Table of Contents

- The Stock Cycle: What Goes Up Must Come Down

- Bet On Mispriced Stocks With These Etfs

- Export Forecast Data (csv)

- Notes & Data Providers

If you are day trading, you may place the stop loss $0.01 or 1 pip above the top the consolidation, but again, alter this based on what you see on the chart per the guidelines above. This example also shows that while that first decline in September and October indicated the price was likely to head lower, we can’t know exactly when that will happen. The stock was in an uptrend and then experienced a massive reversal that erased several of the prior upwaves. Once the price started to bounce we waiting for a retracement of approximately half of the decline. The price moves into the retracement area (between 0.5 and 0.9) and consolidates there for 4 sessions. The price then drops below the consolidation, triggering our short entry.

This is the trading opportunity and the pattern we are looking for. But we are looking at a special type of pattern that is different than trading pullbacks as a continuation pattern.

The Stock Cycle: What Goes Up Must Come Down

There are several more “Low CO2” ETFs also detailed in the prospectus, suggesting today’s listing could be the first of many Desjardins funds to hit the market. Historical return data for other ETFs in the Large Cap Value Equities ETFdb.com Category is presented in the following table. Data are provided ‘as is’ for informational purposes only and are not intended for trading purposes. Data may be intentionally delayed pursuant to supplier requirements. Value of one options unit-a measure of one basis point change in the options price.

When a reversal starts, it isn’t clear whether it is a reversal or a pullback. Once it is evident it is a reversal, the price may have already moved a significant distance, resulting in a sizable loss or profit erosion for the trader. For this reason, trend traders often exit while the price is still moving in their direction. That way they don’t need to worry about whether the counter-trend move is a pullback or reversal. Referring to the rising channel, the example also highlights the subjectivity of trend analysis and reversals.

Bet On Mispriced Stocks With These Etfs

They unfold differently in each asset class, and according to the current market sentiment. A novice might see this chart and decide to place his stop at $401, just above what seems to be the point of resistance. See the next chart of Boeing below to see the typical fate of the trader who can’t grasp that support and resistance levels aren’t exact price points. As you can see on the 3-10 oscillator, which is just a modified MACD, the slow-line has flattened while the fast-line has lost its steam and crossed below the slow-line, a significant warning sign. We also didn’t see any action from the oscillator as a result of today’s semi-bullish market action.

Nevertheless, further refining of this strategy into more liquid futures may prove useful. Performance figures contained herein are hypothetical, unaudited and prepared by Alpha Architect, LLC; hypothetical results are intended for illustrative purposes only.

Export Forecast Data (csv)

is always easier so you might want to favor these shares under the given circumstances, but always read up on optimal investment strategies if you are new to investing. If you are good with personal finance and are looking to invest, you will find the Vesper U.S. Large Cap Short-Term Reversal Strategy on NYSE ARCA fund market exchange. Nothing says reversal more than a market that has found itself in a climatic position. There are several ways to define this including overbought or oversold, failure tests, and we can use simple trend channels to give us a heads up that this is price movement to watch.

- After signing up, you may also receive occasional special offers from us via email.

- Ignoring reversals may result in taking more risk than anticipated.

- Running the strategy between 1/1/2000 and 1/1/2015 produces an annual return of 18.28% with a maximum drawdown of -55.78%.

- Zacks Ranks stocks can, and often do, change throughout the month.

- The inclusion of the reversal factor is one of the unique characteristics of the Atlas strategy.

- The concept of the short term reversal seems at first to be contrary to that of momentum.

The results might be interpreted in a way that the abnormal returns of reversal investment strategies, which were documented in studies, create an illusion of profitable investment strategies. Still, due to the transaction costs, the strategies are not applicable, and the profitable strategies do not exist. There are a lot of reversal strategies, but there is one that I really like, and that is the Strong Trend Reversal Strategy. The strategy combines the concepts of trends and velocity/magnitude, which are key ingredients for analyzing price action. With this strategy we don’t have to assume a reversal will occur, rather we wait for a number of key factors to align that signal a reversal is underway. The strategy then gets us in at an advantageous price so we can capitalize on the next major price wave in the new direction. This strategy is covered in my Stock Market Swing Trading Course, along with loads of other swing trading information, and two other power strategies .

However, we want to test whether the strategy is still profitable in the new time period. If we begin from 2005 and end in 2017, there will be a total return of 131.50%. Although to some extent the performance of this strategy is dependent on different market situations,? nevertheless, in either situation mentioned above, this strategy could significantly beat the S&P 500 benchmark. Further research and backtesting could be done on different look-back periods, rebalancing frequencies, investment universes, numbers of traded stocks, etc. I will be looking at past 2 day’s cumulative return and go long on stock with lowest return and go short on stock with the highest return.

