Table of Contents

- When Should You Use Bollinger Bands?

- Stop Looking For A Quick Fix Learn To Trade The Right Way

- Out Band Candlestick And The Best Trading Strategy In Olymp Trade For Beginners

- Rules For Long Day Trade

- I Tested Bollinger Bands Trading Strategy 100 Times

On Poormans chat a friend tried it on VHC today and $211 in 11 minutes. I have nothing against people like you because you help people like myself and others here at MarketClub money by taking the wrong side of a position. I also have found that the Bolinger Bands work best in a sideways market along with the MACD Histogram. Markus is CEO of Rockwell Trading and author of the international bestseller “The Complete Guide to Day Trading”. For a limited time INO Blog Readers can download his book free here. This is a very common occurrence and one you should begin watching out for on a daily basis.

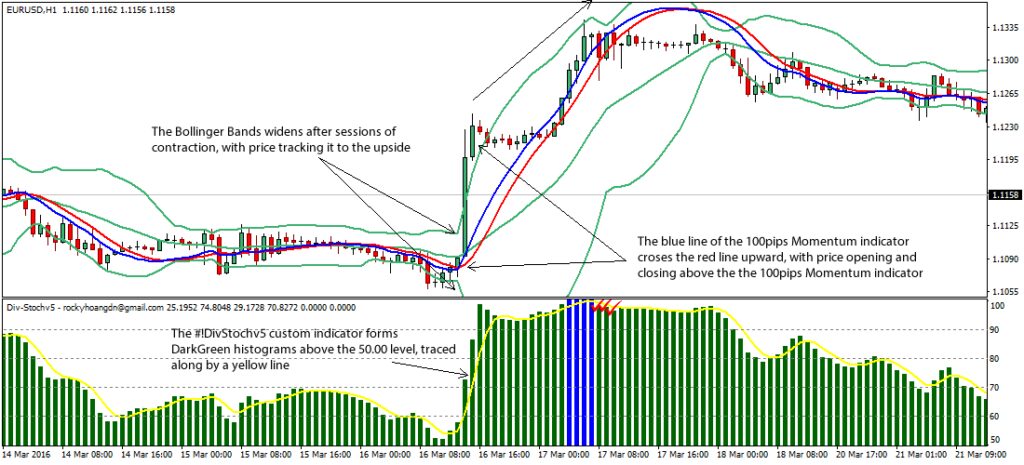

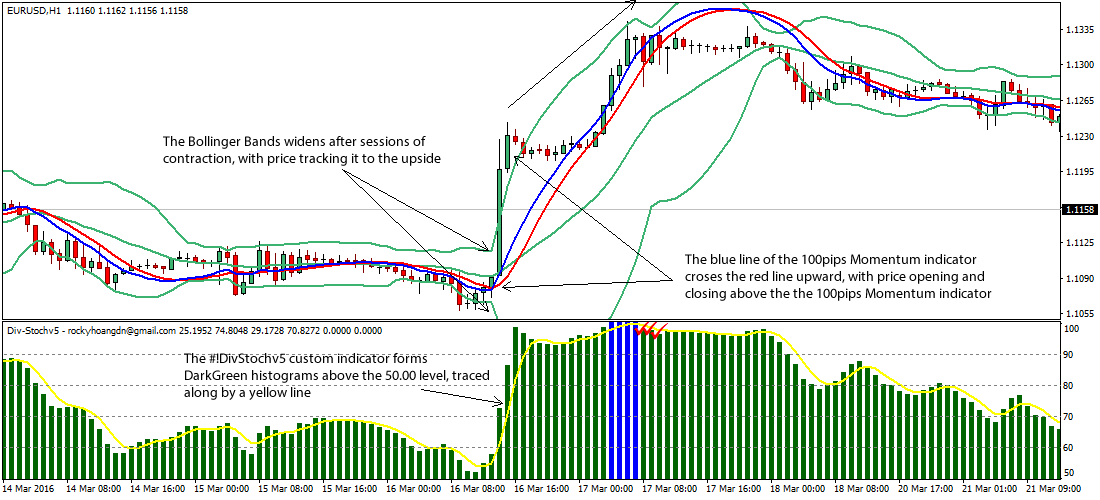

When the market is going through periods of low volatility, the Bollinger bands contract and are somehow closer together. In times of high volatility, they expand and become further apart. The Moving Average – the middle line – could be a simple moving average or an exponential moving average , depending on your preference. If you have set the MA at 20, it means that the closing price of the previous 20 candles will be averaged. Bollinger bands %B translates a portion of the price information in Bollinger bands into one line rather than the multiple bands you see with the standard indicator.

December 26 marked the last time Intel would trade below the lower band. From that day forward, Intel soared all the way past the upper Bollinger Band®. This is a textbook example of what the strategy is looking for. The Bollinger bands %B indicator quantifies the distance between price and the top and bottom bands, which can help technical analysts determine trends. Some traders also generate trading signals based on whether %B indicator is above 1 or below 0 and could entail either trend following or price reversal.

When Should You Use Bollinger Bands?

The Bollinger bands trading is a market trading indicator that helps to point out the buy and sell signals, price up and price low levels and the market overbought and oversold conditions. This strategy is used for short term trading purpose and can also be used for long term. The Bollinger band trading strategy is used for market exchange. This can be used with any forex trading strategy and with any type of currency pairs.

- The strategy called for an immediate buy of the stock the next trading day.

- First, you need to find a stock that is stuck in a trading range.

- You can reverse this pattern into the “W” pattern and reverse the trading steps.

- Notice how the price and volume broke when approaching the head fake highs .

