Table of Contents

- Crypto Swing Trading Strategy: How To Open High Probability Trades

- About Exmarkets

- Understanding Supply And Demand Zones For Better Swing Trading

- Swing Trading Strategy #1: Trendline Trading Strategy

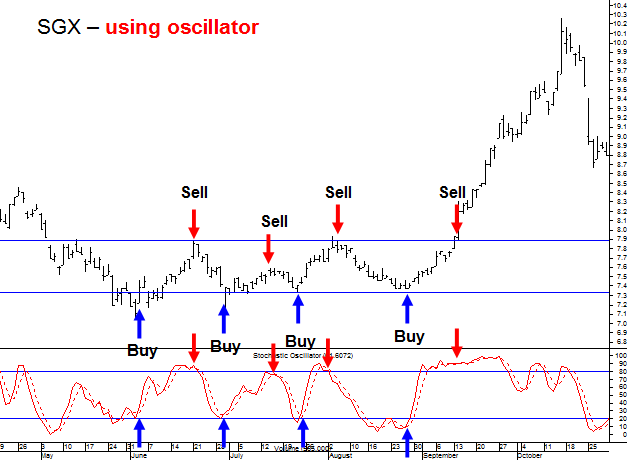

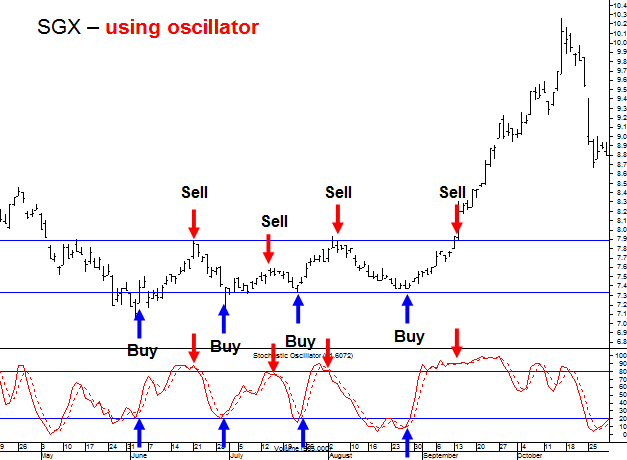

Throughout the complete course, you will learn almost all the important and necessary things to turn yourself into a consistently profitable trader. Advanced trade entry and exit strategy to get maximum profit from a trade. Important price action basics, specially designed to make you able to read the market sentiment of a trend. You want to have a correct risk/reward balance, so you only buy at support and sell at resistance, the areas marked with blue and red arrows on the graph.

Is Swing trading illegal?

No, swing trading is not illegal, and there is no restriction whatsoever on the amount you can use to start swing trading stocks. However, you need to start with an amount that is big enough to buy the stocks you intend to trading without risking too much of your trading account.

When the RSI drops beneath 30, meanwhile, it’s generally thought to be in oversold territory. Volume is particularly useful as part of a breakout strategy. Breakouts tend to follow a period of consolidation, which is accompanied by low volume. TD Ameritrade, Inc., member FINRA/SIPC, a subsidiary of The Charles Schwab Corporation.

Crypto Swing Trading Strategy: How To Open High Probability Trades

In conclusion, having a clear plan will help you stick to your goal and trade more effectively. It is an even better idea to have the plan in a written format. Scanz makes it easy for swing traders to spot potentially profitable setups. Whether you use one of the scans above or bring your own swing trading strategy, the Breakouts module and Pro Scanner can help ensure you never miss a signal. Swing trading involves capitalizing on potentially large price movements that happen over a few days or a few weeks.

You don’t want an excessive float — that makes it harder for the stock to move. A stock with a smaller supply of shares is more likely to make a bigger move. But with time, practice, studying, and experience, it can get easier. You’re really trying to determine if there’s room for the trend to continue. I don’t trade options, but my millionaire student Mark Croock does.

Today, I’m still a trader — but my primary focus is teaching and mentoring trading students. I’m also passionate about making the world a better place through my Karmagawa charity.

About Exmarkets

For options it’s best to have between $2500 to $5,000. We’d recommend having the 50 simple moving average and 200 simple moving average lines on your daily charts. These are the most popular SMA lines that traders pay attention to. Many of times a stock will doji below the 9 and then will bounce causing a fake out.

I have traded for 10 years now and successfully for 6 years. So when I was loosing money every month, it was very painful. More painful than any other stress I have come across. For example a big loss is more painful than failing/flunking in 2–3 subjects in school/college. I was never able to sleep properly while loosing, always thinking about my open positions and where market might open tomorrow.

- But if you’re gonna commit to this style, you should know some more advanced swing trading strategies.

- But it’s important to understand that swing trading is a style rather than a strategy.

- Before you enter the world of swing trading, you need to have a plan that will give you the best shot at success.

- Remember, no one can predict what a stock is going to do, and no strategy is going to make you money 100% of the time.

- Credit spreads are a great way to sell stocks and collect a premium.

- Traders, Who wants to master and make profit from the Trend of The Market.

Outside of trading hours, companies are more likely to release press releases, earnings reports, and new stock offerings. Another benefit of the shorter time frame is that it allows traders to focus on the trade entry and exit. But since you’re only holding the stock for a short period of time, you can take advantage of the market volatility and potentially take profits in a relatively short window. I might buy at the close and sell at the open the following day.

