Table of Contents

- Combining Smas And Emas

- What Is The Best Moving Average For Various Markets?

- What Are Moving Averages And How Are They Calculated

- Types Of Moving Average Crossovers

- Triple Ema Trading Strategy

- Adjusting Moving Averages

The longer moving average is referred to as the slower moving average. Sl NoBuy PriceSell PriceGain/Loss% Return % .2% %From the above table, it is obvious that the first and last trades were profitable, but the 2nd trade was not so profitable. If you inspect why this happened, it is evident that the stock was trending during the 1st and the 3rd trade, but during the 2nd trade, the stock moved sideways. We stay invested by the trading system till we get an exit signal, which we eventually got at 187, marked as This trade generated a profit of Rs.22 per share.

With the rise of hedge funds and automated trading systems, for every clean crossover play I find, I can probably show you another dozen or more that don’t play out well. This again is why I do not recommend the crossover strategy as a true means of making money day trading the markets.

The only difference is that you will need to choose Linear Weighted as the MA Method in the indicator window. For example, for a 5-period MA the weight of the last price value will be 5, the one before that will be 4 and so on until it reaches 1. The only difference is that you will need to choose Exponential as the MA Method in the indicator window. This MA has been developed to facilitate a smoother transition between the time frames.

Combining Smas And Emas

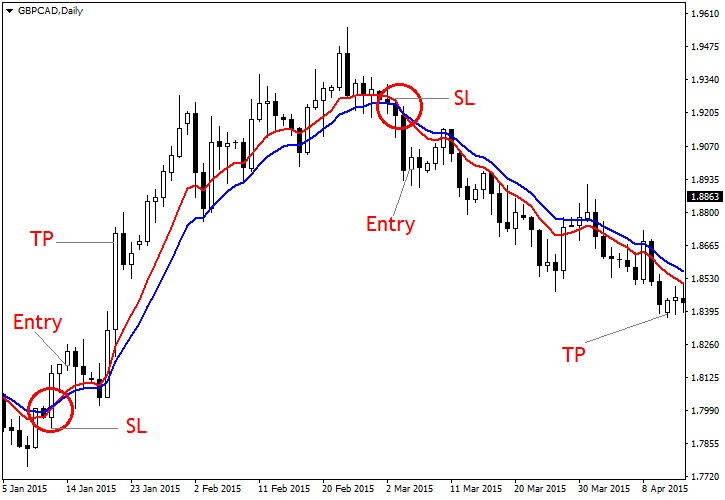

Secondly, we need to wait for the EMA crossover, which will add weight to the bullish case. Our exponential moving average strategy is comprised of two elements.

ReplyCoachShaneApril 10, 2020There is no typical time as the market dictates when it’s time to hit the exits. Since I trade off daily charts, I am always looking at more than 3 days and have held positions for the better part of the year. There are the very obscure outliers that end the same day due to interventions or words from govt officials. If you don’t blindly trade the 3 EMA crosses, you could find an edge in this type of strategy where you take advantage of trend, momentum, and a simple trade management and profit taking routine. The lagging issue with moving averages can cause problems such as price moving too far too fast. This can have us getting into a trade just when price snaps back to an average price.

By using Chuck Hughes’ EMA crossover strategies, traders can count on dependable strategic investments instead of trades based upon emotion. Chuck Hughes personally trades options and provides professional trading strategy services. Using Chuck Hughes’ options investing strategies and trading recommendations, your potential for profit within the options trading system can be increased and your risk for loss reduced.

What Is The Best Moving Average For Various Markets?

Schmoo of moving average length shows a stead progression of performance as the moving average length increases. Each possible combination is examined for the period of time indicated on the chart. Once simulations are completed, tradestation will indicate which combination of variables was most profitable.

It is highly popular among traders, mostly because of its simplicity. As part of Chuck’s investment trading strategy, you’ll never have to guess when a stock price has bottomed out in order to make a purchasing decision. Chuck’s exponential moving average crossover rules protect investors and minimize losses should a stock price decline significantly. A double EMA crossover is a calculation of both single and double EMAs. Double exponential moving average crossovers provide traders with the advantage of representing larger term trends with less lag time. This means they have a higher accuracy rate which can lead to a reduced risk of loss. It can be confusing to understand the appropriate times to use an EMA or an SMA.

Does Warren Buffett use technical analysis?

In less than seven decades, he took roughly $10,000 in seed capital and turned it into more than $79 billion in net worth. However, Buffett hasn’t needed fancy computers, technical analysis, or any quantitative analysis to figure out which stocks to buy.

features a daily live trading broadcast, professional education and an active community. Therefore, the best MA to use in a 15-minute chart should be relatively short. For example, it does not make any sense to use a 100-period MA on a 15-minute chart. This is because the market is made up of complex parts that move as a result of different triggers.

What made a moving average work better than another moving average in the past is probably just due to random luck (i.e. there’s no solid reason why one should work better than another). The best moving average setting in the past might not be the best moving average setting in the future. What worked in the past may suddenly stop working in the future. As usual, these kinds of questions bring out a lot of responses from various traders, and everyone has their own opinion.

What Are Moving Averages And How Are They Calculated

Perhaps the market will fall even more in the short term before it bounces. While the market does eventually bounce, the short term decline can be very painful and may even last a long time before the market “eventually” bounces.

