Table of Contents

- Statistical Arbitrage And Long Run Relations

- Statistical Arbitrage: Defined & Strategies

- Triangular Arbitrage

- How Statistical Arbitrage Affects Markets

- Hjb Equation And Statistical Arbitrage Applied To High Frequency Trading

- Principal Component Analysis

Simulations of simple StatArb strategies by Khandani and Lo show that the returns to such strategies have been reduced considerably from 1998 to 2007, presumably because of competition. Statistical arbitrage is also subject to model weakness as well as stock- or security-specific risk. The statistical relationship on which the model is based may be spurious, or may break down due to changes in the distribution of returns on the underlying assets. Factors, which the model may not be aware of having exposure to, could become the significant drivers of price action in the markets, and the inverse applies also. The existence of the investment based upon model itself may change the underlying relationship, particularly if enough entrants invest with similar principles.

Market pricing depends on the flow of information, which means that pricing is not instant and mispricing can occur here and there. Different brokers could offer different prices or different effective prices when traders look for arbitrage trading opportunities.

Statistical Arbitrage And Long Run Relations

The challenge occurs when the spread dynamics change from ‘stationary’ to ‘directional’. A directional spread is where the moving average is increasing/decreasing over time. In other words one pair is continuously strengthening while the other is either unchanged or weakening. In this scenario we need an automated arbitrage engine to be able to automatically detect the direction of the spread. Over the course of the V3 development program we have experimented with various algorithms to track and monitor spread trend.

Traders can adjust up to 8 trend filters which calculate the trend based on multi-timeframe trend analysis. For example, a trader may prefers to trigger their arb trades from the 15 minute chart and may want to lock the trades in the direction of the M30, M60 and M240 trends. In this case the trader would simply set the M30, M60 and M240 T_Filters to ‘True’ as shown in the screenshot below. STD Multiple- This parameter allows traders to tune the trigger levels for the arb entry points. The STD Multiple is adjusted by accessing the external input parameters for the STD indicator. Ideally traders should look to set the STD Multiple so that peaks in spread divergence coincide with the upper and lower trigger levels. In the screenshot below we can see the STD Multiple has been adjusted down to 0.7 on the Daily chart to coincide with typical peaks in spread divergence.

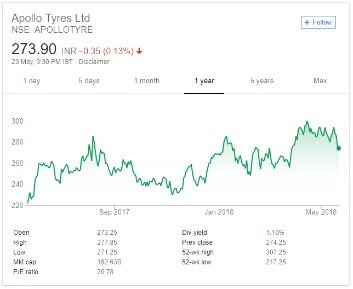

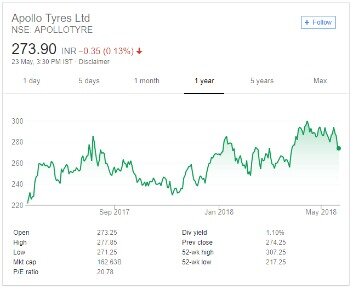

I have taken all constituents of NSE-100 which are categorized as ‘FINANCIAL SERVICES’ companies. However, we filter out companies with less than 10 years of daily pricing data and are left with only the final 15 stocks. We take the daily closing price for these 15 stocks and split the dataframe into test and training sets. This is to ensure that our decision to select a cointegrated pair is based on the training dataset and backtesting is done using out of sample test dataset. The function coint, will return p-values of the cointegration test for each pair.

Statistical Arbitrage: Defined & Strategies

When trading on margin, traders need to make sure to maintain enough free margin in their trading account in order to avoid a margin call. As you can see, the Kalman Filter does a very good job of updating its beta estimate to track the underlying, true beta . As the noise ratio Q/R is small, the Kalman Filter estimates of the process alpha, kfalpha, correspond closely to the true alpha, which again are known to us in this experimental setting. You can examine the relationship between the true alpha and the Kalman Filter estimates kfalpha is the chart in the upmost left quadrant of the figure. With a level of accuracy this good for our alpha estimates, the pair of simulated stocks would make an ideal candidate for a pairs trading strategy. But the single, most common failing of such studies is that they fail to consider the per share performance of the strategy.

