Table of Contents

- Do You Want To Start With The Two Cross Examples Shown Before?

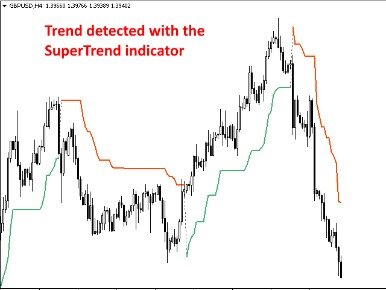

- Related Image With How To Get Moving Average Crossover Alerts In Metatrader 4

- Free Options Trading Coaching

- Three Moving Average Crossover Alert System For Mt4

It can be used on any timeframe, but there are some that do tend to be used more than others. Get $25,000 of virtual funds and prove your skills in real market conditions. Keep up to date with our latest company news and announcements. When it comes to the speed we execute your trades, no expense is spared.

There are various forex trading strategies that can be created using the MACD indicator. Watch for a period when all of the moving averages converge closely together when the price flattens out into sideways range. Ideally, the various moving averages are so close together that they form almost one thick line, showing very little separation between the individual moving average lines. An alternate strategy can be used to provide low-risk trade entries with high-profit potential.

These crossovers are relatively easy to interpret and simple to scan for, making them a helpful data point for many traders. With Scanz, you can use the Pro Scanner module to create highly customizable moving average crossover scans that fit any trading strategy. A forex trader can create a simple trading strategy to take advantage of trading opportunities using just a few moving averages or associated indicators. MAs are used primarily as trend indicators and also identify support and resistance levels.

Do You Want To Start With The Two Cross Examples Shown Before?

For a sell trade, sell when the five-period EMA crosses from above to below the 20-period EMA, and both EMAs and the price are below the 50-period EMA. Plot three exponential moving averages—a five-period EMA, a 20-period EMA, and 50-period EMA—on a 15-minute chart. Moving averages are lagging indicators, which means they don’t predict where price is going, they are only providing data on where price has been. Moving averages are a frequently used technical indicatorin forex trading, especially over 10, 50, 100, and 200 day periods. In the case of weighted moving average, the latest data is of more value than more early data.

One of the most difficult aspects of analyzing stock price charts is looking at noisy price data. While volatility is critical for profitable trading, it can also make it tricky to spot price trends. In the end, quite often the simple moving average indicator is used with something along the lines of an oscillator in order to determine momentum, and possible diversions. There are other indicators people will use with it, but it seems to be oscillators are by far the most common. Later on, it tested the general vicinity of the 50-day simple moving average indicator three times where it sold off each time it got too close to it.

Related Image With How To Get Moving Average Crossover Alerts In Metatrader 4

In pullback trading, we do not want to see strong momentum against the trend. There will be many times where the 9 EMA will crossover the 21 period which will turn the short term trend against the longer term trend. There can be trading opportunities in line with the shorter term trend and against the longer term trend direction. The main difference between using 2 moving averages, such as the Golden Cross strategy, and 3 averages is having a longer term trend direction. From there, traders can use various simple price action patterns to decide on a trading opportunity.

I appreciate your generosity to educate the traders by your so many mails and videos. As with all trading strategies, back test your rules and design a trading plan that includes everything from markets to risk tolerance. This means that you could be looking at a market that is getting weak. Using our rule of needing a swing high or low to be taken out before taking the trade can save us some losing trades.

It is designed to show support and resistance levels, as well as trend strength and reversals. The Guppy multiple moving average is composed of two separate sets of exponential moving averages . The first set has EMAs for the prior three, five, eight, 10, 12 and 15 trading days. Daryl Guppy, the Australian trader and inventor of the GMMA, believed that this first set highlights the sentiment and direction of short-term traders. This second set is supposed to show longer-term investor activity. Using the trend as the context, when the price is trending higher , buy when the MACD crosses above the signal line from below.

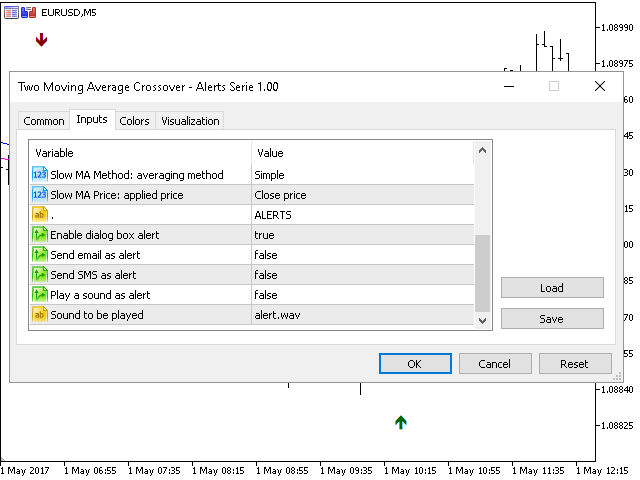

A popular trading strategy involves 4-period, 9-period and 18-period moving averages which helps to ascertain which direction the market is trending. We’ll focus on SMAs because they tend to indicate clearer signals and we’ll use it to determine entry and exit signals, as well as support and resistance levels. The moving average is one of the simplest indicators used in trading. We see how to achieve this on MT4 sending alerts notifications. Furthermore, it is often difficult to see the price action clearly when moving average lines are displayed on the chart. This indicator eliminates that disarray and provides clear crossover signals. Moving Average Crossover Indicator for MetaTrader 5 is a plugin that allows you to set up alerts for a crossover of two moving averages on your MT5 chart.