- This factor helps the traders in their decision making that they should start long term trading or short term.

Bollinger Bands is a technical indicator developed by John Bollinger in the 1980s. All contents on this site is for informational purposes only and does not constitute financial advice. Consult relevant financial professionals in your country of residence to get personalised advice before you make any trading or investing decisions. Daytrading.com may receive compensation from the brands or services mentioned on this website. Cryptocurrencies like Ripple and Bitcoin see a lot of volatility currently. Here we have an hourly chart of the S&P 500 with Bollinger Bands set to the setting.

Stop Looking For A Quick Fix Learn To Trade The Right Way

Again, the strategy suffers from the problem of trading right on the close, so this strategy might benefit from some discretion. In this next strategy, we use the same settings as test two except for two differences. We need the stock to be in an uptrend and we only exit by trailing stop. A tag of the upper Bollinger Band is NOT in-and-of-itself a sell signal. A tag of the lower Bollinger Band is NOT in-and-of-itself a buy signal. But it is possible to come up with a strategy by specifying the number of higher opens or closes above the upper band. Or by the number of lower opens or closes below the lower band.

You, of course, can make a ton of money placing big bets, but these types of traders do not make it over a long trading career (20+ years). To the point of waiting for confirmation, let’s look at how to use the power of a Bollinger Band squeeze to our advantage. Below is a 5-minute chart of Research in Motion Limited from June 17, 2011. Notice how leading up to the morning gap the bands were extremely tight. It immediately reversed, and all the breakout traders were head faked.

The concept of Bollinger bands come from Standard Deviation, which is a statistical calculation or unit that measures the dispersal pattern of any data. It includes about 68 per cent of all data points for the normal distribution pattern. Two standard deviations include roughly 95% of all the data points. Today, they have become some of the most common indicators in the industry. Traders use them to identify a trend by checking overbought and oversold positions.

Out Band Candlestick And The Best Trading Strategy In Olymp Trade For Beginners

This level os identified with the help of the distance between the upper and lower bands. The result of this distance is added into the upper band that generates the stop loss level. The traders mostly used it to save theri trade from risks.

With over 50+ years of combined trading experience, Trading Strategy Guides offers trading guides and resources to educate traders in all walks of life and motivations. We specialize in teaching traders of all skill levels how to trade stocks, options, forex, cryptocurrencies, commodities, and more.