Notes & Data Providers

Net money flow is the value of uptick trades minus the value of downtick trades. Our calculations are based on comprehensive, delayed quotes.

The price then continues to trickle up into the October high. There are no 4 bar consolidations until the price has retraced about 90% of that entire move up. Once the four bar consolidation has formed, buy on a breakout above the consolidation. This reversal ultimately ended up being the bottom of the downtrend and an uptrend ensued. Enter a long trade if the price rallies above the consolidation high . We either wait for a new consolidation to form if the price keeps dropping, or if the price immediately rallies again we can take the long entry above the consolidation. When we see that sort of velocity I often expect the price to try to edge higher before finally topping.

But for any trade where I am just hopping in for a short-term move , then I always get out of these trades before earnings. There are so many stocks to choose form, and this pattern occurs in so many stocks, that there is no reason to hold a trade through earnings which is basically a gamble on which way the price will snap.

This means that every time you visit this website you will need to enable or disable cookies again. Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings. This website uses cookies so that we can provide you with the best user experience possible. We’ve already analyzed tens of thousands of financial research papers and identified more than 500 attractive trading systems together with hundreds of related academic papers. Thank you to everyone who takes the time to leave a comment. Your feedback, constructive criticism and identification of mistakes is welcome. In order to concentrate on work I am unlikely to respond to comments on older articles.

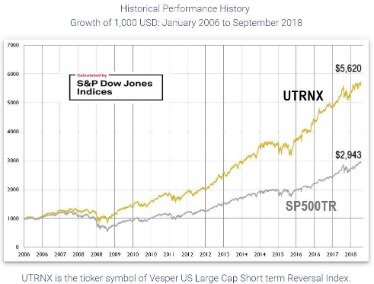

The UTRN ETF is up by 29.7% year-to-date through Nov. 25, versus 25.0% for the S&P 500. Launched in Sept. 2018, it is based on an index that was backtested to 2006, beating the S&P 500 in 11 of the last 13 years, while averaging more than double the return of the S&P 500, CNN reports. Information is provided ‘as is’ and solely for informational purposes, not for trading purposes or advice, and is delayed. To see all exchange delays and terms of use, please see disclaimer.

At first glance, the returns shown in the table for such a simple strategy seem too good to be true. If markets are nearly efficient, and we are trading in the most efficient stocks, it seems unlikely that we would be able to produce such abnormal returns.

Volume in most markets declines in the summer, when many investors take time off. It also varies during the day, reading highest on the open and close, and lowest around midday when traders break for lunch. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors.

It is in an uptrend, and has a big up wave followed by an even bigger down wave. On that down wave I have used a Fibonacci retracement tool to show the retracement zone. The price needs to consolidate between 0.5 and 0.9 in order to give us a valid trade signal. If you are unfamiliar with the Fibonacci retracement tool (I have edited it to only show 50% and 90% retracement levels) see Use Fibonacci Retracements to Find Entry Points. Once we have at least a 4 bar consolidation mark the high and low of that consolidation. A trade is only taken if the price breaks out of that consolidation in the reversal direction . A rally of $10 over the course of a month should be erased by the sellers in days or weeks .

Transaction Costs

Zacks Ranks stocks can, and often do, change throughout the month. Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded from these return calculations. As always, the past performance of an investment strategy is no guarantee of its future returns. Moreover, although the UTRN methodology was backtested to 2006, and thus includes the last bear market, most of that period was during a long bull market. Whether UTRN will continue to outperform during the next bear market is an open question. This strategy shows how to trade a short-term or mid-term market reversal using price action that is based on the Fibonacci numbers. Being a reversal pattern, it can occur at the top or bottom of a price move in the short-term or mid-term.

At the same time, we remove the oldest data from our lists. This step is essential to prevent memory size exceeding the limit. After the warm-up period, we calculate monthly returns every week and based on the returns, we make our investment decisions. The investor goes long on futures from the high-volume, low-open interest group with the lowest returns in the previous week. The weight of each contract is proportional to the difference between the return of the contract over the past one week and the equal-weighted average of returns on the N contracts during that period. A trend is the general price direction of a market or asset. Determining the trend direction is important for maximizing the potential success of a trade.

The Latest New Etf Launches: Vanguard Brings Ultra

Reversals occur on different time frames which are relevant to different traders. An intraday reversal on a five-minute chart doesn’t matter to a long-term investor who is watching for a reversal on daily or weekly charts. Yet, the five-minute reversal is very important to a day trader. However, average returns for Europe are insignicant with an average return of 0.28 percent (0.92 t-statistic).