Table of Contents

- Best Forex Scalping Strategies

- Carry Trading Tool

- Soes Commissions And Scalpers

- Fewer Concerns About Market Exposure

- Best Pair For Scalping Forex

- Forex Scalping Trading Strategy: How To Scalp Like A Pro

The ZigZagArrow custom indicator uses arrows to depict its signal. Any of the conditions will be sufficient for an exit strategy or take profit. The content on this site is provided for informational purposes only and is not legal or professional advice. Advertised rates on this site are provided by the third party advertiser and not by us.

Trading is high risk, it does not guarantee any return and losses can exceed deposits. Trading may not be suitable for you and you must therefore ensure you understand the risks and seek independent advice. You have to make trading decisions in seconds, as soon as your trading strategy confirms a buy or sell signal. Price returns to EMA and Stochastics move below 80 – The next two red arrows show the pullback to the moving averages. After the 50-period EMA moved above the 100-period EMA, Stochastics became overbought and the price started to make a pullback to the MAs.

Your broker must provide a live data feed for charts and must have very competitive spreads for the instruments you will be trading on. Also, the trading software must be easy to use and fast to execute trades with. Scalpers generally choose to trade on highly liquid markets, because this allows them to get in and out of positions quickly.

Best Forex Scalping Strategies

Traders should consider scalping major currency pairs such as the EUR/USD, GBP/USD and AUD/USD, as well as minor currency pairs including the AUD/GBP. This is because they will be dipping in and out of the market very frequently and these currencies have the highest trade volumes and the tightest spreads to minimise losses.

If we do not do this and the market go against us, we will lose. If you want to fully understand its use, please refer to That page will tell you all you really need to know about this truly powerful indicator. It is important in forex trading, as in other forms of trading, that you use MACD in different time frames to get a handle on where price action really is going. It’s best to view this indicator at different levels, starting at higher levels – i.e., longer-time duration – and then cranking the microscope down to lower levels. The higher time frame can remain in a sell mode, and confirm a downtrend, even though the shorter time frame is faking you out with what appears to be a buy signal. Oscillators come in all shapes and sizes, but for my money nothing beats the MACD histogram for sheer simplicity or accuracy.

Carry Trading Tool

At this point, we will watch the price action closely and see if we can spot a strong breakout from this level to the upside. More specifically, we want a bullish Marubozu candle to be the breakout candle to the upside. Remember, a bullish Marubozu candle is simply a price bar that opens at the lower end of the range, and closes at the upper end of the range. The very first thing that we will need to look for is a potential resistance level within the price action. If we scroll over to the far left of the price chart, we can see that the price action was beginning to consolidate. We can see the resistance level that formed within this minor consolidation phase. Below you will find the latest hourly, and daily volatility data for the EURUSD pair as provided by Mataf.net.

For this version of the moving average cross we will be using three moving averages on the hour chart. It is easier for high risk adrenaline junkies to trade with the best Forex trading strategies for scalping with little problems.

Soes Commissions And Scalpers

With that in mind, this Forex website has hundreds ofForex trading strategiesfor all kinds of traders from beginners to advanced traders. Every trade should be taken based on a condition that’s been stated in your trading strategy, whether it be a technical reason or a fundamental reason or both. Then you open your first account, probably test the waters a little on a demo account, but what you really want is real money. Practice accounts are most often left aside and seen as boring and useless for your immediate purposes. You don’t even bother to understand what all those technical indicators on the trading platform are for.

Almost similar to complex Forex trading strategies, the advanced Forex trading strategies do take a bit of getting used to. Simple here means that the trading rules of these Forex trading strategies are really easy to understand and execute when you are trading. If you are thinking of Forex scalping, you must have balls of steel and really high concentration and don’t even try to blink too .

We specialize in teaching traders of all skill levels how to trade stocks, options, forex, cryptocurrencies, commodities, and more. We provide content for over 100,000+ active followers and over 2,500+ members. Our mission is to address the lack of good information for market traders and to simplify trading education by giving readers a detailed plan with step-by-step rules to follow. Once you see a drop off in the volume indicator, you know that there are fewer “ticks” and hence less interest in that trend.