It is possible because its performance is measured according to the spread between the long and short exposure of the fund. The fund manager exploits the price movements by holding both long and short positions in stocks that are closely related. In order to project a given company’s share price trajectory and execute profitable trades based on the predictions, the investor used a fundamental analysis instead of quantitative algorithms. Fundamental analysis may include the overall financial health of the business, market conditions, competitors, etc. Market neutral refers to a type of investment strategy wherein the investor aims to profit from both an increase and a decrease in stock prices.

Triangular Arbitrage

The screenshots above demonstrate the potential for healthy profits using statistical arbitrage / conversion trading techniques. However, most traders require higher trade frequencies so an arbitrage system needs to be able to operate on much lower timeframes and with much higher trading frequencies.

Also, deriving a mean reverting portfolio is one of the most popular methods in portfolio selection . Traditionally, a mean reverting portfolio originated from pairs trading. There are many studies on the mean reversion of the price difference between two similar assets, i.e. spread until now. A broad range of investors from individual investors to institutional investors invest in pairs trading strategy exploiting the mean reversion of spread . According to , there are many approaches to the pairs trading strategy such as stocks distance, time series model e.g. co-integration and stochastic control.

And Cross asset arbitrage contains unique risks such as stock delisting. Higher frequency strategies incur significant trading costs and portfolio turnover. There are plenty of in-built pair trading indicators on popular platforms to identify and trade in pairs. However, many a time, transaction cost which is a crucial factor in earning profits from a strategy, is usually not taken into account in calculating the projected returns.

An investment strategy or portfolio is considered market-neutral if it seeks to avoid some form of market risk entirely, typically by hedging. To evaluate market-neutrality requires specifying the risk to avoid. For example, convertible arbitrage attempts to fully hedge fluctuations in the price of the underlying common stock. Algorithmic trading is a method of executing orders using automated pre-programmed trading instructions accounting for variables such as time, price, and volume. This type of trading attempts to leverage the speed and computational resources of computers relative to human traders. In the twenty-first century, algorithmic trading has been gaining traction with both retail and institutional traders.

How Statistical Arbitrage Affects Markets

As you know, if you go long in a currency pair this involves buying the base currency and selling the counter-currency in an equal amount and at the current market exchange rate. An example of this would be a case where EUR/USD trades with a 1.1600 rate while GBP/USD trades with 1.33. By dividing these two rates we should get the price for EUR/GBP of 0.87218. Therefore, if the actual price of EUR/GBP differs from our calculated price – an arbitrage opportunity exists. To tune the model, we could expand our universe of stocks beyond the current 20 equities or incorporate more PCA components.

This is often seen towards the end of the Asian session and near the Frankfurt open. As liquidity flows into the market spread can become directional over short timeframes. Placing specific bets on convergences of stock prices simultaneously hedges away general market risk, which enables market neutral strategies to achieve low positive correlations with the market. Market neutral funds focus on mitigating market risk while constructing a portfolio. In a situation where financial markets are characterized by high volatility, such funds are more likely to outperform other funds that employ different strategies.

Quantitative trading consists of trading strategies which rely on mathematical computations and number crunching to identify trading opportunities. Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. Even though it has the word “arbitrage” in its name, stat arb can be highly risky and lead to enormous and systemic losses, such as in the epic collapse of the hedge fund Long Term Capital Management . Stat arb involves several different strategies, but all rely on statistical or correlational regularities between various assets in a market that tends toward efficiency. Consider an arbitrary momentwe should close these two positions when. SA strategy starts decision rule, if orders should be sent after receivingNumber of Periodstrades.

