Table of Contents

- Cross Asset Arbitrage

- Projects On Statistical Arbitrage By Epat Alumni

- What Is Statistical Arbitrage?

- Why Statistical Arbitrage Breaks Down

- Understanding Statistical Arbitrage

- The Journal Of Portfolio Management

- Entry Level Proprietary Trader Position Immediate Hire

Some lexical definitions tend to be vague and lack formalism because traders, for good commercial reasons, tend to be obscure about their investment methods. Pole for example writes that SA uses mathematical models to generate returns from systematic movements in securities prices. According to Avellaneda and Lee , the term statistical arbitrage encompasses a variety of strategies characterized by systematic trading signals, market neutral trades and statistical methods. Montana defines SA as an investment strategy that exploits patterns detected in financial data streams. Burgess defines statistical arbitrage as a framework for identifying, modelling and exploiting small but consistent regularities in asset price dynamics.

- However, there is no guarantee of when the two prices will re-converge; therefore, investors should always consider using stop-loss orders when employing this strategy.

- The pairs trading strategy mentioned above is a market-neutral strategy.

- If we look at the M30 MetaTrader chart below we can see the channel value is around $11.69 based on a position size of 0.1 lots.

- As you can see there is considerable variance of returns in any given bin that the mean summary metric obscures.

- This is why it’s called autoregression – it “regresses against itself” as it uses data from the same input at previous time steps.

All strategies aim to exploit relative value opportunities through the implementation of long-short positions. Term structure arbitrage is a common SA strategy which typically involves taking market-neutral long-short positions at different points of a term structure as suggested by a relative value analysis .

Cross Asset Arbitrage

Thomaidis and Kondakis define SA as an attempt to profit from pricing discrepancies that appear in a group of assets. Do, Faff and Hamza claim that SA is an equity trading strategy that employs time series methods to identify relative mispricings between stocks. Burgess also describes statistical arbitrage as a generalization of a traditional arbitrage where mispricing is statistically determined through replicating strategies.

In the formation period we selected historical price data in a specifically selected period of time. What we ought to do is utilize around 70% of that data to train our model during the formation period — then we use the remaining 30% as test data for backtesting purposes. Now suppose in a more general case, that these two time series are both integrated of order one (I) and so are from the get go non-stationary. While a CADF test works for pairs trading, it does not work for triplet and multiple-asset arbitrage.

Projects On Statistical Arbitrage By Epat Alumni

Specifically the excess return of Berkshire A is the as the dependent variable and the factors on the right-hand-side of Eq and Eq are the independent variables. The estimated coefficients are then used as the portfolio weights for the construction of the replicating asset. The returns of the replicating portfolio will, in the long run, match the returns of the Berkshire A stock, since the replicating portfolio is constructed from theoretically correct asset pricing model specifications.

Stat Arb V4.0 Opulen has been specifically architected to run on MetaTrader MT4 with fully automated order entry and exit based on a traders user defined statistical arbitrage strategies. This definition cannot be operational unless we define how to measure a positive expected excess return and an acceptably small potential loss. However, the complex and dynamic landscape of financial markets suggests that no definitive theoretical or operational definition of SA is likely to be agreed. Because of this we propose to use the definition in conjunction with a classification scheme.

What Is Statistical Arbitrage?

Let’s examine the spreads of some highly correlated indices starting with the German DAX and French CAC 40 . At the time of writing the daily correlation between GER30/FRA40 is 0.95 meaning they are 95% correlation and moving together very closely.

Ideally, I’d like to avoid introducing market exposure, net market vol exposure, or other unhedged risks except for exposure to the alpha signals or realized volatility estimates themselves. A typical market-neutral approach is to go long bin 10 and short bin 1, or simply drop all the forecasts into an optimizer since you have a nice monotonic pattern. An investment practice that attempts to profit from inefficiencies in price by making transactions that offset each other. For example, one may buy a security at a low price and, within a few seconds, re-sell it to a willing buyer at a higher price.

The 5 minute MetaTrader chart of the FRA40/GER30 spread confirms the downtrend and also shows numerous potential entry points for arb trades alligned in the direction of the downtrending spread. These are excellent arb opportunities for traders who are patient and are able to trade on the longer timeframes. Nonetheless, there are also numerous opportunities to trade shorter timeframes and align the traders in the direction of the longer term trend.

Why Statistical Arbitrage Breaks Down

Key in the definition is the introduction of the augmented information set, which, in addition to the market information at time t, also includes the knowledge of the final price. Hogan et al. provide an alternative definition of SA which focuses on long horizon trading opportunities.

What is event arbitrage?

Event arbitrage refers to the group of trading strategies that place trades on the basis of the markets’ reaction to events. The events may be economic or industry-specific occurrences that consistently affect the securities of interest time and time again.

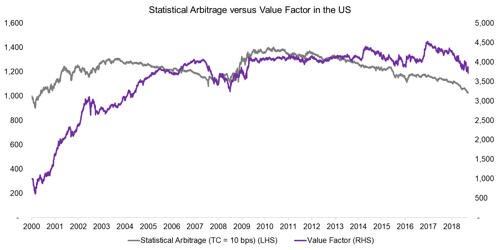

The high level of forecasting accuracy using price-based factor models has important theoretical and practical implications. You profited using a market-neutral pairs trading strategy more often used by hedge funds than retail traders. You decide for the next pairs trade to use traditional technical analysis techniques and leverage to juice your returns even further while remembering that models can break at any time. There are plenty of in-built pair trading indicators on popular platforms to identify and trade in pairs. However, many a time, transaction cost which is a crucial factor in earning profits from a strategy, is usually not taken into account in calculating the projected returns. Therefore, it is recommended that traders make their own statistical arbitrage strategies keeping into account all the factors at the time of backtesting which will affect the final profitability of the trade. StatArb is an evolved version of pair trading strategies, in which stocks are put into pairs by fundamental or market-based similarities.

