Table of Contents

- Bad Trading Moments

- Trading Approach: Adopt Or Avoid?

- Best Swing Trading Strategies To Follow

- Swing Trading Tips: Top Strategies For Technical Analysis

- Spotting A Trend Break

The gains may be small but, if you execute it properly and consistently over time, can easily compound into pretty great annual returns. For example, position or trend traders may wait six months to earn a 30% profit. Whereas swing traders may earn steady 5% gains every week and could eventually record more gains than the other traders in the long run. The goal here is to identify an overall trend and ride it to capture larger gains than is normally attainable in an intraday trading time frame.

Is MACD good for swing trading?

The MACD indicator measures momentum by measuring the distance between two different moving averages and plotting a line as the average. He first discussed the MACD in his book Technical Analysis Power Tools for Active Investors, and to this day remains the most popular swing trading indicator.

But how do swing traders determine how long they should hold on to a stock? This is where different swing trading strategies come into play.

Bad Trading Moments

This fluctuation means the trader needs to be able to implement their strategy under various conditions and adapt as conditions change. Swing trading and day trading both require a good deal of work and knowledge to generate profits consistently. Swing traders are less affected by the second-to-second changes in the price of an asset.

Trend-following strategies usually return the best results to traders who’re new to the world of trading. If the market is not trending, you can easily switch to trading the range until the market starts trending again. Swing traders hold their trades longer than day traders, often up to a few days or even weeks, aiming to catch the swings (“moves”) in the market. This leads to lower trading costs and trade setups with higher profit opportunities. In addition, swing traders don’t need to manage their trades all day long, which means more free time.

Now that we know what we’re looking for, here are some of the hottest swing trading stocks from 2020 so far. Note that these stocks will change frequently — catalysts are rare by definition and earnings reports only occur 4 times per year per company. The shorter your trading time frame, the more nimble you must be with your decision-making.

Trading Approach: Adopt Or Avoid?

He pointed to four critical components of a trade setup. Some traders attempt to capture returns on these short-term price swings.

- Find the best stock screener based on data, platform, and more.

- Day traders can find themselves doing all the work, and the market makers and brokers reap the benefits.

- Swing traders hold their trades longer than day traders, often up to a few days or even weeks, aiming to catch the swings (“moves”) in the market.

- While some swing traders pay attention to fundamental indicators as well, they are not needed for our simple strategies.

- Investopedia requires writers to use primary sources to support their work.

- Getting caught in a congested market with violent swings in each direction can stop you out repeatedly causing you many losses.

The scan for potential trading opportunities can be fast and you can do it during the slower times of the markets. This allows those that are employed full time a chance to view the charts and find trading opportunities. Swing trading strategies are designed for people who want to trade but don’t have time to day trade. Many traders are now appreciating the need and simplicity of trading using ETF. These funds play a very critical role in ensuring that traders avoid liquidity risk. They also ensure maximum diversification for the trader. To date, there are more than 1,600 ETFs which gives swing traders excellent opportunities to allocate their money.

Best Swing Trading Strategies To Follow

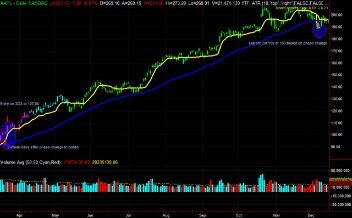

The channel pattern can be easily explained by plotting a chart and just drawing two straight lines to show what the price direction of the stock is. Check out the nice uptrend in the price of Amazon stock over the last 9 months . I want to illustrate the simplicity of trend trading by showing you one of the most straightforward chart patterns—the ascending channel pattern. There is a variety of trading strategies, and so it’s best to try your hand at them to find the one or ones that work best for you.

Those types of gains might not seem to be the life-changing rewards typically sought in the stock market, but this is where the time factor comes in. Trade positions are subject to overnight and weekend market risk. Traders can rely exclusively on technical analysis, simplifying the trading process. It maximizes short-term profit potential by capturing the bulk of market swings. Swing traders will often look for opportunities on the daily charts and may watch 1-hour or 15-minute charts to find a precise entry, stop loss, and take-profit levels. Scanz can help you find top-performing stocks in any sector. In this guide, learn how to scan for the best REIT’s using the Scanz platform.

Swing Trading Tips: Top Strategies For Technical Analysis

Options gives you the right but not the obligation to buy or sell an asset at an agreed on price in a certain amount of time. Day trading is when you hold for less than a day whereas with swing trading you usually hold the option from 2 to as many days as it takes to hit your resistance zone . Profit-taking activities also cause a reversal of the price after it reaches support or resistance zones. Investors who were long need to sell in the market to take profits, creating selling pressure in the market which sends the price down. Notice the support and resistance zones in the chart, and the swings that the market forms after the price reaches one of those zones.

