Table of Contents

- Volatility Skew Example

- Short Strangles

- Stock Charting & Technical Analysis

- Trading Volatility Skew

- Option Trader Q&a W

Both options are roughly the same distance away from the current underlying price $190.00, but the put option is worth more than three times the short call option. A jade lizard is an option strategy consisting of selling an out of the money short put and an out of the money short call spread. The trade has undefined risk to the downside with no upside risk if we collect a net credit greater than the width of the short call spread. Short puts are the bread and butter of our trading at tastytrade and dough.

This includes strategies in backspread or long time spread category. f options generally appear overpricedlook for spreads wtth a negative vega. This includes strategies in the ratio vertical or short time spread category.

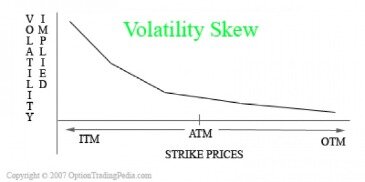

Volatility Skew Example

LocVol models offer a way of capturing the implied skew without introducing additional sources of randomness; the only source of which is the underlying asset’s price that is modeled as a random variable. In LocVol models, the volatility is a deterministic function of the asset’s level. In the Black-Scholes model, the asset’s price is modeled as a log-normal random variable, which means that the asset’s log-returns are normally distributed. However, the fact that we have a skew is the market telling us that the asset’s log-returns have an implied distribution that is not Normal. Although models nesting both stochastic volatility and jumps have shown some success, Bates and Pan indicate that they are still incapable of fully capturing the empirical features of stock index options prices.

For an implied volatility surface to be arbitrage free, some criteria must be met. The skew for any specific stock is steeper for short-term maturities than for long-term maturities.

In its place is a graph that illustrates increasing demand, as measured by an increase in implied volatility for OTM puts along with a decreased demand for OTM calls. A volatility smile is a u-shaped pattern that develops when an option’s implied volatility is plotted against varying strike prices. It shows that implied volatility tends to increase the further in- or out-of-the-money an option moves. Because volatility in some markets does seem to be dependent on the price of the underlying contract, a further variation of the Black-Scholes model has been proposed. The constant-elastictty ofvariance,or CEV, mode1 8 is based on an assumed relationship between volatility and the price level of the underlying contract. This relationship determines the probability of price moves of various magnitudes at each moment in time.

Short Strangles

Because there were fewer sellers than buyers for both OTM puts and calls, they traded at higher than “normal” prices — as is true in all aspects of trading (i.e.,supply and demand). The vertical debit spread consists of buying to open a higher strike put while selling to open a lower strike put in the same expiration cycle. The premium received from the short put reduces the overall cost of the trade. And since the net cost is the max loss in the position, the put spread is a much less risky way of acquiring protection than a straight up put buy.

Are calls safer than puts?

Selling a put is riskier as a comparison to buying a call option, In both options are looking for long side betting, buying a call option in which profit is unlimited where risk is limited but in case of selling a put option your profit is limited and risk is unlimited.

Last year’s 2019 US corn crop was marked by turbulence due to poor weather conditions and record prevented planting numbers coupled with trade war headlines happening during non-US hours. This resulted in record spread option volume as market participants from around the world accessed the market to manage their risk related to market events. The Option Skew tools general purpose is to provide the Option Trader a visual display of an options prices Implied Volatility so they can compare the values across the range of strike prices in a specific expiration period. In general, what you are going to trade is either going to be some sort of risk reversal/collar or a 1 by N put or call spread in a delta-neutral manner. It is, however, very hard to separate the 3 risks above from each other using vanilla structures, assuming that your underlying actually moves.

Stock Charting & Technical Analysis

As the world’s leading and most diverse derivatives marketplace, CME Group is where the world comes to manage risk. Receive exclusive insights on key FX macro themes, volatility trends, and market events through our bi-weekly report.

Because there were fewer sellers than buyers for both OTM puts and calls, they traded at higher than “normal” prices—as is true in all aspects of trading (i.e., supply and demand). Forward-skew IV values go up at higher points in correlation with the strike price. This is best represented within the commodities market, where a lack of supply can drive prices up. Examples of commodities often associated with forward skews include oil and agricultural items. Impliedvolatilityis the market’s forecast of a likely movement in a security’s price. It is a metric used by investors to estimate future fluctuations of a security’s price based on certain predictive factors. Implied volatility, denoted by the symbolσ, can often be thought to be a proxy of market risk.

Trading Volatility Skew

If the LocVol surface has a 22% implied at the 90% strike and 20% implied at the ATM strike, then the Black-Scholes implied volatility for the 90% strike is 21%. For ATM implied volatilities, the LocVol at the strike is equal to ATM implied volatility. Hence the average of two identical numbers is simply equal to the ATM implied volatility. For this reason, Black-Scholes implied is equal to LocVol ATM implied. It is a partial differential equation describing the evolution of the option price as a function of the current stock price and the current time. The dynamics of vanilla options are thus described by the Black-Scholes model, which is the only complete model with sticky strike dynamics. Without going to much into details here, we can actually make some progress without any knowledge of the true dynamic causing the implied volatility smile.