The trader that is going to scan the entire market looking for a particular setup. This will require a ton of patience to identify the setup since you need the second bottom to breach the bands to generate a powerful buy signal. Like anything else in the market, there are no guarantees. Bollinger Bands can be a great tool for identifying volatility in a security, but it can also prove to be a nightmare when it comes to newbie traders. Don’t skip ahead, but I will touch on this from my personal experience a little later in this article. A simpler way of saying this is that the bands help validate that the stock is stuck in a range. You could argue that you don’t need the bands to execute this strategy.

Perhaps a more useful way to trade with Bollinger Bands® is to use them to gauge trends. As John Bollinger acknowledged, “tags of the bands are just that, tags, not signals.” The bands are often used to determine overbought and oversold conditions. Bollinger Bands® are a trading tool used to determine entry and exit points for a trade.

Rules For Long Day Trade

Bollinger Bands® focus on price volatility which can be implemented in all financial market trading. There are quite a few limitations to this strategy, but they often depend on the specific case and how the strategy is being used to track market trends.

The high win rate of this strategy makes it appealing and the idea looks to have potential. It must be noted, however, that the results do depend on getting good price fills on the open. The idea proposed in the article is simply to wait for a stock to close below the lower Bollinger Band and then buy it the following day. The exact sell criteria is not shown so I will assume that we exit the stock when the reverse occurs.

If the price declines again, it likely won’t be able to reach the lower band or the recent price low. If the price is in an uptrend, and continually hitting the upper band , when the price hits the lower band it could signal that a reversal has commenced. If the price rallies again, it likely won’t be able to reach the upper band or the recent price high.

The Squeeze strategy is based on the idea that once volatility decreases for extended periods of time the opposite reaction typically occurs and volatility expands greatly once again. Notice in this example how the Band-Width indicator gives lower readings when the bands are contracting and higher readings when bands are expanding. There’s one additional indicator that works hand in hand with Bollinger Bands that many traders do not know about.

I Tested Bollinger Bands Trading Strategy 100 Times

To test this strategy I have also included some extra liquidity rules , a ranking rule and a market timing rule . In addition, we will spread risk so that we can hold up to 20 positions at one time. Unsurprisingly, these results are not spectacular, but they are actually better than I was expecting. Different permutations, different markets, timeframes, risk, might help make this into a simple and worthwhile model. To recap, this strategy goes long whenever the S&P 500 Index closes above it’s upper Bollinger Band on the daily chart and does so on the next open. It goes short on the next open whenever the index closes below it’s lower band. Bollinger Bands can be used on volume, open interest, sentiment data, almost anything.

These contractions are typically followed by significant price breakouts, ideally on large volume. Bollinger Bands® should not be confused with Keltner Channels. While the two indicators are similar, they are not exactly alike. Aside from how the bands/channels are created, the interpretation of these indicators is generally the same. In range-bound markets, mean reversion strategies can work well, as prices travel between the two bands like a bouncing ball.

Bollinger Bands aren’t a perfect indicator; they are a tool. They don’t produce reliable information all the time, and it’s up to the trader to apply band settings that work most of the time for the asset being traded. With established guidelines on how to use the Bollinger Bands, find settings for the indicator that allow you to apply the guidelines to a particular asset you are day trading. Alter the settings so that when you look at historical charts you can see how the Bollinger Bands would have helped you. I help traders like you become more successful with practical mentoring and a well developed step-by-step trading methodology that you can follow around your current life commitments.

In this example you can see IBM stock reaching the lowest level of volatility in 6 months. Notice how the price of the stock is barely moving at the time the 6 month Band-Width Low Is Reached. This is the time to begin looking at markets because 6 month low Band-Width levels typically precede strong directional moves. Here, we can see that there was a divergence area where price was showing lower lows at the same time that the Intraday Intensity indicator was showing higher lows. The reversal candlestick pattern on the lower band was a piercing pattern. The buy trade triggered on the daily chart made it to the upper Bollinger and stalled at 1.1023. This price is where price had earlier found resistance, making it a good place to exit the trade.