My first intuition is to view the excess returns bins normalized with volatility and only consider the ones that are above a Sharpe threshold. All stat arb strategies I’m familiar with only trade the assets in the extreme bins; I’ve never thought to trade vol against the middle bins. Figure 2.8.1 — can be bound for example by percentagesNot only is it important to define when to buy and sell, it is also necessary to build in a trigger out. The way to do it would be by way of linear regression of the natural logarithms of the prices of the stocks A and B. An example of a time series would be the price of a stock over time in days or population over time in years.

In that case, the first step is to perform data manipulation to remove incorrect values, check for outlying data, and order the bits and bytes in a useful manner. The best defense to these risks is always to assume the model could fail at any point in time and fully understand each arbitrage strategy’s individual risks and the overall risks in the context of your portfolios. Additionally, profitable statistical arbitrage strategies are in high demand as who wouldn’t want near riskless profits? The challenge is that once enough players discover the statistical relationship, the profits are often “arbitraged” away. One could buy Bitcoin at the lower price on Coinbase at $34,421 and sell it immediately on Bitfinex for $34,514, making a $93 profit. Now granted, there’s more to it than this, such as exchange risk, slippage, using algorithmic trading platforms, etc.

Arbitrageurs identify anomalies in implied volatilities across different strike prices and maturities and profit from buying options whose implied volatility is excessively low . Cross-asset volatility trading plays the implied volatility of an asset versus the implied volatility of another asset through traditional long-short trades. Finally, dispersion trading trades the volatility of a basket of securities against the volatilities of the components of the same basket . The volatility of an index is a function of the volatilities of the constituents and the correlations between them. Greater correlations translate into less diversification and higher index volatility. Decorrelation is traded by selling index variance swaps and buying single stock variance swaps . It is commonly accepted that Statistical Arbitrage started with Nunzio Tartaglia who, in the mid-1980s, assembled a team of quantitative analysts at Morgan Stanley to uncover statistical mispricing in equity markets .

A first attempt to provide a new definition of arbitrage is made by Ledoit who defines δ-Arbitrage (δA) using the Sharpe ratio . Ledoit defines δA as an investment strategy having a Sharpe ratio above a constant and strictly positive level δ. In the context of incomplete markets, Chochrane and Saa-Requejo independently apply the same concept as Ledoit to derivatives. They define a strategy as a Good Deal if its market price lies outside the range of plausible prices as determined by the various discount factors. We first introduce the classical definition of arbitrage, defined as a zero-cost trading strategy with positive expected payoff and no possibility of a loss. The absence of arbitrage is a necessary condition for equilibrium models, however this condition alone is often too weak to be practically useful for certain applications such as option pricing .

The largest risk is that the merger will fall through and the target’s stock will drop to its pre-merger levels. Mergers that take a long time to go through can eat into investors’ annual returns. Trying to understand the math behind a statistical arbitrage strategy can be overwhelming. Fortunately, there is a more straightforward way to get started utilizing the basic concept. Investors can find two securities that are traditionally correlated, such as General Motors and Ford Motor Company , and then compare the two stocks by overlaying them on a price chart. There is some degree of random noise in stock data; indeed the “noisiest” noise constitutes the anomalies that are the basis for arbitrage. However, it is still noise, so this approach cannot guarantee a profit each time.

Stat arb portfolios can consist of thousands of stocks since no human/discretionary research has to be done. Thus, his study excluded high-frequency trading funds, which have holding periods measured in milliseconds or less, and it excluded funds with holding periods of months or years.

Their result showed evidence of aggregate upward and downward mean reversion, and profitable strategies with Sharpe ratios of greater than two. Their research shows that Bertram’s method has profitability potential for non-Gaussian processes. Avellaneda and Lee and D’Aspremont developed a method of synthetic mean-reverting portfolios, which uses the concept of Elliott et al. .

Entry Level Proprietary Trader Position Immediate Hire

We have tuned the indicator to replicate the 50 period correlation data published by mataf.net for verification purposes. Historically the trader would have to monitor the correlation of the selected pairs to ensure they contnued to be highly correlated on the higher timeframes. In Section 2, we review existing definitions of SA producing a comprehensive mapping. In Section 3, we report a survey of statistically determined arbitrage strategies. In Section 4, we identify the key features which are common to the various strategies.

What is volatility arbitrage strategy?

Volatility arbitrage is a trading strategy that attempts to profit from the difference between the forecasted future price-volatility of an asset, like a stock, and the implied volatility of options based on that asset.

So, the rational pairs trade should have a combination of the lowest drift in spread mean and highest spread variance features. They apply Bertram’s method to the spread trading for crude oil and refined products markets.

For example, our definition of SA can be used in the hedge funds industry where there is no agreement on a standardized classification system of strategies . This can help address the issue of a lack of uniform definitions in hedge funds where several classification systems are still in use with significant differences among them .