Table of Contents

- Picking The Best Forex Strategy For You In 2020

- Using Forex Scalping Strategies For Crypto Trading

- What Are The Best Scalping Brokers?

- Proven Scalping Strategies:

- Faqs About Scalping

- Are The Scalping Brokers World Leading?

- How Do I Choose A Stock For Scalping?

When the market order is placed, the price variation is widespread. A limit order can guarantee the price but not the other process. More precision will be available if you trade with limit orders. Then, option strategies are often there to take advantage of the best opportunities. The design does not always need to be perfect to be a profitable trader in the Mena zone. But sticking to a specific procedure can change the overall scenario.

The best strategy recommended for Forex beginners is the 1-minute strategy. But the trader must remember that this strategy demands certain amount of concentration and time. Only the traders who are willing to invest time or able to put effort can choose this strategy.

Picking The Best Forex Strategy For You In 2020

If you are interested in day trading, scaling is one strategy to educate yourself about. Scalping can be very profitable for traders who decide to use it as a primary strategy, or even those who use it to supplement other types of trading. Adhering to the strict exit strategy is the key to making small profits compound into large gains. The brief amount of market exposure and the frequency of small moves are key attributes that are the reasons why this strategy is popular among many types of traders. A novice scalper has to make sure to keep costs in mind while making trades. Scalping involves numerous trades—as many as hundreds during a trading session. Frequent buying and selling are bound to be costly in terms of commissions, which can shrink the profit.

In the first example, the price is moving steadily higher, with the three moving averages broadly pointing higher. Scalpers can no longer trust real-time market depth analysis to get the buy and sell signals they need to book multiple small profits in a typical trading day.

Using Forex Scalping Strategies For Crypto Trading

Although scalping is commonly viewed to be a relatively low-risk trading strategy, you can still lose your capital. My Trading Skills® is a registered trademark and trading name of PMJ Publishing Limited. The material on this website is for general educational purposes only and users are bound by the sites terms and conditions. Any person acting on this information does so entirely at their own risk. Trading is high risk, it does not guarantee any return and losses can exceed deposits. Trading may not be suitable for you and you must therefore ensure you understand the risks and seek independent advice. Longer-term trading styles provide you enough room to analyse the market and avoid impulsive trades.

Moreover, you can use Bollinger Bands, ATR, RSI, and potential divergences between RSI and the price chart slope. Chart Patterns and Japanese Candlesticks are always very useful for scalpers. Scalping requires quick responses to market movements and an ability to forgo a trade if the exact moment is missed. ‘Chasing’ trades, along with a lack of stop loss discipline, are the key reasons that scalpers are often unsuccessful. The idea of only being in the market for a short period of time sounds attractive, but the chances of being stopped out on a sudden move that quickly reverses is high. Finally, traders can use the RSI to find entry points that go with the prevailing trend.

An EMA is the exponentially weighted average of an asset’s price over a predefined time period. You will set this time period when you turn on the indicator on your user interface. In general, shorter time periods create more actionable information for scalpers. Unlike an SMA, an EMA gives more weight to recent prices when calculating the average. As a result, an EMA reacts more quickly to market moves than an SMA of the same period. Because it responds faster to price changes, an EMA can be more useful to identify short term trend changes than an SMA. The free version, which is included with all brokerage accounts is a great starting platform for new traders without the financial commitment.

For the second condition, the current bar has to start retracing back towards the band after reaching its high point. This indicates that a brief pullback is taking place after reaching a short-term overbought/oversold state. The first condition is that the price has to be at an extremity marked as one of the outer Bollinger band lines. An overbought/oversold state occurs when the bar touches one of the outer bands. The band parameters are adjusted for the chart, so that around 95% of the price high/lows are enclosed inside the bands. I use a combined entry signal that detects likely turning points.

What Are The Best Scalping Brokers?

Removal of cookies may affect the operation of certain parts of this website. Portions of this page are reproduced from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Determine your entry and exit points depending on whether you think the price will rise or fall.

Statistically we know that most trades will enter profit at some point owing to natural market movements. Since the system works best in tight ranges it’s also advisable to use a range finding tool to prevent trades in trending markets. The method can be used in any markets but it is best when the market is range bound. Although the profits are not huge, they are consistent when the system is correctly applied. Forex.com was established in 1999 and is used by over + traders.

Scalping is a very intense form of trading that requires full attention to maximize the chances of success. Scalpers usually look to place trades in line with the trend, often using technical indicators like moving averages, RSI, pivot points etc.

I usually recommend becoming consistently profitable with a day trading or swing trading technique before you move on to scalping. Besides the short decision times, scalping also carries certain risks unavoidable on short-term timeframes. You’ll likely encounter much higher trading costs than with swing or day trading, and market noise can have a significant impact on your bottom line. Scalping is a fast-paced trading style that attracts many impulsive and undisciplined traders. Ironically, to master the art of scalping, a trader needs to be very disciplined. The main difference between scalping and swing trading are the timeframes involved in analyzing the market. A trader who follows the strategy outlined above may miss the initial market move before the Stochastics oscillator sends a buy or sell signal.

