Table of Contents

- Market Neutral

- Performance

- What Is A Market

- The 4 Best Investments For 2021

- Factor Inve(nn)stigator: Vanguard Market Neutral Fund

- The Journal Of Alternative Investments

- Pros And Cons Of Market Neutral Funds

We have re-engineered the process to manage the correlation and downside risk,” says Heslop. It does not go long of growth and short of non-growth stocks, but rather seeks to identify mispricings within the universe of growth stocks. One example is that risk-loving investors may overpay for stocks with potentially lottery-like payoffs that display rather erratic or ephemeral patterns of growth.

The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. An author, teacher & investing expert with nearly two decades experience as an investment portfolio manager and chief financial officer for a real estate holding company.

This type of trade would seek to benefit from only the expected underperformance of the individual stock relative to the market. Risk tolerance can evolve over time, so it’s a good idea to review your portfolio at least once a year to make sure your investments are still meeting your needs. When reviewing your portfolio, check the fees you’re paying against the returns you’re earning, as well as an investment’s risk level to decide if it’s still a good fit. Holding multiple funds with the same underlying investments can actually increase risk if one of those investments sees a significant drop in value. Market neutral funds also offer a way to diversify, beyond the usual selection of mutual funds or other investments.

Market Neutral

Market-neutral funds take long positions on stocks they believe are cheap and short positions on expensive ones they expect to decline. Large pension funds tend to invest in several market-neutral strategies to provide diversification, but the expected benefits were not there. The strategy historically has exhibited a lower equity beta, lower correlations to both the equity and fixed income markets, lower absolute volatility and limited drawdowns. While private hedge funds focus on delivering positive residual returns over time, liquid alternatives may leave something more to be desired. As this analysis demonstrates, mainstream investors need to be careful in their evaluation and selection of liquid alternatives and should understand the types of exposures they’re getting as a result.

Indices utilizing a rigorous quantitative selection process to represent the broader hedge fund universe. Concerns about how to continue to sell short in an extended market decline when stocks can be shorted only on an uptick — that is, when the most recent price change is higher than the last — keeps Aronson sleepless. Other market-neutral funds due out include Montgomery U.S. Market Neutral, Value Line Hedged Opportunity and Zweig Euclid Market Neutral. Still, Evensky has placed a small percentage of assets in the fund as part of an equity allocation.

•Construct cointegrated portfolios with market neutral to one or more markets. Adding a 10% allocation to EMN can maintain an attractive and comparative return profile whilst reducing the volatility profile and the maximum drawdown.

Performance

The biggest benefit of investing in market neutral funds is the ability to neutralize market movements in your portfolio. By giving equal weight to short and long positions, these funds are designed to withstand fluctuations in the market. Elsewhere, Husic Capital Management in San Francisco chalked up an 18.9% return with its pairs strategy that focuses on fundamental stock picking, says William M. Stephens, chief investment strategist. Husic, which manages $275 million in market-neutral portfolios, also is style-, sector- and industry-neutral.

This brochure provides an introduction to Alternative Investments, and explores that many types of alternative funds. Learn how an alternative allocation may potentially enhance a portfolio’s diversification and decrease exposure to market volatility. Like stocks, convertibles typically offer upside appreciation in rising equity markets. Like bonds, convertibles provide income and potential downside protection in declining markets. The Market Neutral Income Fund fact sheet provides a snap shot of the investment team, the fund strategy, performance, composition, ratings and returns. Employs an absolute-return strategy with historically lower beta to fixed income and equity markets as well as lower volatility and limited drawdowns.

What Is A Market

Beyond the method mentioned above, market-neutral strategists may also use other tools such as merger arbitrage, shorting sectors, and so on. Managers who hold a market-neutral position are able to exploit any momentum in the market. Hedge funds commonly take a market-neutral position because they are focused on absolute as opposed to relative returns. A market-neutral position may involve taking a 50% long, 50% short position in a particular industry, such as oil and gas, or taking the same position in the broader market. Mutual fund investing involves risk, including the potential loss of principal.

While this idea sounds reasonable in theory, the results can be less than optimal in practice. Funds that are designed to be market neutral based on past return data are not guaranteed to remain that way in the future.

This is compatible with the observation that most of the managers are seeking to hedge out market risk, but not necessarily sector and factor risks. The models are constantly evolving and have so far been through 22 incarnations, informed by a simulation process using 20 years of data that naturally includes the famous “quant meltdown” month of August 2007.

The 4 Best Investments For 2021

The IQ Hedge Market Neutral Index seeks to replicate the risk-adjusted return characteristics of the collective hedge funds using a market neutral hedge fund investment style. Consider market neutral funds as a secondary or backup strategy to investing in traditional stocks, bonds and funds. That way, you’ll be set up to benefit from market neutral funds without over-exposing yourself to risk. Morningstar Market Neutral Category represent funds that attempt to eliminate the risks of the market by holding 50% of assets in long positions in stocks and 50% of assets in short positions. Though all the rage now, market-neutral strategies are really nothing new. The A.W. Jones investment partnership, commonly thought of as the first hedge fund, took a market-neutral approach when it was established in 1949. In the nearly 50 years since then, the market-neutral approach has remained in the realm of hedge funds and separately managed accounts.

