Table of Contents

- Option Strategies For Trading Implied Volatility On Stocks

- How Implied Volatility Affects Options

- Take Advantage Of Stockstotrade Features

- Four Things To Consider When Forecasting Implied Volatility

- The Trifecta Of Trading Strategies?

This means that even if the IV of TATACOMM was at 48.2%, it was still trading at one of its highest levels similar to SUZLON. Therefore, before trading options using IV, one should be aware as to what has been the historical IV values for an option and where it stands currently.

Come and test out your favorite indicators — and learn some great new ones — with a 14-day, $7 trial. Implied volatility plugs a few more things into the mix to try to make a projection for how a security might perform in the future. Think of it like a number that’s adjusted for inflation or something similar. It tries to factor in elements to see what might happen in the future. With historical volatility, you can look at the past and try to make predictions about the future. While there are no guarantees, history is known to repeat itself, so it’s worth looking at what the security has done in the past to see how it might perform in the future.

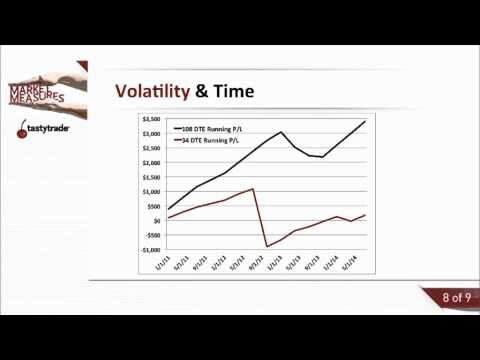

The only difference here is that you are staggering out and using out of the money options instead of at the money options. That changes the dynamic a bit and we’ll see the p&l graphs towards the back end on one of the final slides, and what you’re doing is you’re changing the structure of the buyer. Another perfect example of trading options in high volatility scenarios is happening right now in front of us.

Option Strategies For Trading Implied Volatility On Stocks

In essence, implied volatility is a better way of estimating future volatility in comparison to historical volatility, which is based only on past returns. This formula allows you to work out the implied volatility that has already been factored into the price of an option. It is not a formula to determine the implied volatility of an option from scratch. One can solve for the implied volatility in the price of an option through working the Black-Scholes model in reverse. The expression “implied volatility crush” or “IV crush” refers to a sudden and sharp drop in implied volatility that will trigger a steep decline in an options value. So at options expiration, there’s a 68% chance that Microsoft shares will trade as low as $90.59 ($100 – $9.41) or as high as $109.41 ($100 + $9.41).

What is meaning of IV in option trading?

Implied volatility (IV) is an estimate of the future volatility of the underlying stock based on options prices. Generally, IV increases ahead of an upcoming announcement or an event, and it tends to decrease after the announcement or event has passed.

Keep in mind that volatility can always go higher or lower, which is why it’s a good idea to put volatility in the context of IV percentile, which compares current IV to past highs and lows. TD Ameritrade, Inc., member FINRA/SIPC, a subsidiary of The Charles Schwab Corporation.

How Implied Volatility Affects Options

This web site discusses exchange-traded options issued by The Options Clearing Corporation. No statement in this web site is to be construed as a recommendation to purchase or sell a security, or to provide investment advice. Prior to buying or selling an option, a person must receive a copy of Characteristics and Risks of Standardized Options.

Now let’s look at which trades work well in low volatility environments. The more people buying protection, the higher the price of the put. In fact, there are specific strategies that you can execute for extraordinary returns in a low vol market. Not investment advice, or a recommendation of any security, strategy, or account type. The low IVR reading in SPY alongside a weak VIX seems to validate that premium sales in this underlying may not be optimal at current levels . Having said that, there may be instances where such trades are warranted – especially if they hedge correlated risk in your portfolio.

So, in pursuing options trading, you’re betting on a change in a stock’s future price, either up or down, depending on your position as a buyer or seller. The calculation takes into account things like the market price, the price of the underlying asset , the strike price of the option, the interest rate, and the date of expiration. These economists created this model to calculate implied volatility and determine theoretical options prices. The authors satisfactorily explain the success of buy-write strategies in a traditional low-volatility framework. The improvement is the result of a strategy that involves rebalancing long-dated options on a monthly basis, which yields enhanced risk-adjusted return. The option strategy where the middle options have different strike prices is known as a Condor. Last year’s 2019 US corn crop was marked by turbulence due to poor weather conditions and record prevented planting numbers coupled with trade war headlines happening during non-US hours.

TD Ameritrade is a trademark jointly owned by TD Ameritrade IP Company, Inc. and The Toronto-Dominion Bank. Past performance of a security or strategy does not guarantee future results or success. Applicable portions of the Terms of use on tastytrade.com apply. Deploying capital involves the same type of decision-making, although typically over a longer time horizon. If you find yourself running late for a job interview, you’re forced to weigh the risk of getting a speeding ticket versus the potential reward of a new job offer. Your results may differ materially from those expressed or utilized by Warrior Trading due to a number of factors.

Take Advantage Of Stockstotrade Features

We are more prone to buy calendar spreads when underlyings are at extreme lows in IV. We also purchase debit spreads as opposed to selling credit spreads when we want to make directional plays. Most importantly, in low IV markets, we continue to look for underlyings in the market that have high IV, as premium selling is where the majority of our statistical edge lies. A calendar spread is a low-risk, directionally neutral options strategy that profits from the passage of time and/or an increase in implied volatility. An iron condor involves buying and selling calls and puts with different strike prices when a trader expects low volatility. The iron condor is constructed by selling an out-of-the-money call and buying another call with a higher strike price while selling an in-the-money put and buying another put with a lower strike price. Generally, the difference between the strike prices of the calls and puts is the same, and they are equidistant from the underlying.