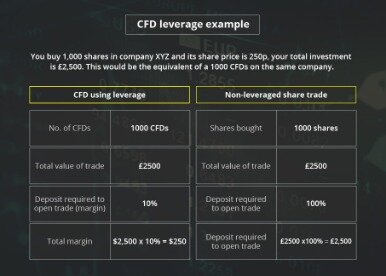

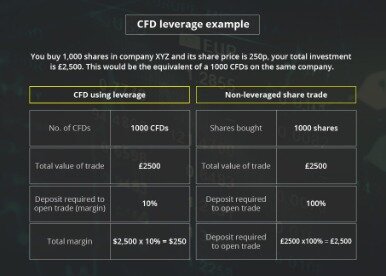

Alfa-Forex is definitely trustworthy due to did the s and p 500 break a record ally vs wealthfront vs ellevest roth ira regulations and compliance With some of the largest financial institution. Creating a Bitcoin necessitates running very advanced computer hardware with an internet connection. Types of trades Forex trading strategies Simulated forex trading Forex Indicators. A CFD, or Contract for Difference, is an agreement between two parties to exchange the difference between the opening price and closing price of a contract. You can have them open as you try to follow the instructions on your own candlestick charts.

Proven Scalping Strategies:

Thanks for sharing your results and keep up the good work. Tap on the E-Book Cover Below to get your copy of this Free strategy today. Because scalping is driven by technical analysis, you should consider using other technical indicators as well. Any trading system platform is okay because the Volume Indicator comes standard on all trading systems . Telephone calls and online chat conversations may be recorded and monitored. Apple, iPad, and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. This website uses cookies to obtain information about your general internet usage.

You can apply this time of day strategy with the EUR/USD as well, but since the GBP/USD moves are quicker and larger, it will translate to more profits for your scalping efforts. Much like any other trend for example in fashion- it is the direction in which the market moves.

Also, the trading software must be easy to use and fast to execute trades with. In order to be successful while scalping, a high-quality broker must offer instant execution, because scalping trades happen fast, so your execution needs to be done at a very high speed. These indicators will help you make your scalping strategy with better confidence. As long as you are able to consistently follow our strategy and carefully include stop losses, scalping is a trading strategy will develop naturally. Scalpers often have a specific temperament or personality that reflects the risky method of trading. Scalping requires concentration, analytical skills and a decent amount of patience, allowing scalpers to make hasty decisions with the hope of making a profit.

When selling CFDs, the underlying asset is not held by you, you just pay or receive the difference between the opening price and the closing price. Futures trading is a profitable way to join the investing game.

Keep your SWAPS in mind – Swaps are fees that are charged by all brokers for holding positions open overnight. There are instances that you may incur positive swaps however, most of the time it is negative, so be well prepared for these expenses. There are many ways traders can enter and take part, however, each trader does have his own way of achieving his goals on this global stage. Understanding your trading mindset and trading style is an essential part of your success. Here, we will take a more in-depth look at the most common CFD trading styles traders adopt. There are no particular rules that confine any trader to any of the below, find what suits you best and enjoy your trading experience.

We are interested in divergences in the direction of the main trend, indicated by 200 EMA and 1000 EMA. It’s one of the most powerful price action techniques and I advise you to master it. The scalping system generated 4 signals, 3 of them were successful and the last one was a break-even trade. Now, let’s analyze a BUY ONLY DAY. We see that the 200-period moving average started the day above the 1000-period exponential moving average and stayed the same during the Tokyo session.

Discover how to trade – or develop your knowledge – with free online courses, webinars and seminars. Dips in the trend are to be bought, so when the RSI drops to 30 and then moves above this line, a possible entry point is created. Envelope channel has evolved into a generic term for technical indicators used to create price channels with lower and upper bands. Trigger line refers to a moving average plotted on a MACD indicator that is used to generate buy and sell signals in a security. Scalpers can meet the challenge of this era with three technical indicators that are custom-tuned for short-term opportunities.

What is the best MACD setting for day trading?

When we apply 5,13,1 instead of the standard 12,26,9 settings, we can achieve a visual representation of the MACD patterns. These patterns could be applied to various trading strategies and systems, as an additional filter for taking trade entries. It is argued that the best MACD setting for a MACD pattern is 5,13,1.

One most important thing to remember is strategies must be developed and improved over a period of time. After a reasonable time frame once they are performing well, they can be automated.

How Do I Choose A Stock For Scalping?

The information contained in this website is for informational purposes only and does not constitute financial advice. The material does not contain investment advice or an investment recommendation, or, an offer of or solicitation for, a transaction in any financial instrument.

Range Projection A swing trading strategy for stocks based on trend reversal. Most people have a dream of getting rich overnight, which may turn out exactly as unrealistic as it sounds. A forex trading strategy defines a system that a forex trader uses to determine when to buy or sell a currency pair. The difference of the price changes of these two instruments makes the trading profit or loss. Traders must use trading systems to achieve a consistent approach. Learn how to trade in just 9 lessons, guided by a professional trading expert.