When a stock rises higher than this amount, you can exit the trade to minimize losses. The profit target is the lowest price of the recent downtrend. When the stock reaches this price or lower, you can consider exiting at least some of your position to potentially solidify some gains. Whether you’re a bull or a bear , you can utilize swing trading as part of your investment strategy. But since swing trading involves technical analysis beyond the typical research done on various securities, you can’t just lace up your shoes and head out, so to say. Instead, the following specific swing trading strategies could improve your chances for success.

One of the biggest rules for being a consistent trader is to never risk the health of your account on a trade. Some traders won’t risk more than 1% of their account on a single trade. As for swing trading strategies, I’ll give you one of my all-time favorite afternoon patterns. This one often turns into a good swing trading opportunity. When you look at a stock’s moving average, its trajectory can become more apparent. And when you plan for a swing trade, that’s what you need.

The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision. Ally Invest does not recommend the use of technical analysis as a sole means of investment research. With fading during an uptrend, you could take a bearish position near the swing high because you expect the security to retreat and go back down. And trading the fade during a downtrend means that you would buy shares near the swing low if you expect the stock to rebound and rise.

After listing these ETFs, find the best and worst performing and shift your focus towards this. Now you have 4 ETFs which you will trade with during that day. In every trading day, some sectors will perform better than others. This is known as the relative strength whose goal is to find a good ETF to buy and a weak ETF to short. On a daily basis, We recommend that you list the above ETFs in a table and identify 2 best and 2 worst performing ones. Sometimes your impulses can turn out to be profitable, but more often than not, they won’t. You’ve probably heard, “the trend is your friend,” but which trend are people referring to?

To swing trade forex, the minimum recommended is about $1,500, but preferably more. This amount of capital will allow you to enter at least a few trades at one time. Capital requirements vary according to the market being trading. Day trading and swing traders can start with differing amounts of capital, depending on whether they trade the stock, forex, or futures market. Swing trading accumulates gains and losses more slowly than day trading, but you can still have certain swing trades that quickly result in big gains or losses. Assume a swing trader uses the same risk management rule and risks 50% of their capital on each trade to try to make 1% to 2% on their winning trades. You can start swing trading with a small account, just like day trading penny stocks.

What Are Some Common Swing Trading Indicators?

And you should test your strategies and see them working in the way you planned. Every trader needs a powerful platform like StocksToTrade.

Support and resistance are areas on a market’s chart that it has difficulty crossing. They form the basis of the majority of technical strategies, and swing trading is no different.

I lost a lot of money because I was comparing dozens of patterns for one stock in one time period. Eventually, I came to my senses and focused on just a few patterns and a few companies. I also traded a few popular stocks and made thousands on them. I got scared a few times and a little fundamentalist theory influenced my buying. In the beginning, part of my criteria was that I’d buy “long swing” (I don’t know if this is a term) stocks that were severely undervalued from a fundamentalist’s point of view. That way if I was wrong about the stock, I could hang on to it for a few months and at least break even. It’s a lot like day trading except the slightly longer timeframe.

Spotting A Trend Break

Swing trading indicators are primarily used to find trends that play out between 3 and 15 trading periods. After we analyze these periods, we will be able to determine whether instances of resistance or support have occurred. Jesse Livermore, one of the greatest traders who ever lived once said that the big money is made in the big swings of the market. In this regard, Livermore successfully applied swing trading strategies that work. A simple swing trading strategy is a market strategy where trades are held more than a single day. Here is how to identify the right swing to boost your profit. Swing trading is a type of trading style that focuses on profiting off changing trends in price action over relatively short timeframes.

Can swing trading make you rich?

Swing trading can definitely make you rich. With an average annual return of around 30%, you would double your capital every three years, which will grow to huge amounts over time.

Our Best Stock Indicators focuses on stock and ETFs that attracts institutional accumulation and therefore have good liquidity. Relatively calm – You’ll be holding your position for a few days or weeks so the asset you’re trading shouldn’t be experiencing extreme volatility. Large market capitalization – this makes the stocks much easier to buy or sell quickly with more liquidity. Swing trading essentially presents less stress compared to many other trading styles, like day trading. Swing trading is one of the most popular trading techniques out there. Part of the reason is its moderate time frame and focus on taking advantage of routine price fluctuations.

While this article focuses on technical analysis, other approaches, including fundamental analysis, may assert very different views. You could still get in a position as long as the rules of the strategy are met beforehand. The reason why we take profit here is quite easy to understand. We want to book the profits at the early sign the market is ready to roll over.

By contrast, depressed investing sentiments are mirrored by the pair’s corresponding price movement. By combining this knowledge with other technical indicators, you can use a pair such as AUD/JPY to capitalize on these ebbs and flows regardless of how the market fluctuates. The forex market sees a wide range of trading strategies used on a daily basis. Each one of them has its own pros and cons, although some strategies have a better track record than others when it comes to delivering results. is a process of buying and selling stocks for short durations, usually a few days to a couple of weeks. I think every trader should find an awesome community — like the SteadyTrade Team. We share strategies and push each other to get better.