Table of Contents

- Day Trading Support And Resistance Levels

- My Top 21 Stock Market Strategies & Tips

- The Day Traders Fast Track Program, A Complete Forex, Futures And Stocks Trading Blueprint

- Use Stockstotrade For Your Day Trading

- Are There Pure Play Day Trades?

- Techniques To Master As You Learn How To Day Trade

My patterns, my indicators, my trading rules and my money management, all rules based and anyone can learn. To teach, guide, mentor and coach you in all that I now know about day trading. If you wish to rise to epic day trader status there is no room for complacency. When you trade you have to be 100% disciplined, patient and focused. My desire is to inspire, encourage, coach, and support you as your success coach through this program. I want each and every one of my members to achieve massive success as traders.

The PDT rule states a trader needs at least $25,000 in order to day trade. With the E-mini S&P 500 you can start day trading with as little as $1,000 (although starting with $2000 or $3000+ is recommended). It is not just buying on green lights or selling on red lights.

Day Trading Support And Resistance Levels

Rules based trading strategies help with in the development of the required discipline in overcoming the fear and greed that paralyse most traders. Now that you understand the four different types of trading strategies, you can determine which works best for you. Once you’ve identified that strategy, start doing your research to understand what you should look at to execute the best trades and make the most profit. The benefit is that swing traders will hold positions for several days and even weeks. If you are a swing trader, you aren’t locked into looking at charts and graphs all day.

Strategy is key — just like it is in any other activity whether it’s playing chess, building a shed, or playing golf. It’s just good practice to have a strategy, a plan for how you’re going to trade. newbies to open up a trading account, throw some capital into it, and randomly make some stock trades. One of the best day trading secrets that we can give you is to watch for the 9/20 ema crossover. If the 9 ema points wards and pushes price up then you could ride the 9. There’s lots of manipulation that happens with level 2 so that’s why it’s important to always keep an eye on time and sales. Time and sales is actual buyers and sellers and where they bought or sold at.

My Top 21 Stock Market Strategies & Tips

It looks to get the most out of tiny price changes. Momentum trading is for day traders who usually rely on technical analysis instead of fundamental analysis. The most important stocks for a day trader are stocks that are moving.

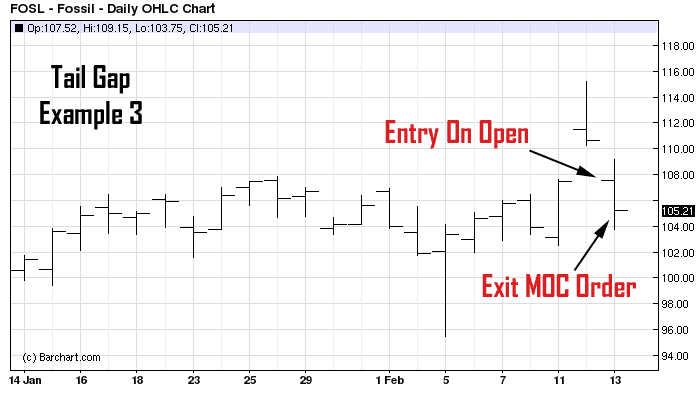

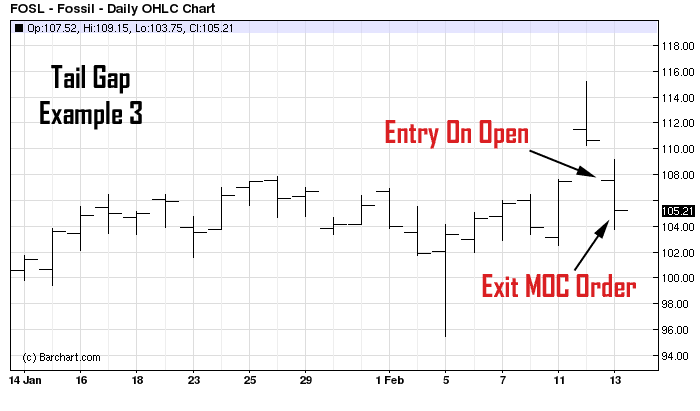

This book is a must-read because of how easy it is to apply the strategies the author describes in the book. He gives a number of detailed strategies that cover entry and exit points, patterns to identify, and charts to use as well as other indicators. The image below explained that high volume during a breakout is likely to push price through key resistance. When you short or long a stock, which has happed down or gapped up it must open with heavy volume and then retrace on lighter volume .

The Day Traders Fast Track Program, A Complete Forex, Futures And Stocks Trading Blueprint

This means, instead of solely focusing on fundamentals, they are looking more for momentum or breakout stocks to buy. Some things thing day traders can use to help offset the potential for a larger daily loss stop-loss trades and limits. Using those keeps your risks smaller and allow you to capture profits.

- It’s just good practice to have a strategy, a plan for how you’re going to trade.

- The swing trader’s focus isn’t on gains developing over weeks or months; the average length of a trade is more like 5 to 10 days.