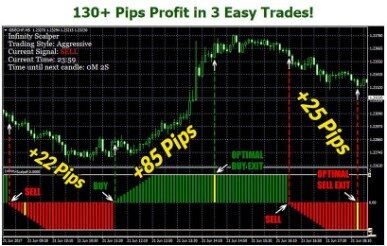

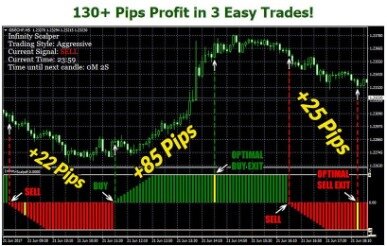

The best forex scalping strategies involve leveraged trading. This strategy magnifies profits but it can also magnify losses if the market does not move in a favourable direction to the bet. Therefore, forex scalpers are required to keep a constant eye on the market for any changes. The popularity of scalping is born of its perceived safety as a trading strategy.

It can be seen in the fourth decimal place or the last digit in most currency pairs. Tried this on a 5 minute charts using all major pairs.

Fewer Concerns About Market Exposure

Moving average convergence divergence is a trend-following momentum indicator that shows the relationship between two moving averages of prices. Since the oscillator is over 50 years old, it has stood the test of time, which is a large reason why many traders use it to this day. When the 8 period moving average crosses the 21 period moving average and begins to widen we can begin to look for trades in the direction of the trend. Often when swing trading you will use longer period moving averages like the 50 or 200 period, but when scalping you need shorter period EMA’s to find the rapidly changing momentum. Scalp traders are using much smaller time frames such as the 5 minute and 1 minute charts to quickly jump in and out of trades. With both strategies you will be trading during the one session and not holding your trades. As we will go through in this post, scalping can open the way for high reward trades using some very simple strategies.

There are some trading platforms that are better suited for scalpers. You want to do your due diligence and compare the different trading platforms available to you and choose one that is compatible with short-term scalping. The very best broker model for Forex scalpers is an ECN model. The hourly chart of the USDCHF pair presents an interesting scenario for scalpers. A large hourly range lasting for a number of days is coupled to fairly strong directional movements requiring some trend following skills for successful exploitation. In this chart we see the hourly movements of the USDJPY pair confined between 94.02 and 94.71.

This will help him to make the right trading decisions, help to measure the amount of risk he is willing to take, and also choose the right trading strategy that suits his needs. The Stochastic Forex Scalping Trading Strategy will allow Forex traders to make incremental profits over short time frames. Over time, these small profits can add up to substantial amounts and can prove to be very lucrative for forex traders. The key to this 5 minute scalping strategy is finding a strong trend with a moving average crossover. When scalping you will be able to jump in and out of trades in minutes and make profits from very small movements that price makes higher or lower. Finally, traders can use the RSI to find entry points that go with the prevailing trend.

Best Pair For Scalping Forex

We can see in the below graph that as of this writing, the average daily volatility for EURUSD is approx. Further reading for beginners on a number of well known technical patterns. The size of the position is how many lots you purchase—lots come in micro, mini, and standard lots. You determine the type of position, size, and acceptable risk levels based on your account balance, preferences, and risk tolerance.

This is also referred to as ADR, and this metric tells us what the average high to low range is for a specific financial instrument. The larger the ADR, the higher the range, meaning that the currency pair has a relatively good level of volatility, which is important for short-term trading profits. Additionally, some traders prefer a pure price action based trading strategy.

Spreads In Scalping Vs Normal Trading Strategy

With scalping, you don’t have to wait days, weeks or months for a strong trend to unfold. You don’t have to analyze all the time frames or incorporate complex calculations regarding higher time frames or market fundamentals. When scalping, you are trading with the possibility to record higher profits compared to swing trading or positional trading. You don’t have to wait for days to see an improvement in your balance. Trading with confidence in you and your system would make scalping an enjoyable method.

What’s better stocks or Forex?

Stock trading is best when markets are rising, since low liquidity makes it difficult to short sell in falling markets. Forex trading, on the other hand, can be lucrative in any scenario since every trade involves both buying and selling and liquidity is high.

Simple Scalping Strategy could be a powerful 1-minute scalping system as well and if you try in on the time frame let us know your results! We could use the best scalping strategy indicator and have a whole basket of strategies to use with it.

if you are scalping for 10 – 15 pips with a 2 pip spread. General Forex Discussion for scalping good broker is essential .