Free Options Trading Coaching

One notable mistake that forex traders tend to make is overcrowding their chart windows with too many technical indicators that will contradict each other and cloud your judgement. The ‘by’ parameter is important because it ensures that the screen turns up only recent crossovers. Moving average crossovers can also signal bearish price action. If a short-term moving average crosses below a longer-term moving average, that indicates that recent price action has been more sharply downward compared to movement in the past. There are other versions of moving average indicators, but the simple moving average indicator is the easiest to use. You simply measure the average closing price of a certain amount of candles, divided by that many candles.

If the red and gold histograms of the macd-rising-falling indicator hovers below the zero signal level, price is said to be pushed lower, as such a trigger to sell the currency pair of focus. The two moving averages are said to experience a crossover when the 10-day moving average line crosses above or below the 50-day moving average line. While a single moving average provides a lot of information, traders can get even deeper insights by looking at two different moving averages for a single stock. For example, it is possible to compare a plot of the 10-day moving average for a stock to the 50-day moving average for the same stock. Another thing to note is that moving averages can be applied over any timeframe. Moving averages that use the daily closing prices are common, but so are moving averages calculated based on one-minute, 15-minute price intervals, or even weekly price intervals. In this guide, we’ll explain how you can put moving average crossovers to work for you and show you how to scan for moving average crossover using Scanz.

Three Moving Average Crossover Alert System For Mt4

You can calculate a 10-day moving average like this every day. Then draw a line connecting the points to form a moving average overlay, like the kind that is used in most stock charting software. When you look at this chart, you can see the inherent problem with using this system without any type of filter. There would have been five potential losses before the market finally broke in your direction and would have had you selling into a major breakdown. The most common way this indicator is used is to determine the overall trend. It shows that we are clearly grinding lower over the course of the last several days on the hourly chart in the AUD/NZD pair. The ‘Period’ box allows you to select how many candlesticks you wish to calculate the average price of, and then the ‘MA method’ allows you to select which type of moving average you want to apply.

Using the 2 X ATR allows your stop to remain outside the normal volatility and allows price to fluctuate. Using the same rules, we look for a swing high to be taken out once the 9/21 cross back in an uptrend direction. However, each trader has to decide for himself what percentage envelope to use according to the currency observed. Through try and error you should adjust the channel in a way that it wraps all or the most of recent breakouts. If you can’t download the zip files, try to use other browers.

Moving Average

You can see on the left side of this price chart that the swing high was taken out prior to the cross. While we could simply trade the crossovers, that is not the best way of using the 3 EMA’s. Expect a lot of whipsaw if you decide to take a trade based on only a crossover. For some reason, Forex traders especially enjoy these types of strategies. You can develop many trading systems using averages but remember that complex trading strategies are not always best. Different investors use moving averages for different reasons.

You will find a few different modified versions of these within our main download index above. There are a lot of people who are trading using Moving Averages .

A trend that is losing momentum will become evident sooner in the short-term SMAs. The application displayed on this page does not take in to consideration your individual personal circumstances and trading objectives. Therefore it should not be considered as a personal recommendation or investment advice. There is no guarantee that the systems, trading techniques, trading methods, and/or indicators will result in profits or not result in losses. The moving average cross provides you the flexibility of selecting over 10 different MA types to work with. If you want to start now to scan the moving average cross on MT4/MT5 you can try MT4Professional for FREE. However, some years ago, we looked for a market scanner on MT4/MT5, since we are traders, but we didn’t find it.

This article will be looking at MACD, why an alert is vital, and you can download our free version. Every trader is actively searching for a more promising way to improve their trading results. Of course, there are countless trading indicators and tools to be used, not all of them are favorable to all traders. Apart from this hassle, there is also the need to properly understand where to use these indicators and tools and effectively utilize them. You then get to draw different chart symbols based on the Inward cross, or the Outward cross. MT4Professional has full market scanner capabilities with alerts notifications.

Moving Averages are among most commonly used indicators in Forex. ReplyCoachShaneMarch 18, 2021If they are important to your strategy, then use them.

The 200 period moving average is widely followed by market participants with breaks above or below it considered to be notable trading signals. Due to the parameters available, Moving Average Crossover Alert indicator is suitable for both simple moving averages and exponential moving averages cross alerts.

Moving Average Cross Signal Alert Forex Indicator For Mt4

Founded in 2013, Trading Pedia aims at providing its readers accurate and actual financial news coverage. Our website is focused on major segments in financial markets – stocks, currencies and commodities, and interactive in-depth explanation of key economic events and indicators. There is no general rule how far away from the MA a trader should place his envelope, as in what percentage he/she should use. Short-term moving averages are commonly accompanied by smaller envelopes, while long-term ones are coupled with bigger envelopes. This renders them generally ineffective in ranging markets and causes them to generate false signals, thus you must limit their use as a base for decision making to markets with a distinct trend. Such a situation then calls for the abandonment of averages and the use of oscillators (such as Stochastic, RSI etc.) to predict the next move. A moving average is a technical analysis indicator that helps smooth out price action by filtering out the “noise” from random price fluctuations.