The data include computed delta, theta, gamma, vega, and implied volatility statistics that are used in option attribution analysis. The relatively higher return in conjunction with a reduction in risk is inconsistent with the prediction of standard models and suggests overvaluation. The authors attribute the higher return to the skewness premium that option writers gain in exchange for assuming potentially unlimited losses.

Time is a critical component of option value, and when there are fewer days to trade an option, the decay becomes a detriment to the option buyer. In a couple of weeks, the markets will be closed for a full session .

By using this site, you agree to the Terms of Use and Privacy Policy. Wikipedia® is a registered trademark of the Wikimedia Foundation, Inc., a non-profit organization. The double option position in the middle is called the body, while the two other positions are called the wings. CME Group is the world’s leading and most diverse derivatives marketplace. To calculate the Implied Volatility of a call or put option, we first need to understand the mathematics behind the Black Scholes Merton Model. In the last three weeks if you were able to predict each day whether the DOW will be up 1,000 or down 1,000 points, there was some strong earning potential.

Four Things To Consider When Forecasting Implied Volatility

You don’t know how many shares the company has outstanding or how much earnings per share the company is producing. If you are bullish enough to consider owning the $55 calls, the market is $1.05 to $1.15 (fair value is $1.11). To enter the trade, simply right click the order and select “confirm and send”. We’re paying $13.55, so when we make 25% of that we’ll go ahead and take the Calendar off. This expires on 9/16, so I’ve changed our calendar up at the top to 9/16.

For example, if you think a stock might rise in the next 30 days, you could find an option with an expiration that’s about 30 days out. Debit spreads are designed to almost always have a positive vega and benefit when IV rises over time. This ideally allows you to sell the spread for more than you paid for it. Credit spreads almost always have a negative vega and benefit when IV falls over time. This makes sense, because as IV falls, options become less expensive and are cheaper to buy back to close the trade.

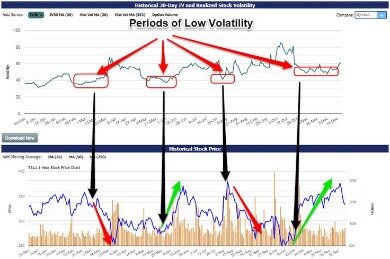

In both of these strategies you don’t need to hold till expiration. Once you see volatility come in your position should be showing a profit so go ahead and close out and take your winnings. When trying to decide if we are in a high volatility or low volatility market we always look towards the S&P 500 implied volatility, also known as the VIX. The average price of the VIX is 20, so anything above that number we would register as high and anything below that number we register as low. The higher the implied volatility the more people think the stock’s price will move. Stocks listed on the Dow Jones are value-stocks so a lot of movement is not expected, thus, they have a lower implied volatility. Growth stocks or small caps found on the Russell 2000, conversely, are expected to move around a lot so they carry a higher implied volatility.

News of the coronavirus turned sour and tech stocks started to dive. I got out quick, but only collected a premium of $33.10 on the option.

Write (or Short) Calls

Volatility, represented by the Implied Volatility, is slowly becoming a known asset class all on its own. You can buy and sell volatility and profit from it using various methods. For an option trader, when implied volatility is low and expected to increase over the next month, one could actually “Buy Volatility” by establishing an option strategy such as a Straddleon a stagnant stock. In this instance, as the position is “Long Vega” , the position will increase in price as implied volatility increases even without a move in the underlying asset. Selling strangle is selling volatility and know it’s going to get crushed after earnings. Selling a strangle versus the straddle means you’re receiving less premium and less capital upfront, but you do have a wider range of profitability.

Implied volatility can then be derived from the cost of the option. In fact, if there were no options traded on a given stock, there would be no way to calculate implied volatility. That is just another way of saying that implied volatility is higher than it has been in the recent past. The first step to selling high volatility is to find assets whose current implied volatility is much higher than usual, relative to it past history. I used the Survey feature in OptionVue 6 to quickly scan all stocks looking for those with the highest IV Percentile .

To gain a higher profit but smaller range of safety you want to trade a short straddle. In this strategy you will sell your call and put on the same strike, usually at-the-money. Here you are really counting on the underlying to pin or finish at a certain price. If you are running a short strangle you are selling your call and put on different strikes, both out of the money. This means your underlying can move around more while still delivering you the full profit.

This equation establishes a relationship between the price of a call and put option which have the same underlying asset. The value of a delta-neutral portfolio remains constant with small price changes in the underlying assets.

In that case, you might sell an at-the-money call and put for expiration one month out while buying an at-the-money call and put for two months out. You would be pretty well protected from modest movement of the underlying while having an opportunity to profit if the front month had a sharp drop in IV .

When you see options trading with lower Implied Volatility levels, it’s best to target option buying strategies. Make sure you can determine whether IV is high or low prior to getting into a trend reversal trade. Compared with options that have a lower IV, these would be considered to have more “fair” prices, and possibly even lower prices or even undervalued prices in the market. Direction matters, because options trades are exposed to changes in IV—also known by its options greek term vega—for the duration of the trade. As a general rule, some traders consider buying a debit spread when IV is between the 0 to 50% percentile of its 52-week range .