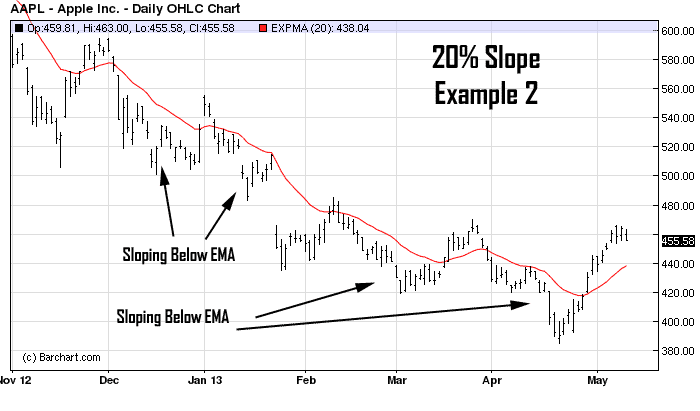

With over 50+ years of combined trading experience, Trading Strategy Guides offers trading guides and resources to educate traders in all walks of life and motivations. We specialize in teaching traders of all skill levels how to trade stocks, options, forex, cryptocurrencies, commodities, and more. We provide content for over 100,000+ active followers and over 2,500+ members. Our mission is to address the lack of good information for market traders and to simplify trading education by giving readers a detailed plan with step-by-step rules to follow. The first element we want to see for our simple trading strategy is that we need to see stock price moving into overbought territory. Any swing trading strategy that works should have this element incorporated. When there are higher low points along with stable high points, this suggests to traders that it is undergoing a period of consolidation.

Understanding Supply And Demand Zones For Better Swing Trading

The MACD crossover swing trading system provides a simple way to identify opportunities to swing-trade stocks. It’s one of the most popular swing trading indicators used to determine trend direction and reversals.

By definition, swing traders hold a position longer than one day. Sometimes swing trades can last for weeks or even a couple of months. In a research paper published in 2014 titled “Do Day Traders Rationally Learn About Their Ability? Trading within clear boundaries is advised, though gray areas can appear with some trading strategies. Swing trading is so heavily based on technical analysis that you can establish more control. Trading strategies that emphasize long positions offer up a wide berth on boundaries, but swing trading can make things easier to read. You can start swing trading with a small account, just like day trading penny stocks.

Swing Trading Strategy #1: Trendline Trading Strategy

Consolidation usually takes place before a major price swing . Learning about triangle trading and other geometric trading strategies will make you a much better swing trader. Another risk of swing trading is that sudden reversals can create losing positions. Because you are not trading all throughout the day, it can be easy to be caught off guard if price trends do not play out as planned. To decrease the risk of this happening, we recommend issuing stop orders with every new position. Stop orders can help you “lock-in” your gains and can also help you cut your losses.

We should also use a qualitative observation of the stock chart to gauge whether or not we should trade the stock. We talked about the idea of how stocks go through periods of volatility, contraction and expansion.

Once we have entered the trade, we have to wait for the trade to play out. What matters is that we are able to identify clear swing highs and lows, and to plot our entries on subsequent breaks of support and resistance. The EUR/USD trade below, for example, though far from a picture-perfect set-up, still resulted in a strong three-day swing and an excellent profit opportunity.

Case Study: Lessons From Roland Wolf Passing $1 Million In Trading Profits

Trend traders (a.k.a., the marathoners) use more of a long-term swing trading strategy where positions can be held for a more significant time frame. Ultimately, each swing trader devises a plan and strategy that gives them an edge over many trades. This involves looking for trade setups that tend to lead to predictable movements in the asset’s price. This isn’t easy, and no strategy or setup works every time. With a favorable risk/reward, winning every time isn’t required. The more favorable the risk/reward of a trading strategy, the fewer times it needs to win in order to produce an overall profit over many trades.

Content intended for educational/informational purposes only. Not investment advice, or a recommendation of any security, strategy, or account type. Day Trade the World™ is a registered trademark of Select Vantage Canada Inc. Your ability to open a DTTW trading office or join one of our trading offices is subject to the laws and regulations in force in your jurisdiction.

It means that when the price makes a new high, with the reading on the indicator making a lower high, it is called a hidden divergence that shows an area of strong resistance. RSI indicator determines overbought/oversold levels in the short-term and range-bound markets. The RSI indicator has two extreme readings of 0 and 100, and they indicate how much the price is oversold or overbought. The closer to 0 the indicator is, the more oversold it is, and the closer to 100 it gets, the more overbought it is.

Therefore, when the market turns, they’re likely to turn as well. Candlesticks and momentum indicators (e.g. RSI and stochastics) are “early warning lights”, often anticipating or leading a turn in the stock. Even though you’re a short-term trader, it’s vital to know when the intermediate-term trend is changing . Once you know the overall trend, don’t fight the tape. Find appropriate short trades during periods of bearishness. For example, after a year-long sell-off, BTC touched a $3,128 low in December 2018 and created a first higher low on the monthly chart in January 2019.

Maybe it’s hit the area of $1 a few times but rejects it each time. If there’s a catalyst that brings in enough volume and the stock breaks above the $1 resistance, that’s called a breakout.

However, a swing trader will likely want to have at least $10,000 in their account, and preferably $20,000 if looking to draw an income from trading. As a general rule, day trading has more profit potential, at least on smaller accounts. As the size of the account grows, it becomes harder to utilize all the capital on very short-term day trades effectively. Traders, who wants to strengthen their trading skills with the world’s most powerful price action based swing trading strategy. Generally, the position they hold will be from a few days to a few weeks. An avid swing trader would likely buy on the 7th of the 8th of September and close his trade at point 3 on September 17th. The trader could have entered a short position at point 3 and closed it at point 4 as the price approached a vital support level marked by point 1.

Strategies vary by swing trader, but the main focus is on momentum–swing traders want to capture a decent chunk of price movement in the shortest amount of time possible. When the price momentum ends, swing traders move on to other opportunities.