagion in Europe. Though it has less false trades than the single moving average, it is still vulnerable to sideways markets. The dual crossover suffered during the summer (Jun-Sept) of 2011, and it suffered in the spring (Mar-April) of 2012. The most commonly used type of moving average, the simple moving average is calculated by adding and then averaging a set of numbers representing the market. The SMA is by far the more popular mode, and it is considered highly useful because of its smoothing effect. Ultimately, it is the noise in the market that undermines the performance of the moving average, and smoothness negates the noise.

Within his first two years of trading options he profited over $460,000. Moving Average is one of the most popular indicators for trading. This is truly, in our humble opinion, the better of all moving averages you can use for free.

When should you buy moving averages?

Buy when the moving average slopes upward and the closing price crosses above the moving average. Close the position when the price closes below the moving average. Sell short when the moving average slopes downward and the closing price crosses below the moving average.

If the 10-day has just given a buy signal by crossing above the 20-day average, a trader might abstain from making the purchase if the 5-day is now declining or below the 10-day average. The purchase would be made only if the 5-day resumes its ascent or is above the 10-day average while the 10-day average is still above the 20-day average. The sale would be made only if the 5-day resumes its decline or falls below the 10-day average while the 10-day average is still below the 20-day average.

We specialize in teaching traders of all skill levels how to trade stocks, options, forex, cryptocurrencies, commodities, and more. We provide content for over 100,000+ active followers and over 2,500+ members. Our mission is to address the lack of good information for market traders and to simplify trading education by giving readers a detailed plan with step-by-step rules to follow. Our exponential moving average strategy is comprised of two elements. The first degree to capture a new trend is to use two exponential moving averages as an entry filter.

This is because the price will only briefly touch the shorter moving average (20-EMA). The two successful retests of the zone between 20 and 50 EMA give the market enough time to develop a trend.

Sticking with the EMA, the utilisation of multiple averages can provide us with a good mix of the long- and short-term moving average strategies. For a trending market, we should see these averages line up where the shorter moving average is closest to the price, and longer average is furthest away. This is where the strategy becomes more subjective – judge the strength of the trend and proceed accordingly. You can wait for the aforementioned moving averages to re-cross each other or you can use your own judgement to determine when to exit the position. In a strong trend you may choose to exit the trend when it starts to head in the wrong direction over a few time periods, as sharp pushes in either direction can be subject to retracements. The two moving averages are said to experience a crossover when the 10-day moving average line crosses above or below the 50-day moving average line. While a single moving average provides a lot of information, traders can get even deeper insights by looking at two different moving averages for a single stock.