Table of Contents

- How Do Day Traders Make Money?

- Holding Positions Until The Next Day Is Risky

- Traders Are Often Lured To Into The Futures Markets With A Fascination For Day Trading

- Futures Trading Strategies To Avoid

- Helping Futures Traders Since 1997

- Range Trading

The thing is, and I got caught up in this trap, without data you think you take good trades, but in reality you can be losing more than winning with them. The mind has a funny way of remembering things incorrectly. If you don’t keep track of them, you will never truly know. So why miss out on another opportunity because of restrictions?

For the ES, a margin requirement can be as low as $400 per day. This is very powerful but also where many beginners that just start trading futures come unstuck – such low margins provide the opportunity to trade on under-capitalized accounts. It may seem confusing when you are learning to trade futures and you hear about contracts, delivery dates, or expiration so here is an example of how futures trading actually works for speculators. Let’s use a favorite breakfast beverage, orange juice futures, as an example.

Unlike stocks, futures markets are less developed than equity markets. Because of this, trends are easier to spot and exploit – which makes it easier to earn excess returns. Since carry costs increase the price of a futures contract and carry benefits decrease the price of a futures contract – you can exploit imbalances when they occur. By taking the other side of the trade, you can capture the excess premium for assuming that risk. To that point, there are also plenty of arbitrage opportunities in the futures market.

The pullback strategy is a powerful futures trading strategy that is based on price pullbacks. A pullback occurs during trending markets when the price breaks above or below a support/resistance level, reverses and retests that broken level again. Speculators use futures contracts to speculate on the market and make a profit on falling or rising prices of the underlying instrument.

How Do Day Traders Make Money?

Our brokerage services are designed to help traders acquire the knowledge and resources they need to engage in commodities trading. For over 20 years, Cannon Trading has helped clients all over the world achieve their trading goals in the lucrative commodities futures trading market. Traders only need to put up a percentage of the contract cost, which means that a considerably smaller capital is required compared to a physical trade.

We call it structure-based trading rather than rule-based trading. We are able to teach people how to actually understand what the market is doing rather than masking it with indicators and software. Also, since futures are a “speculators market” there are no restrictions for shorting like there are in the stock market. A contract for differences is a marginable financial derivative that can be used to speculate on very short-term price movements for a variety of underlying instruments. Confidence based on solid research helps to remove the emotion for the trading decision. Reading a blog or following someone else’s lead without knowing why they are making the trade is a recipe for failure. Do you have a special knowledge of a futures market that gives you an added advantage?

Of course, your broker may have rules for day trading futures. It is best to take some time to learn how the markets work before you move headlong into this strategy given the risk that is involved. In addition, your broker may impose certain limitations on how you day trade or may require certain account minimums before you can begin a day trading strategy. Nonetheless, futures are an ideal market for day trading because the capital requirements for this type of strategy may be less than you would find on the stock market. It just so happens that larger traders/investment companies/banks, etc. may trade thousands of contracts at a time in different futures trading markets. These larger positions must adhere to CFTC position limits and reportable position rules. The term day trading can be used to describe an unlimited number of futures trading strategies and approaches that involve buying and selling a commodity contract in the same trading session.

It is a pure-play on the stock market where futures traders can control around $75,000 worth of stock for about $3,500 in the margin. A day trader must follow the strict discipline to be successful. The temptation to make marginal trades and to overtrade is always present in futures markets. Chuck Kowalski is an expert on trading strategies and commodities for The Balance. He has more than 20 years of experience in the futures markets as a trader, analyst, and broker, and has written market commentary for SeekingAplha.com, TalkMarkets.com, and more. Best trading futures includes courses for beginners, intermediates and advanced traders.

Holding Positions Until The Next Day Is Risky

The futures may close at the end of the day at one price and open the next day at a much different price. Futures traders who trade stock indices — Dow Jones Industrial Average , the S&P 500 , Nasdaq or the Russell — may benefit from an annual “anomaly” that takes place most of the time at the end of the year. This article is about the art of taking a trading position. The instruction here is limited in terms of its ability to “involve” you in the process, as the Confucius quote says above. Making the transition from being a “simulation trader” to one who trades the live market is a necessary step to becoming a seasoned and successful futures trader. Nevertheless, prepare yourself, as the experience can range from sobering to flat-out shocking. The same strategy can be applied to other markets as well, such as the futures on stocks, commodities, and metals.

If you’re just going to be trading with no predictability then scalping will suit you best. If your forex brokerage firm does not offer good service then you should change to another firm. Check with the Better Business Bureau and with online consumer reports to make sure you’re dealing with a reputable broker. Applicable exchange, regulatory, and brokerage fees apply to rates shown. These are beyond the scope of an introductory booklet and should be considered only by someone who clearly understands the risk/reward arithmetic involved.

Traders Are Often Lured To Into The Futures Markets With A Fascination For Day Trading

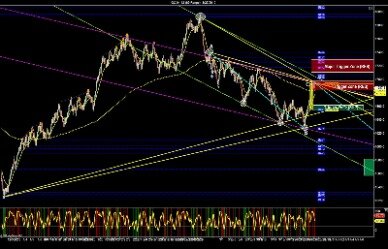

This involves hours, days, weeks and even months of futures charting. It is important to remember that there are many indicators on charts and if you use too many, you will be clouding your judgment and bound to be confused and unsure, which will ultimately lead to loss of profits.