Statistical arbitrage trading or pairs trading as it is commonly known is defined as trading one financial instrument or a basket of financial instruments – in most cases to create a value neutral basket. This website and content is for information purposes only since TradeOptionsWithMe is not registered as a securities broker-dealer nor an investment adviser. No information herein is intended as securities brokerage, investment, tax, accounting or legal advice. TradeOptionsWithMe in no way warrants the financial condition or investment advisability of any of the securities mentioned in communications or websites. In addition, TradeOptionsWithMe accepts no liability whatsoever for any direct or consequential loss arising from any use of this information. This information is not intended to be used as the sole basis of any investment decision, nor should it be construed as advice designed to meet the investment needs of any particular investor. The trade, in theory, can generate profits at a speed and frequency that is impossible for a human trader.

Video Walkthrough For Spread Basics

That’s why market makers often use so-called sniffing algorithms that try to find and profit from big order executions through these algorithms. Trend following strategies are the longer-term adaptation of momentum strategies and to be honest, they are rather self-explanatory. They try to identify price trends and take advantage of them by following the found trend. Usually, these are longer-term trends, but they can also be mid to short term. The exact definition of a trend depends on the chosen implementation of a trend following algorithm.

- This is because, regardless of which direction the sector moves in, the gains and losses made by the trades offset each other.

- But I hope these examples gave you a good overview of what mean reversion strategies are and how they work.

- The STD Indicator is made up of several components which are detailed in the diagram below.

- It’s kind of like pairs trading, except you typically don’t hedge the trade unless your exposure becomes adversely large.

- Some risk arbitrageurs have begun to speculate on takeover targets as well, which can lead to substantially greater profits with equally greater risk.

Arbitrage is a form of trading where a trader looks for short-term mispricing in an underlying instrument across different exchanges. Therefore, the trader purchases an instrument on an exchange where the price is low and at the same time sells the same instrument on an exchange where the price is high. This locks in immediate profit without any real exposure to the financial instrument.

We show the investment universe in Table 2 and the performance statistics in Table 3. The data are retrieved from Bloomberg and adjusted Friday-closed weekly return is employed. The trading experiment is carried out from March 23th, 2007 to August 30th, 2019. Statistical arbitrage faces different regulatory situations in different countries or markets.

For the most part such studies report very impressive returns and Sharpe ratios that frequently exceed 3. Furthermore, unlike Ernie’s example which is entirely in-sample, these studies typically report consistent out-of-sample performance results also. We investigate the optimal martingale transport problem under additional constraints and its application to robust price bounds for financial derivatives.

Hjb Equation And Statistical Arbitrage Applied To High Frequency Trading

The STD Indicator is made up of several components which are detailed in the diagram below. For example, they may belong to companies in the same market sector, industry, or country. They may also be historically correlated or with similar market capitalization. Portfolios carrying EMNs can create positive returns for the investors regardless of the overall market trend . Market exposure refers to the absolute amount of funds or the percentage of a portfolio that is invested in a given security. prefer to remain market neutral because they desire absolute returns, not relative returns.

In the second or “risk reduction” phase, the stocks are combined into a portfolio in carefully matched proportions so as to eliminate, or at least greatly reduce, market and factor risk. This phase often uses commercially available risk models like MSCI/Barra, APT, Northfield, Risk Infotech, and Axioma to constrain or eliminate various risk factors. We will start with an initial capital of 100,000 and calculate the maximum number of shares position for each stock using the initial capital. On any given day, total profit and loss from the first stock will be total holding in that stock and cash position for that stock.

Principal Component Analysis

Statistical arbitrage is also a popular arbitrage strategy as it can be done with manual trading. Additionally, any broker fees, swaps, and spread differences can quickly reduce any potential for profit. A sudden increase in the spread during the time of execution can make all the difference as the arbitrage opportunities are usually very small. Besides the two-currency and triangular arbitrage strategies, there’s also another interesting trading approach to exploit pricing discrepancies in the forex market – Statistical arbitrage.