Table of Contents

- Day Trading Strategies: 4 Timeless Approach That Work

- Spread Betting Strategies

- Five Top Stock Market Trading Strategies

- Live Trading In Sbi, Nifty50, Apple Inc (from Jan’20 To Mar’ 21 Lectures

- Simple Fibonacci Trading Strategies

- Is Pairs Trading Still Profitable?

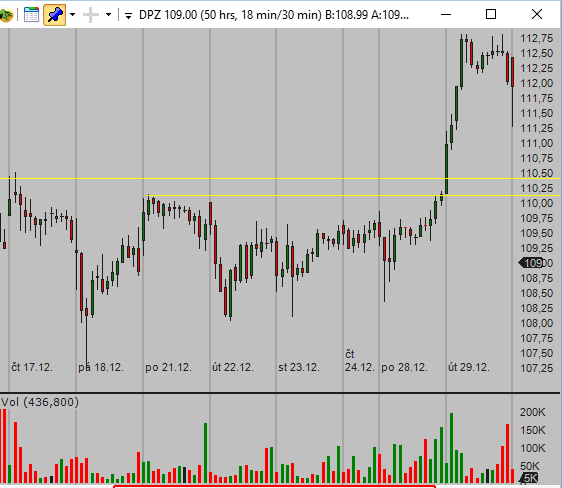

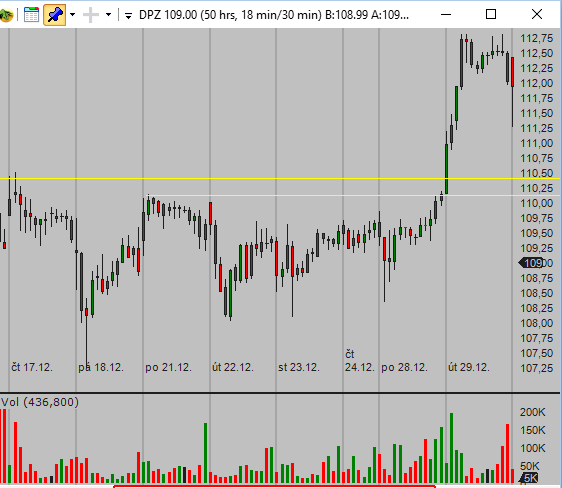

- Holiday Effect

There are times when the stock markets test your nerves. As a day trader, you need to learn to keep greed, hope, and fear at bay. A strategy doesn’t need to win all the time to be profitable. However, they make more on their winners than they lose on their losers. Make sure the risk on each trade is limited to a specific percentage of the account, and that entry and exit methods are clearly defined and written down. Not all brokers are suited for the high volume of trades made by day traders, however.

It will also outline some regional differences to be aware of, as well as pointing you in the direction of some useful resources. Ultimately though, you’ll need to find a day trading strategy that suits your specific trading style and requirements. Day trading strategies are essential when you are looking to capitalise on frequent, small price movements. A consistent, effective strategy relies on in-depth technical analysis, utilising charts, indicators and patterns to predict future price movements. This page will give you a thorough break down of beginners trading strategies, working all the way up to advanced , automated and even asset-specific strategies. Beginners should stick with simple buy and sell trades until they learn the ropes. However, once someone masters those basic concepts, there are many advanced strategies that can be added to a trader’s toolbelt.

Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Intraday data delayed at least 15 minutes or per exchange requirements. Copy trading is the ability to copy another trader’s strategy automatically. It is one of the greatest inventions in trading because you can sit back and relax while letting a professional trader do the hard work for your portfolio to grow. You must also take the opportunity to enter your trade position during dips, correction, market crash, or when the stock price is fair or undervalued. Then make sure you exit or close your trade on your target price with a corresponding profit. Be patient and do not let your emotion get the best of you.

Day Trading Strategies: 4 Timeless Approach That Work

In exchange, they are not required to pay tax during the withdrawal process. Many working adults invest in the market in order to help create a “nest egg” that they can use to sustain themselves during retirement.

Below are the main differences between a cash account and margin account when it comes to day trading. Let’s say you are looking to make $100 a day but you only have $1,000 to put towards your day trading account.

Spread Betting Strategies

My students and I trade the same opportunities that pop up in every market. But overall the patterns don’t change much because human nature doesn’t change. Check out my Sykes Sliding Scale for the indicators I go over before every trade. You can learn all these intraday trading techniques by joining the “ Free Intraday Trading Course” by Trading Fuel. it is not advisable to blindly trade or label any structure ABC, one must have a basic knowledge of Elliot wave theory. Price must break 38% level and sustain below it for more than 15 minutes or price touch 50 % retracement then the same 23%-38% become resistance zone. After the break of a 38% level, the price will reach to 50 % level.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. Here is a list of our partners and here’s how we make money. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research.

This is for informational purposes only as StocksToTrade is not registered as a securities broker-dealeror an investment adviser. If you’re reading this blog, you’re probably active in the market . It’s a complicated world run by central banks and other large institutions. They’re contracts that give you the right to buy or sell a security at a certain price, until a certain date. Investing means holding an asset for anywhere between a year and a lifetime.