In early September, the price broke above the EMA and the trend on the 4-hour chart turned bullish, with BTC-USD moving above $10,000. However, when the price broke below the EMA, the trend turned bearish, testing the $10,000 level again. For example, the 50-day moving average didn’t follow the price that closely as shown above. The pullbacks during the rally from $3,500 to $13,900 did not touch the 50-day MA. When putting the 34-day MA on the chart, we see that it provided better entry signals than the 50-day MA, as the price touched the 34-day MA several times on during the uptrend.

Types Of Moving Average Crossovers

ReplyCoachShaneMarch 18, 2021Over the years, I’ve played with many different combinations and to be honest, I prefer simplicity. As with any strategy, as long as you understand the logic behind it, can execute it, and has a positive expectancy, it’s all good. The good thing is we can judge momentum based on the separation of the averages as well as the distance price is from the averages. We have the cross to the downside on this crude oil futures chart and the candlestick we’d short is marked. Using the 2 X ATR allows your stop to remain outside the normal volatility and allows price to fluctuate. If momentum occurs when the averages cross, I would suggest standing aside until price normalizes. This pulling away by the EMA ultimately results in price breaking the EMA after closing above the SMA.

You should strive to combine MAs with only a few indicators because doing so with many indicators will hamper your decision making. It is also important to always look at the fundamentals of any asset that you want to buy or sell. A good strategy is to combine MAs with volume-based indicators, and oscillators. Personally, we suggest to combine MAs with stochastics, Relative strength index , and accumulation/distribution. Moving Averages aresome of the best technical toolsto use to make trading decisions. Indeed, they are so popular that they are the foundation of most technical indicators like Bollinger Bands, Envelopes, Average Directional Movement Index , and MACD, among others.

Triple Ema Trading Strategy

Swing trading is an attempt to capture gains in an asset over a few days to several weeks. Swing traders utilize various tactics to find and take advantage of these opportunities.

Most investors will look for a cross above or below this average to represent if the stock is in a bullish or bearish trend. Every indicator is based on math, but the SMA is not some proprietary calculation with trademark requirements. Moving averages work as macro filters as well, telling the observant trader the best times to stand aside and wait for more favorable conditions. Among short- and long-term EMAs, they discovered that trading the crossovers of the 13-day and 48.5-day averages produced the largest returns. Similarly, the 128-week and 200-week MAs have highlighted good opportunities to buy bitcoin when the price has tested these levels.

All moving average combinations deliver whipsaw losses and they all lag the real action. A classic example is when the 10-day crosses above the 20-day, you should buy. You should sell when the 20-day crosses the 10-day to the downside. Some technical analysts apply the word “breakout” to the crossover. When it comes to choosing a moving average for day trading Forex, make sure to take a look at EMAs. Forex traders like to use the 5, 10, 20, or 50 just to name a few.

Moving Averages help to define the trend and recognize changes in the trend. Many traders, however, make some fatal mistakes when it comes using moving averages. Short term moving averages are more reactive to daily price changes because they only considers a short period of time.

Now, to be clear, I am not a fan for always staying in the market, because you can get crushed during long periods of low volatility. I only mention this, so you are aware of the setup, which may be applicable for long-term investing. Since TradingSim focuses on day trading, let me at least run through some basic crossover strategies. Simply buy on the breakout and sell when the stock crosses down beneath the price action. Before you dive into the content, check out this video on moving average crossover strategies. The video is a great precursor to the advanced topics detailed in this article.

Options Trading Strategies: Double Ema Crossover

This is something I touched on briefly earlier in this article, essentially with a lagging indicator, you will never get out at the top or bottom. Thinking back to our cryptocurrency example, there were times where we left over 10% or more in paper profits on the table because we did not exit the position. It all comes down to my ability to size up how a stock is trading in and around the average.

- Exponential moving average – The EMA removes the lag in SMAs by prioritising the recent prices.

- Moving averages may be a particularly useful tool to help you see through the noise and identify trends as they are unfolding.

- Therefore, based on our analysis this claim is considered to be true.

- Finding what works best for each individual situation will result in the greatest profit and smallest average loss.

- Both algorithms could run concurrently, creating a combined Long/Short strategy without any issues.

In this Forbes article, ‘If You Want to Time the Market, Ignore Moving Averages‘, Michael Cannivet highlights the issue with using moving averages . I use the 20-period moving average to gauge market direction, but not as a trigger for buying or selling. This was by far my darkest period of the journey with moving averages. For those of you not familiar with displaced moving averages, it’s a means for moving the average before or after the price action. My path to this trading edge was to displace the optimized moving averages.

One interesting use of the CCI/Moving average trading strategy is using it on 2 time frames. Once the moving average cross over happens which is confirmed by the CCI indicator, wait for a reversal candlestick pattern and then take the trade. This idea was put forward by Daryl Guppy and is named the moving average ribbon. The moving averages on this chart number 12, with each one adjusted a fixed number of points above and below the 20-day.

PrimeXBT shall not be responsible for withholding, collecting, reporting, paying, settling and/or remitting any taxes which may arise from Your participation in the trading with margin. The 200MA is among one institutional investors use to signal when an asset may find support after an extended downtrend. This Moving Average often provides an extremely strong buy signal if it holds. Much like the Weighted Moving Average, an Exponential Moving Average or EMA, is an average of data points with weighting factored into the calculation.