Simply, they have given up trying to predict the market direction and instead they are taking advantage of the market neutral strategy. We’re going to have a look at some of these market neutral option strategies. Being a directional trader and being able to forecast the market’s direction consistently it’s very difficult. Most successful traders and hedge fund managers are only right about the market direction 50% of the time or even less. A portfolio is truly market-neutral if it exhibits zero correlation with the unwanted source of risk.

What does neutral Stock mean?

Neutral describes a position taken in a market that is neither bullish nor bearish. In other words, it is insensitive to the direction of the market’s price. Neutral market trading strategies enable investors to make money when an underlying security does not move in price or stays within a tight range of prices.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling .

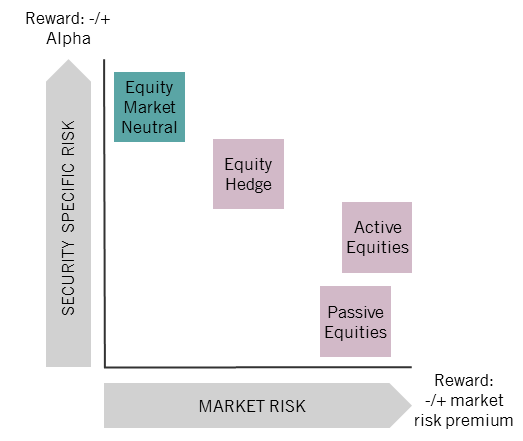

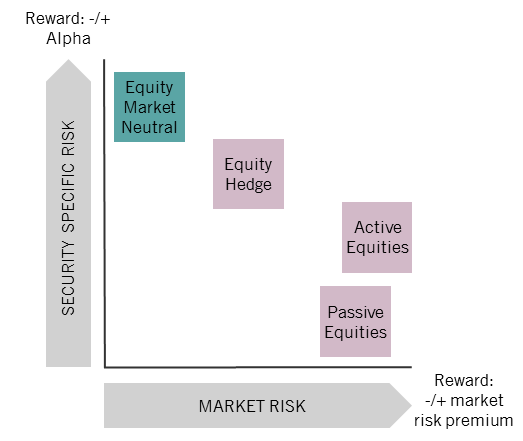

The Zacks Market Neutral Fund seeks to remove the risk involved in the equity market by simultaneously investing in a long portfolio and a short portfolio . EMN strategies could be considered either as part of a diversified portfolio’s alternatives allocation, or could be used to augment an investor’s equity allocation. In either event, the goal is an aggregate increase in diversification, reducing risk as measured by volatility and drawdown, whilst retaining stock specific risk.

OMGI today are varying weights to express active model signals on timing the factors. “The investment process evolved to deal with the cyclicality of factor returns, which is endemic in factor and thematic investment. There are periods when some factors are not rewarded, and some factors, most importantly value, can become correlated to the market.

But if you’re going to buy them, they don’t belong inside your core portfolio but rather inside your non-core portfolio. The non-core portfolio is always much smaller in size compared to your core. The declining interest rates of the past decade provided a strong tailwind for bond funds. And yet, Calamos Market Neutral Income Fund managed to add value by delivering a bond-like return with a bond-like standard deviation but without the bond-like risk exposures. Illustration of equity alternatives performance in down markets and fixed income alternative performance in rising interest rate environments.

The risks associated with an investment in the Fund can increase during times of significant market volatility. More detailed information regarding these risks can be found in the Fund’s prospectus.

For example, between January 1995 and December 2001 the most successful self-financing statistical arbitrage strategies returned approximately 10% with roughly 2% annual volatility and negligible correlation with the market. Now more than ever, investors are assessing the nature of risks in their portfolios. We believe the ability to gain more targeted risk exposure offered by equity market neutral strategies could be especially valuable if widespread recession takes hold. Next, peek under the hood to see what the fund invests in — different market neutral funds can focus on different types of securities. Checking the asset mix can confirm whether a specific fund’s strategy aligns with your investment goals. There’s more turnover in a market neutral fund, with the underlying assets being traded more frequently. And more frequent trading can mean higher taxable capital gains, if the securities are sold at a profit.

Style weights fluctuate within bands, at the overall strategy level, as shown below. Whereas some generic factors, such as growth and momentum, can become highly correlated over some periods, OMGI’s factors are designed to be orthogonal over multi-year periods. “On average, the five factors should have zero correlation through the cycle,” says Servent. Following the rules of the pairs trading strategy we would have bought Facebook shares and at the same time sell an equal amount of Twitter shares.

Pros And Cons Of Market Neutral Funds

They also took into consideration the relative assets under management, nature of the investment strategy, other supporting materials, and professional knowledge they have about the shortlisted funds to come to their decisions. Six finalists were chosen out of 11 entries for the Best 40 Act Fund category.