An OTM bull put spread, comprising a sold put and a purchased further OTM put could be placed for a substantial credit given the puts’ elevated implied volatility. One such example is trading the reverse skew of OTM puts mentioned above when a stock has fallen in price, but is believed to have bottomed out. This is not because the options contracts are insanely overpriced – it’s just because they require a huge change in volatility to ever make any money. As we get closer to expiration, the impact of volatility on an option price goes down. In fact, as we approach expiration, option Vega decreases because longer dated option contracts are more tied to changes in volatility.

For example, on most equities, the volatility skew lies with out-of-the-money puts. That is, the implied volatilities of out-of-the-money puts exceed the implied volatilities of out-of-the-money calls at similar distances from the current stock price.

What Is Skew?

LocVol models try to stay close to the Black-Scholes model by introducing more flexibility into the volatility. Exotic equity derivatives usually require a more sophisticated model than the Black-Scholes model. The most popular alternative model is a local volatility model , which is the only complete consistent volatility model. The pricing of any derivative must be done in the risk-neutral measure in order to avoir arbitrage.

Option contracts that are out of the money and close to expiration naturally have really high implied volatilities. This means that the lower the Vega and the lower the option price, it requires a much larger change in volatility to change that option price dramatically – a huge volatility event. On the put side, looking at the $275 put options, the price is $140. It’s not until you get all the way down to the $240 options on the put side that you find put options that are the same price as the $290 call options at $15. That naturally is going to create some sort of skew in the pricing of those option contracts. If they buy up the put options, then that is increasing the price of the put options and they are selling call options, which is decreasing the price of the call options because of the selling pressure. However, it is too costly to buy them outright, so they generally sell call options that are out of the money to help finance that cost – a simple synthetic collar strategy.

There is no need to conduct extensive research to understand the reason for this phenomenon. OTM options were usually inexpensive , and were more attractive as something forspeculators to buythan as something for risk-takers to sell .

Hosted by Risk.net, these awards bring together recognition of the leading vendor solutions for credit, operational and enterprise-wide risk management. View our latest in market leading training courses, both public and in-house. Sessions include the impact of low and negative rate challenges, the impact of AI on interest rate risk, and handling the Ibor transition. The financial products offered by the company carry a high level of risk and can result in the loss of all your funds. Thanks for the synopsis on skew at the end of the article, and for some actionable ideas. I would love to learn more about skew “Tylerized.” Thanks for always keeping things digestible.

Option Trader Q&a W

For instance, one might want to keep track of the 5 delta put, the 20 delta put, the 50 delta call, the 25 delta call, and the 10 delta call. I think using these options can give a fairly accurate representation of the skew curve. After picking your options, keep track of the volatility, but more importantly, the volatility spreads from strike to strike and option to option. Run a graph over the vols and you will really be able to see the skew curve. Run a second graph over the differences in the vol spread, and you will really be able to see how the curve is moving.

For a given strike, implied volatilities vary depending on the maturity of the option. In most cases, the term structure is an increasing function of maturity. It is generally the case in calm periods where short-term volatilities are relatively low.

- At no other time in its life is a stock option call an early exercise candidate.

- Commodities often exhibit an inverse or positive skew because the risk sits on the upside.

- On the contrary, the volatility over time seems to be dependent on the direction of movement in the underlying contract.

- LocVol is still a one-factor model and it also allows for risk-neutral dynamics, which means that, like Black-Scholes, the model is still preference free from the financial point.

- Volatility is basically the fluctuation in the price of a product or a derivative.

- On the other hand, if we look at the call that’s 100 points above SPX, we see that the 2,410 call is trading for $1.25 (an implied volatility of 8.2%).

On the other hand, the horizontal skew does not have to disappear by expiration, since the options don’t expire at the same time. Sometimes, calendar spreaders are attracted by a very distorted horizontal skew, but there are other things that are perhaps more important in that strategy. Let’s look at why there’s a difference between put and call prices. When investors consider hedging their bullish stock positions, they commonly do so with options by buying puts or selling calls.

Explore historical market data straight from the source to help refine your trading strategies. Stream live futures and options market data directly from CME Group. Vlad and his team may have a financial interest in its picks as they trade many of the same equities and options they pick. • This provides an opportunity to buy options at a cheaper price and take advantage of Volatility potentially increasing thereafter. The classic 60/40 stock/bond portfolio has stood the test of time in both hypothetical and live fund results from multiple fund sponsors such as Vanguard, Fidelity, and American Funds.