- But when there’s an active trend, the bands or alligator mouth widens.

- Experienced day traders may also use a variety of other technical indicators.

- My win ratio is definitely better than 50% which would satisfy my first bullet.

You are likely to have seen her on either CNN or Bloomberg. Markus Heitkotter helps break trading strategy down in an easy-to-understand format. His book is widely touted as the top book for those looking for information on day trading in forex and options.

Use Stockstotrade For Your Day Trading

This is going to vary by person, based on what they practice and their psychological makeup. Thus, even though we are trading the same strategy, we could end up taking different trades, or getting in or out at slightly different places. The concept behind the Congressive Trading Strategy was to keep things simple and be able to adapt to the market as it changes. Congressive stands for conservative and aggressive put together.

Do Day Traders pay quarterly taxes?

But for traders, tax season is potentially year-round. If your profits are bigger than your losses, you may have to pay taxes quarterly on those profits. If you are trading in a taxable account and accumulating profits, you are subject to estimated income tax payments and the associated rules on all of your income.

I really need to get this point across; you don’t have to be naturally gifted to have an epic career as a day trader because; Genius is not the realm of genetics. Genius is the realm of practice and thanks to modern technology you can practice on the simulator risk free for months if necessary before you open and fund a live trading account. Discover how we trade the futures, forex and stock markets with the world’s best strategies and techniques. Position traders are looking more at an overall market trend and not on short-term fundamentals or momentum. Being a scalping trader requires a lot of time and quick diligence.

This may influence which products we write about and where and how the product appears on a page. Here is a list of our partners and here’s how we make money. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. We believe everyone should be able to make financial decisions with confidence. NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only.

Normally, swing traders own securities for a few days or weeks. Day traders don’t do this, as they only own securities for a day, although both day traders and swing traders perform a type of short-term trading. The buy the dip day trading strategy is extremely simple. It is a discretionary day trading strategy so that means that there are many variables that traders must be aware of. Risk management is a huge portion of this day’s trading strategy. However, with practice and understanding of the market and price action, a trader can turn this into a highly profitable strategy.

Keep track of your trades — the good, the bad, and the ugly. Breakouts are one example of the gimme patterns I trade. It happens all the time, but you need excellent technical analysis skills or great software to spot them, like StocksToTrade. Stock prices are unpredictable, especially with penny stocks … That’s why I rarely stay in a play long enough to catch the bottom or top of the move.

Are There Pure Play Day Trades?

Readers can think of it as the halfway point between day trading and long term stock investments. In our opinion, that makes this book a useful tool that can be utilized by both day traders and long-term investors to diversify and maximize their gains. It is because they lack the proper training to profit from the market. You can’t jump into the market blind and expect to come out on top. We provide Online Day Trading Courses for our students. Our goal is to teach you the day trading strategies that I use everyday to profit from the market.

What is most common time frame for day trading?

The 15-minute time frame is probably the most popular interval for day traders focusing on multiple stocks throughout the day. The longer the watchlist, the higher the chart interval should be.

Day trading doesn’t take as much time to do like some of the other strategies, but you have to be disciplined enough to examine those technical factors in an instant. For the purpose of this, we will outline the four types of trading strategies you should know. No matter what your reason for trading, it’s important to understand the different strategies out there.

There are many overcomplicated trading strategies on the internet. We show you four simple trading strategies, together with some stock market basics, you can use today to find success. Ross Cameron’s experience with trading is not typical, nor is the experience of students featured in testimonials. Becoming an experienced trader takes hard work, dedication and a significant amount of time. This challenge also serves as an example all of our beginner traders can aspire to, but remember, learning how to day trade is hard, and it’s not for everyone. Just because your strategy is working doesn’t mean that you can suddenly predict every market move.

It also varies at different times of the day, depending upon how the market is behaving. In this book, the reader will learn how to make money by using one simple strategy, one-hour a day.

You may employ one or even more than one, but knowing the different ways to trade can only make you better at it. There are investors looking for short-term gains with time to spend monitoring market trends. Then there are investors who eye more long-term profits or even a consistent income stream from investing. Investors are just as different and varied as the trading strategies they use. The swing trader’s focus isn’t on gains developing over weeks or months; the average length of a trade is more like 5 to 10 days. In this way, you can make a lot of small wins, which will add up to big overall returns. If you are happy with a 20% gain over a month or more, 5% to 10% gains every week or two can add up to significant profits.

A day trader can make use of local and international markets and can open and close many positions within the day. A day trader only opens short-term trades that usually last around 1 to 4 hours, which minimises the likelihood of risks that may exist in longer-term trades. Swing trading involves trading ‘both sides’ of the market, so traders can go long and short across a number of securities. News traders need to understand how certain announcements will affect their positions and the wider financial market. Additionally, they need to be able to understand news from a market perspective and not only subjectively. Ultimately, it’s up to you to decide which the best trading strategy is. Some important factors to consider include your personality type, lifestyle and available resources.