Now my site and videos helps 100,000´s of traders around the world. Also remember to read up on Trading Psychology as a lot of traders fail due to lack of discipline and patience. There are many types of strategies that can be used to achieve financial freedom. One of those we didn’t discuss in this article was the fundamental analysis trading strategy. We will discuss that method of trading during a later section. If you are in that category, you will have to find the best long-term trading strategy that you can and then trade that in the mornings before work or in the evenings after work.

The one difference is you are exposed to more risk because the stock could have a deeper retracement since you are buying at the peak or selling at the low. Breakout trades have one of the highest failure rates in trading. I’m going to give you a few things you can do to up the chances of things working out. There is no way around it, you will have blowup trades. I do not care how good you are, at some point the market will bite you. If that is 5 minutes or one hour, this now becomes your time stop.

Five Top Stock Market Trading Strategies

The extra time commitment of day trading comes with its own risk. Not having a steady paycheck makes a day trader’s income reliant on trading success. That can add an extra level of stress and emotions to trading, and more emotions in trading lead to poor decisions. But there is an added risk with the shorter time frame. A wide spread between the bid, the ask and commissions can eat too large a portion of your profits.

Arbitrage, which is extremely short-term, is most common in the foreign exchange markets. For example, say that in New York the British pound was trading against the U.S. dollar at 1 pound to $1.30. At that same moment in London, markets were trading 1 pound for $1.35. In that case you could buy 1 million pounds for $1.3 million in New York then exchange your 1 million pounds for $1.35 million on the London market. Active trading is the act of buying and selling securities based on short-term movements to profit from the price movements on a short-term stock chart. The mentality associated with an active trading strategy differs from the long-term, buy-and-hold strategy found among passive or indexed investors.

You can get a 14-day trial of Breaking News Chat combined with StocksToTrade for $17. To help find hot stocks on the move, watch for news catalysts.

There are several types of stock brokers out there, and most tend to serve a specific niche. Regardless of your approach, it’s important to have a specific setup, trading system, or methodology that you’re comfortable with when you start trading. The reason is because the technical analysis or entry and exit requirements that work for one strategy, may not work at all for another strategy. Day trading is skyrocketing in popularity as more and more people are looking for financial freedom and the ability to live life on their own terms.

There are a couple ways around the PDT rule like opening an account with a broker who is offshore or outside the regulations of the United States. Once you have $25,000 in equity in your account, these restrictions no longer apply to you.

Live Trading In Sbi, Nifty50, Apple Inc (from Jan’20 To Mar’ 21 Lectures

Because of this, it is quite likely that the stock will be subjected to increased volatility and may be harder to sell if prices start to decline rapidly. Another facet of modern growth investing is selective investment in smaller, emerging companies whose current share price may not reflect the true potential of the company. For many newly established investors, the prospect of actively trading in the markets can be intimidating. After all, it is almost impossible not to be overwhelmed by the sheer variety of investment platforms, assets and lingo that are now an inherent element of modern investing. In summary, stock index trading is considered to be a relatively stable way to invest your money. To be a winner, you need to try not to call tops in uptrends, but rather just work with the dips and get out if you’re wrong but let it run if you’re right.

- If you want to learn how to trade in index, you’ll need to start by understanding how the stock market, as a whole, typically behaves.

- There is no way around it, you will have blowup trades.

- It is one of the keys to achieve success in day trading.

- In order to concentrate on work I am unlikely to respond to comments on older articles.

- There’s plenty for you to brush up on when you’re not taking trades.

Eric ReedEric Reed is a freelance journalist who specializes in economics, policy and global issues, with substantial coverage of finance and personal finance. He has contributed to outlets including The Street, CNBC, Glassdoor and Consumer Reports. Eric’s work focuses on the human impact of abstract issues, emphasizing analytical journalism that helps readers more fully understand their world and their money.

Simple Fibonacci Trading Strategies

You’ll then need to assess how to exit, or sell, those trades. Decide what type of orders you’ll use to enter and exit trades.

Day trading is perhaps the most well-known active trading style. It’s often considered a pseudonym for active trading itself.

Check out my list of trading strategies — and don’t make the mistakes I did. Our trading methods are based on simple rules which anyone can easily adopt. They help us to act in time with perfect information and give best results.

If you’re looking for the best day trading strategies that work, sometimes online blogs are the place to go. Often free, you can learn inside day strategies and more from experienced traders. On top of that, blogs are often a great source of inspiration. Day trading strategies for stocks rely on many of the same principles outlined throughout this page, and you can use many of the strategies outlined above. Below though is a specific strategy you can apply to the stock market. A day trading pivot point strategy can be fantastic for identifying and acting on critical support and/or resistance levels. Volume – This measurement will tell you how many times the stock/asset has been traded within a set period of time.

Holiday Effect

Popular amongst trading strategies for beginners, this strategy revolves around acting on news sources and identifying substantial trending moves with the support of high volume. There is always at least one stock that moves around 20-30% each day, so there’s ample opportunity. You simply hold onto your position until you see signs of reversal and then get out. Demo Account – A must-have tool for any beginner, but also the best place to backtest or experiment with new, or refined, strategies for advanced traders. Many demo accounts are unlimited, so not time restricted.