Next you need to follow how that hypothetical trade would go. Just like a sport, musical instrument, or anything else, you won’t get good unless you practice.

The NIFTY futures trading strategy will offer you a very low-risk entry point. The NIFTY futures trading strategy is a technical-based strategy. We use the best combination of indicators that can generate accurate trading signals. This futures trading strategy will let you capture the intraday NIFTY trend. Now for the real thing, we’re going to reveal the most profitable trading pattern to trade the NIFTY, the National Stock Exchange of India’s benchmark broad-based stock market. The margin requirements really depend on the futures contract traded and sometimes on your futures broker.

However, the benefit for this methodology is that it is effective in virtually any market (stocks, foreign exchange, futures, gold, oil, etc.). Scalping highly liquid instruments for off-the-floor day traders involves taking quick profits while minimizing risk . It applies technical analysis concepts such as over/under-bought, support and resistance zones as well as trendline, trading channel to enter the market at key points and take quick profits from small moves.

On the other hand, traders who wish to queue and wait for execution receive the spreads . Some day trading strategies attempt to capture the spread as additional, or even the only, profits for successful trades. Do all of that, and you could well be in the minority that turns handsome profits. Stocks and other financial instrument tend to gravitate toward those price-levels that have the largest number of orders.One of the best futures trading strategies are trend-following strategies.

The best time to buy during an uptrend is at the higher low, i.e. the bottom of the price correction. This is exactly the point where the underlying uptrend should resume. The same is true for downtrends, only that you would look for the tops of lower highs to enter with a sell position. As its name suggests, these strategies aim to enter in the direction of the underlying trend. If the trend is up, a trend-following strategy would only look for suitable long positions. Similarly, if the trend is down, a trend-following strategy would only look for potential short positions. Large trading orders won’t affect the price of a highly-liquid security, such as Amazon, to a large extent.

Futures Trading Strategies To Avoid

It includes advance charting tools as well as access to an experienced team of financial experts, engineers and customer support representatives. When you take historical data and program the system to implement its strategy – you get clear results of how successful it can be. When trading central bank policy, focus on rhetoric from Federal Reserve officials as well as economic data. Falling unemployment is a major indicator but rising inflation is most significant.

Brokers at Cannon Trading are experienced, knowledgeable, and available whenever you need them. When a future is at a premium, it generally indicates near-term demand. It is likely that it will trade higher in the coming trading sessions. Premium futures offer a buying opportunity, especially when an investor takes a long position. This situation can normally be found for non-perishable commodities with a cost of carry.

This comes with strict risk management, patience, diligence and discipline. If you wait for price to settled down and qualify the trade based on other criteria explained at TPA. You might catch the 2879 on the way down with the target initially at the previous peak lower at . 1 contract on that move is a USD $250 gain in just minutes. Shorting the ES futures on the pullback into that level is a high probability trade because it’s in the direction of the trend where the big money is taking price. We’ve teased you long enough, in the following section we are going to get into the first futures trading strategy that we use most often and can be a high probability strategy. All trades are random examples selected to present the trading setups and are not real trades.

There is a substantial risk of loss in trading futures and options. The information and data contained on DeCarleyTrading.com was obtained from sources considered reliable. Information provided on this website is not to be deemed as an offer or solicitation with respect to the sale or purchase of any securities or commodities. Any decision to purchase or sell as a result of the opinions expressed on DeCarleyTrading.com will be the full responsibility of the person authorizing such transaction.

Range Trading

With over 50+ years of combined trading experience, Trading Strategy Guides offers trading guides and resources to educate traders in all walks of life and motivations. We specialize in teaching traders of all skill levels how to trade stocks, options, forex, cryptocurrencies, commodities, and more.

- Before diving in, however, it is important to understand how futures markets work and they key differences that exist from stock or bond markets.

- S&P 500 E-mini and NASDAQ-100 E-mini futures are popular day trading markets.

- Emotional – by riding a rollercoaster of feelings, these traders are more likely to “spend more” when trades work favorably.

- Sometimes these traders may give up altogether if profits aren’t made within a short period of time.

- Traders only need to put up a percentage of the contract cost, which means that a considerably smaller capital is required compared to a physical trade.

- E-mini Nasdaq futures, E-mini Russell futures and Dow futures are some of the other markets, and each market has different features.

Commissions stand at $0.85 while margin rates are between 1.41% and 1.91%. The brokerage’s configurable trading platform gives you access to 50+ futures order types. It also has a mobile app that’s supported on Android and iOS. During a downtrend, the price breaks below an established support level, reverses and returns to the support level again. This represents a pullback and you may enter with a short position in the direction of the underlying downtrend. During an uptrend, the price breaks above an established resistance level, reverses and retests the resistance level. After the retest is complete, you may enter with a long position in the direction of the underlying uptrend.

Optimus Futures, LLC is not affiliated with nor does it endorse any trading system, methodologies, newsletter or other similar service. The use of descriptions such as “best” are only for search purposes. Optimus Futures, LLC does not imply that you cannot find better tools or opposing valid views to our opinion. We do our best to share things based on our experience and scope of expertise. If you’re a beginner to the market, then give the pullback strategy a try.